District of Columbia Equal Pay Checklist

Description

How to fill out Equal Pay Checklist?

If you wish to obtain, acquire, or generate authentic document templates, utilize US Legal Forms, the leading collection of legal forms, which is accessible online.

Employ the site’s straightforward and efficient search function to locate the documents you require.

Numerous templates for business and personal purposes are categorized by types and categories, or keywords.

Step 3. If you are not satisfied with the form, use the Search box near the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have found the form you need, select the Purchase now button. Choose the pricing plan you prefer and provide your information to create an account.

- Utilize US Legal Forms to locate the District of Columbia Equal Pay Checklist with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to access the District of Columbia Equal Pay Checklist.

- You can also find forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Verify that you've selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the form’s content. Ensure to read through the description.

Form popularity

FAQ

Yes, Washington, D.C. does require salary transparency. Employers must provide salary information for job postings, aligning with the District of Columbia Equal Pay Checklist. This requirement aims to promote equitable pay and reduce wage disparities among employees. UsLegalForms offers resources and templates to help you understand and comply with these regulations effectively.

Enforcement of DC’s minimum wage laws is primarily handled by the Department of Employment Services. The department investigates complaints about unpaid wages and can impose penalties on businesses that violate wage laws. You can strengthen your understanding of your entitlements by reviewing the District of Columbia Equal Pay Checklist. This checklist can help you navigate the complexities of minimum wage enforcement in DC, ensuring your rights are upheld.

The wage payment law in Washington, DC, requires employers to pay employees at least twice a month. This law ensures timely payment for the labor you provide. It's important to familiarize yourself with this law as well as the District of Columbia Equal Pay Checklist. This checklist outlines your rights and provides essential information on how to handle wage disputes effectively.

The 4 hour rule in Washington, DC, dictates that employees must be compensated for a minimum of four hours when they report to work, regardless of whether they work the full shift. This rule helps safeguard workers by providing a clear expectation of pay for their time. If you feel unsure about how this applies to your situation, the District of Columbia Equal Pay Checklist can offer guidance on your rights and compensation. Always remember, being informed is key to protecting your earnings.

To report missing wages in Washington, DC, you should contact the District of Columbia Department of Employment Services. They provide a process for employees to file claims for unpaid wages. It is also wise to gather documentation, such as pay stubs and correspondence with your employer, to support your case. By utilizing the District of Columbia Equal Pay Checklist, you can ensure you have all the necessary details ready for a smooth reporting process.

