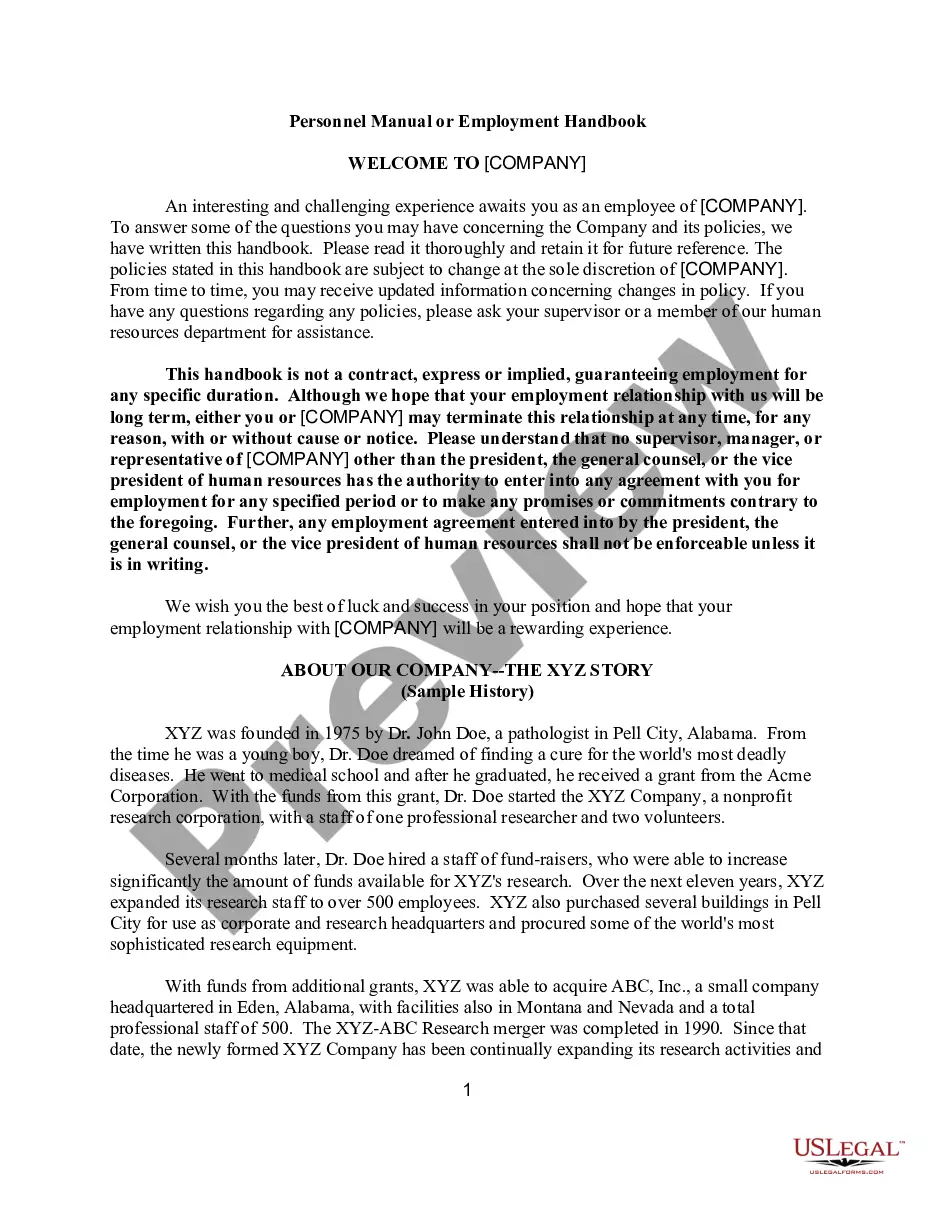

An employee handbook is a manual that contains an employer's work rules and policies. It can also contain other information that is useful to the employee, such as the business's history, its goals, and its commitment to customer service.

District of Columbia Employee Handbook 2014 Version Approved at January 20, 2015 Business Meeting

Description

How to fill out Employee Handbook 2014 Version Approved At January 20, 2015 Business Meeting?

If you wish to obtain, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Make use of the site’s user-friendly and convenient search feature to find the documents you require.

Various templates for business and personal purposes are categorized by types and regions, or keywords.

