District of Columbia Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

How to fill out Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

Are you currently inside a situation where you need to have papers for either business or person uses virtually every day? There are a lot of lawful document templates available on the Internet, but locating kinds you can trust isn`t easy. US Legal Forms provides thousands of kind templates, such as the District of Columbia Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock, that are created to satisfy federal and state specifications.

If you are already knowledgeable about US Legal Forms website and get a merchant account, simply log in. Following that, you are able to down load the District of Columbia Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock format.

If you do not provide an bank account and wish to start using US Legal Forms, follow these steps:

- Find the kind you want and make sure it is for your right city/county.

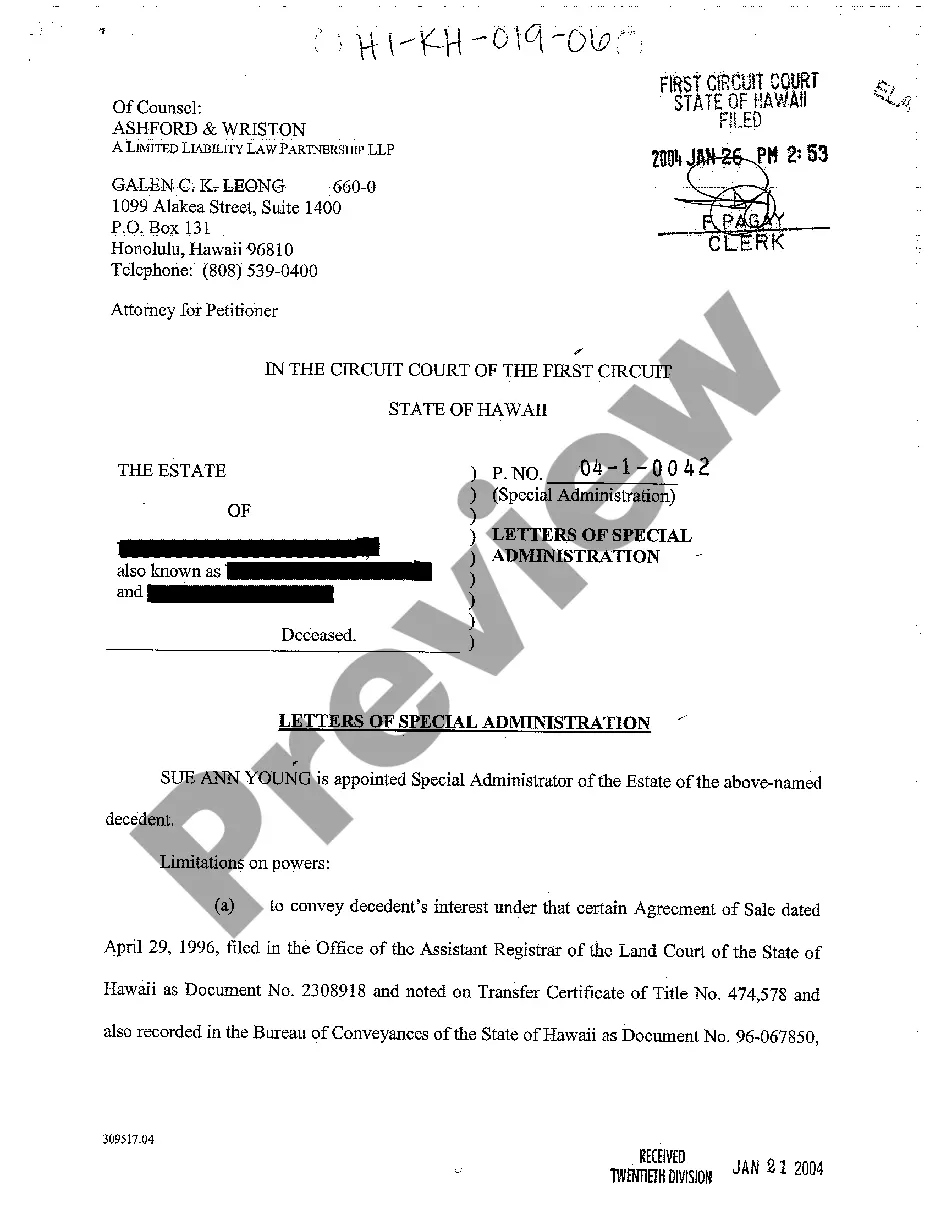

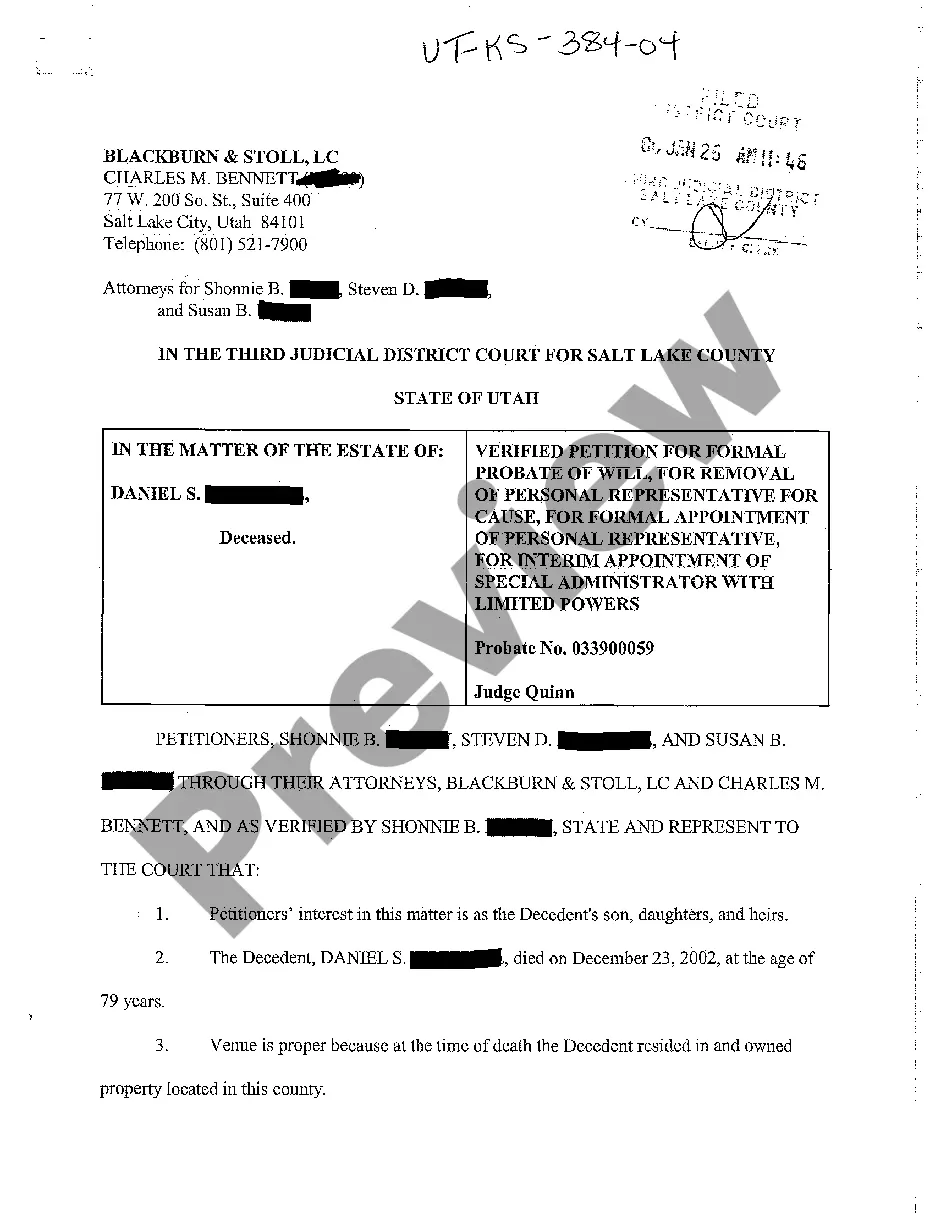

- Utilize the Preview button to review the form.

- Browse the outline to ensure that you have chosen the appropriate kind.

- In the event the kind isn`t what you`re searching for, make use of the Look for field to discover the kind that meets your needs and specifications.

- When you get the right kind, simply click Purchase now.

- Select the costs prepare you need, complete the specified information to create your bank account, and pay money for the order making use of your PayPal or credit card.

- Pick a convenient document file format and down load your duplicate.

Locate all the document templates you may have purchased in the My Forms menus. You may get a extra duplicate of District of Columbia Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock whenever, if required. Just click on the needed kind to down load or print the document format.

Use US Legal Forms, the most comprehensive collection of lawful varieties, in order to save time and prevent blunders. The services provides appropriately made lawful document templates that can be used for a selection of uses. Produce a merchant account on US Legal Forms and begin producing your life a little easier.

Form popularity

FAQ

What is an Amended and Restated Certificate of Incorporation? An Amended and Restated Certificate of Incorporation is a legal document filed with the Secretary of State that restates, integrates, and adjusts the startup's initial Articles of Incorporation (i.e. the company's Charter).

Articles of Incorporation refers to the highest governing document in a corporation. It is also known known as the corporate charter. The Articles of Incorporation generally include the purpose of the corporation, the type and number of shares, and the process of electing a board of directors.

What information do Articles of Incorporation contain? Name or number of your business. ... Full Address of the corporation's registered office. ... Names and addresses for directors/incorporators for the Articles of Incorporation. ... Directors Citizenship Status. ... Share Structure and Provisions.