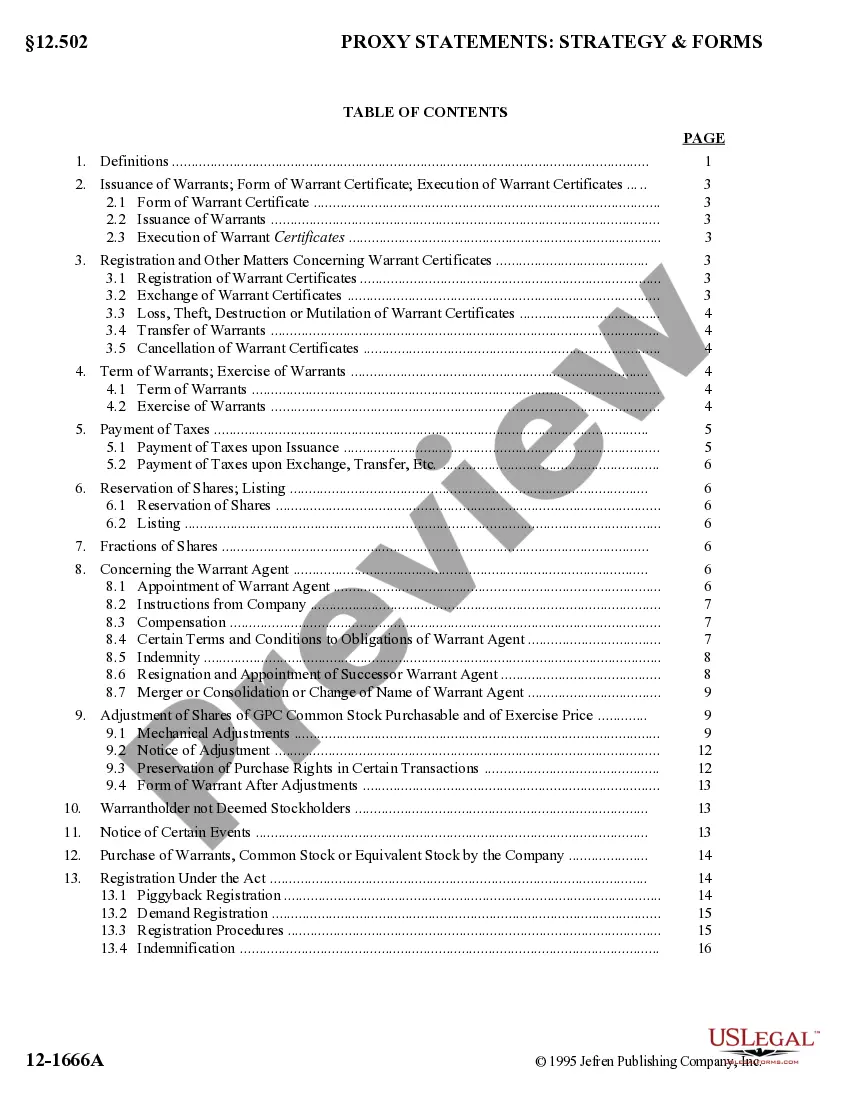

District of Columbia Second Warrant Agreement by General Physics Corp.

Description

How to fill out Second Warrant Agreement By General Physics Corp.?

Are you in a placement where you need documents for possibly company or person uses virtually every day time? There are tons of legitimate document layouts accessible on the Internet, but getting versions you can rely is not simple. US Legal Forms offers 1000s of develop layouts, much like the District of Columbia Second Warrant Agreement by General Physics Corp., that happen to be created to fulfill state and federal demands.

Should you be already informed about US Legal Forms site and also have a free account, just log in. After that, you are able to download the District of Columbia Second Warrant Agreement by General Physics Corp. web template.

Unless you provide an bank account and need to start using US Legal Forms, follow these steps:

- Obtain the develop you want and ensure it is for that right metropolis/area.

- Take advantage of the Review key to analyze the shape.

- Read the outline to ensure that you have selected the right develop.

- If the develop is not what you are looking for, utilize the Search area to discover the develop that meets your needs and demands.

- Once you get the right develop, click on Acquire now.

- Select the prices strategy you desire, fill in the specified information and facts to generate your bank account, and buy your order using your PayPal or Visa or Mastercard.

- Choose a convenient file file format and download your copy.

