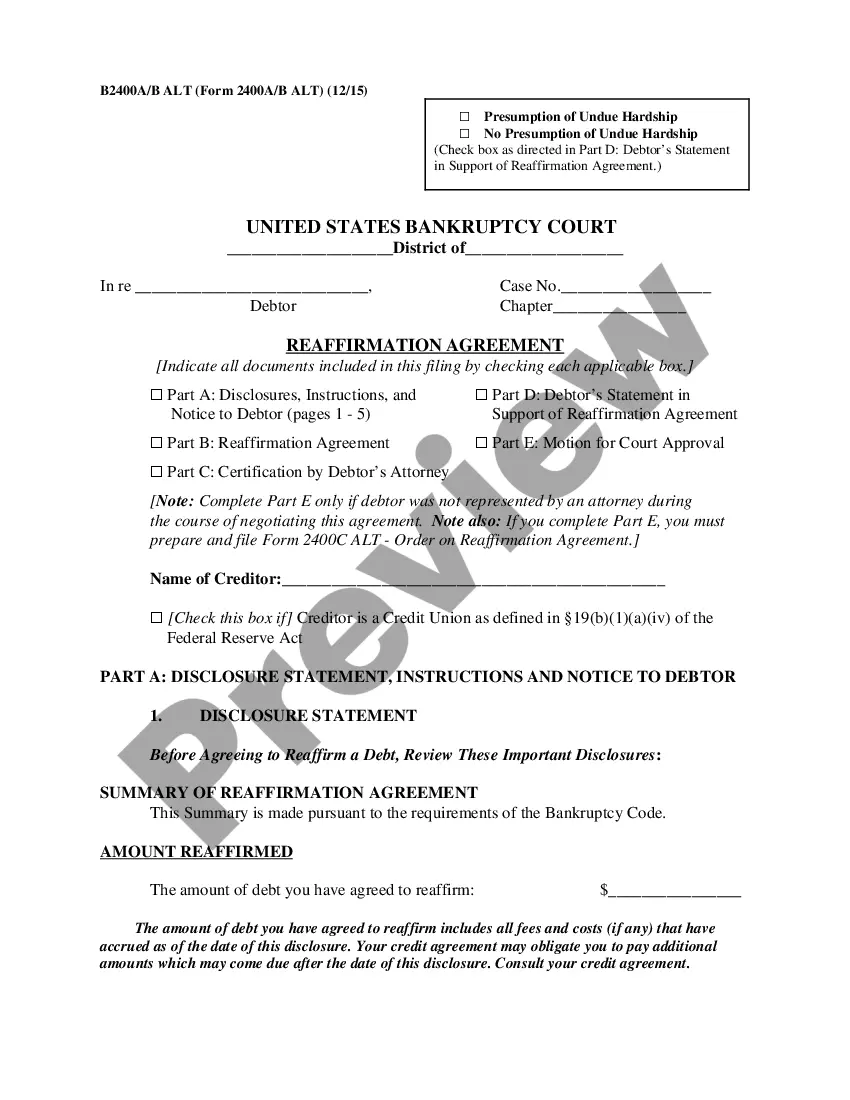

District of Columbia Reaffirmation Agreement, Motion and Order

Description

How to fill out Reaffirmation Agreement, Motion And Order?

US Legal Forms - among the largest libraries of legitimate varieties in the United States - provides a wide array of legitimate record templates you may acquire or produce. Utilizing the internet site, you can find a large number of varieties for business and specific functions, sorted by categories, claims, or key phrases.You can find the most recent types of varieties like the District of Columbia Reaffirmation Agreement, Motion and Order within minutes.

If you have a membership, log in and acquire District of Columbia Reaffirmation Agreement, Motion and Order from the US Legal Forms collection. The Acquire button will show up on every kind you see. You gain access to all previously acquired varieties in the My Forms tab of the profile.

If you wish to use US Legal Forms the very first time, here are easy recommendations to help you get started out:

- Make sure you have selected the best kind to your metropolis/area. Go through the Preview button to examine the form`s articles. See the kind description to actually have selected the proper kind.

- When the kind doesn`t satisfy your needs, use the Search area on top of the screen to find the one which does.

- In case you are satisfied with the form, confirm your option by clicking the Purchase now button. Then, choose the pricing plan you prefer and offer your qualifications to register for the profile.