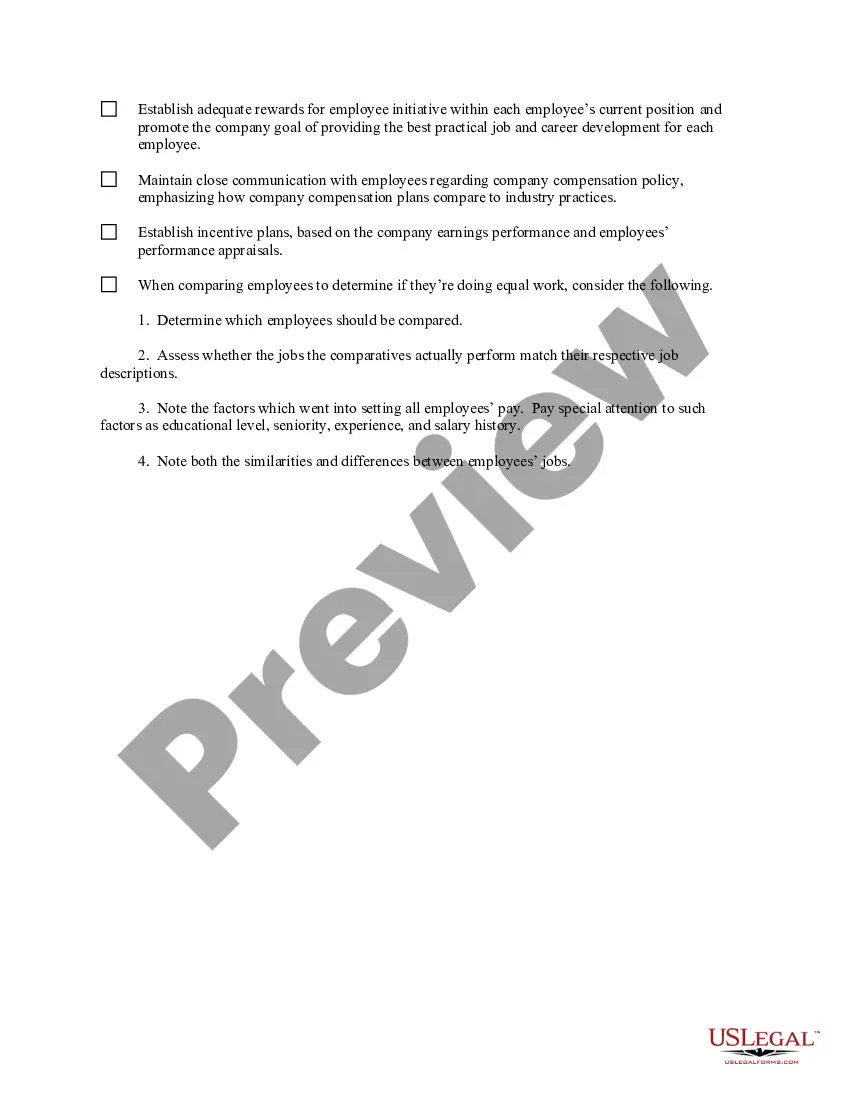

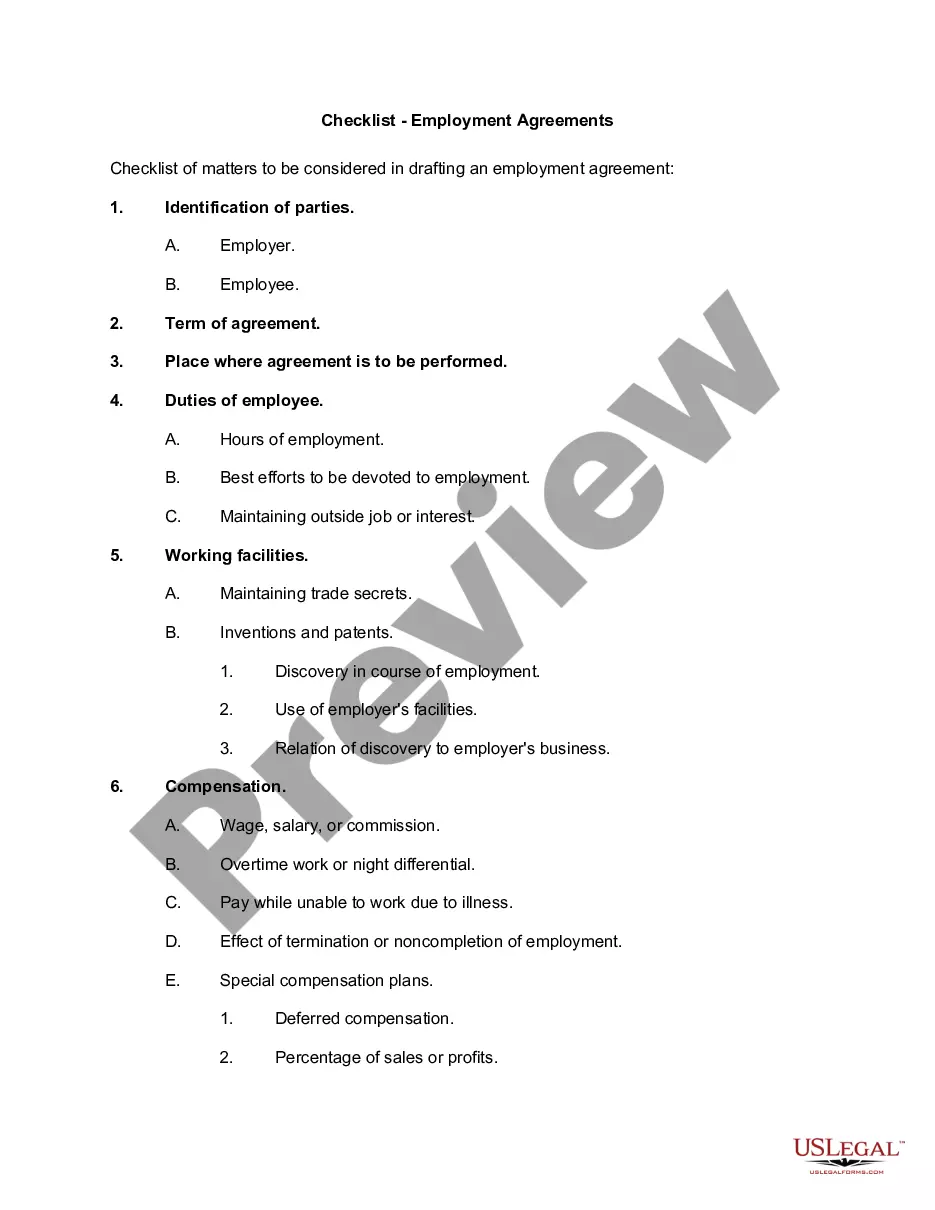

A checklist is a systematic list of items or tasks designed to ensure all essential steps are completed in a specific process. For instance, a payroll checklist may comprise items such as verifying employee hours, calculating wages, and executing tax withholdings. Including a District of Columbia Equal Pay Checklist in your payroll process not only enhances accuracy but also ensures compliance with pay equity laws. This methodical approach minimizes errors and supports fair treatment for all employees.

An employee checklist is a document that outlines the necessary steps to onboard new staff members effectively. This checklist may include tasks like collecting personal information, completing tax forms, and familiarizing new hires with company policies. When including the District of Columbia Equal Pay Checklist, employers can ensure that equitable pay practices are communicated and understood from the start. This fosters a culture of transparency and inclusivity.

A checklist in payroll serves as a guide to ensure all essential payroll tasks are performed correctly. It typically includes employee data verification, payroll processing steps, and compliance checks. Incorporating a District of Columbia Equal Pay Checklist into your payroll system can streamline the process and improve accuracy. Such a checklist promotes organizational efficiency and supports fair compensation for all employees.

Certain positions are exempt from the District of Columbia's minimum wage regulations, which may include some salaried employees in managerial roles or outside salespeople. Additionally, certain internships and volunteer positions may not meet the minimum wage requirements. Understanding these exemptions is crucial for compliance, and consulting your District of Columbia Equal Pay Checklist can clarify classifications. Always review the current laws to ensure your organization remains in compliance.

A payroll checklist is a systematic tool used by employers to ensure that all payroll tasks are completed accurately and on time. It typically includes items such as timesheet verification, wage calculations, and tax deductions. Utilizing a District of Columbia Equal Pay Checklist can enhance this process by ensuring adherence to local pay equity standards. This proactive approach helps avoid discrepancies and fosters a fair work environment.