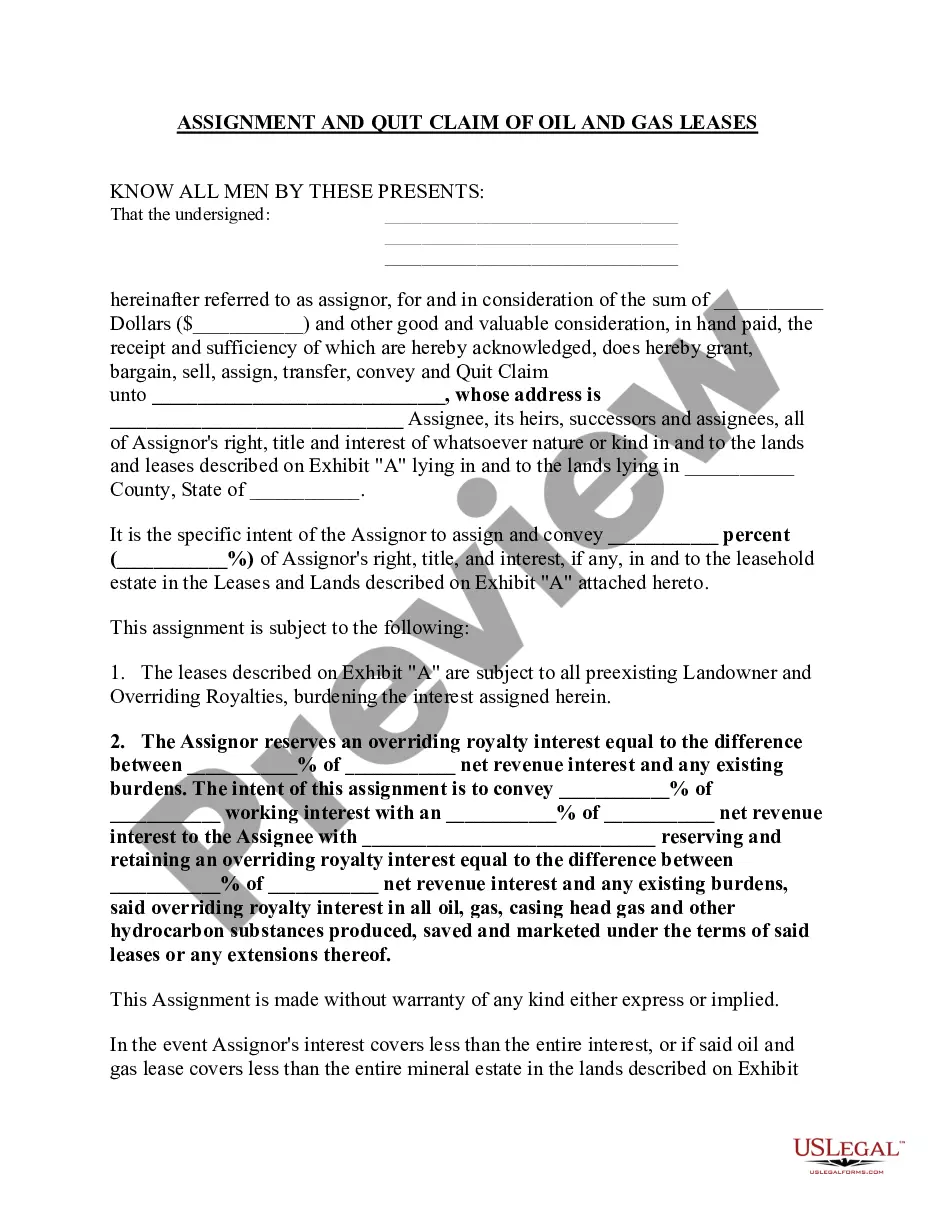

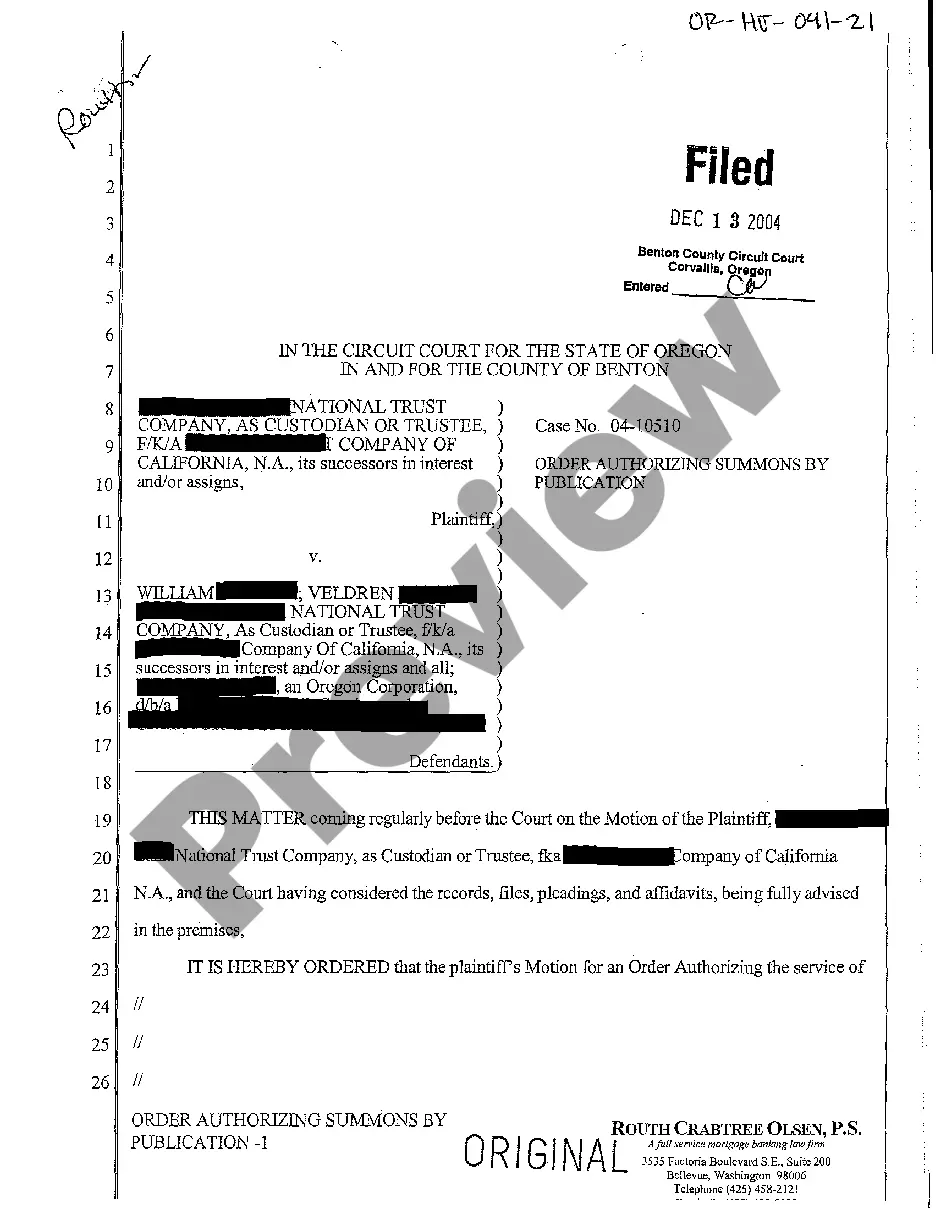

District of Columbia Natural Gas Inventory Forward Sale Contract

Description

How to fill out Natural Gas Inventory Forward Sale Contract?

Finding the right lawful file web template can be a have a problem. Naturally, there are plenty of themes accessible on the Internet, but how can you find the lawful kind you require? Use the US Legal Forms site. The service provides a huge number of themes, for example the District of Columbia Natural Gas Inventory Forward Sale Contract, that you can use for enterprise and private requirements. Each of the varieties are inspected by pros and meet federal and state specifications.

Should you be currently signed up, log in for your profile and then click the Download key to find the District of Columbia Natural Gas Inventory Forward Sale Contract. Make use of profile to appear with the lawful varieties you may have bought earlier. Proceed to the My Forms tab of your respective profile and get an additional version of your file you require.

Should you be a fresh user of US Legal Forms, here are easy guidelines that you can comply with:

- First, ensure you have chosen the right kind for your personal city/area. You may check out the form using the Review key and read the form description to guarantee this is the right one for you.

- When the kind is not going to meet your expectations, make use of the Seach industry to discover the appropriate kind.

- Once you are sure that the form is suitable, select the Acquire now key to find the kind.

- Choose the pricing strategy you would like and type in the essential information. Make your profile and pay money for an order making use of your PayPal profile or credit card.

- Choose the submit format and acquire the lawful file web template for your gadget.

- Complete, revise and printing and indicator the acquired District of Columbia Natural Gas Inventory Forward Sale Contract.

