District of Columbia Employee Evaluation Form for Sole Trader

Description

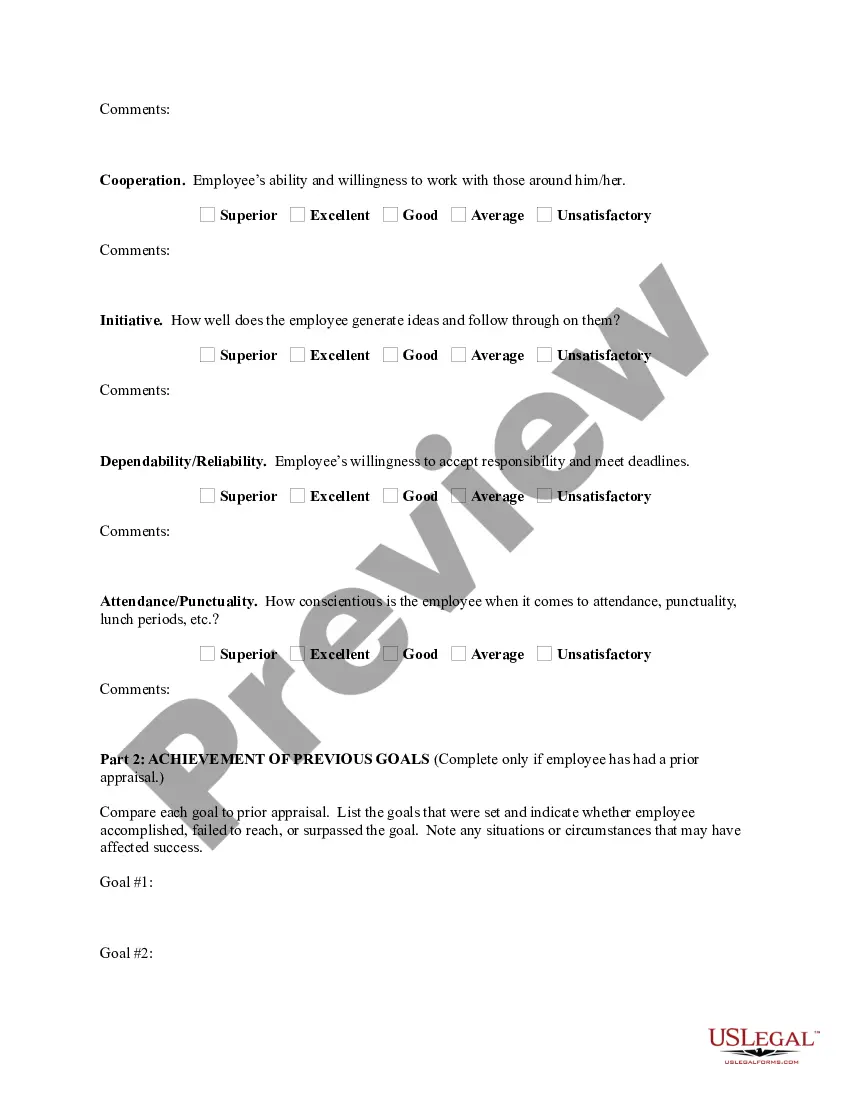

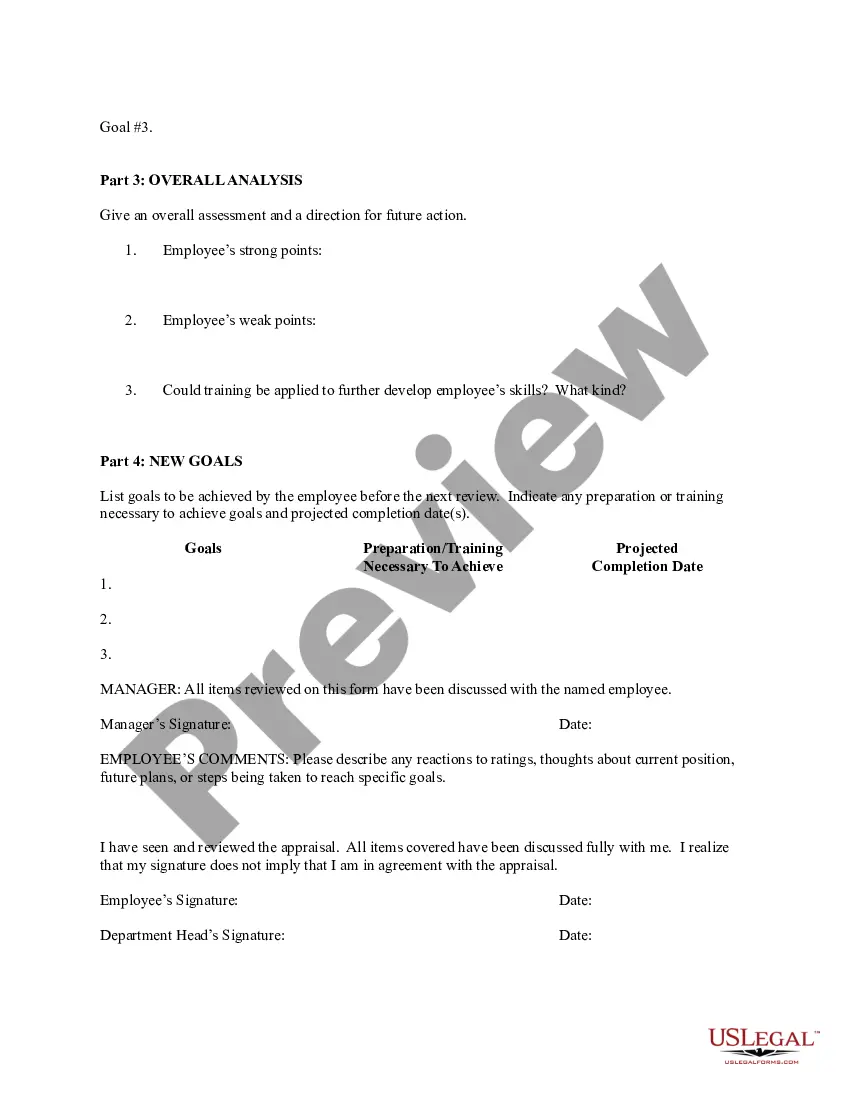

How to fill out Employee Evaluation Form For Sole Trader?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal template documents that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can find the most recent versions of forms like the District of Columbia Employee Assessment Form for Sole Proprietor in moments.

If you already have a monthly subscription, Log In to download the District of Columbia Employee Assessment Form for Sole Proprietor from the US Legal Forms repository. The Download button will appear on each document you view. You gain access to all previously downloaded forms from the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the document onto your device.Edit. Fill in, modify, print, and sign the downloaded District of Columbia Employee Assessment Form for Sole Proprietor.Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the document you need.

- Ensure you have chosen the right document for your region/area.

- Click the Preview button to review the form’s content.

- Check the form description to confirm that you have selected the right document.

- If the document does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your information to sign up for the account.

Form popularity

FAQ

Obtaining the FR 500 in DC can take several days to a few weeks, depending on processing times at the tax office. If you are a sole trader, timely submission ensures compliance with your tax responsibilities. Consider utilizing USLegalForms to streamline your submission process related to the District of Columbia Employee Evaluation Form for Sole Trader.

