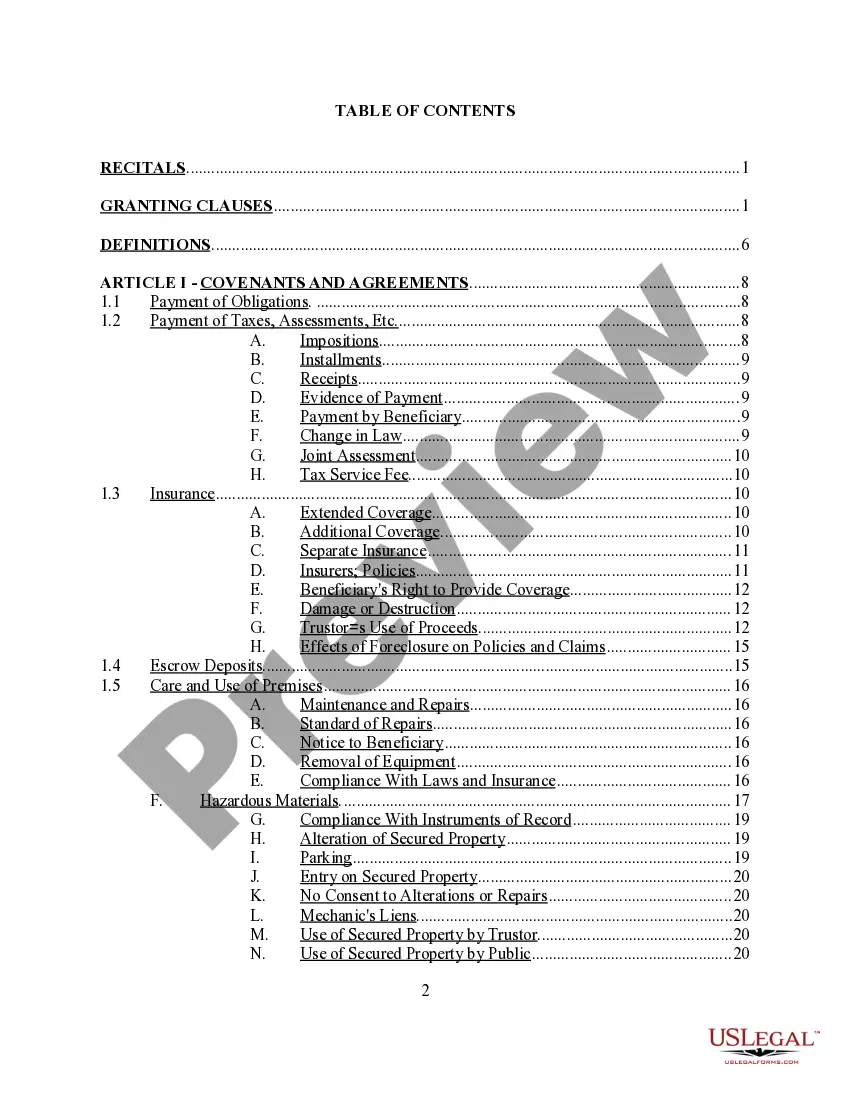

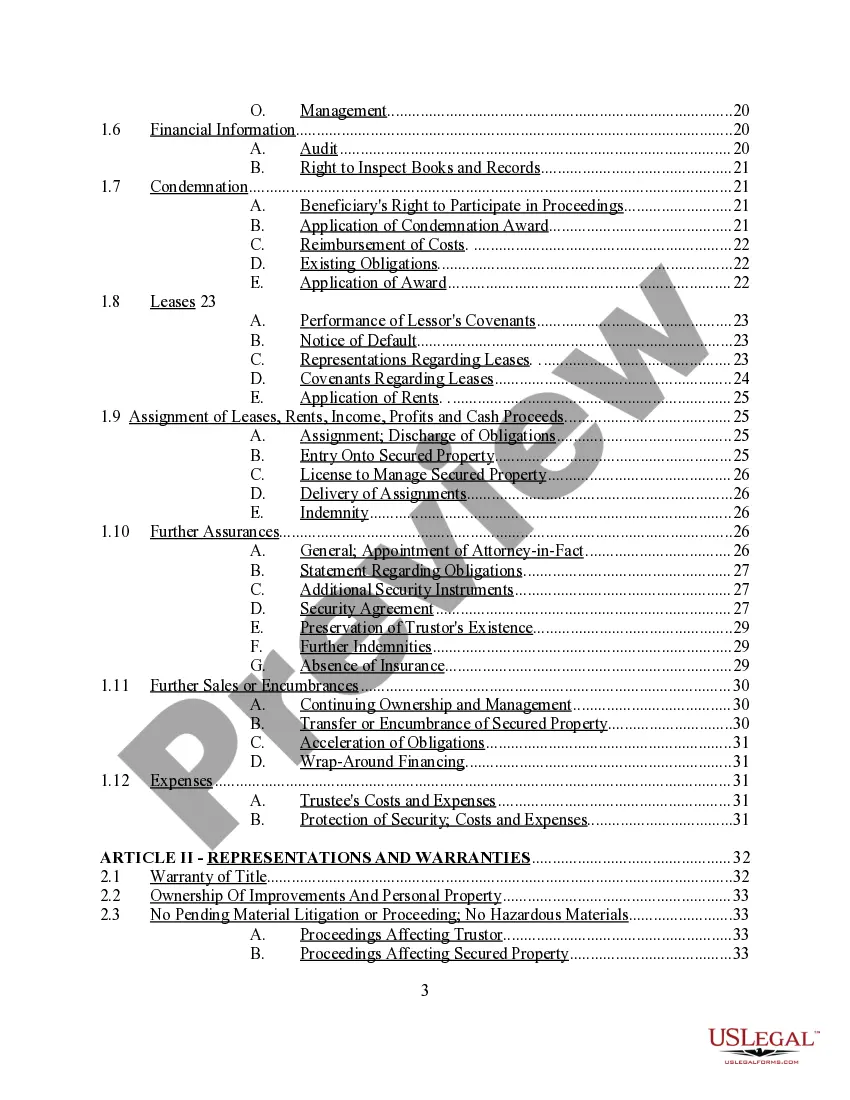

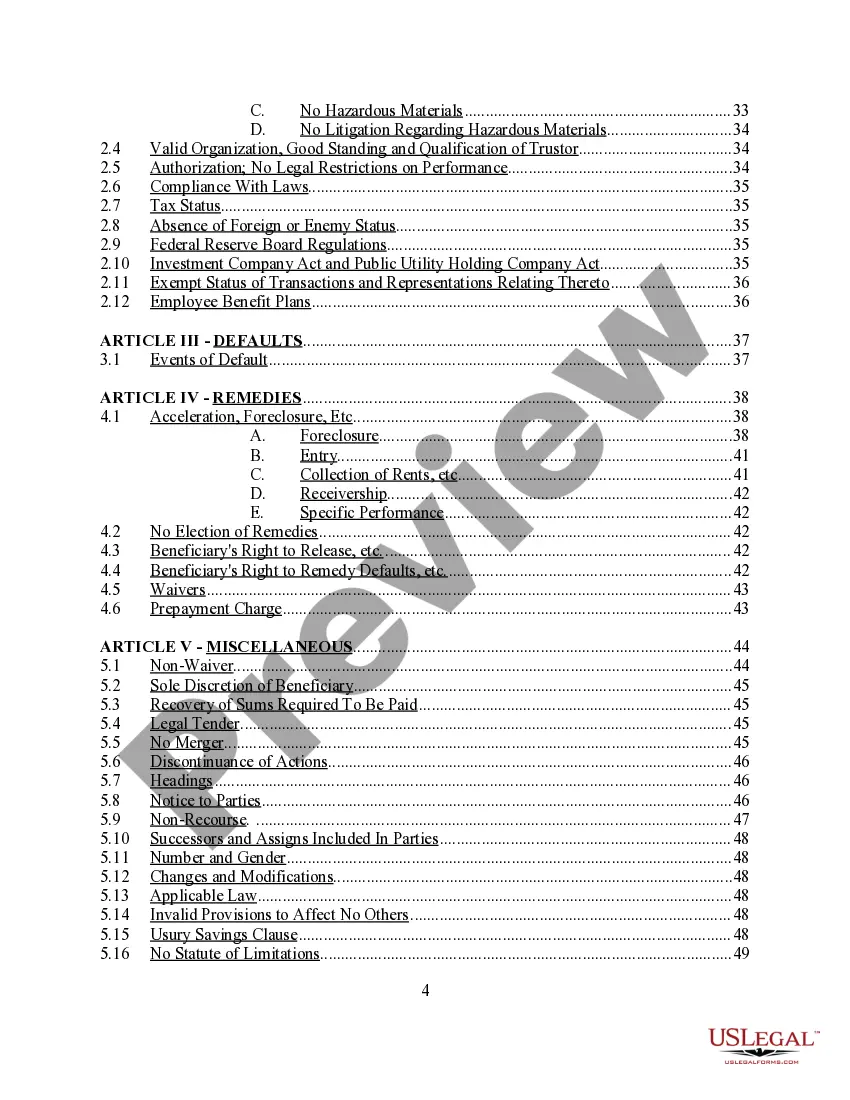

District of Columbia Complex Deed of Trust and Security Agreement

Description

How to fill out Complex Deed Of Trust And Security Agreement?

Are you within a position where you require paperwork for both company or specific purposes nearly every day? There are plenty of legal papers templates available on the net, but finding versions you can rely on isn`t effortless. US Legal Forms gives thousands of kind templates, just like the District of Columbia Complex Deed of Trust and Security Agreement, which are composed in order to meet state and federal requirements.

In case you are previously informed about US Legal Forms site and have a free account, merely log in. Afterward, you can download the District of Columbia Complex Deed of Trust and Security Agreement format.

If you do not provide an account and would like to begin to use US Legal Forms, abide by these steps:

- Discover the kind you require and make sure it is to the proper town/county.

- Take advantage of the Preview switch to check the shape.

- Look at the information to ensure that you have selected the right kind.

- If the kind isn`t what you`re trying to find, take advantage of the Search industry to obtain the kind that meets your requirements and requirements.

