District of Columbia Joint-Venture Agreement - Speculation in Real Estate

Description

How to fill out Joint-Venture Agreement - Speculation In Real Estate?

US Legal Forms - one of the most extensive collections of legal documents in the United States - provides a diverse selection of legal paperwork templates that you can download or print. By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest documents such as the District of Columbia Joint-Venture Agreement - Speculation in Real Estate in just moments.

If you possess a subscription, Log In and download the District of Columbia Joint-Venture Agreement - Speculation in Real Estate from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents section of your account.

To utilize US Legal Forms for the first time, here are some essential tips to get you started.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded District of Columbia Joint-Venture Agreement - Speculation in Real Estate. Every template added to your account has no expiration date and belongs to you indefinitely. Thus, if you wish to download or print another copy, just navigate to the My documents section and click on the form you need. Access the District of Columbia Joint-Venture Agreement - Speculation in Real Estate with US Legal Forms, the most comprehensive library of legal document templates. Take advantage of numerous professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your area/county.

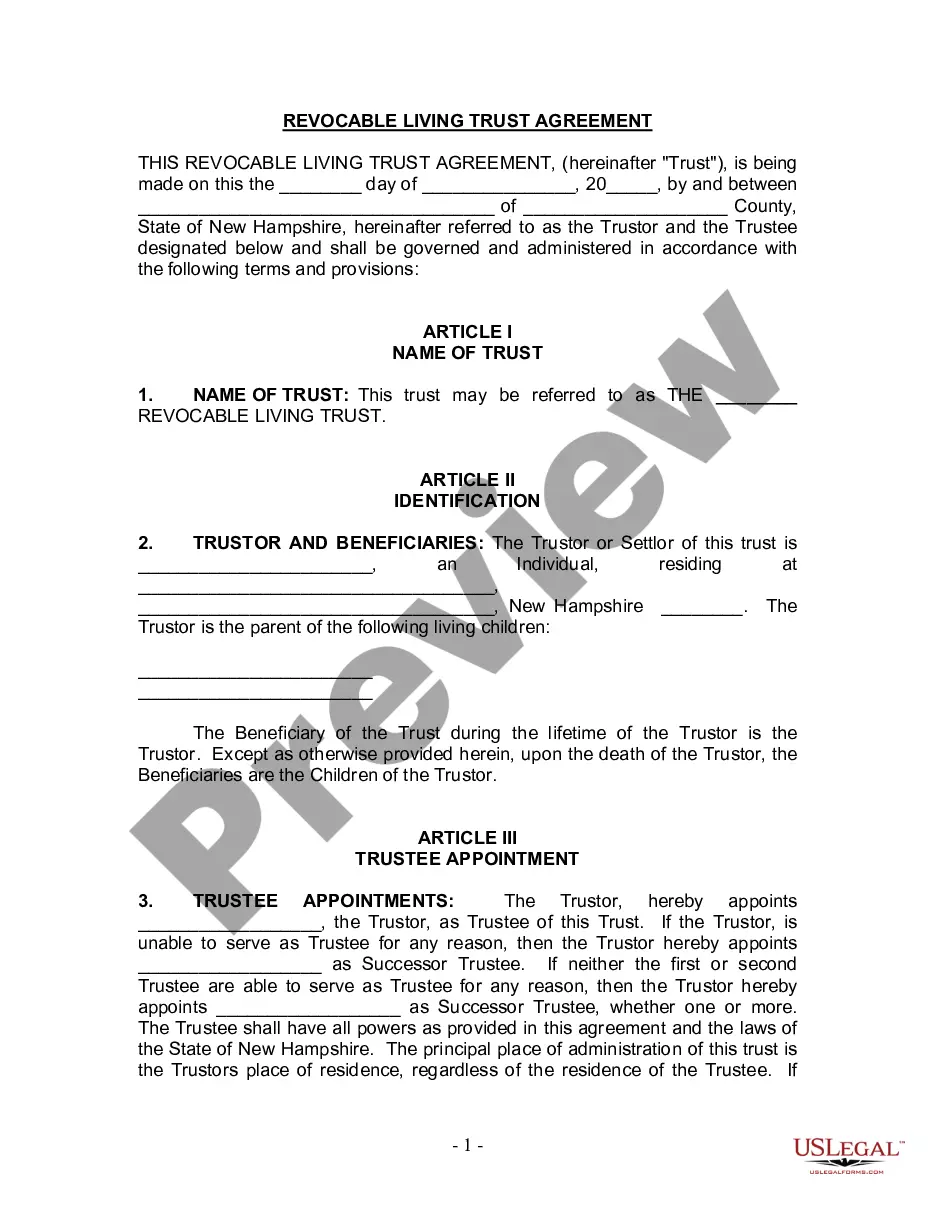

- Use the Preview button to review the content of the form.

- Check the form description to confirm that you have chosen the suitable form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

A joint venture in real estate is when two or more investors combine their resources for a property development or investment. Despite working together, each party maintains their own unique business identity while working together on a deal.

What is included in a Joint Venture Agreement?Business location.The type of joint venture.Venture details, such as its name, address, purpose, etc.Start and end date of the joint venture.Venture members and their capital contributions.Member duties and obligations.Meeting and voting details.More items...

Structuring a real estate JVThe 'investor' will typically be structured as a limited partnership managed by a general partner or other tax efficient vehicle. The investor vehicle will contract with the asset managerowned by the operator investment vehicleto form the JV entity.

A joint venture (JV) is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance.

While a joint venture agreement is a business arrangement in which two or more partners join their resources for the purpose of accomplishing a specific task, a memorandum of understanding is a document that is used in the early stages of negotiation between the partners of a joint venture agreement.

A joint venture in real estate is when two or more investors combine their resources for a property development or investment. Despite working together, each party maintains their own unique business identity while working together on a deal.

Bringing on a joint venture (JV) partner for a real estate investor is a major decision. Partners can infuse capital and help take your business to the next level. In fact, many investors believe that creating a partnership is the best business decision they ever made.

A real estate joint venture contract is an agreement between two or more individuals or businesses who have decided to put their money and other resources together to purchase real estate.

Commercial real estate can be an excellent diversifier to an existing investment portfolio. Investors with significant capital may consider investing in real estate through a joint venture.