District of Columbia General Form of Assignment as Collateral for Note

Description

How to fill out General Form Of Assignment As Collateral For Note?

Are you presently located in a place where you often require documents for both business or personal purposes.

There are numerous legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms provides thousands of document templates, including the District of Columbia General Form of Assignment as Collateral for Note, designed to meet state and federal requirements.

Once you locate the correct form, click on Acquire now.

Choose the pricing plan you want, fill in the necessary information to create your account, and complete the transaction using PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the District of Columbia General Form of Assignment as Collateral for Note template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

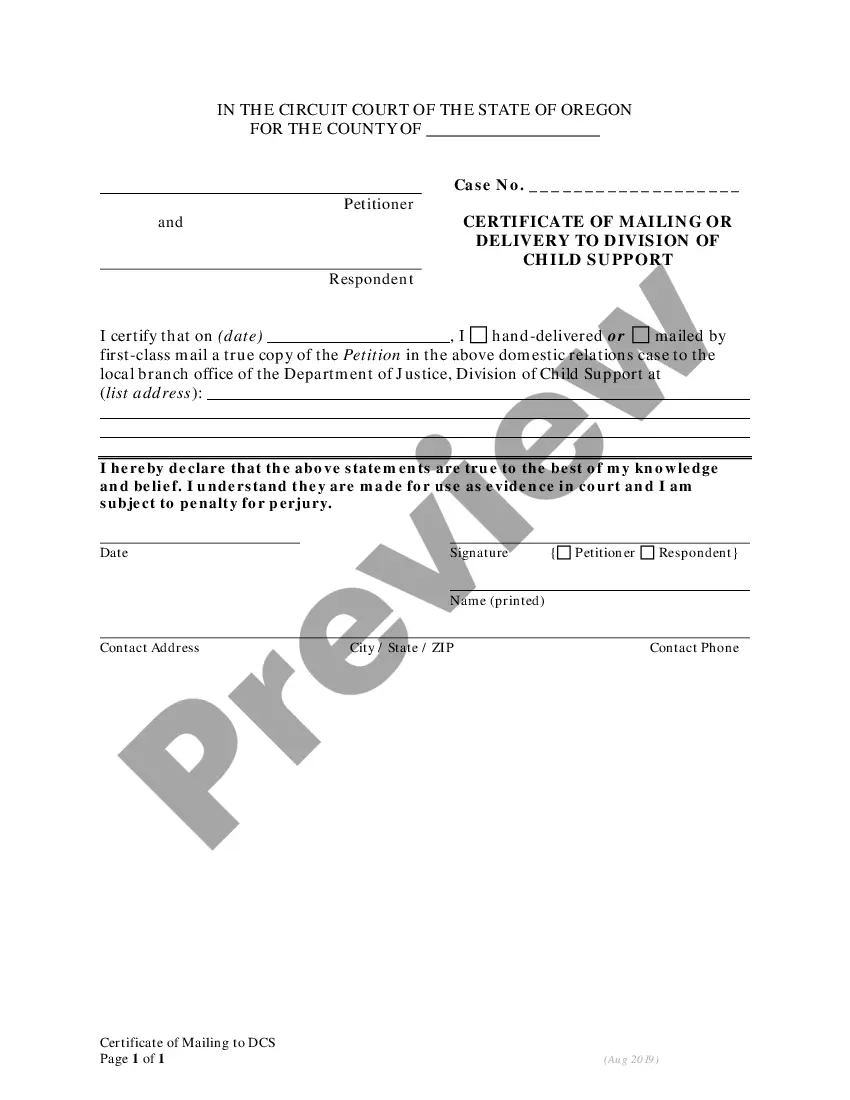

- Utilize the Preview feature to review the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

A consent to collateral assignment is an agreement that acknowledges the assignment of an asset as collateral, typically requiring approval from a third party. In relation to a District of Columbia General Form of Assignment as Collateral for Note, this consent ensures that all parties are aware of and accept the terms of the collateralization. This is crucial for maintaining transparency and legal validity. You can easily manage these documents through our legal forms platform, ensuring compliance and peace of mind.

Filling out a collateral assignment form, such as the District of Columbia General Form of Assignment as Collateral for Note, is a straightforward process. Start by entering the names of the borrower and assignee, followed by a detailed description of the collateral. Be sure to review the document carefully to ensure accuracy, and consult legal resources on uslegalforms if you have questions.

In a collateral assignment, the assignee is the entity or individual who receives rights to the collateral asset. Typically, this party is the lender who will benefit from the collateral if the borrower defaults on their obligations. The District of Columbia General Form of Assignment as Collateral for Note clearly identifies the assignee, ensuring both parties understand their roles and responsibilities.

A collateral document, like the District of Columbia General Form of Assignment as Collateral for Note, provides assurance to lenders regarding the borrower's repayment. For instance, a mortgage note can serve as collateral, ensuring that lenders will recover their investment in the event of default. Utilizing the right form is crucial, as it outlines the specifics of the collateral involved.

The two predominant types of assignments are absolute assignments and collateral assignments. An absolute assignment transfers full rights to another person or entity, removing any retention of rights by the original owner. Conversely, a collateral assignment retains the underlying rights for the assignor while granting the assignee rights until the obligation is fulfilled. Utilizing the District of Columbia General Form of Assignment as Collateral for Note can facilitate the proper execution of these assignments.

A collateral form serves as a legal document that designates a specific asset or rights as security for a financial obligation. This form is vital when you need to assure lenders that they will have a claim over the assigned asset if a borrower defaults. The District of Columbia General Form of Assignment as Collateral for Note is a perfect example of how such a form can be utilized to create a secure agreement. It provides clarity and security for both parties involved.

UCC 9 406 is a provision in the Uniform Commercial Code that addresses the rights of a secured party in relation to collateral. It clarifies how a creditor can enforce their rights when a borrower defaults on their obligations. Familiarity with the District of Columbia General Form of Assignment as Collateral for Note is essential for ensuring compliance with UCC regulations during such transactions.

A collateral assignment form is a legal document that grants a lender rights to specific collateral in case the borrower does not fulfill their obligations. This form outlines the terms under which the collateral can be accessed. Utilizing the District of Columbia General Form of Assignment as Collateral for Note can streamline this process and provide clear guidelines for all parties.