District of Columbia Sample Letter for Explanation of Bankruptcy

Description

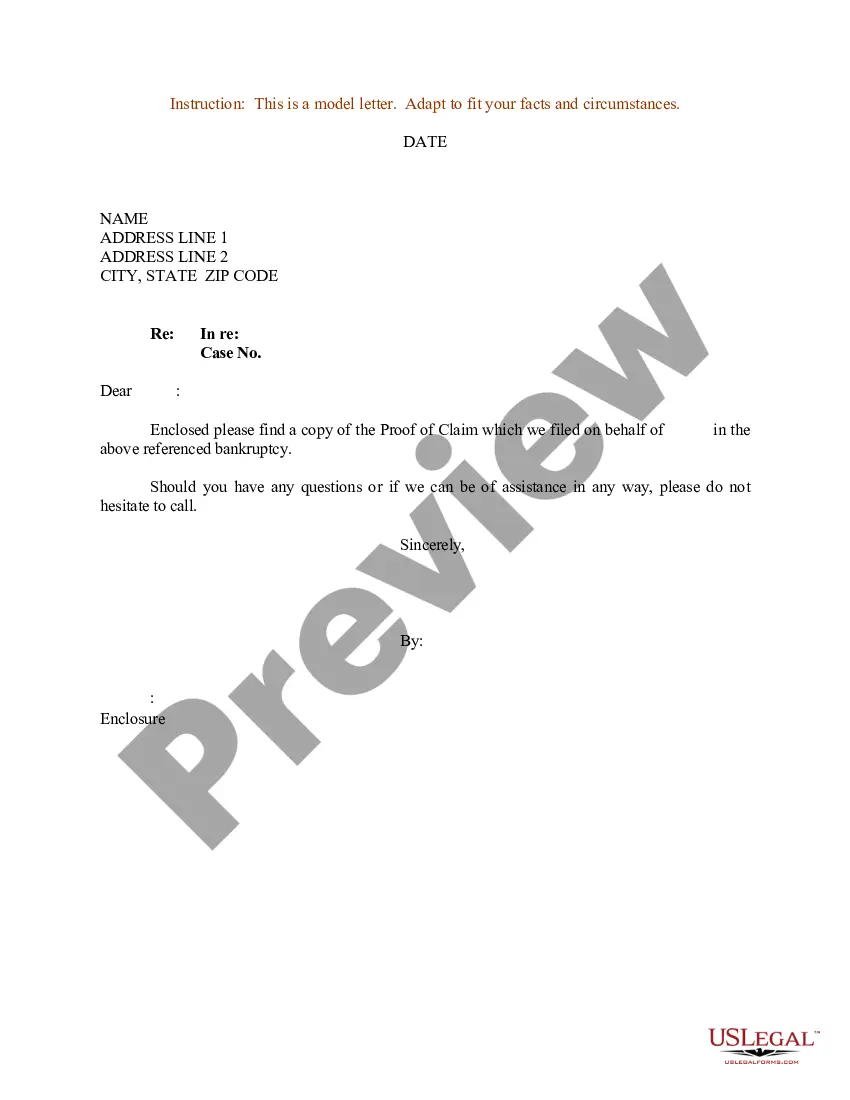

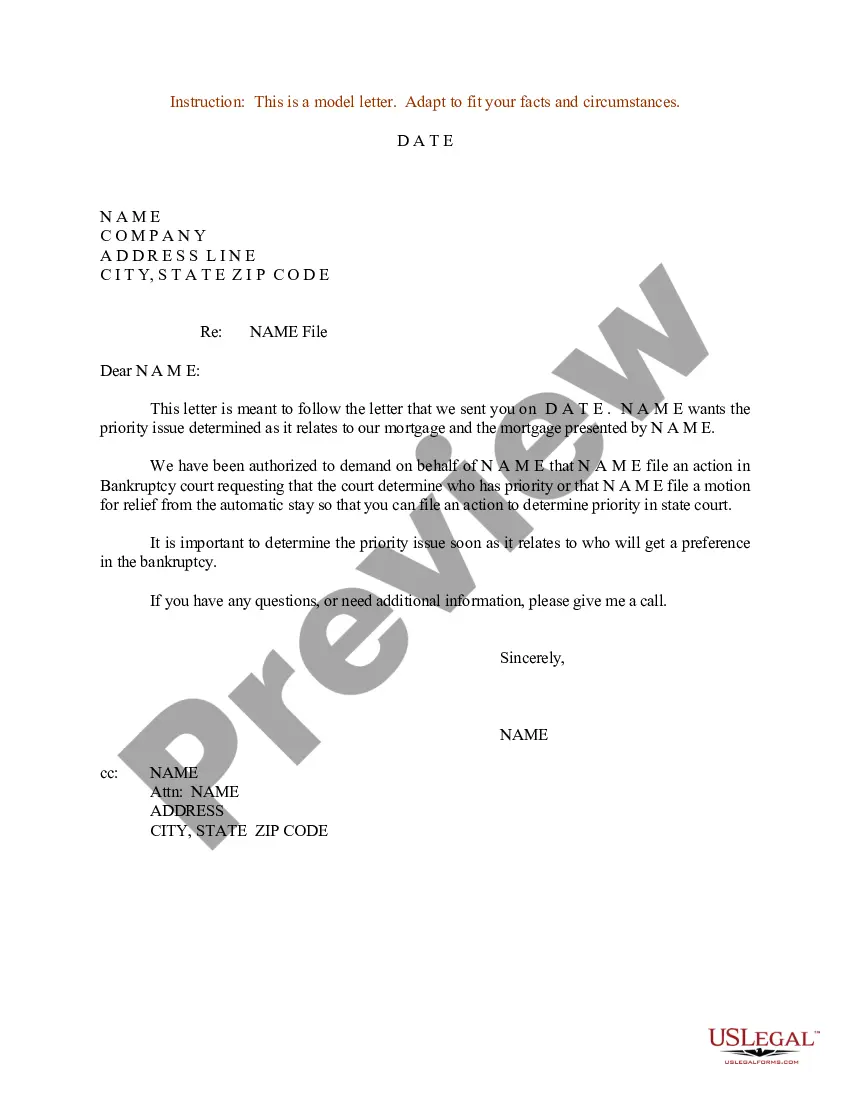

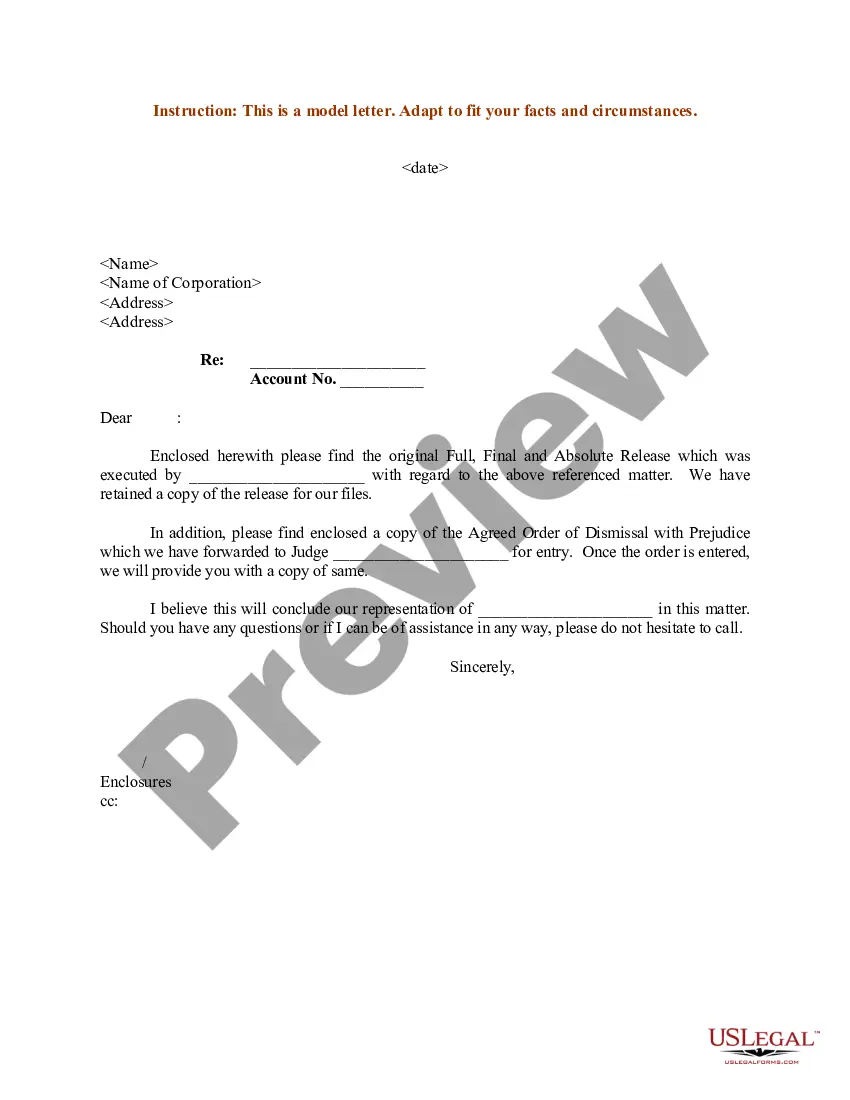

How to fill out Sample Letter For Explanation Of Bankruptcy?

You might spend hours online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that have been reviewed by experts.

You can obtain or print the District of Columbia Sample Letter for Explanation of Bankruptcy from our service.

If available, utilize the Review button to browse the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the District of Columbia Sample Letter for Explanation of Bankruptcy.

- Every legal document template you obtain is yours indefinitely.

- To get another copy of any purchased document, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area of your choice.

- Review the form description to confirm you have chosen the correct document.

Form popularity

FAQ

A cease and desist is a written notice demanding that the recipient immediately stop an illegal or allegedly illegal activity. It may be an order or injunction issued by a court or government agency or a letter from an attorney. A cease and desist order or injunction has legal power.

A 341 notice is the notice sent by the bankruptcy clerk to the debtor, the creditors, and all other interested parties, notifying them of the date, time, and place in which the 341 meeting (creditors meeting) will be held.

You cannot stop a debt collection agency from sending you letters if they have a legitimate reason to do so. Some of the letters they send will be a legal requirement on their part to show you what the status of your debt is. The easiest way to prevent letters is to pay the debt.

Format the letter thusly: Your full name and address. The collections agency's name and address. A request for the amount of the debt claimed to be owed. A request for the name of the original creditor. A request for the judgment information (if applicable) A request for proof of the company's license.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Statement of intention is a declaration filed by a debtor in a chapter 7 bankruptcy case. A statement of intention is filed prior to the meeting of the creditors. It is a document that discloses the details of secured debt that a debtor intends to reaffirm. When a debtor reaffirms a debt, it is omitted from discharge.

Bankruptcy cases get dismissed for a variety of reasons ranging from intentional misconduct (such as fraud) to simply failing to file the correct forms with the court.

Dear debt collector: Pursuant to my rights under the state and federal fair debt collection laws, I hereby request that you immediately cease all calls to your phone number in relation to the account of wrong person's full name. This is the wrong number to contact that person.

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

Retain: You tell the court you want to keep the property. You may have to pay some or all of the debt that goes with the property. If you want to retain the property, you must tell the court how you will pay the loan on it.