US Legal Forms is the most significant catalogue of lawful varieties where you can find numerous file themes. Use the service to acquire professionally-produced papers that comply with status specifications.

Form popularity

FAQ

Modernized e-File (MeF) - Unincorporated business franchise taxpayers that have a Federal Employer Identification Number (FEIN) are encouraged to e-file the D-30 Unincorporated Business Franchise Tax Return through MeF.

Generally, every corporation or financial institution must file a Form D-20 (including small businesses, professional corporations, and S corporations) if it is carrying on or engaging in any trade, business, or commercial activity in the District of Columbia (DC) or receiving income from DC sources.

Who Must File? Individuals, corporations, partnerships, executors, administrators, guardians, receivers, and trustees that own or hold personal property in trust in the District of Columbia must file a DC personal property tax return.

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 must file a D 30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

The filing of the D-30 is a requirement for operating or continuing to operate a motor vehicle for hire in the District by a non-resident.? In this circumstance, a return would need to be forced to generate.

The D-30 form will print when gross income is more then $12,000. The D-65 will print when gross income is less than $12,000. There are print options for these forms located on D.C. interview form DC1.

A return must be filed by an unincorporated business if its gross income from engaging in or carrying on any trade or business in DC plus any other gross income received from DC sources amounts to more than $12,000 during the year, regardless of whether it had net income.

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2022 and who did not maintain a place of abode in DC for a total of 183 days or more during 2022.