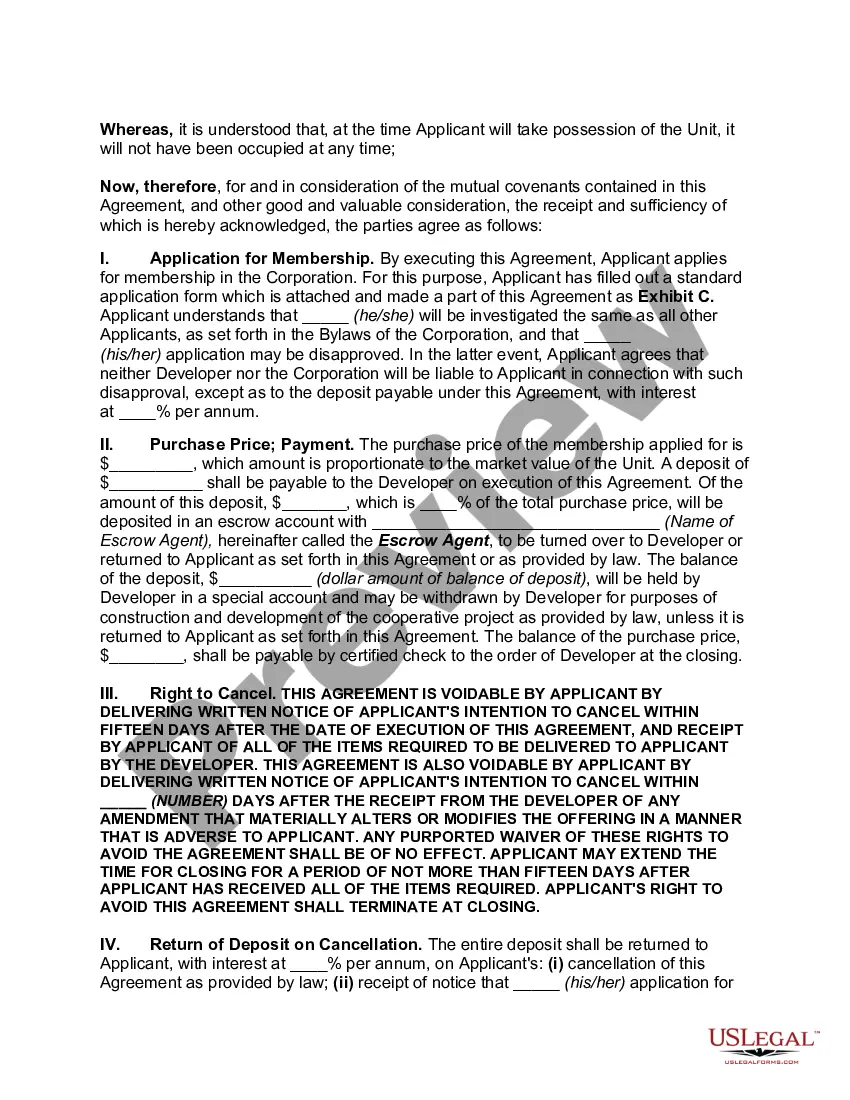

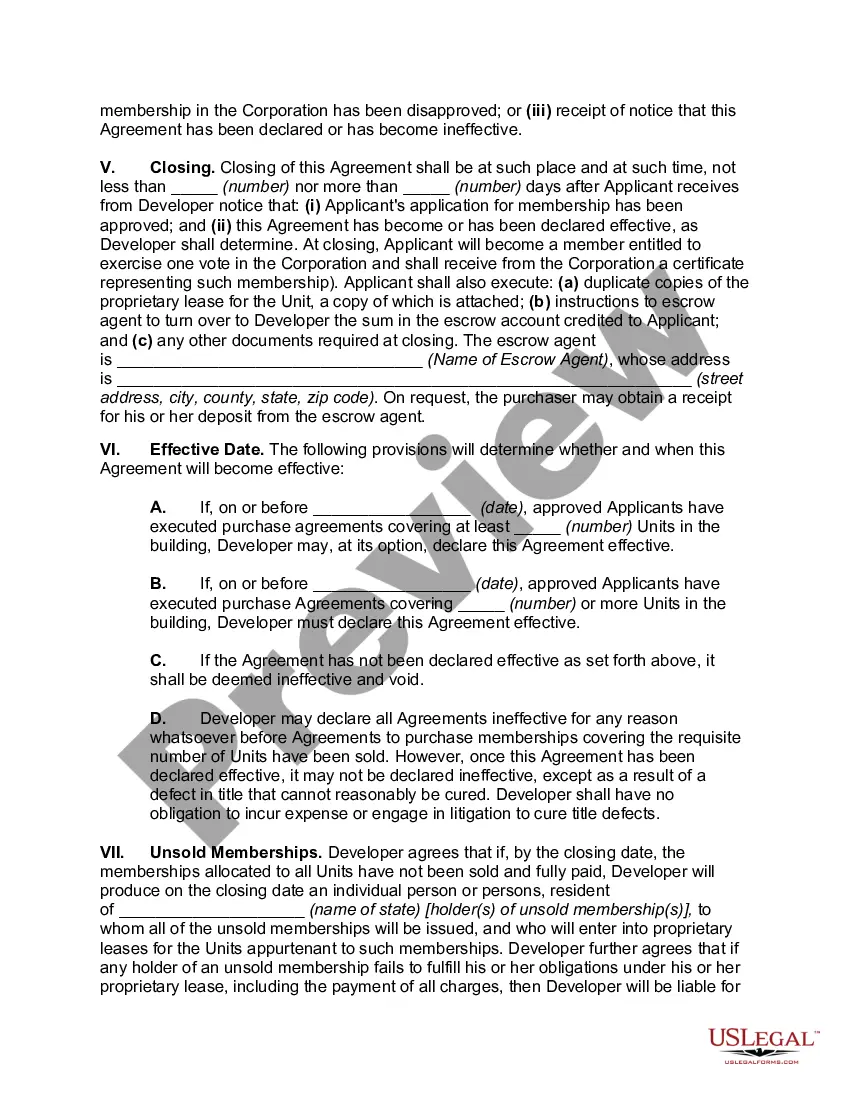

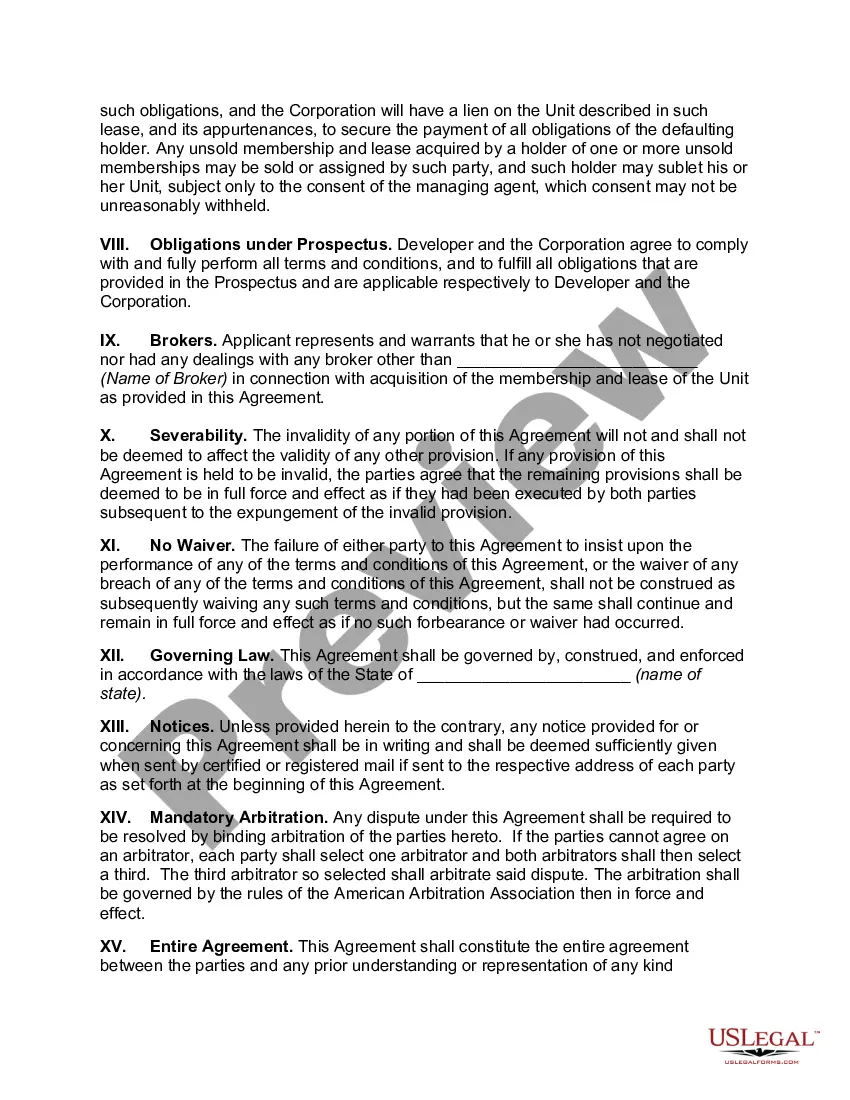

District of Columbia Agreement with Developer to Sell Membership in Cooperative along with Dwelling Unit Allocated to Membership

Description

How to fill out Agreement With Developer To Sell Membership In Cooperative Along With Dwelling Unit Allocated To Membership?

