District of Columbia Proposal to approve agreement of merger with copy of agreement

Description

How to fill out Proposal To Approve Agreement Of Merger With Copy Of Agreement?

It is possible to commit several hours online trying to find the legitimate file template that meets the federal and state needs you require. US Legal Forms offers thousands of legitimate kinds that are evaluated by professionals. You can easily download or print the District of Columbia Proposal to approve agreement of merger with copy of agreement from your assistance.

If you already have a US Legal Forms profile, you can log in and then click the Acquire switch. Next, you can complete, modify, print, or indication the District of Columbia Proposal to approve agreement of merger with copy of agreement. Every legitimate file template you get is your own permanently. To acquire an additional duplicate of any purchased type, go to the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms web site for the first time, stick to the simple instructions listed below:

- First, make sure that you have chosen the right file template for that region/metropolis that you pick. See the type explanation to make sure you have chosen the right type. If offered, make use of the Review switch to look throughout the file template too.

- If you would like discover an additional version of the type, make use of the Look for area to find the template that fits your needs and needs.

- After you have found the template you desire, simply click Purchase now to continue.

- Find the costs prepare you desire, type in your qualifications, and sign up for your account on US Legal Forms.

- Full the purchase. You should use your bank card or PayPal profile to cover the legitimate type.

- Find the file format of the file and download it to the device.

- Make alterations to the file if needed. It is possible to complete, modify and indication and print District of Columbia Proposal to approve agreement of merger with copy of agreement.

Acquire and print thousands of file templates utilizing the US Legal Forms website, which provides the biggest assortment of legitimate kinds. Use expert and condition-certain templates to tackle your small business or person requirements.

Form popularity

FAQ

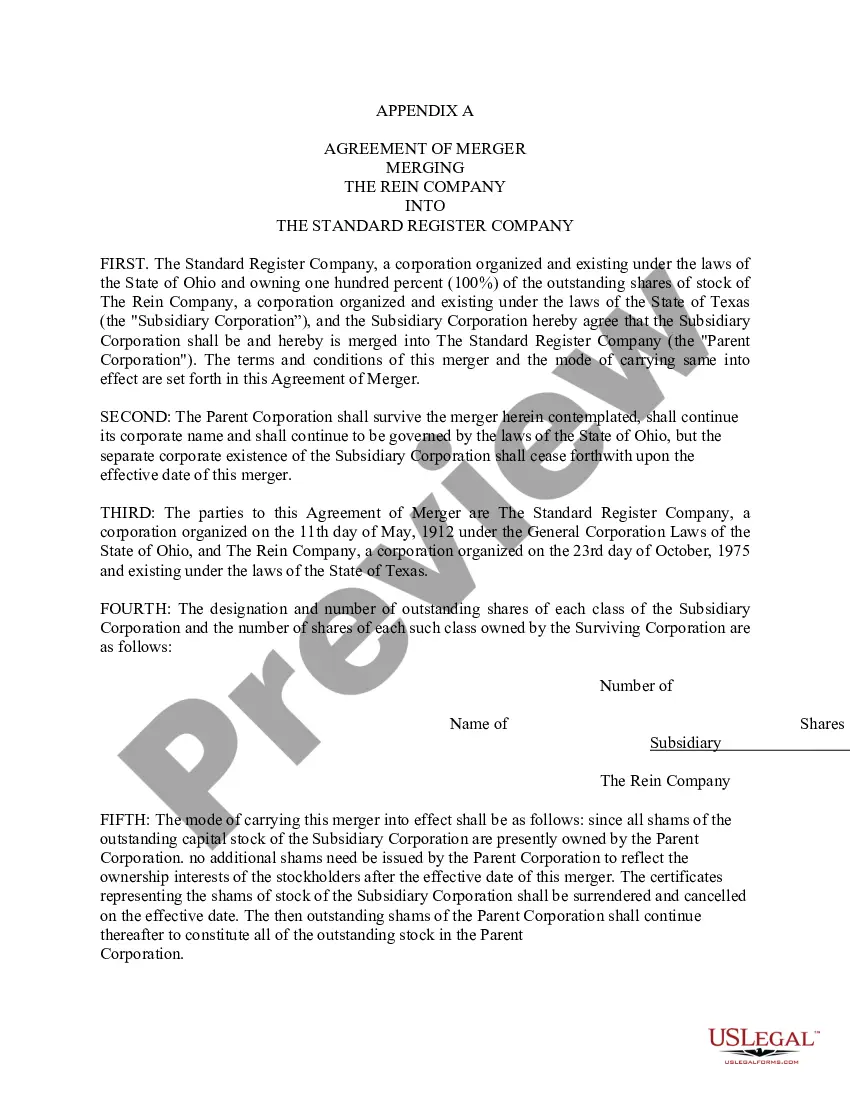

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

Public company mergers require filing a variety of public disclosure documents. In the United States, the companies make public filings of these materials with the Securities and Exchange Commission (SEC).

Business Source Complete, ABI/INFORM, Mergent Online, and Nexis Uni (formerly LexisNexis) will provide news articles on recent mergers and acquisitions, as well as industry reports. These industry reports may indicate whether an industry is consolidating or growing industry.

A public seller will file the merger proxy with the SEC usually several weeks after a deal announcement. You'll first see something called a PREM14A, followed by a DEFM14A several days later. The first is the preliminary proxy, the second is the definitive proxy (or final proxy).

A merger agreement (or ?definitive merger agreement?) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.

Use SEC filings to find details about a company's merger or acquisition. Both the target and acquirer will file reports.

If the merger or acquisition requires a vote by shareholders, the agreement will be available in the proxy document, Schedule 14A (or sometimes an information statement, Schedule 14C). The proxy will include the terms of the merger and what shareholders can expect to receive as proceeds.

When a transaction closes, the new company will simply take over performance as the successor-in-interest to the old company. The merger agreement will already assign the rights and obligations under existing contracts to the buyer without a new, specific process for each existing agreement.