- Procedure the financial transaction. Make use of Visa or Mastercard or PayPal profile to finish the financial transaction.

- Find the formatting and acquire the form on your product.

- Make changes. Fill up, revise and produce and indicator the acquired District of Columbia Reaffirmation Agreement, Motion and Order.

Every single web template you put into your account does not have an expiration time which is your own eternally. So, if you want to acquire or produce another copy, just go to the My Forms area and click on about the kind you need.

Get access to the District of Columbia Reaffirmation Agreement, Motion and Order with US Legal Forms, probably the most substantial collection of legitimate record templates. Use a large number of professional and express-certain templates that satisfy your organization or specific demands and needs.

Form popularity

FAQ

Reaffirming a debt informs the lender that you intend to continue to pay the loan. Generally, the lender will continue to report the loan and all payments made on that loan to the credit reporting agencies, which may help improve your credit score after bankruptcy, provided timely payments are made on the loan.

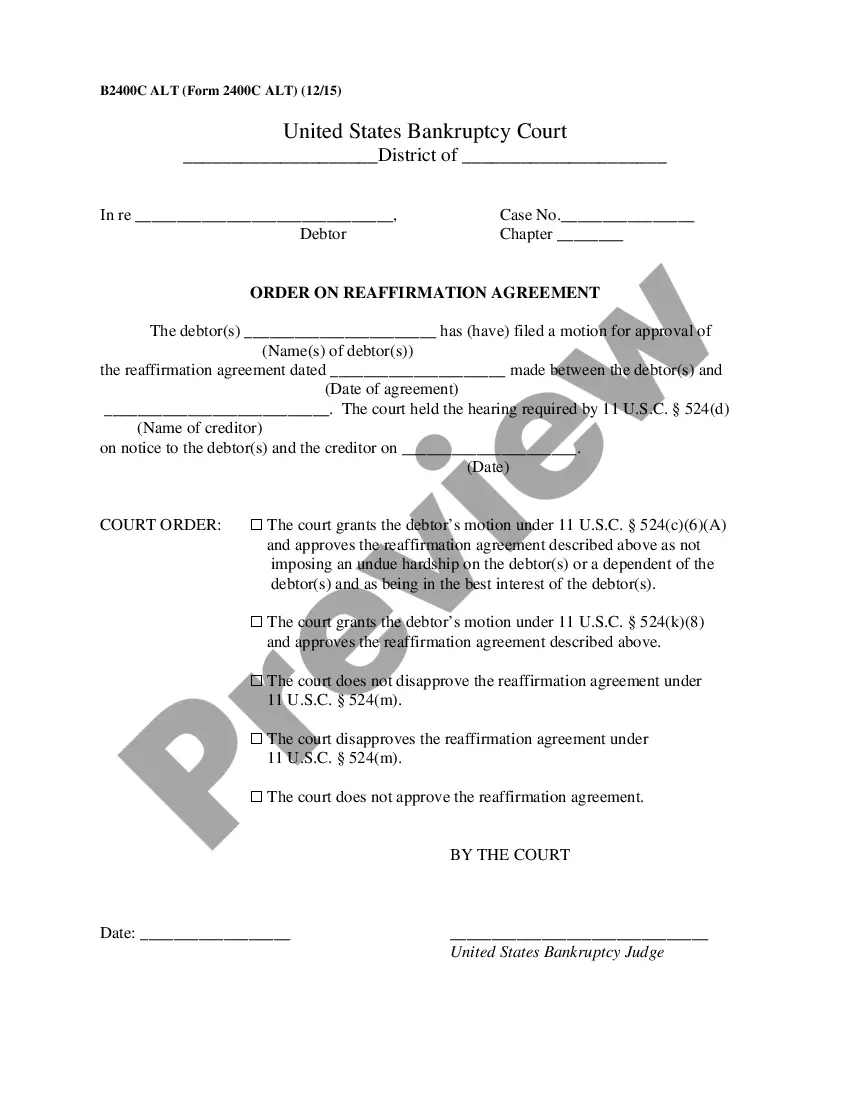

Reaffirmation agreements can be rescinded any time before the Court issues the discharge, or within 60 days after the agreement is filed with the Court, whichever is the later. Notice of the rescission must be given to the creditor.