- If you obtain the proper kind, simply click Acquire now.

- Pick the rates program you need, submit the required information and facts to produce your bank account, and pay for an order making use of your PayPal or Visa or Mastercard.

- Choose a hassle-free document formatting and download your backup.

Discover each of the papers templates you might have bought in the My Forms food selection. You can get a additional backup of District of Columbia Complex Deed of Trust and Security Agreement any time, if necessary. Just click the necessary kind to download or print out the papers format.

Use US Legal Forms, the most extensive variety of legal varieties, in order to save time as well as steer clear of mistakes. The assistance gives skillfully created legal papers templates which you can use for a variety of purposes. Produce a free account on US Legal Forms and begin producing your life easier.

Form popularity

FAQ

Trustee: This is the third party who will hold the legal title to the real property. Beneficiary: This is the lender.

(b)(1) Except as otherwise provided in paragraph (2) of this subsection, if (i) a deed of trust is not released as a lien on the real property described therein within a period of 12 years after the maturity date of the obligation secured by the deed of trust, or (ii) no determinable maturity date is recited in the ...

The security deed is an interest in real estate which gives legal title of property to the lender of the mortgage for the term of the mortgage note. Trust deed is a written instrument legally conveying property to a trustee often used to secure an obligation such as a mortgage or promissory note.

This document may be called the Security Instrument, Deed of Trust, or Mortgage. When you sign this document, you are giving the lender the right to take your property by foreclosure if you fail to pay your mortgage ing to the terms you've agreed to.

The security is held by a neutral third party known as the trustee. With a deed of trust, the mortgagor (borrower) is called the trustor and the mortgagee (lender) is called the beneficiary. The correct answer is: The trustee.

Generally, the trustee must be an attorney, title insurance company, trust company, bank, savings and loan, credit union, or other company specifically authorized by law to serve as a trustee. Other states have no limitations.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

For a Deed of Trust, the parties involved are the lender, the borrower, and a neutral third party who will serve as a trustee. The title of the property is held as security for the loan and held by the trustee for the benefit of the lender. The title is released from the trust once the loan is paid.