District of Columbia Employee Evaluation Form for Actor

Description

How to fill out Employee Evaluation Form For Actor?

If you need to thorough, acquire, or create valid document templates, utilize US Legal Forms, the largest assortment of valid forms available online.

Take advantage of the site’s user-friendly and efficient search to obtain the documents you need.

Various templates for business and personal needs are categorized by types and jurisdictions, or keywords.

Step 4. After locating the form you need, click the Get Now button. Choose your preferred pricing option and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the District of Columbia Employee Evaluation Form for Actor in merely a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and then click the Download button to retrieve the District of Columbia Employee Evaluation Form for Actor.

- You can also access forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

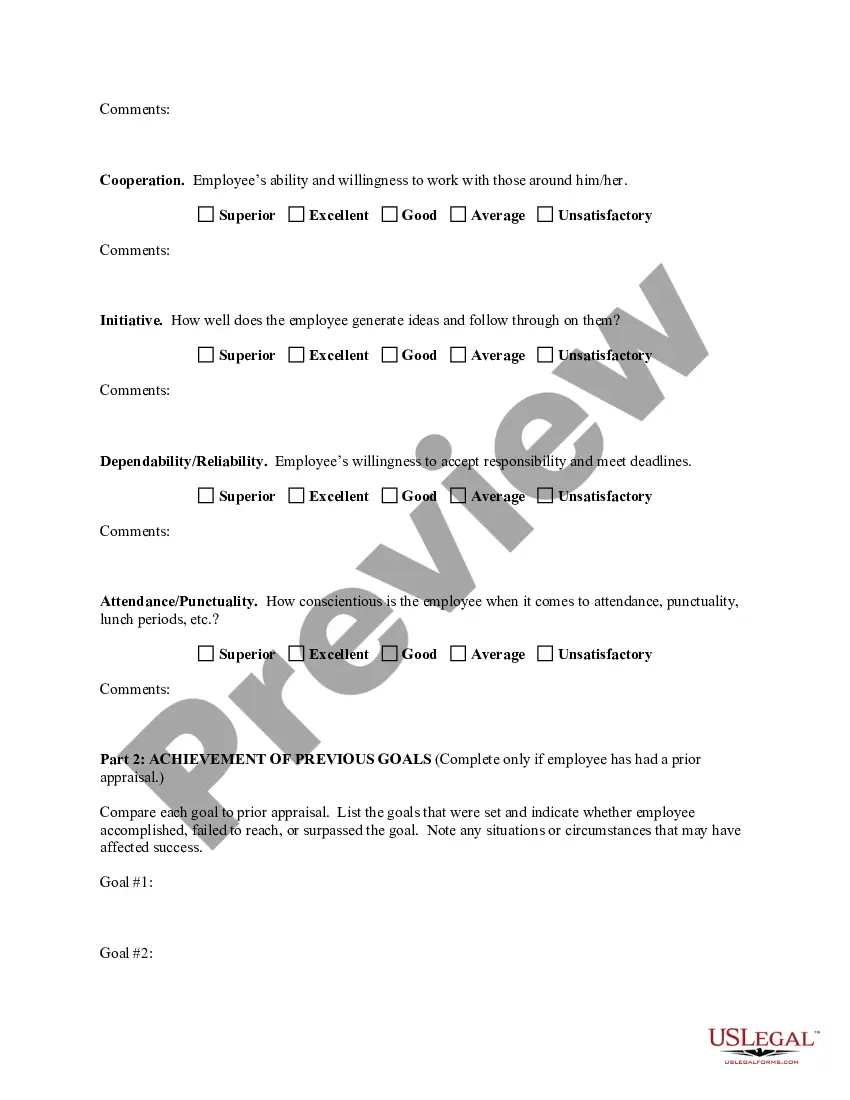

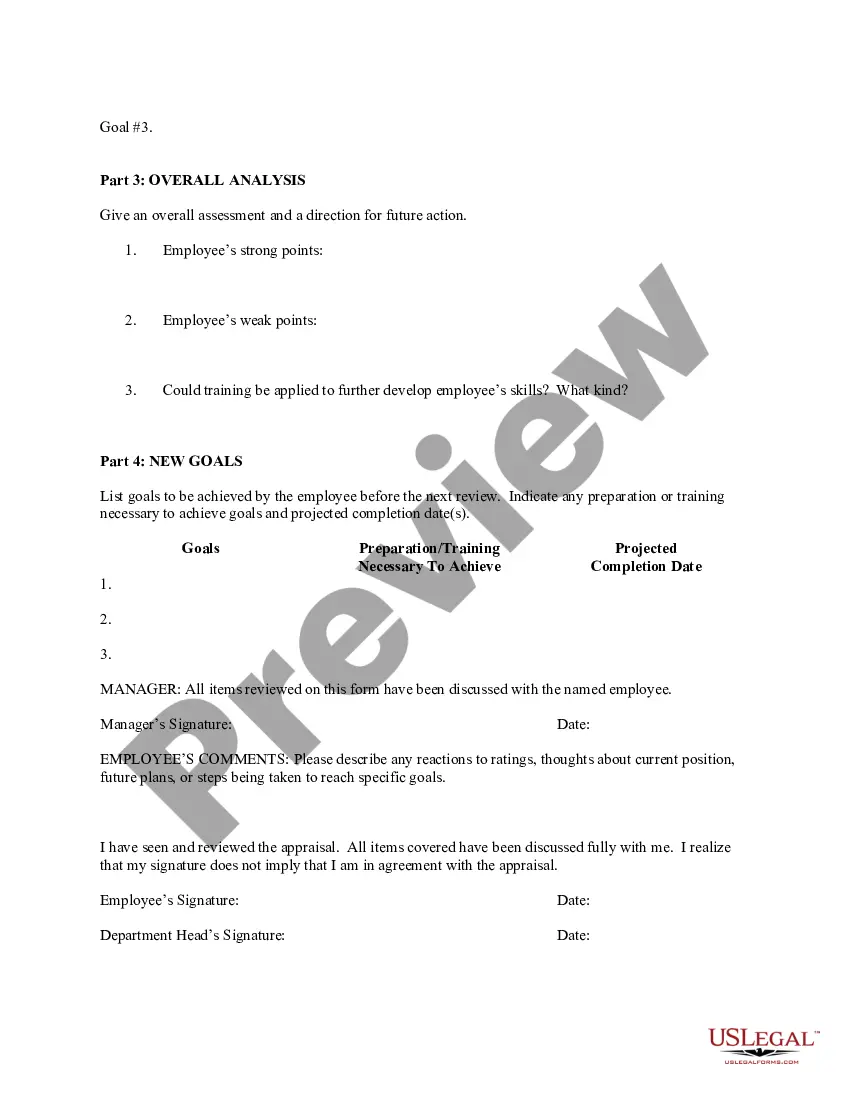

- Step 2. Use the Preview feature to review the content of the form. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative templates in the legal form directory.

Form popularity

FAQ

When completing the District of Columbia Employee Evaluation Form for Actor as a self-evaluation, begin by honestly reflecting on your job performance. Identify your major accomplishments, challenges, and areas for improvement. Articulating your career goals and aligning them with the feedback provided can create a constructive dialogue with your supervisor.

