District of Columbia Performance Stock Option Award Agreement of Special Devices, Inc.

Description

How to fill out Performance Stock Option Award Agreement Of Special Devices, Inc.?

You are able to spend hrs on the Internet trying to find the legal papers web template which fits the state and federal specifications you need. US Legal Forms gives a large number of legal kinds that happen to be analyzed by specialists. You can actually acquire or printing the District of Columbia Performance Stock Option Award Agreement of Special Devices, Inc. from the assistance.

If you currently have a US Legal Forms account, it is possible to log in and click the Obtain switch. Following that, it is possible to full, modify, printing, or indicator the District of Columbia Performance Stock Option Award Agreement of Special Devices, Inc.. Each legal papers web template you acquire is yours permanently. To get yet another version of any obtained type, go to the My Forms tab and click the related switch.

If you use the US Legal Forms website for the first time, stick to the easy directions under:

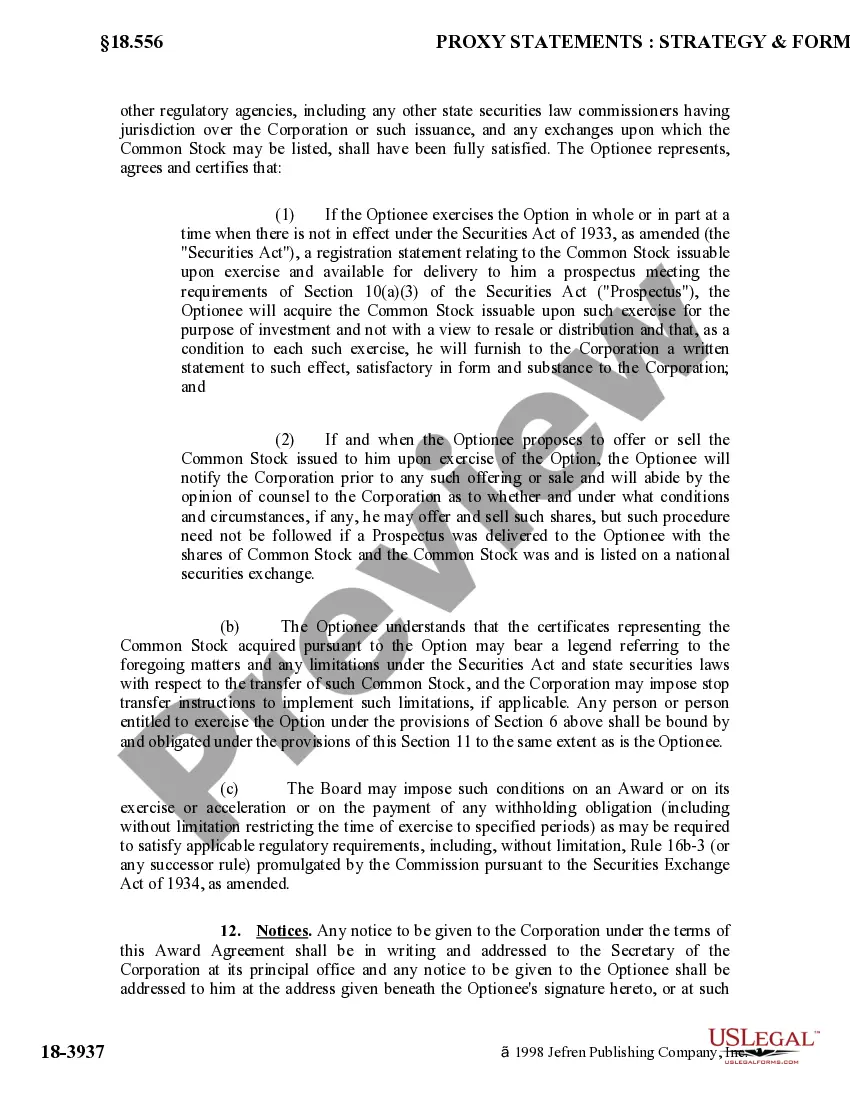

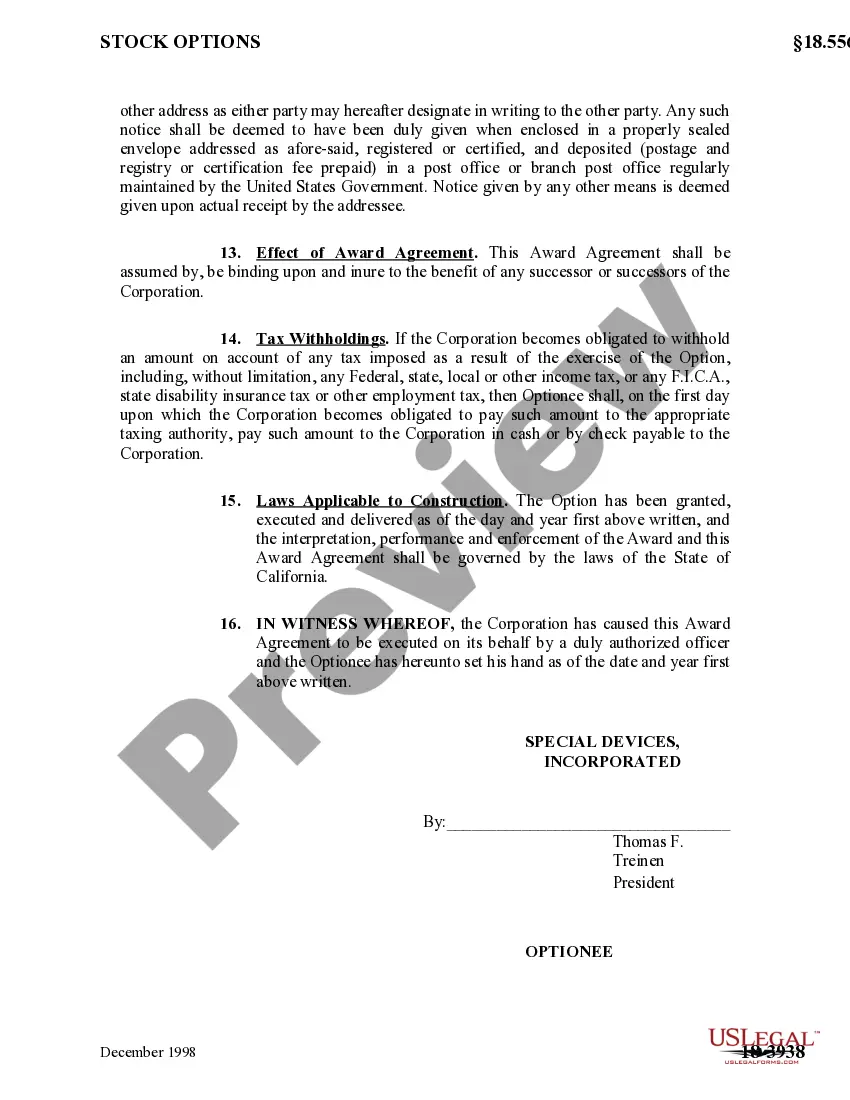

- Very first, make sure that you have chosen the best papers web template for the county/area of your choosing. See the type outline to make sure you have picked out the right type. If readily available, use the Review switch to check with the papers web template also.

- In order to get yet another version of your type, use the Look for area to find the web template that meets your requirements and specifications.

- When you have found the web template you would like, click Acquire now to proceed.

- Select the costs plan you would like, type in your accreditations, and register for your account on US Legal Forms.

- Comprehensive the deal. You should use your charge card or PayPal account to pay for the legal type.

- Select the formatting of your papers and acquire it for your product.