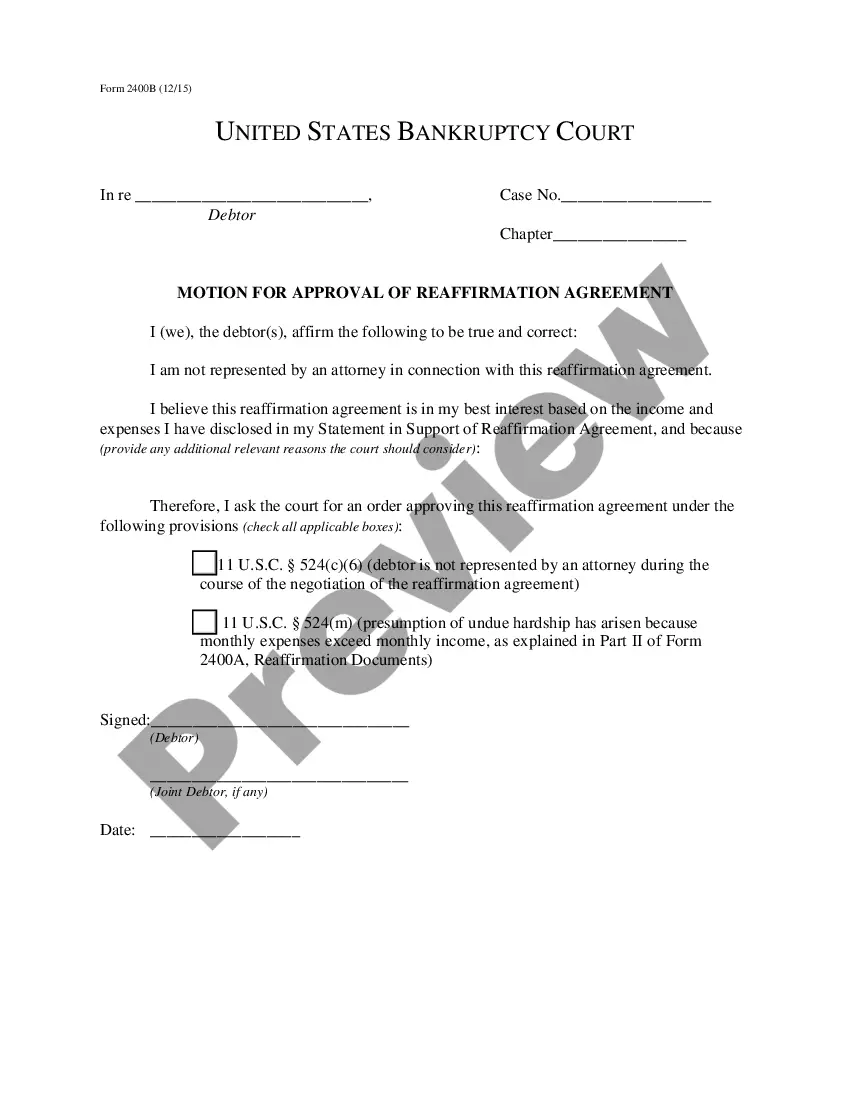

After you have entered into a reaffirmation agreement and all parts of this form that require a signature have been signed, either you or the creditor should file it as soon as possible.

In this article, you'll learn that lenders sometimes agree to new terms when completing a reaffirmation agreement, including lowering the amount owed, interest rate, or monthly payment. A local bankruptcy lawyer can help you with the negotiation process.

A reaffirmation agreement is an agreement between a chapter 7 debtor and a creditor that the debtor will pay all or a portion of the money owed, even though the debtor has filed bankruptcy. In return, the creditor promises that, as long as payments are made, the creditor will not repossess or take back its collateral.

A reaffirmation agreement is where you agree to pay a debt even though you could have eliminated the debt in your bankruptcy case. When you reaffirm a debt, you continue to be legally responsible for paying it back. This gives the creditor some legal rights.

If I deny the motion to reaffirm the debt, you are under no legal responsibility to pay the creditor, but the creditor can seek to repossess the collateral (if there is any). However the creditor cannot obtain a judgment against you for the amount you owe on this debt.

Creditors holding a security interest that they want to protect post-bankruptcy will request that a Reaffirmation Agreement is signed. They will prepare it and provide it to your attorney's office for review.