District of Columbia Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

If you wish to aggregate, acquire, or create authentic document templates, utilize US Legal Forms, the foremost assortment of lawful forms, which can be located online.

Take advantage of the site's simple and convenient search to locate the documents you require.

Various templates for business and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have located the form you need, select the Purchase now button. Choose the pricing plan you prefer and enter your details to register for the account.

Step 5. Process the purchase. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Use US Legal Forms to find the District of Columbia Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company with just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Obtain button to get the District of Columbia Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have selected the form for your correct city/state.

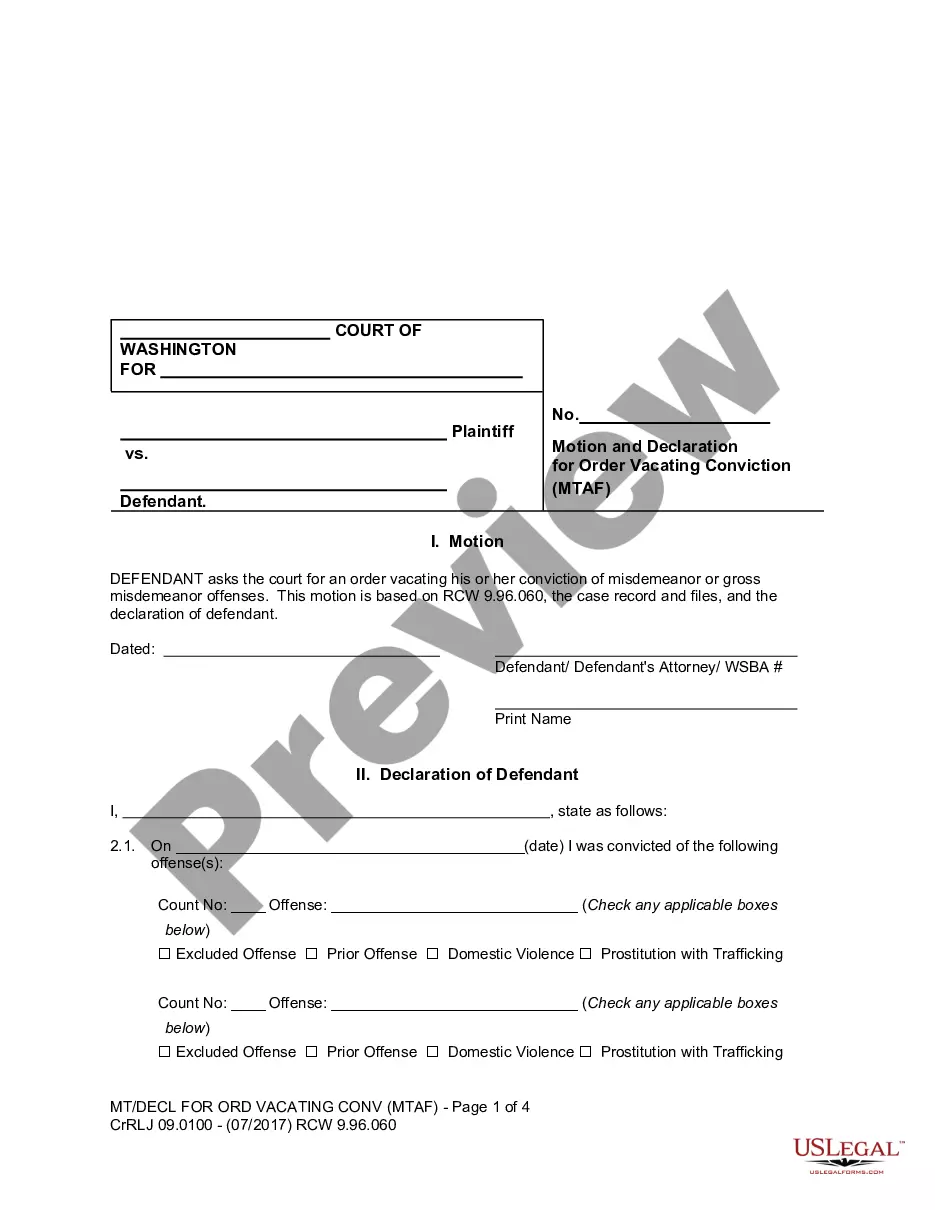

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

What Are Shares? Shares are units of equity ownership in a corporation.

There are three primary methods of dividing a corporation tax-free: (1) spin-off, (2) split-off, and (3) split-up.

Ownership in a corporation is represented by stock certificates, which is why the owners are called stockholders.

Explanation: Articles of incorporation must contain (1) the name of the corporation, (2) the number of authorized shares, (3) the address of the initial registered office of the corporation, (4) the name of its first registered agent at that address, and (5) the names and addresses of the incorporators.

Broadly, articles of incorporation should include the company's name, type of corporate structure, and number and type of authorized shares. Bylaws work in conjunction with the articles of incorporation to form the legal backbone of the business.

Corporations acquire their capital by issuing shares of stock; these are the units into which corporations divide their ownership. Investors buy shares of stock in a corporation for two basic reasons.

O The names of the initial members of the board of directors (D.C. law provides that a nonprofit corporation must have a minimum of three directors);

What must be included in articles of incorporation?the corporation's name and business address.the number of authorized shares and the par value (if any) of the shares.the name and address of the in-state registered agent.the names and addresses of its incorporators.

There are two kinds: limited partnerships and limited liability partnerships. A limited partnership has one partner with unlimited liability while everyone else involved has limited liability.

Cost to Form an LLC in the Washington D.C. The cost to start a Washington D.C. limited liability company (LLC) online is $220. This fee is paid to the Washington D.C. Department of Consumer and Regulatory Affairs when filing the LLC's Articles of Organization.