Step 4. Once you have found the necessary form, click the Purchase now button. Choose the pricing plan you prefer and provide your information to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to acquire the District of Columbia Employee Handbook 2014 Version Approved at January 20, 2015 Business Meeting with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the District of Columbia Employee Handbook 2014 Version Approved at January 20, 2015 Business Meeting.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

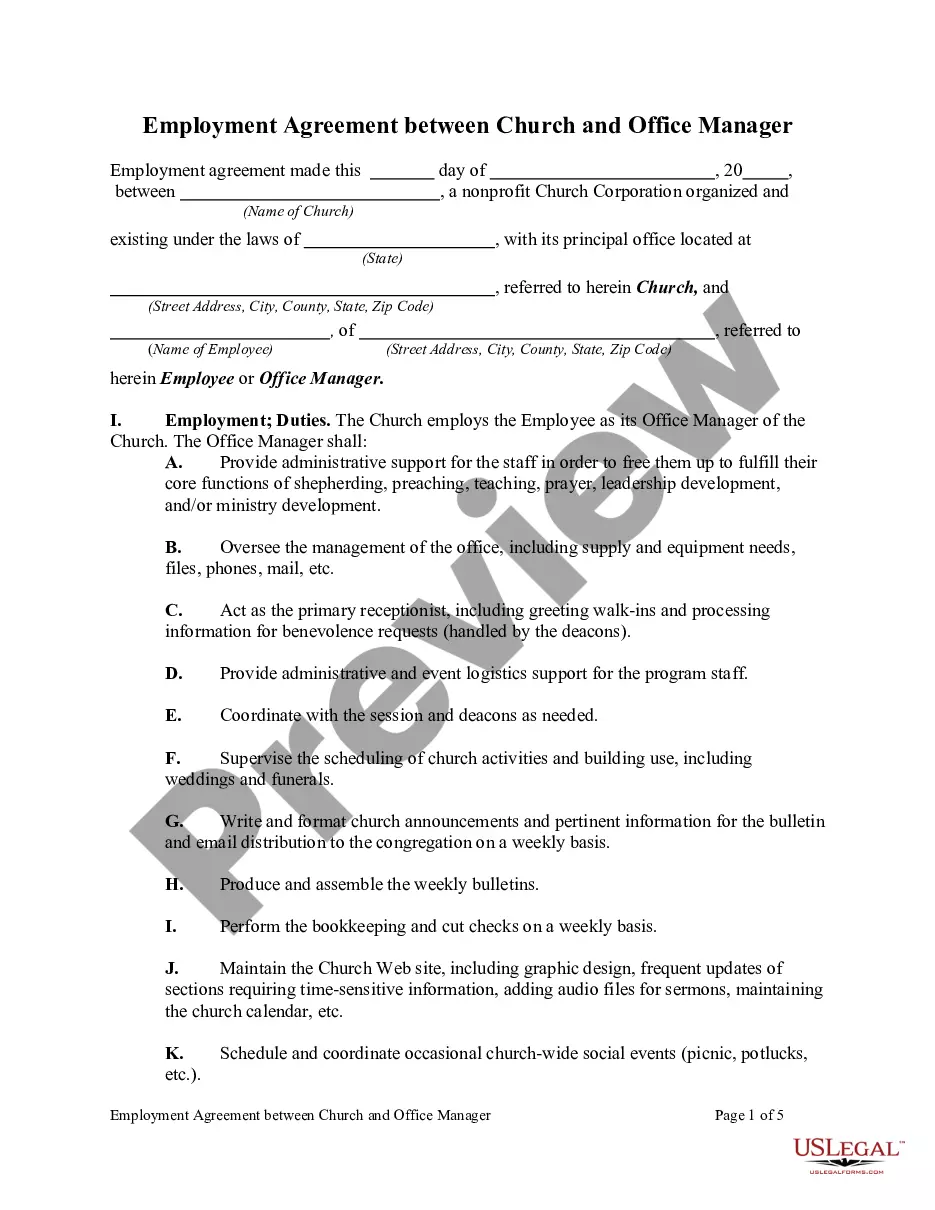

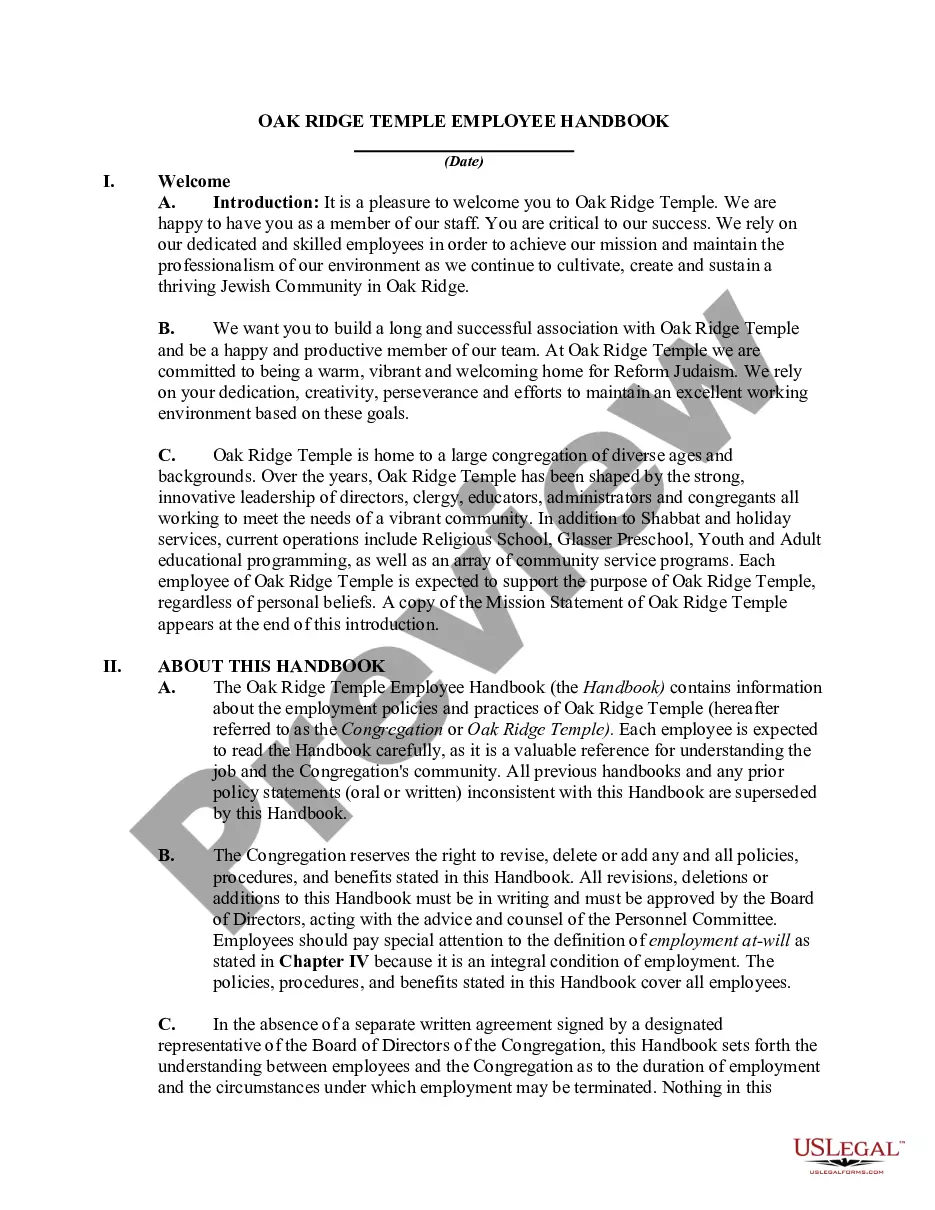

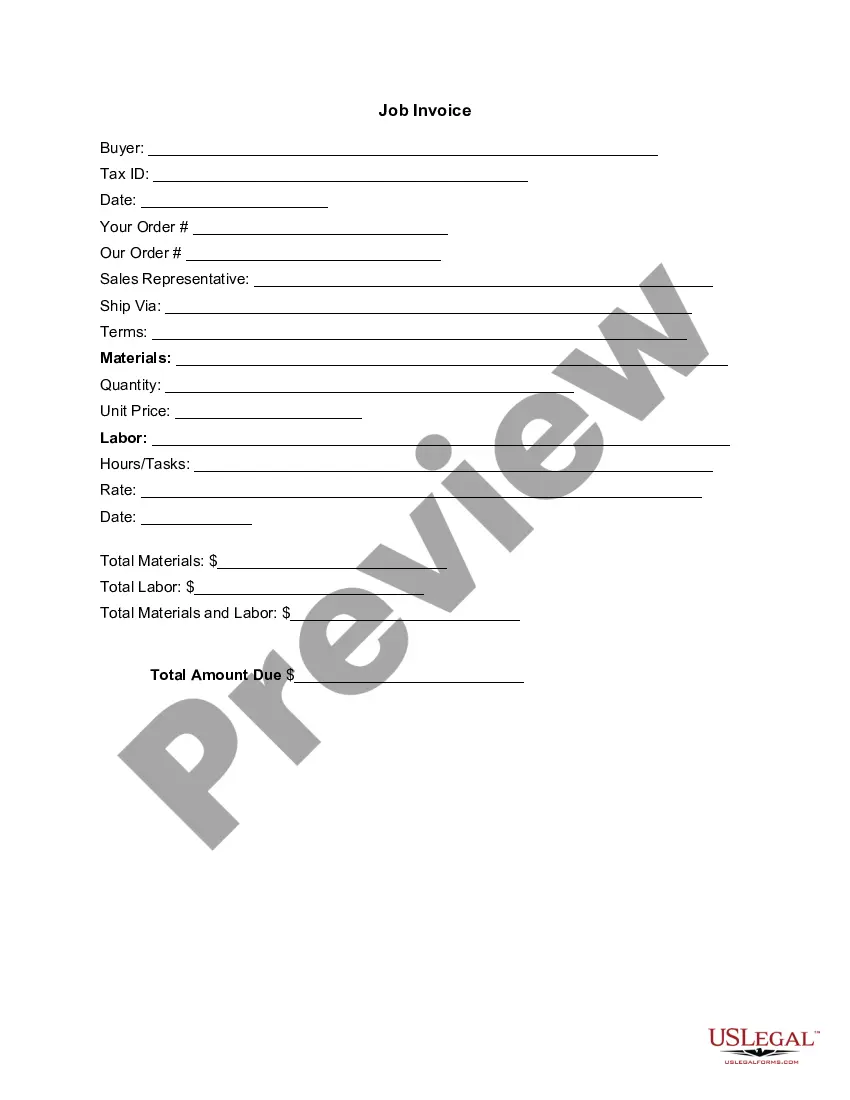

- Step 2. Use the Preview option to review the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find additional forms within the legal form category.

Form popularity

FAQ

Employee PFL contributions are post-tax deductions, which means the contributions made into the state fund are subject to taxes. If an employee takes PFL, the wages they receive are subject to federal income tax, but not Social Security and Medicare taxes, or federal unemployment tax.

