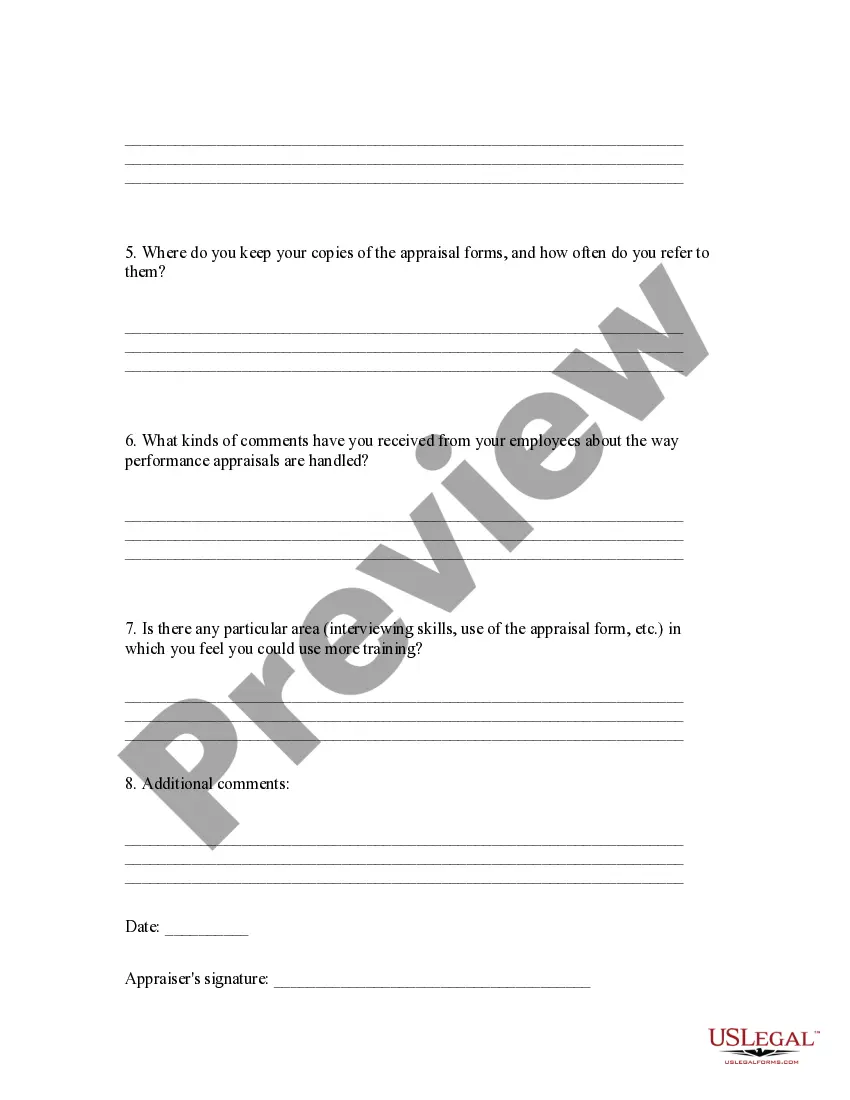

District of Columbia Appraisal System Evaluation Form

Description

How to fill out Appraisal System Evaluation Form?

Finding the correct legal document format can be a challenge.

Of course, there are many templates available online, but how do you obtain the legal document you require.

Utilize the US Legal Forms website. The service offers a vast collection of templates, such as the District of Columbia Appraisal System Evaluation Form, which you can use for both business and personal purposes.

First, ensure you have selected the correct form for your city/region. You can review the form using the Review option and examine the form summary to confirm it is the right one for you. If the form does not satisfy your needs, utilize the Search field to find the appropriate form. When you are confident that the form is suitable, click on the Purchase now option to acquire the form. Choose the pricing plan you need and fill in the required details. Create your account and make the payment using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, modify, print, and sign the acquired District of Columbia Appraisal System Evaluation Form. US Legal Forms is the largest collection of legal documents from which you can access a variety of document templates. Take advantage of the service to obtain professionally-created documents that comply with state requirements.

- All of the documents are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and then select the Download option to get the District of Columbia Appraisal System Evaluation Form.

- Use your account to search through the legal documents you have purchased in the past.

- Visit the My documents tab in your account to obtain another copy of the document you need.

- If you are a new customer of US Legal Forms, here are simple instructions you can follow.

Form popularity

FAQ

Filling out a self-appraisal form requires introspection and honesty about your work performance. Use the District of Columbia Appraisal System Evaluation Form to guide your reflections, focusing on personal achievements and growth opportunities. Be specific in your self-assessment, as this will contribute significantly to your overall performance review.

Enter the address in the D.C. Office of Tax and Revenue's Real Property Database2026. In the Property Detail page that comes up, the square and lot number will be listed as SSL. The square is the first four-digit number. The lot is the second four-digit number.

Washington, D.C. Tax Brackets for Tax Year 2020Tax Rate:4.00% Income Range:$0 to $10,000.Tax Rate:6.00% Income Range:$10,000 to $40,000.Tax Rate:6.5% Income Range:$40,000 to $60,000.Tax Rate:8.5% Income Range:$60,000 to $350,000.Tax Rate:8.75% Income Range:$350,000 to $1,000,000.Tax Rate:8.95% Income Range:$1,000,000+

If you need assistance, call the Customer Service Center at (202) 727-4TAX or contact OTR via email. Mortgage/Title Companies: Visit Real Property Public Extract and Billing/Payment Records.

The amount of tax due is determined by dividing the assessed value of the property by $100, and then multiplying that amount by the applicable tax rate for the property, as stated in the below chart. For example, your residential property is under the Class 1 tax rate, which is $0.85.

Square & Lot is a full service urban development firm based Washington serving the greater Washington - metropolitan area.

District of Columbia state income tax rate table for the 2020 - 2021 filing season has six income tax brackets with DC tax rates of 4%, 6%, 6.5%, 8.5%, 8.75% and 8.95% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.

Washington, D.C. Property Taxes The tax rate on residential property in D.C. is just $0.85 per $100 in assessed value.

How to Appeal Your DC Property Tax AssessmentFile as soon as possible. The Office of Tax and Revenue (OTR) requires appeals be filed electronically on or before April 1.Call your assessor.Gather evidence.File a first-level appeal.Appeal to the Real Property Tax Appeals Commission.Appeal to the DC Superior Court.

DC Science is the District of Columbia's statewide assessment of the Next Generation Science Standards (NGSS). The DC Science assessment presents students with tasks that are built around scientific phenomena as well as engineering design challenges.