District of Columbia Returned Items Report

Description

How to fill out Returned Items Report?

US Legal Forms - one of the most significant collections of legal documents in the United States - offers a broad selection of legal document formats that you can download or create.

By using the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents like the District of Columbia Returned Items Report in moments.

If you have a monthly subscription, Log In and obtain the District of Columbia Returned Items Report from the US Legal Forms library. The Download button will be visible on every document you view. You have access to all the previously downloaded documents within the My documents section of your account.

Choose the file format and download the document to your device.

Make modifications. Fill out, edit, print, and sign the downloaded District of Columbia Returned Items Report. Every template added to your account has no expiration date and belongs to you forever. Therefore, if you need to download or print another copy, simply go to the My documents section and click on the document you need.

- If you are using US Legal Forms for the first time, here are simple steps to help you start.

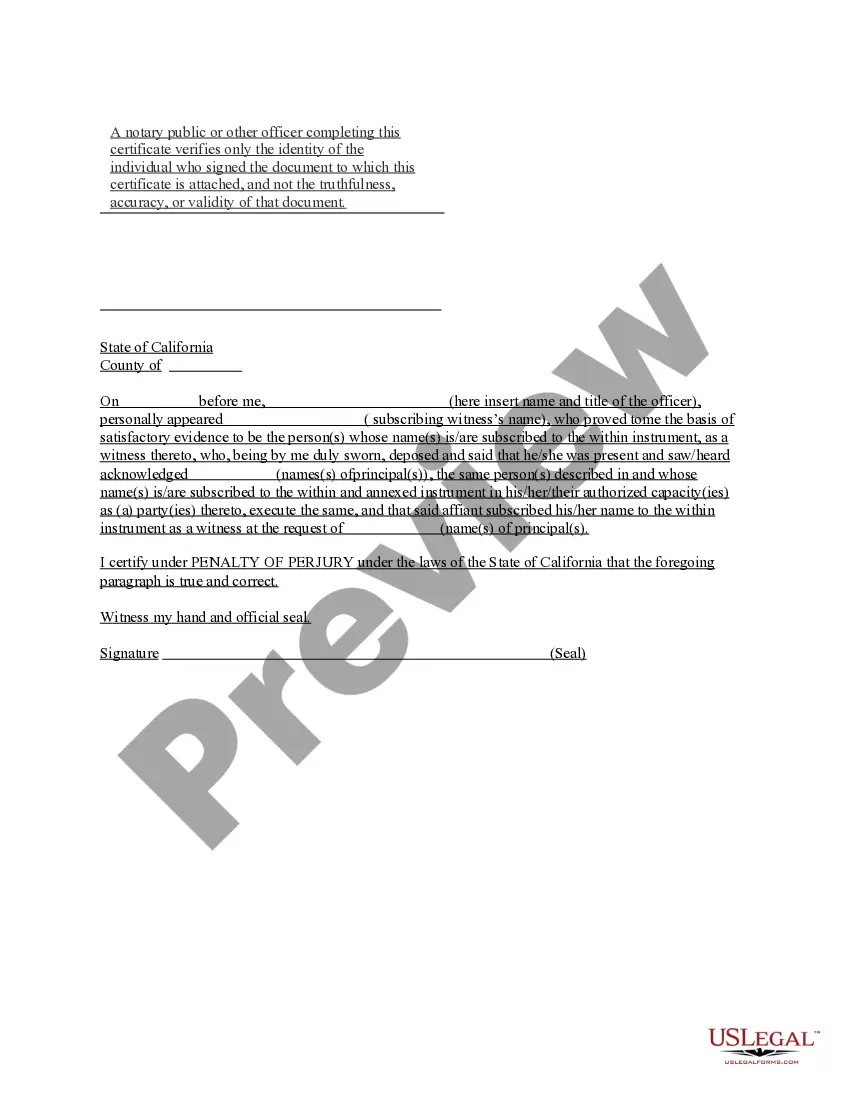

- Make sure you have selected the correct document for your city/state. Click on the Preview button to review the document's content.

- Check the document description to confirm you have chosen the right document.

- If the document does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Buy Now button. Then, select your preferred pricing plan and provide your information to register for an account.

- Complete the purchase. Use a credit card or PayPal account to finalize the transaction.

Form popularity

FAQ

To obtain a certificate of clean hands in Washington DC, an individual must apply through the appropriate court or agency that handles this certification. This document serves as proof that you have no pending legal issues in DC. If you’re reviewing the District of Columbia Returned Items Report, securing this certification can demonstrate your good standing in legal matters. You may benefit from using resources like uslegalforms, which can provide guidance on the application process.

WHO MUST FILE A D.C. PARTNERSHIP FORM D-65. Except for partnerships required to file an unincorporated business fran- chise tax return, D.C. Form D-30, all partnerships engaged in any trade or business within the District of Columbia or which received income from sources within the District, must file a D.C. Form D-65.

Form D-30 can be e-filed. Refer to this article for information on the date you can begin e-filing this form. Generally, an unincorporated business with gross income over $12,000 from D.C. sources must file a D-30, regardless of whether it has net income.

You must file a DC return if: You lived in the District of Columbia for 183 days or more during the taxable year, even if your permanent residence was outside the District of Columbia. You were a member of the armed forces and your home of record was the District of Columbia for either part of or the full taxable year.

To file by paper, you can obtain forms via the website at MyTax.DC.gov and select Forms, or from several locations around the District. Visit Location of Tax Forms to find out where.

Additional information. Form D-30 can be e-filed. Refer to this article for information on the date you can begin e-filing this form. Generally, an unincorporated business with gross income over $12,000 from D.C. sources must file a D-30, regardless of whether it has net income.

To file by paper, you can obtain forms via the website at MyTax.DC.gov and select Forms, or from several locations around the District. Visit Location of Tax Forms to find out where.

The regular deadline to file a Washington D.C. state income tax return is April 15. Find additional information about Washington D.C. state tax forms, Washington D.C. state tax filing instructions, and government information.

You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);

You are not required to file a DC return if you are a nonresident of DC unless you are claiming a refund of DC taxes withheld or DC estimated taxes paid. Use Form D-40B, Non-Resident Request for Refund (available by visiting ).