District of Columbia Nonemployee Director Stock Option Plan of U.S. Bancorp

Description

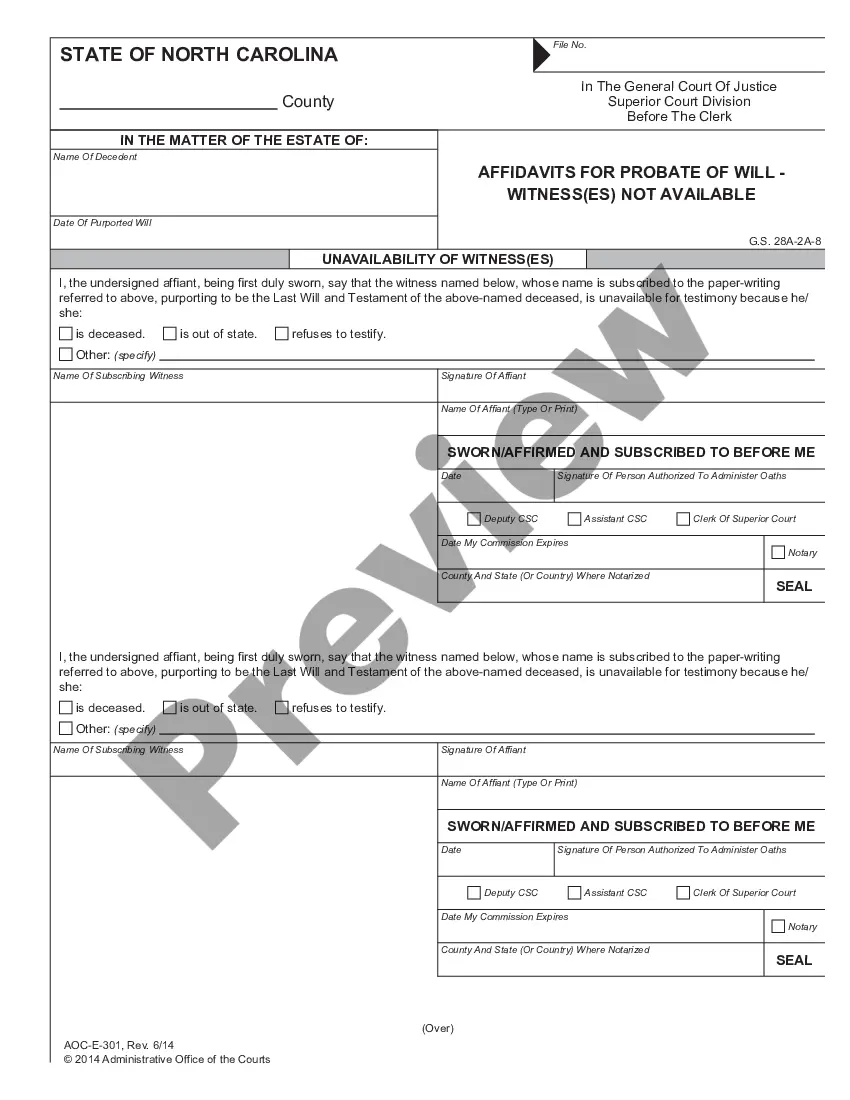

How to fill out Nonemployee Director Stock Option Plan Of U.S. Bancorp?

US Legal Forms - among the greatest libraries of legitimate types in America - delivers a wide array of legitimate file web templates you may down load or produce. Making use of the internet site, you will get 1000s of types for organization and person reasons, sorted by groups, claims, or key phrases.You will find the most recent versions of types just like the District of Columbia Nonemployee Director Stock Option Plan of U.S. Bancorp within minutes.

If you already possess a membership, log in and down load District of Columbia Nonemployee Director Stock Option Plan of U.S. Bancorp through the US Legal Forms collection. The Acquire option can look on every single form you see. You gain access to all previously delivered electronically types within the My Forms tab of your respective profile.

If you wish to use US Legal Forms the very first time, allow me to share simple guidelines to help you started:

- Make sure you have chosen the proper form to your area/county. Go through the Review option to analyze the form`s information. See the form information to ensure that you have chosen the proper form.

- When the form does not fit your specifications, take advantage of the Search field towards the top of the display to find the the one that does.

- In case you are happy with the form, verify your choice by clicking on the Purchase now option. Then, choose the rates strategy you like and supply your qualifications to register for the profile.

- Process the deal. Use your Visa or Mastercard or PayPal profile to complete the deal.

- Select the formatting and down load the form in your product.

- Make alterations. Complete, revise and produce and indicator the delivered electronically District of Columbia Nonemployee Director Stock Option Plan of U.S. Bancorp.

Each web template you included with your account does not have an expiration day and it is the one you have forever. So, if you wish to down load or produce one more duplicate, just visit the My Forms area and click on in the form you need.

Obtain access to the District of Columbia Nonemployee Director Stock Option Plan of U.S. Bancorp with US Legal Forms, probably the most substantial collection of legitimate file web templates. Use 1000s of professional and state-specific web templates that satisfy your organization or person demands and specifications.

Form popularity

FAQ

As Vice Chair and Chief Financial Officer at US BANCORP, Terrance R. Dolan made $6,828,538 in total compensation. Of this total $750,000 was received as a salary, $1,840,500 was received as a bonus, $0 was received in stock options, $4,200,000 was awarded as stock and $38,038 came from other types of compensation.

The Bancorp Inc (Bancorp) is a provider of banking and other related financial solutions to individuals and corporate clients through its subsidiary, the Bancorp Bank. It offers payment solutions such as prepaid and debit card accounts, bill payments, payroll, and clearing and settlement services.

U.S. Bank Mission Statement We work to meet our customers' business and personal banking needs with competitive products and services, convenient access to their accounts, and proven stability backed by industry-leading financial metrics.

U.S. Bank is committed to serving its millions of retail, business, wealth management, payment, commercial, corporate, and investment clients across the country and around the world as a trusted and responsible financial partner.

Yes, U.S. Bancorp [NYSE: USB] is the publicly traded parent company of U.S. Bank. While we often use U.S. Bancorp in formal documents and corporate filings, U.S. Bank is what you'll see on branch doorways, app stores, national television commercials and much more.

Its portfolio of products and services comprises savings and checking accounts, certificate of deposits, consumer and business loans, personal and business lines of credit, mortgages, insurance, savings and investment products, brokerage and fund services, credit and debit cards, asset and wealth management, and ...

Your deposits are safe with us. As an FDIC-insured bank, eligible U.S Bank consumer and business deposits are insured unconditionally by the United States government.

Who owns Us Bancorp? Us Bancorp (NYSE: USB) is owned by 74.04% institutional shareholders, 19.86% Us Bancorp insiders, and 6.10% retail investors. Berkshire Hathaway Inc is the largest individual Us Bancorp shareholder, owning 300.56M shares representing 19.30% of the company.