District of Columbia Charitable Contribution Payroll Deduction Form

Description

How to fill out Charitable Contribution Payroll Deduction Form?

Are you currently in an environment where you need paperwork for professional or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable ones is not easy.

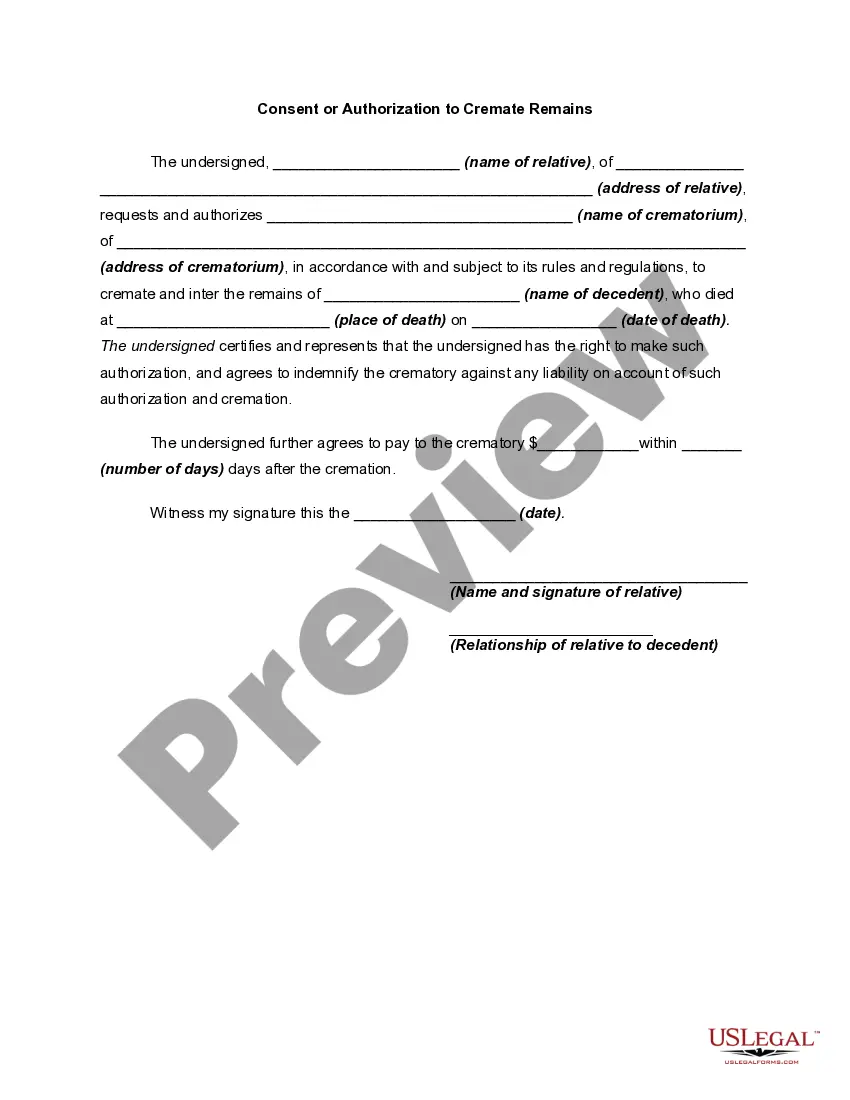

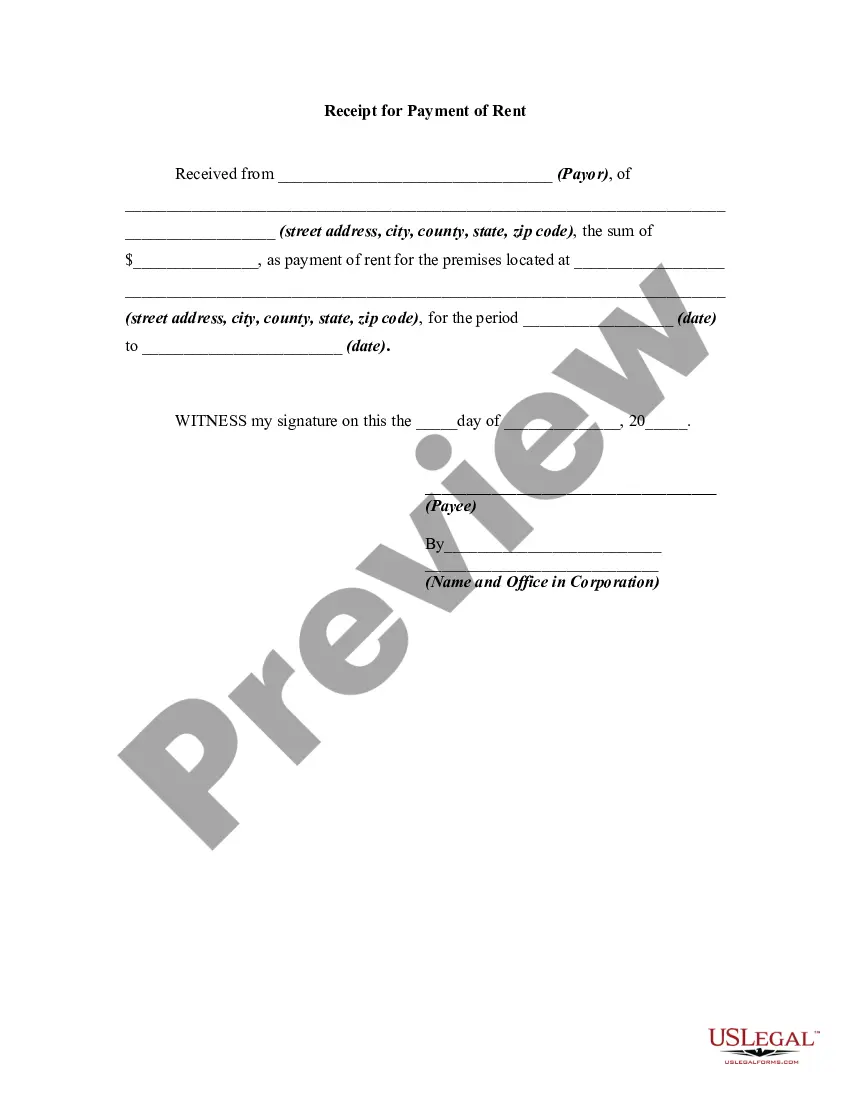

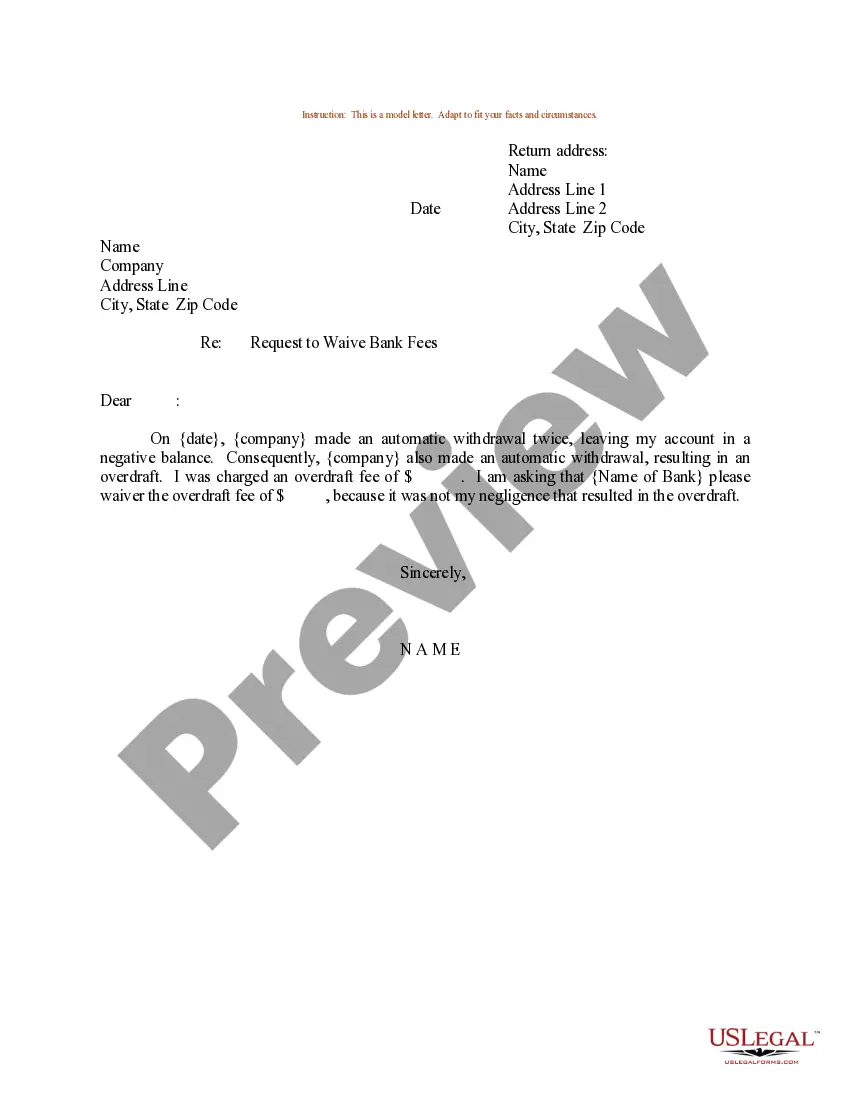

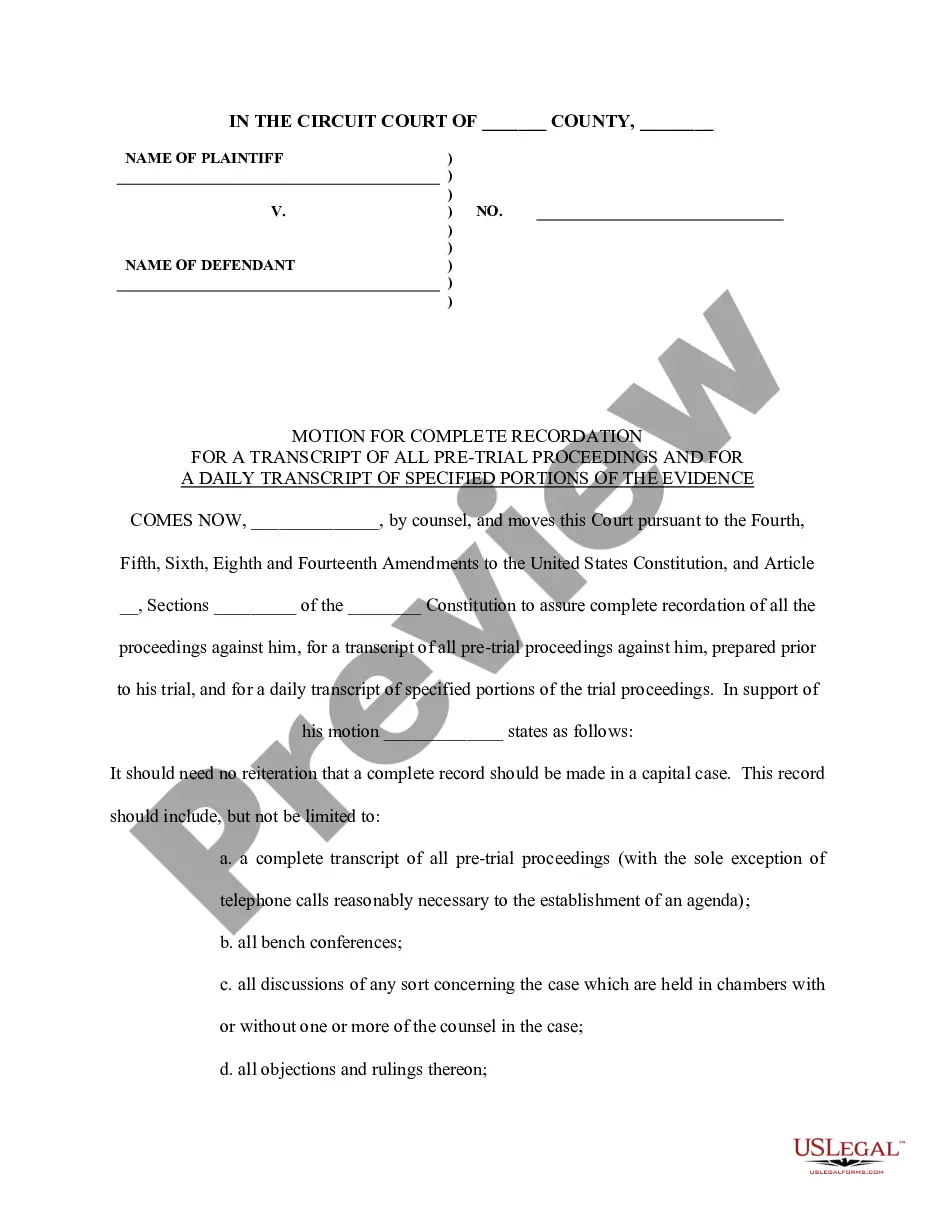

US Legal Forms provides thousands of form templates, including the District of Columbia Charitable Contribution Payroll Deduction Form, designed to comply with state and federal regulations.

Once you find the appropriate form, click Acquire now.

Select the pricing plan you desire, fill in the required details to create your account, and finalize your purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the District of Columbia Charitable Contribution Payroll Deduction Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for your specific city/region.