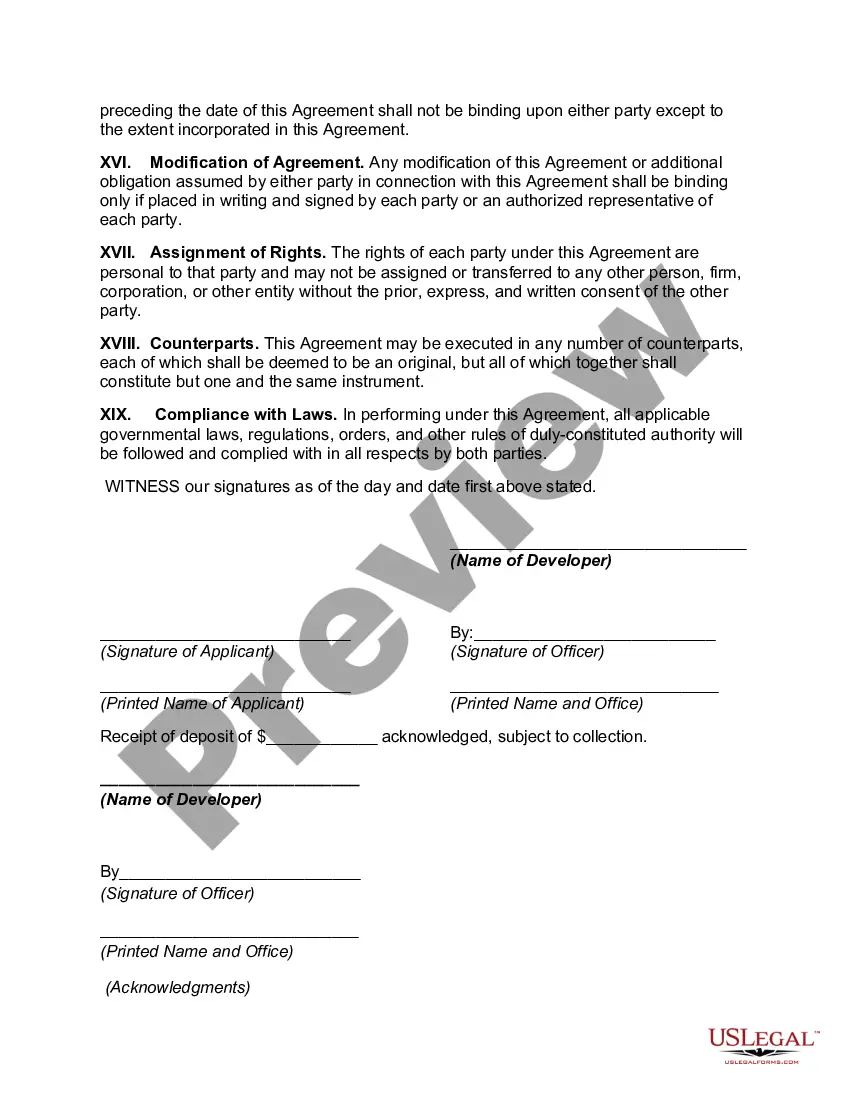

US Legal Forms - one of the largest collections of legal documents in America - offers a vast selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the District of Columbia Agreement with Developer to Sell Membership in Cooperative along with Dwelling Unit Allocated to Membership in just seconds.

Check the form summary to confirm that you have selected the appropriate form.

If the form does not meet your needs, use the Search box at the top of the page to find one that does.

- If you have an account, Log In and download the District of Columbia Agreement with Developer to Sell Membership in Cooperative along with Dwelling Unit Allocated to Membership from your US Legal Forms library.

- The Download button will be visible on each form you view.

- You can access all forms previously downloaded in the My documents tab in your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the right form for your city/region.

- Click the Preview button to review the form's content.

Form popularity

FAQ

The Tenant Opportunity to Purchase Act, or TOPA, affords tenants unique rights in the District of Columbia. Familiarize yourself with them whether you're a buyer or seller. The home owner and landlord must comply with all TOPA laws and provide tenants with appropriate disclosures when applicable.

Stock cooperative means an apartment development in which an undivided interest in the land is coupled with the right of exclusive occupancy of an apartment in the development. For the purposes of these regu- lations, stock cooperatives will be subject to the same requirements as condominiums.

The Community Opportunity to Purchase Act (COPA) gives qualified non-profit organizations the right of first offer, and/or the right of first refusal to purchase certain properties offered for sale in the City.