If an employee takes PFL, the wages they receive are subject to federal income tax, but not Social Security and Medicare taxes, or federal unemployment tax. The employee will receive a 1099-G, which will need to be added to their annual 1040 if the employee claims for the state PFL benefits.

To calculate D.C. PFL, multiply your employee's weekly gross pay by 0.62%. For this employee, you must contribute $6.20 per paycheck for D.C. PFL. Your annual contribution for this employee would be $322.40 ($6.20 X 52 weeks). Remember, do not deduct D.C. PFL from the employee's gross wages.

Are CA PFL benefits taxable? Family leave insurance benefits are subject to federal income tax and to federal rules on reporting income and paying taxes. CA PFL benefits are not subject to California state income tax. Benefits paid directly from the state of California are reported on Form 1099-G.

If you are eligible for Paid Family Leave in the District of Columbia, you may receive a weekly benefit amount which is based on your weekly wages. The current maximum weekly benefit amount is $1,009.

The District of Columbia Family and Medical Leave Act (DCFMLA) requires employers with 20 or more employees to provide eligible employees with 16 weeks of unpaid family leave and 16 weeks of unpaid medical leave during a 24 month period. Employee Eligibility.

You are eligible for Paid Family Leave benefits if you: Spend more than 50% of your time working in DC. Eligible workers must spend a majority of their time working the Districtincluding teleworking or telecommutingfor a covered employer, and must have completed that work during the year prior to needing leave.

As explained in Chapter 2, there is a 7-day waiting period for benefits. Benefit payments occur on a schedule every two weeks. You will always receive payment for your Paid Family Leave benefits after the week for which benefits were payable to you and during which you took leave.

According to the IRS, Family Temporary Disability Insurance payments (also known as Paid Family Leave) are in the nature of unemployment compensation under Section 85 of the Internal Revenue Code. California's Employment Development Department must report the FTDI payments to the IRS on a Form 1099G and, for federal

Reporting paid family leave taxesReport employee contributions to state-mandated PFL on Form W-2 using Box 14, Other. The State Insurance Fund reports paid family leave benefits and any federal income taxes withheld on Form 1099-G, Certain Government Payments.