Obtaining a Certificate of Clean Hands from the Office of Tax and Revenue is a simple process by visiting MyTax.DC.gov on your computer or smart phone. For additional information, please contact OTR's Compliance Administration, Collections Division at (202) 724-5045 or email CleanHands.cert@dc.gov.

After the close of the calendar year, file Form D-40B with the Office of Tax and Revenue, P.O. Box 7861, Washington, D.C. 20044-7861.

Form # Title. Filing Date. D-40. Individual Income Tax Forms and Instructions for Single and Joint Filers with No Dependents and All Other Filers.

After the close of the calendar year, file Form D-40B with the Office of Tax and Revenue, P.O. Box 7861, Washington, D.C. 20044-7861.

To file by paper, you can obtain forms via the website at MyTax.DC.gov and select Forms, or from several locations around the District. Visit Location of Tax Forms to find out where.

2020 Form OR-40. Oregon Individual Income Tax Return for Full-year Residents.

G for DCClick on Federal Taxes (Personal using Home and Business)Click on Wages and Income (Personal Income using Home and Business)Click on I'll choose what I work on (if shown)Scroll down to Other Common Income.On Refunds Received for State/Local Tax Returns, click the start or update button.

Form D-40 is used for the Tax Return and Tax Amendment. You can prepare a 2021 Washington, D.C. Tax Amendment on eFile.com, however you cannot submit it electronically. In comparison, the IRS requires a different Form - Form 1040X - to amend an IRS return (do not use Form 1040 for an IRS Amendment).

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2019 and who did not live in DC for a total of 183 days or more during 2019. A joint request for refund is not permitted.