District of Columbia Relocation Expense Agreement

Description

How to fill out Relocation Expense Agreement?

You can invest hours online looking for the official document template that fulfills the state and federal regulations you require.

US Legal Forms offers a vast collection of legal forms that are evaluated by specialists.

You can easily download or print the District of Columbia Relocation Expense Agreement from their services.

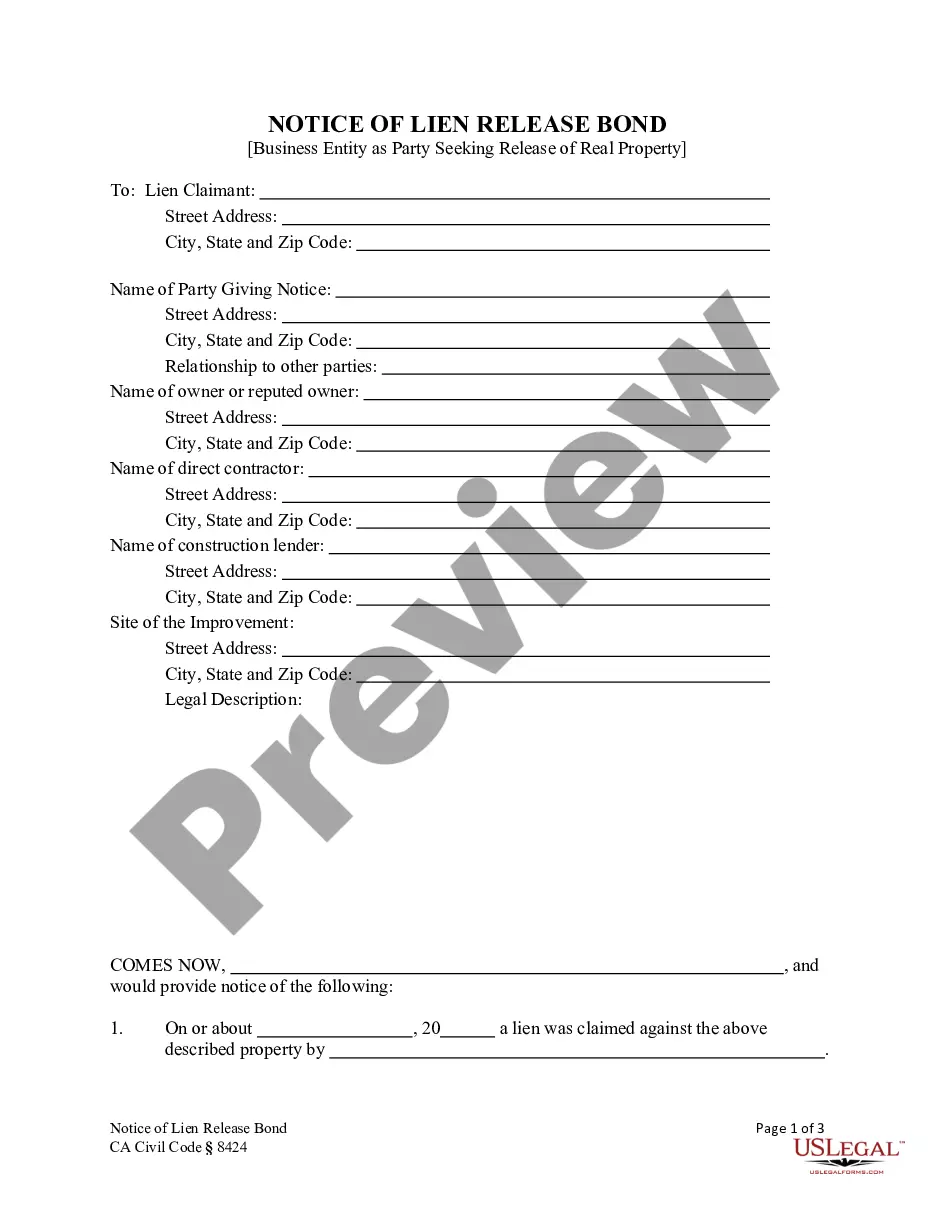

If available, utilize the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the District of Columbia Relocation Expense Agreement.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, go to the My documents section and click the appropriate button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your county/city.

- Review the form summary to confirm you have selected the right form.

Form popularity

FAQ

What: A Relocation Repayment Agreement is a legal document signed at the beginning of a relocation that clearly defines pay-back terms should the employee leave the company. It covers voluntary leave or termination with cause during the move, or for a specified period of time after relocation.

A Repayment Agreement is a legally enforceable contract stating that if the employee resigns or is terminated by the Company within a certain time frame following relocation, the employee agrees to repay the company any relocation expenses that were paid by the company.

If there was a contract requiring reimbursement of relocation expense, such an agreement is valid and enforceable and you would be contractually obligated to repay the expenses.

While most employers will have a standard package of relocation assistance benefits, you can often negotiate for a package that suits your needs better.

In fact, a lot of relocating employees will spend as little as possible on their move so they can pocket some of the cash. While there's nothing explicitly wrong with doing this, it often leads to a bad relocation experience. That's why many companies prefer Capped Allowance Plans.

Since it is legal, it is not a basis or ground to get out of the relocation agreement. Therefore, the stated reasonswork stress and quality of lifehave no bearing on the repayment obligation(s). If you have a relocation expenses repayment agreement, all you can do is stick it out until you can safely resign or quit.

To qualify, reimbursements or payments must be for work-related moving expenses that would have been deductible by the employee if the employee had directly paid them before Jan. 1, 2018.

Some contracts require repayment in full if you leave at day 364 of year long contract. Others offer a pro-rated payment. So, if you received $10,000 in relocation assistance, and leave after 6 months, your repayment amount is $5,000.

If you have a relocation expenses repayment agreement, all you can do is stick it out until you can safely resign or quit.

A relocation agreement, sometimes referred to as an employee relocation agreement, is a legal contract executed by an employer and an employee in which the employer agrees to compensate an employee for relocating for business purposes.