District of Columbia Sample Letter for Execution - Distribution of Will to Church

Description

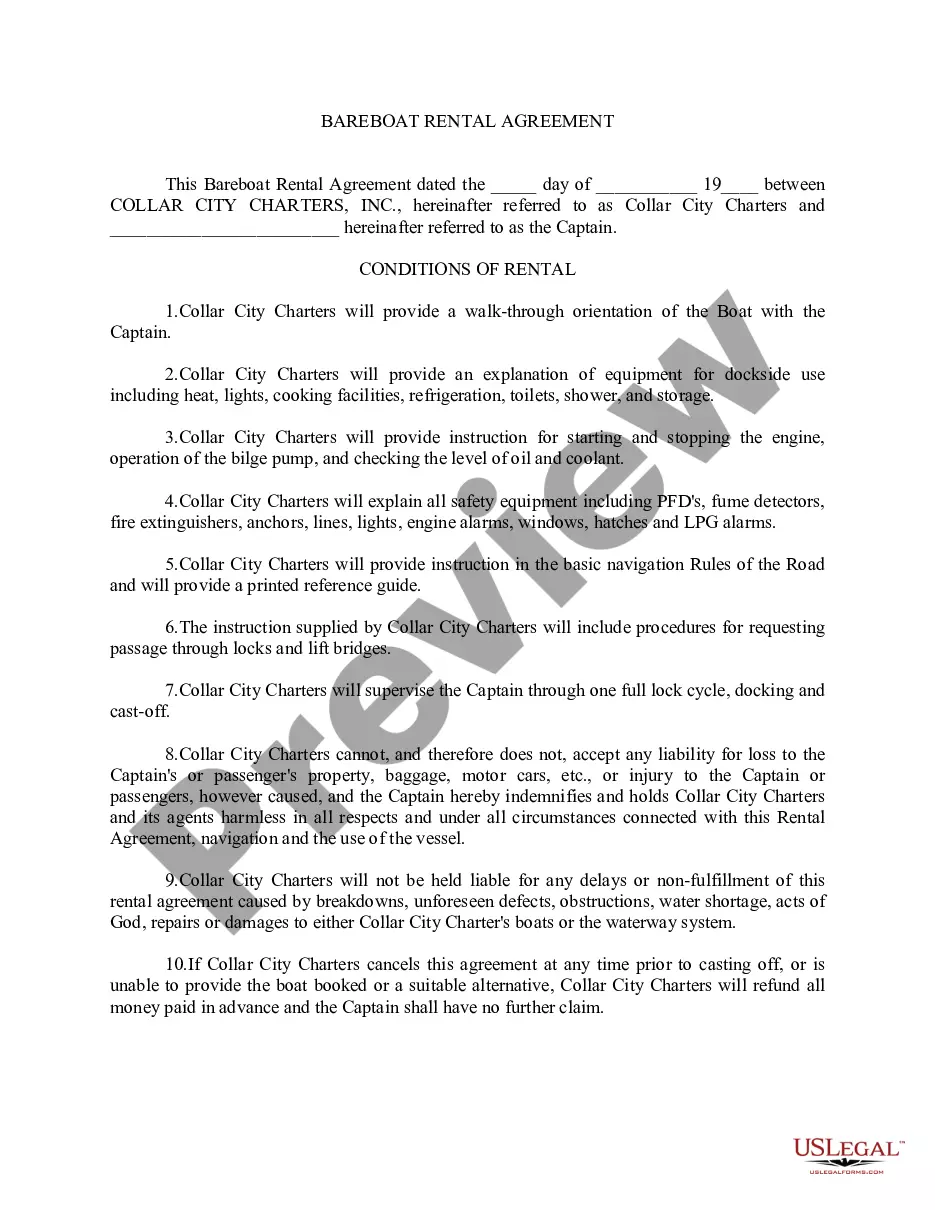

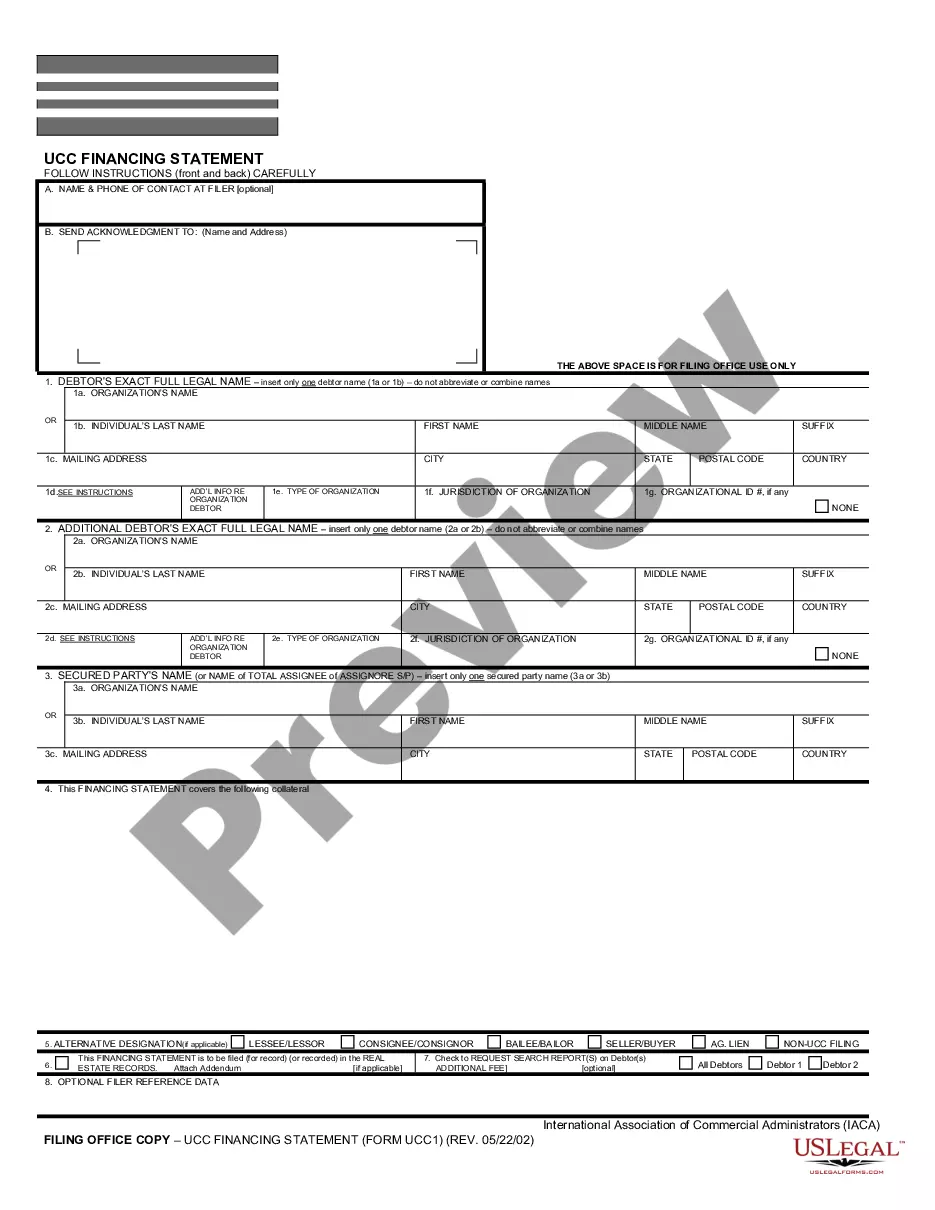

How to fill out Sample Letter For Execution - Distribution Of Will To Church?

US Legal Forms - one of several most significant libraries of authorized forms in the USA - provides a wide array of authorized record templates it is possible to down load or printing. Using the web site, you may get thousands of forms for business and individual purposes, sorted by types, says, or keywords.You will discover the latest variations of forms like the District of Columbia Sample Letter for Execution - Distribution of Will to Church within minutes.

If you have a registration, log in and down load District of Columbia Sample Letter for Execution - Distribution of Will to Church from the US Legal Forms local library. The Obtain key will appear on every form you see. You have accessibility to all formerly acquired forms in the My Forms tab of your own account.

If you wish to use US Legal Forms the first time, listed here are simple directions to help you get started:

- Be sure to have picked out the correct form for your personal town/state. Click on the Review key to analyze the form`s articles. Browse the form outline to ensure that you have selected the appropriate form.

- In the event the form doesn`t suit your demands, take advantage of the Research area at the top of the display screen to find the the one that does.

- If you are content with the form, affirm your selection by simply clicking the Purchase now key. Then, select the pricing plan you favor and supply your credentials to sign up for an account.

- Procedure the financial transaction. Make use of your Visa or Mastercard or PayPal account to finish the financial transaction.