- Make adjustments for your papers if needed. You are able to full, modify and indicator and printing District of Columbia Performance Stock Option Award Agreement of Special Devices, Inc..

Obtain and printing a large number of papers templates utilizing the US Legal Forms site, that provides the largest variety of legal kinds. Use expert and state-specific templates to handle your business or specific needs.

Form popularity

FAQ

A stock option award is a type of compensation contract that companies use to incentivize employees. This contract is an agreement between the company and employee that gives them the right, but not the obligation, to purchase shares of company stock at a set price in the future (usually for pennies on the dollar).

Cash-?Settled Performance Shares (Performance Condition) ?Fair value? is equal to the number of performance shares expected to be earned (or actually earned) multiplied by the fair market value of a share of company stock on the date of determination.

Potential drawbacks of PSUs include complexity in design and administration, challenges in setting fair and achievable performance goals, volatility in payouts due to market and company conditions, and dilution of existing shareholders' ownership.

Performance Stock Unit (PSU) A company's commitment to give a targeted number of shares of stock or cash equivalent to an employee at a future date, once vested. The actual number of shares given will vary based on performance as measured against the defined goals.

The main difference between restricted stock and performance shares is that restricted stock is typically awarded to employees with the condition that they remain with the company for a certain period of time, while performance shares are awarded to employees based on the company's performance.

A performance award is a grant of company shares or units in which the recipient's rights in the shares or units are contingent on the achievement of pre-established performance goals, and restricted until the end of a set performance period.