District of Columbia New Company Benefit Notice

Description

How to fill out New Company Benefit Notice?

Selecting the optimal authorized document template can pose challenges.

There are certainly numerous templates available online, but how do you find the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the District of Columbia New Company Benefit Notice, suitable for both business and personal needs.

You can preview the form using the Preview option and read the form description to ensure it is the right one for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to access the District of Columbia New Company Benefit Notice.

- Use your account to search through the legal forms you have purchased earlier.

- Visit the My documents tab in your account to download an additional copy of the form you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, confirm that you have selected the correct form for your area.

Form popularity

FAQ

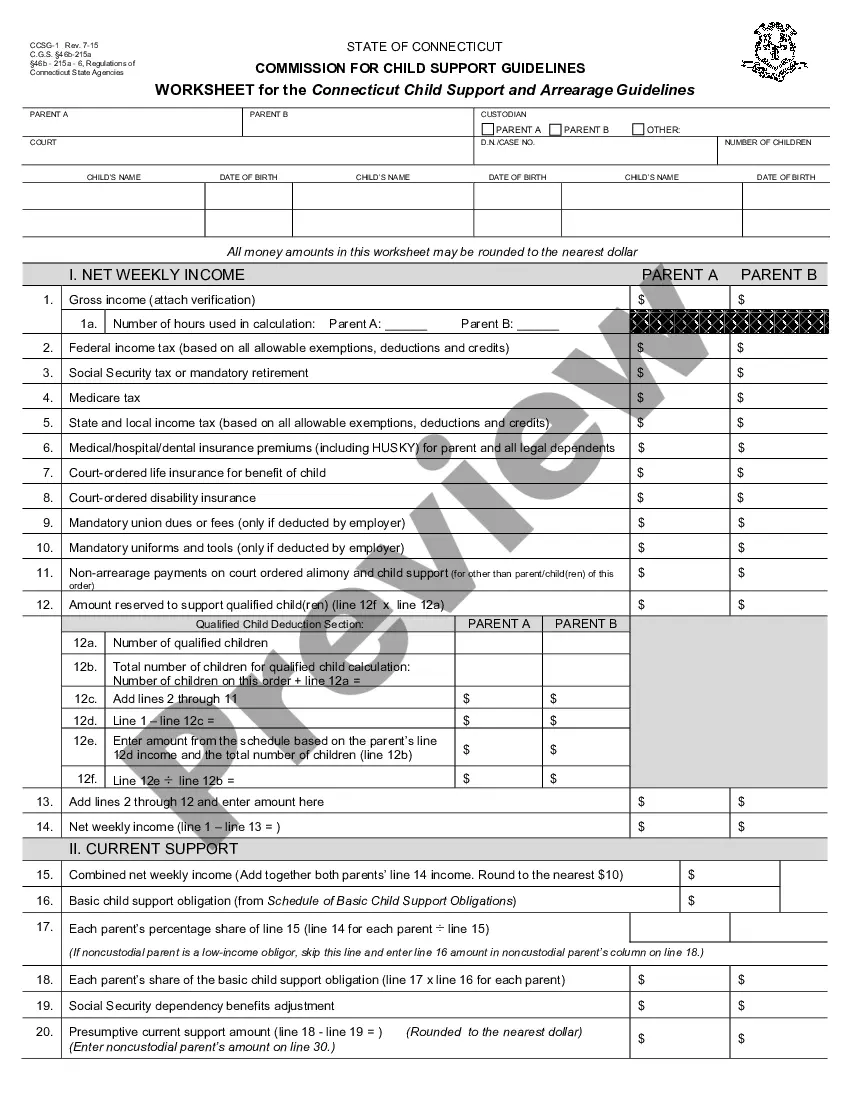

Private-sector employers in the District will pay a . 62% tax beginning July 1, 2019, to fund the paid-leave benefit. The Paid Family Leave tax is 100% employer-funded and may not be deducted from a worker's paycheck.

Paid family leave benefits are funded by a quarterly employer payroll tax of 0.62% of their covered employees' total wages. These quarterly contributions are based on the immediate past quarter of wages paid, on the same reporting schedule as UI tax.

Paid-leave benefits are calculated based on an eligible individual's average weekly wage; the total wages in covered employment earned during the highest 4 out of 5 quarters (the base period) immediately preceding a qualifying event, divided by 52.

Changes to D.C. FMLA However, under the amended law, an employee is eligible for D.C. FMLA leave if the individual has been employed by the same employer for at least 12 consecutive or non-consecutive months in the seven years immediately preceding the date on which the leave will begin.

You are eligible for Paid Family Leave benefits if you: Spend more than 50% of your time working in DC. Eligible workers must spend a majority of their time working the Districtincluding teleworking or telecommutingfor a covered employer, and must have completed that work during the year prior to needing leave.

Starting in 2020, Washington will be the fifth state in the nation to offer paid family and medical leave benefits to workers. The program is funded by premiums paid by both employees and many employers, and is administered by the Employment Security Department (ESD).

As we previously reported, PFL benefits are funded by a 0.62 percent quarterly payroll tax on employees' total wages, which the DC government began collecting on July 1, 2019. Although the tax is calculated based on employees' quarterly wages, the cost cannot be deducted from employee pay.

You may be entitled to get parental leave payments for 26 weeks if you're an employee or self-employed and you've worked for the qualifying period. Parental leave payments are funded by the government, not the employer, and you must apply for them through Inland Revenue (IRD).

The District of Columbia Family and Medical Leave Act (DCFMLA) requires employers with 20 or more employees to provide eligible employees with 16 weeks of unpaid family leave and 16 weeks of unpaid medical leave during a 24 month period. Employee Eligibility.

You will be ineligible for benefits for the number of weeks of severance you received. If your employer pays you severance all at once in a "lump sum," you may or may not be entitled to unemployment benefits.