- Utilize the Review feature to examine the form.

- Check the description to verify that you have selected the correct form.

- If the form is not what you’re looking for, use the Lookup field to find the form that suits your requirements.

Form popularity

FAQ

If you do not have the return envelope, make sure to address your envelope to: for D-20, Office of Tax and Revenue PO Box 96166, Washington DC 20090- 6166, for the D-30 to: Office of Tax and Revenue PO Box 96165 Washington, DC 20090-6165.

Additional information. Form D-30 can be e-filed. Refer to this article for information on the date you can begin e-filing this form. Generally, an unincorporated business with gross income over $12,000 from D.C. sources must file a D-30, regardless of whether it has net income.

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);

Generally, an unincorporated business, with gross income (Line 10) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

For the purposes of this chapter (not alone of this subchapter) and unless otherwise required by the context, the term unincorporated business means any trade or business, conducted or engaged in by any individual, whether resident or nonresident, statutory or common-law trust, estate, partnership, or limited or

30ES, eclaration of Estimated Franchise Tax for Unincorporated Business An unincorporated business must file a declaration of estimated franchise tax if it expects its C unincorporated business franchise tax liability to exceed $1000 for the taxable year.

The unincorporated business franchise tax (Form D-30) must be filed by any D.C. business that is unincorporated, which includes partnerships, sole proprietorships, and joint ventures, so long as such a business derives rental income or any other income from D.C. sources in excess of $12,000 per year.