This License applies to any original work of authorship whose owner has placed the

following notice immediately following the copyright notice for the Original Work:

Licensed under the Open Software License version 2.0.

District of Columbia Open Software License

Description

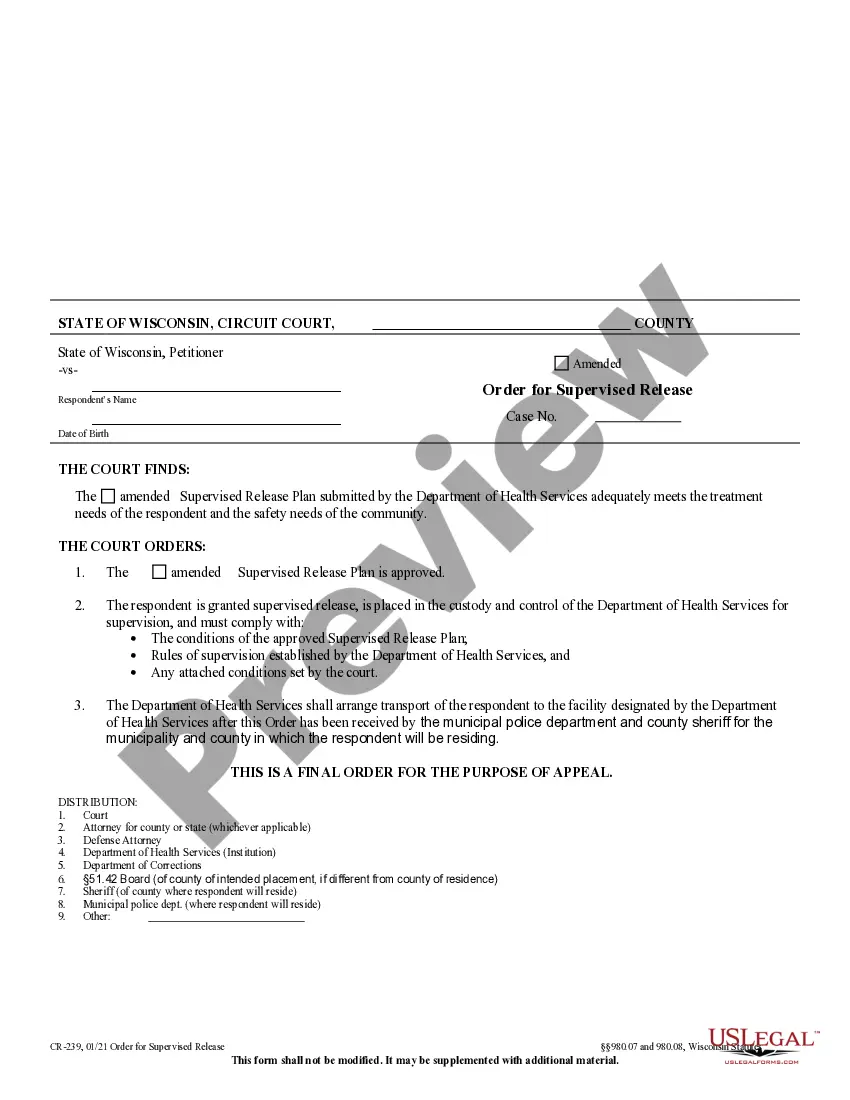

How to fill out Open Software License?

If you require to compile, retrieve, or print lawful document templates, utilize US Legal Forms, the preeminent collection of legal forms available online.

Take advantage of the website's simple and efficient search to locate the paperwork you need.

Numerous templates for business and personal purposes are categorized by type and state, or by keywords.

Each legal document template you acquire belongs to you permanently.

You can access any form you saved in your account. Click on the My documents section and select a form to print or download again.

- Use US Legal Forms to obtain the District of Columbia Open Software License in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the District of Columbia Open Software License.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to inspect the details of the form. Do not forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative templates of the legal form format.

- Step 4. Once you have located the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Step 6. Choose the format of the legal form and download it onto your system.

- Step 7. Complete, edit, and print or sign the District of Columbia Open Software License.

Form popularity

FAQ

A software license is a legal agreement that outlines how software may be used and shared. The open-source software movement promotes transparency and collaboration in technology, enabling users to study, modify, and share software. The District of Columbia Open Software License supports this initiative by providing a framework that respects user rights and fosters community-driven development.

Getting a DC ID involves visiting a DC Department of Motor Vehicles (DMV) office and completing an application process. You will need to provide proof of identity and residency, which may include documents like a utility bill or lease agreement. Additionally, you can find helpful tips and a list of required documents via online platforms focused on helping individuals navigate DC's regulations related to the District of Columbia Open Software License. This can expedite your ID acquisition.

Taxpayers who wish to register a new business in the District of Columbia can conveniently complete the Register a New Business: Form FR-500 application online via the Office of Tax and Revenue's (OTR) tax portal, MyTax.DC.gov.

500, or Combined Tax Registration Form, is used by businesses to register all their tax requirements on one simple form. Whether registering for sales tax, franchise tax, unemployment tax, etc., the business person completes all areas applicable to their business activity either in hardcopy or online.

500, or Combined Tax Registration Form, is used by businesses to register all their tax requirements on one simple form. Whether registering for sales tax, franchise tax, unemployment tax, etc., the business person completes all areas applicable to their business activity either in hardcopy or online.

Apply for a Basic Business LicenseObtain an Employer Identification Number (EIN) from the IRS.Register with the District of Columbia Office of Tax and Revenue.Make sure your DC business premise has a Certificate of Occupancy Permit (or Home Occupation Permit).Complete the Clean Hands Self Certification.More items...

In-person documents are expedited and processed same-day.Choose a Corporate Structure.Check Name Availability.Appoint a Registered Agent.File Washington D.C. Articles of Incorporation.Establish Bylaws & Corporate Records.Appoint Initial Directors.Hold Organizational Meeting.Issue Stock Certificates.More items...

Cost to Form an LLC in the Washington D.C. The cost to start a Washington D.C. limited liability company (LLC) online is $220. This fee is paid to the Washington D.C. Department of Consumer and Regulatory Affairs when filing the LLC's Articles of Organization.

Do You Need a DC Basic Business License? The Department of Consumer and Regulatory Affairs does not require a business license from all DC businesses; some businesses need to obtain only a Basic Business License.

You may need to registered your business with the Washington DC Department of Consumer & Regulatory Affairs (DCRA) Corporations Division.