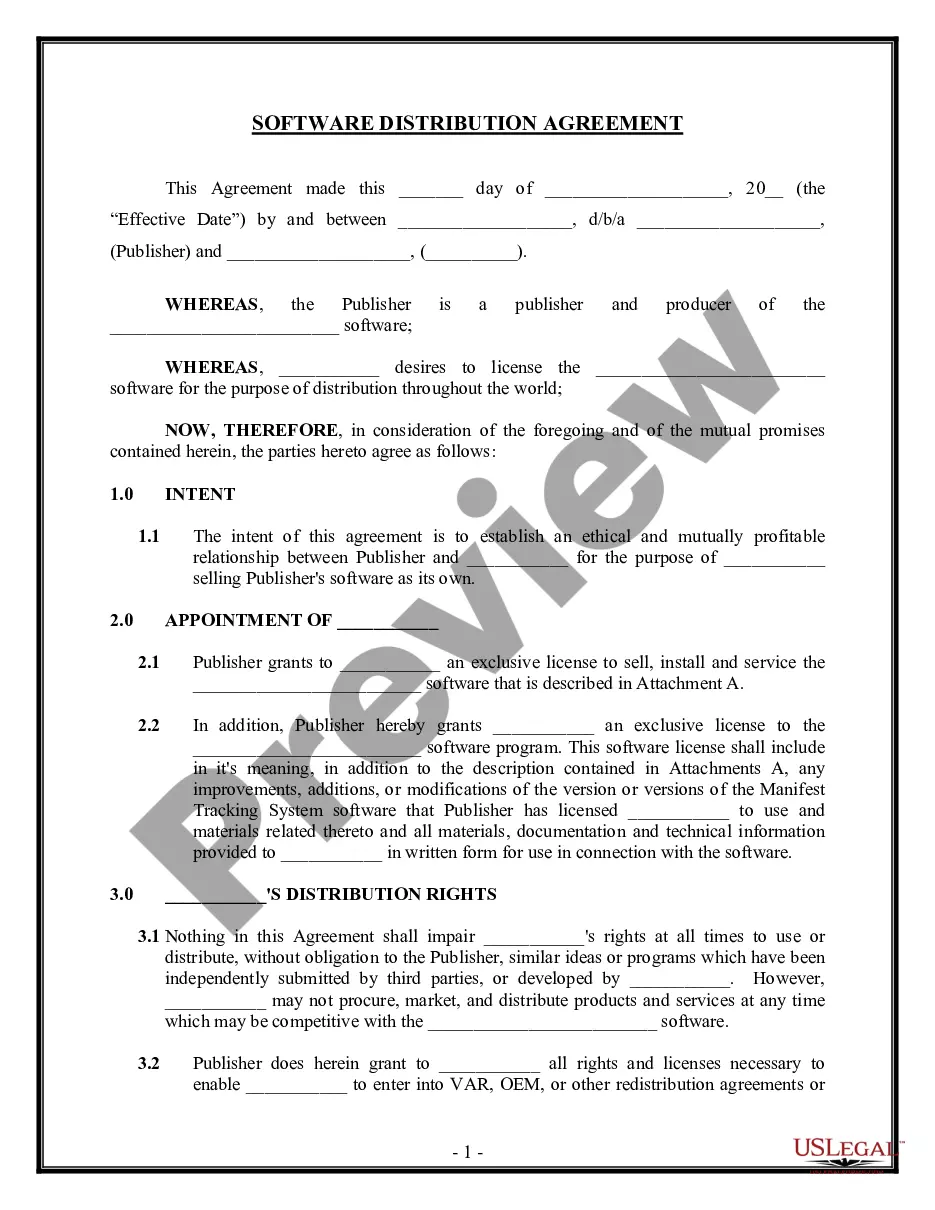

District of Columbia Electronic Software Distribution Agreement

Description

How to fill out Electronic Software Distribution Agreement?

It is feasible to allocate time online searching for the permitted document format that complies with the state and federal criteria you require.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

You can easily obtain or print the District of Columbia Electronic Software Distribution Agreement from the service.

If available, use the Preview button to review the document format as well.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- Afterward, you can complete, modify, print, or sign the District of Columbia Electronic Software Distribution Agreement.

- Each legal document format you purchase is yours indefinitely.

- To acquire another copy of any purchased form, visit the My documents section and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for your chosen state/region.

- Review the form description to verify you have chosen the appropriate form.

Form popularity

FAQ

Who does not have to file Form D-30? You do not have to file if Total gross income (Line 10) is $12,000 or less. You are an organization recognized as exempt from DC taxes.

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

Generally, an unincorporated business, with gross income (Line 10) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

Through a commercial online filing service. This allows taxpayers to transmit their DC and federal returns from their PC for a fee. Note: An Unincorporated business must have an FEIN to file through MeF.

A business is exempt if more than 80% of gross income is derived from personal services rendered by the members of the entity and capital is not a material income-producing factor. A trade, business or professional organization that by law, customs or ethics cannot be incorporated is exempt.

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

WHO MUST FILE A D.C. PARTNERSHIP FORM D-65. Except for partnerships required to file an unincorporated business fran- chise tax return, D.C. Form D-30, all partnerships engaged in any trade or business within the District of Columbia or which received income from sources within the District, must file a D.C. Form D-65.

Washington, D.C. Income Taxes and D.C. Tax Forms. Washington, D.C. State Income Taxes for Tax Year 2021 (January 1 - Dec. 31, 2021) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a D.C. state return).

Additional information. Form D-30 can be e-filed. Refer to this article for information on the date you can begin e-filing this form. Generally, an unincorporated business with gross income over $12,000 from D.C. sources must file a D-30, regardless of whether it has net income.

Taxpayers who wish to register a new business in the District of Columbia can conveniently complete the Register a New Business: Form FR-500 application online via the Office of Tax and Revenue's (OTR) tax portal, MyTax.DC.gov.