District of Columbia General Consent Form for Qualified Joint and Survivor Annuities - QJSA

Description

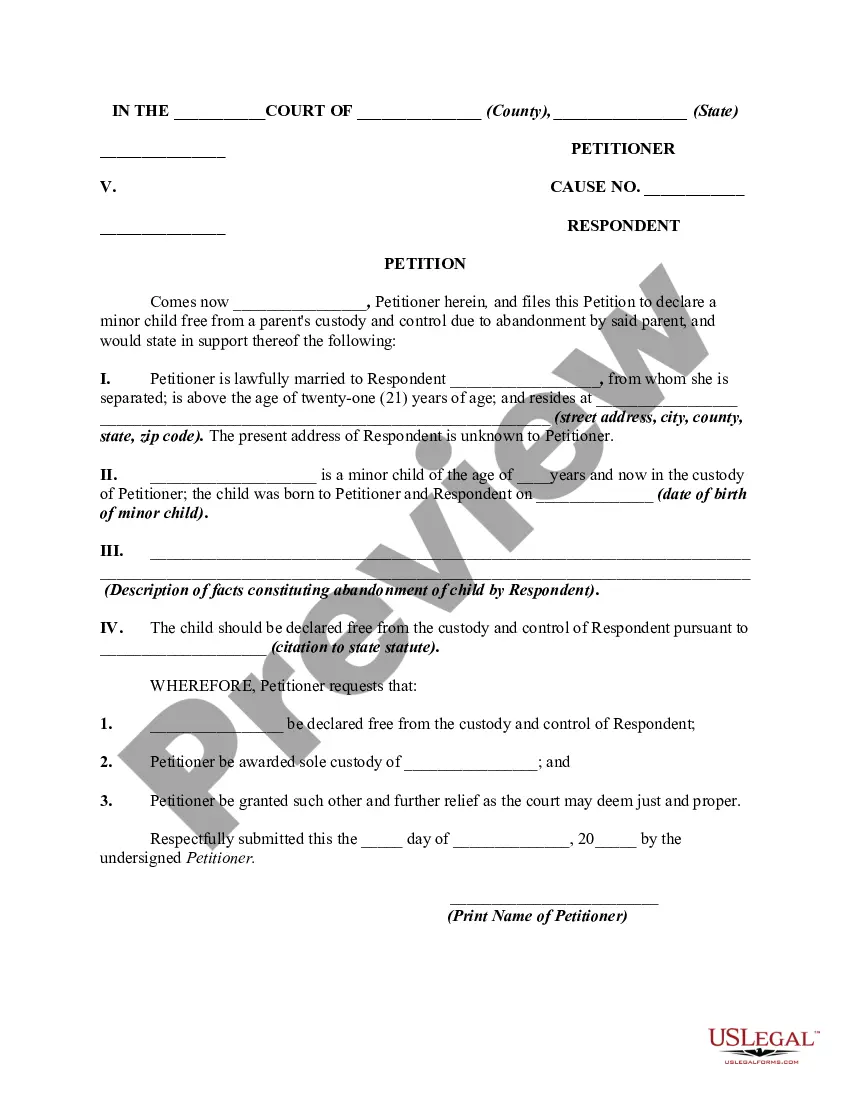

How to fill out General Consent Form For Qualified Joint And Survivor Annuities - QJSA?

If you need to tally, obtain, or print proper document templates, utilize US Legal Forms, the largest assortment of official forms accessible online. Take advantage of the site’s user-friendly search feature to find the documents you need.

Numerous templates for commercial and personal purposes are categorized by types and states, or keywords. Leverage US Legal Forms to easily access the District of Columbia General Consent Form for Qualified Joint and Survivor Annuities - QJSA in just a few clicks.

If you are already a US Legal Forms member, Log In to your account and click on the Download button to retrieve the District of Columbia General Consent Form for Qualified Joint and Survivor Annuities - QJSA. You can also access forms you have previously obtained in the My documents section of your account.

Every legal document template you acquire is yours indefinitely. You have access to all forms you have downloaded in your account. Click the My documents section to select a form to print or download again.

Complete and download, and print the District of Columbia General Consent Form for Qualified Joint and Survivor Annuities - QJSA with US Legal Forms. There are millions of professional and state-specific templates you can utilize for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Use the Preview option to review the form’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the document, utilize the Search box at the top of the screen to find alternative templates in the legal document catalog.

- Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the District of Columbia General Consent Form for Qualified Joint and Survivor Annuities - QJSA.

Form popularity

FAQ

QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits. They can also apply to profit-sharing and 401(k) and 403(b) plans, but only if so elected under the plan.

Spousal Waiver Form means that form established by the Plan Administrator, in its sole discretion, for use by a spouse to consent to the designation of another person as the Beneficiary or Beneficiaries under a Participant's Account.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

If you do not waive the QPSA, after your death the Plan will pay your spouse the QPSA unless your spouse elects another benefit form. The QPSA will not pay benefits to other beneficiaries after your spouse dies. If you waive the QPSA, the Plan will pay your account to your designated beneficiary.

Qualified Joint and Survivor Annuity (QJSA) includes a level monthly payment for your lifetime and a survivor benefit for your spouse after your death equal to the percentage designated of that monthly payment.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

Spouse must consent to the waiver of the annuity to receive a cash distribution of RMDs. Otherwise the RMD must be an annuity payment. Usually, the participant and spouse waive the annuity before RBD and the RMD is paid in cash.

This special payment form is often called a qualified joint and survivor annuity or QJSA payment form. This benefit is paid to the participant each year and, on the participant's death, a survivor annuity is paid to the surviving spouse.

The QJSA payment form gives your spouse, the annuitant, a retirement payment for the rest of his or her life. Under the QJSA payment form, after your spouse dies, the contract will pay you, the surviving spouse, at least 50% percent of the retirement benefit that was paid to your spouse, the annuitant.