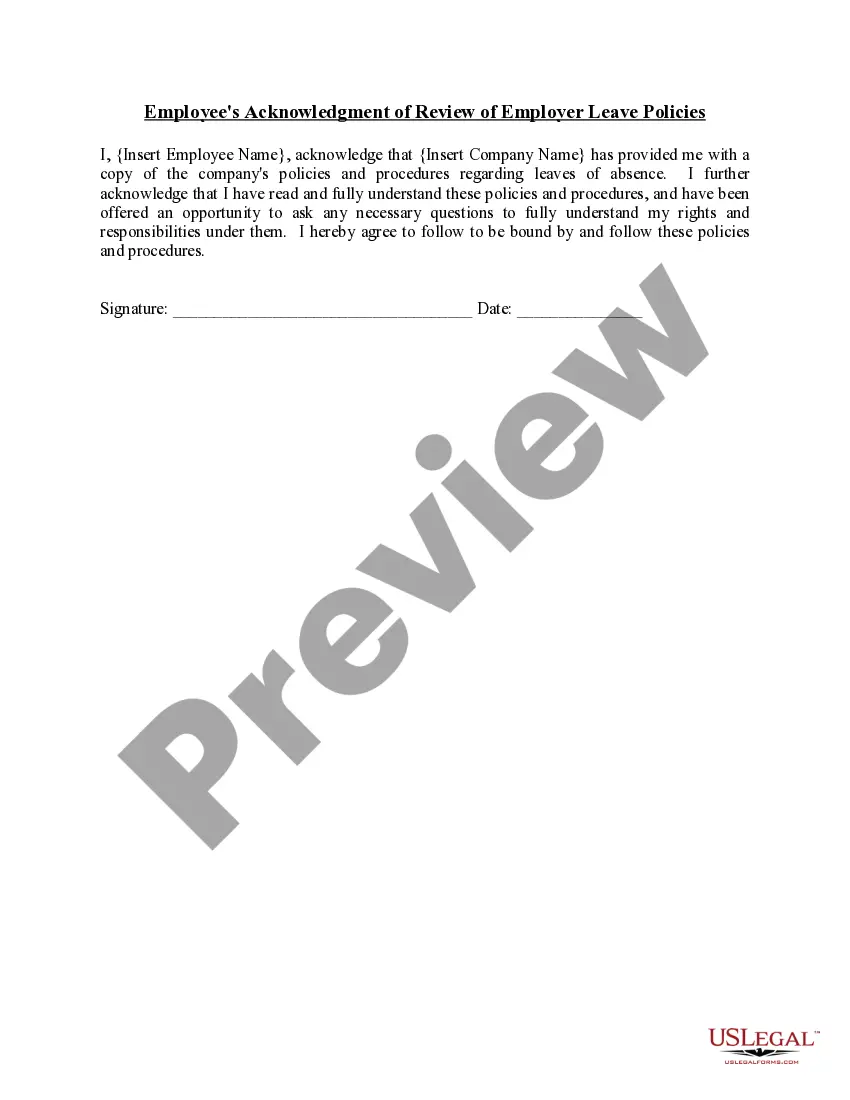

District of Columbia Employee's Acknowledgment of Review of Employer Leave Policies

Description

How to fill out Employee's Acknowledgment Of Review Of Employer Leave Policies?

If you wish to finalize, download, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's user-friendly and convenient search feature to locate the documents you require.

A range of templates for professional and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have identified the form you require, click on the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the District of Columbia Employee's Acknowledgment of Review of Employer Leave Policies with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the District of Columbia Employee's Acknowledgment of Review of Employer Leave Policies.

- You can also access forms you previously acquired from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Review feature to evaluate the form's content. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Starting in 2020, Washington will be the fifth state in the nation to offer paid family and medical leave benefits to workers. The program is funded by premiums paid by both employees and many employers, and is administered by the Employment Security Department (ESD).

Parental leave payments are funded by the government, not the employer, and you must apply for them through Inland Revenue (IRD).

Private-sector employers in the District will pay a . 62% tax beginning July 1, 2019, to fund the paid-leave benefit. The Paid Family Leave tax is 100% employer-funded and may not be deducted from a worker's paycheck.

Again, Washington D.C.'s paid family leave is solely funded by employers. This means employers do not withhold PFL from employee wages. The Washington D.C. PFL program's contribution rate is 0.62% of each employee's wages.

How Much Can I Receive in Parental Leave Benefits? DC Paid Family Leave provides wage replacement of 90% of wages up to 1.5 times DC's minimum wage and 50% of wages above 1.5 times DC's minimum wage. The maximum weekly benefit amount is $1,000.

Covered employers include all DC employers subject to DC Unemployment Insurance (UI) tax and self-employed individuals who choose to opt in to the program. In general, covered workers include all workers who (predominately) work in DC and no more than 50% in another jurisdiction.

The District of Columbia Family and Medical Leave Act (DCFMLA) requires employers with 20 or more employees to provide eligible employees with 16 weeks of unpaid family leave and 16 weeks of unpaid medical leave during a 24 month period. Employee Eligibility.

You are eligible for Paid Family Leave benefits if you: Spend more than 50% of your time working in DC. Eligible workers must spend a majority of their time working the Districtincluding teleworking or telecommutingfor a covered employer, and must have completed that work during the year prior to needing leave.

The legislation also expands the 2019 law that granted paid parental leave to most federal employees to the entire workforce.

To qualify for Paid Family Leave (PFL) benefits, an individual must be a part-time or full-time employee in the District, regardless of their residence, and must meet all of the requirements, monetary and non-monetary, outlined within the law. District government and federal employees are excluded.