District of Columbia Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

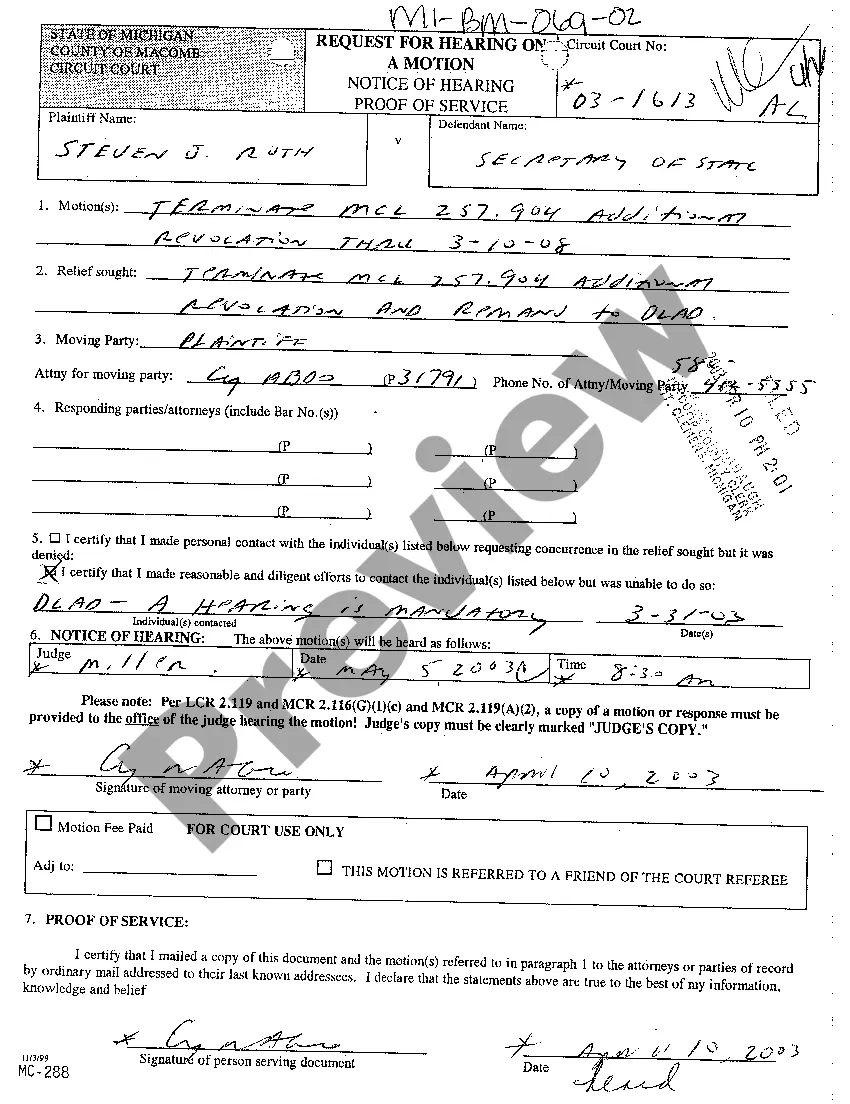

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

If you intend to finalize, download, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Leverage the site's simple and convenient search to locate the files you need.

A variety of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, select the Get Now button. Choose your preferred pricing plan and provide your details to register an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finish the transaction.

- Employ US Legal Forms to acquire the District of Columbia Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to obtain the District of Columbia Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

- You can also access forms you previously stored in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the information.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

You must file a DC return if: You lived in the District of Columbia for 183 days or more during the taxable year, even if your permanent residence was outside the District of Columbia. You were a member of the armed forces and your home of record was the District of Columbia for either part of or the full taxable year.

You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);

Goods that are subject to sales tax in Washington D.C. include physical property, like furniture, home appliances, and motor vehicles. Prescription and non-prescription medicine, groceries, and gasoline are all tax-exempt. Some services in Washington D.C. are subject to sales tax.

For the purposes of this chapter (not alone of this subchapter) and unless otherwise required by the context, the term unincorporated business means any trade or business, conducted or engaged in by any individual, whether resident or nonresident, statutory or common-law trust, estate, partnership, or limited or

Generally, an unincorporated business, with gross income (Line 10) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

The DC franchise tax, also known as the DC unincorporated business franchise tax, is a tax imposed on some businesses operating in the District of Columbia that have gross receipts of $12,000 or more.

Form D-30 can be e-filed. Refer to this article for information on the date you can begin e-filing this form. Generally, an unincorporated business with gross income over $12,000 from D.C. sources must file a D-30, regardless of whether it has net income.

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);

Generally, taxpayers should file with the jurisdiction in which they live. If you live in Maryland, file with Maryland. If you live in Washington, D.C., Pennsylvania, Virginia or West Virginia, you should file with your home state.

Being a 501(c)(3) nonprofit means your organization is exempt from paying most taxes at the federal level. However, being recognized as tax-exempt by the IRS does not automatically mean your organization is exempt from local D.C. taxes including income, franchise, sales, use, and personal property taxes.