Discover each of the document layouts you might have purchased in the My Forms menus. You can obtain a additional copy of District of Columbia Second Warrant Agreement by General Physics Corp. anytime, if needed. Just select the essential develop to download or print the document web template.

Use US Legal Forms, one of the most extensive selection of legitimate types, to conserve some time and avoid errors. The assistance offers expertly manufactured legitimate document layouts that you can use for an array of uses. Generate a free account on US Legal Forms and initiate producing your way of life a little easier.

Form popularity

FAQ

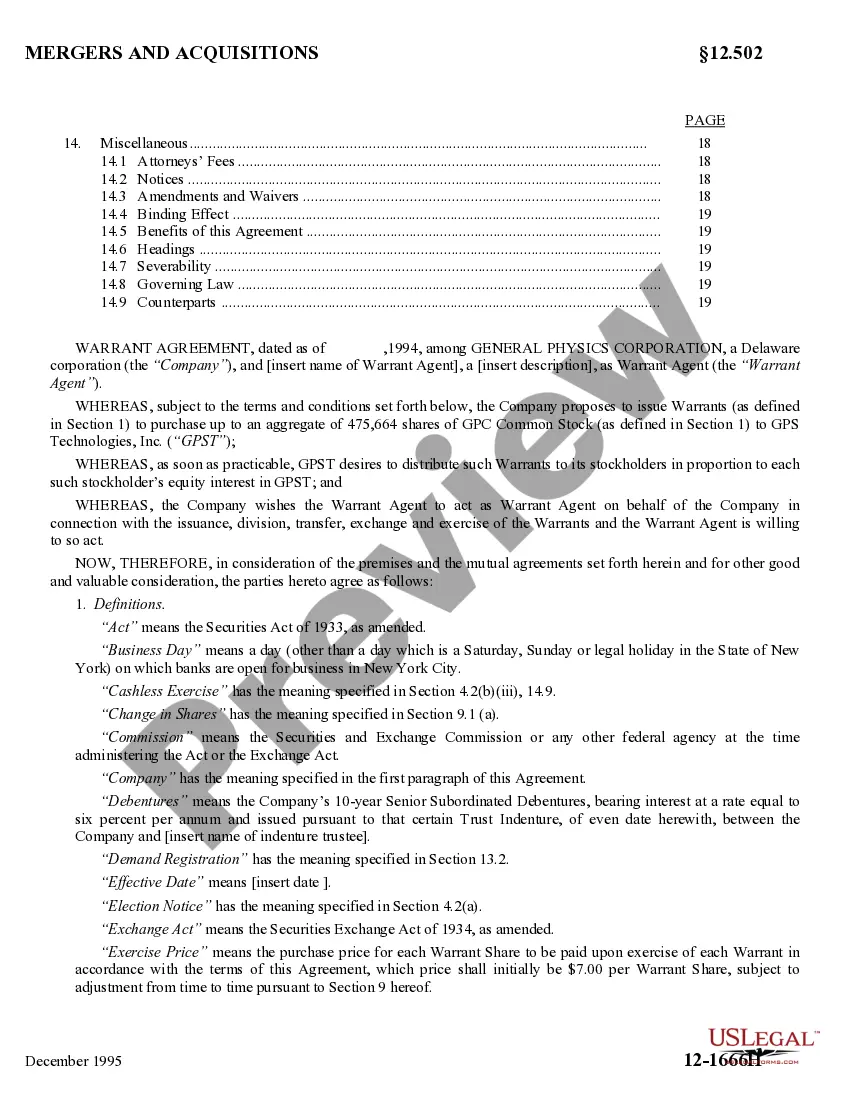

What Is Warrant Coverage? Warrant coverage is an agreement between a company and one or more shareholders where the company issues a warrant equal to some percentage of the dollar amount of an investment. Warrants, similar to options, allow investors to acquire shares at a designated price.

A warrant is an agreement between two parties ? the ?issuer? (i.e., a company) and the ?holder? of the warrant ? that entitles the holder to purchase the issuer's stock at a specified price within a certain time frame.

A warrant agreement is an agreement to purchase stock, also called a stock warrant. The agreement provides one party the right to purchase a company's stock at a specific price and at a specific date.

Warrants and call options are both types of securities contracts. A warrant gives the holder the right, but not the obligation, to buy common shares of stock directly from the company at a fixed price for a pre-defined time period.

Companies often issue stock warrants by attaching the warrant to a bond or other security that they use to raise capital. The warrant helps attract investors and also represents potential future capital for the issuing company.