A housing cooperative is a form of ownership in which a person purchases shares (or membership) in a cooperative corporation that was formed for the purpose of providing its members a place in which to live. The cooperative corporation owns the building, land, apartments and all common elements.

What is it? The Tenant Opportunity to Purchase Act (TOPA) requires that owners notify tenants before they sell. They also need to notify every single one of the Qualified Organizations, which are nonprofit housing developers, community land trust, or housing cooperatives.

There are four classes of real property in the District of Columbia. Class 1 is residential real property including multifamily. Class 2 is commercial and industrial real property including hotels and motels. Class 3 is vacant real property.

Co-ops are democratically-governed businesses that seek to operate on a not-for-profit basis in relation to their members. Members join by purchasing a single share, which entitles them to a vote to elect members to the board of directors that oversees management of the co-op.

The main advantage of buying a co-op is that they are more affordable and cheaper to buy than a condo. This is one reason this type of housing is popular in cities with a high cost of living. What's more is that you typically get better square footage for your money.

Owners of cooperative apartments in Washington, even if they own only a single unit, are subject to rent control, under a recent ruling by the D.C. Rental Housing Commission.

The co-op version is called such a blanket or master mortgage. A portion is allocated to each unit, assumed by the purchaser, and deducted from the seller's proceeds at the time of settlement. Real estate taxes and interest on blanket mortgages are paid by the cooperative, then allocated to owners/members.