- Select the structure and down load the form on the product.

- Make alterations. Fill up, modify and printing and signal the acquired District of Columbia Sample Letter for Execution - Distribution of Will to Church.

Every web template you added to your money does not have an expiry date and is the one you have forever. So, if you would like down load or printing an additional backup, just visit the My Forms portion and click about the form you will need.

Get access to the District of Columbia Sample Letter for Execution - Distribution of Will to Church with US Legal Forms, one of the most substantial local library of authorized record templates. Use thousands of skilled and express-certain templates that satisfy your small business or individual requirements and demands.

Form popularity

FAQ

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Once disbursement is complete, meaning all debts and final taxes are paid, a trustee can distribute the inheritance to beneficiaries. This is called distribution. It is only then that money should be paid to the benefit or care of the beneficiary.

It is often written by the executor or trustee to provide beneficiaries with specific details about their inheritance, such as the assets they will receive, distribution timelines, any applicable taxes or fees, and any requirements or conditions that need to be fulfilled.

The Personal Representative must file a final account, report and petition for final distribution, have the petition set for hearing, give notice of the hearing to interested persons, and obtain a court order approving the final distribution.

It is often written by the executor or trustee to provide beneficiaries with specific details about their inheritance, such as the assets they will receive, distribution timelines, any applicable taxes or fees, and any requirements or conditions that need to be fulfilled.