500, or Combined Tax Registration Form, is used by businesses to register all their tax requirements on one simple form. Whether registering for sales tax, franchise tax, unemployment tax, etc., the business person completes all areas applicable to their business activity either in hardcopy or online.

For the purposes of this chapter (not alone of this subchapter) and unless otherwise required by the context, the term unincorporated business means any trade or business, conducted or engaged in by any individual, whether resident or nonresident, statutory or common-law trust, estate, partnership, or limited or

The DC franchise tax, also known as the DC unincorporated business franchise tax, is a tax imposed on some businesses operating in the District of Columbia that have gross receipts of $12,000 or more.

After the close of the calendar year, file Form D-40B with the Office of Tax and Revenue, P.O. Box 7861, Washington, D.C. 20044-7861.

Generally, an unincorporated business, with gross income (Line 10) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

Form D-40 is used for the Tax Return and Tax Amendment. You can prepare a 2021 Washington, D.C. Tax Amendment on eFile.com, however you cannot submit it electronically. In comparison, the IRS requires a different Form - Form 1040X - to amend an IRS return (do not use Form 1040 for an IRS Amendment).

Form D-30 can be e-filed. Refer to this article for information on the date you can begin e-filing this form. Generally, an unincorporated business with gross income over $12,000 from D.C. sources must file a D-30, regardless of whether it has net income.

Form # Title. Filing Date. D-40. Individual Income Tax Forms and Instructions for Single and Joint Filers with No Dependents and All Other Filers.

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);