District of Columbia Telecommuting Worksheet

Description

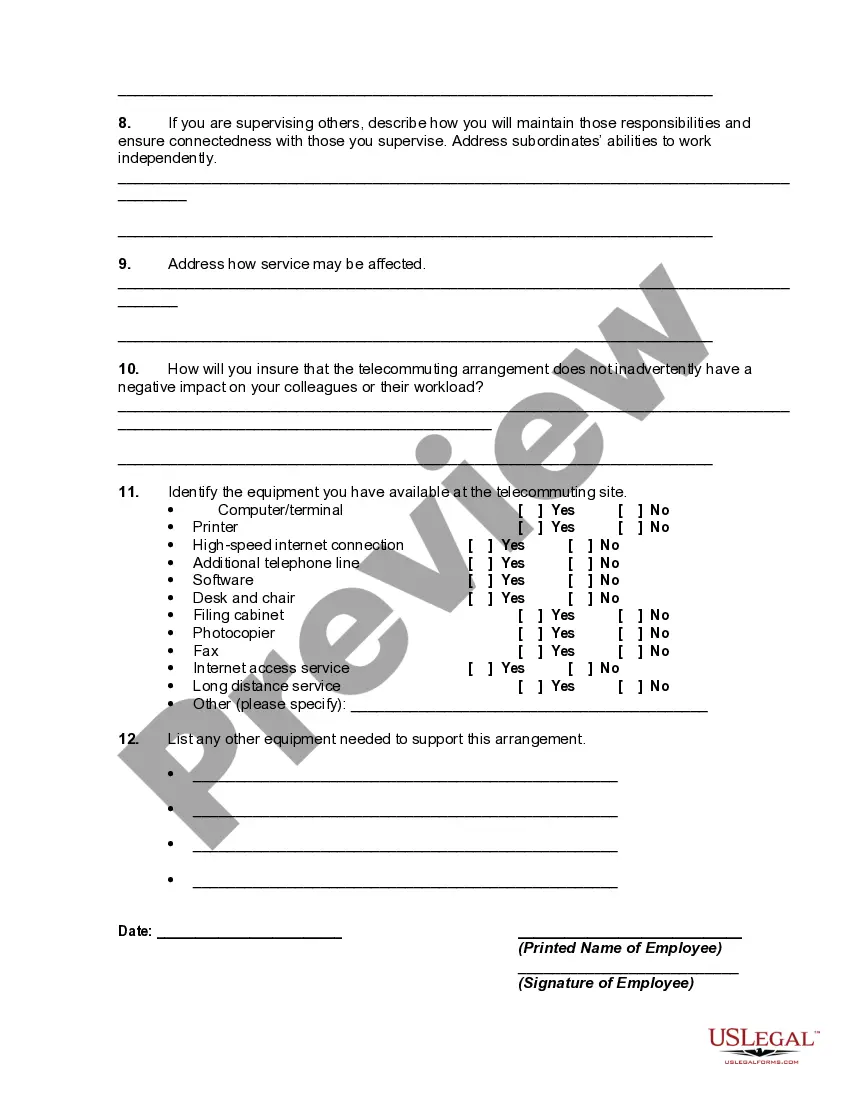

How to fill out Telecommuting Worksheet?

You can spend several hours online looking for the valid document template that complies with the local and federal regulations you require.

US Legal Forms offers a vast collection of valid forms that have been reviewed by experts.

You can easily download or print the District of Columbia Telecommuting Worksheet from my service.

If available, use the Preview option to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- Then, you can complete, modify, print, or sign the District of Columbia Telecommuting Worksheet.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and select the relevant option.

- If you are using the US Legal Forms website for the first time, follow these simple steps.

- First, make sure you have selected the correct document template for the area/city of your preference.

- Review the form details to ensure you have picked the correct one.

Form popularity

FAQ

The daily benefit amount is calculated by dividing your weekly benefit amount by seven. The maximum benefit amount is calculated by multiplying your weekly benefit amount by 8 or adding the total wages subject to State Disability Insurance (SDI) tax paid in your base period.

To be eligible for PFL benefits, you must: Be unable to do your regular or customary work. Have lost wages due to the need to provide care for a seriously ill family member, bond with a new child, or participate in a qualifying event resulting from a family member's military deployment to a foreign country.

What you need to know about paid family leave and taxes: Benefits you receive under this program are taxable and included in your federal and District gross income. You will receive a Form 1099-G from the District reporting the payments you received during the year.

You are eligible for Paid Family Leave benefits if you: Spend more than 50% of your time working in DC. Eligible workers must spend a majority of their time working the Districtincluding teleworking or telecommutingfor a covered employer, and must have completed that work during the year prior to needing leave.

Private-sector employers in the District will pay a . 62% tax beginning July 1, 2019, to fund the paid-leave benefit. The Paid Family Leave tax is 100% employer-funded and may not be deducted from a worker's paycheck.

How Much Can I Receive in Parental Leave Benefits? DC Paid Family Leave provides wage replacement of 90% of wages up to 1.5 times DC's minimum wage and 50% of wages above 1.5 times DC's minimum wage. The maximum weekly benefit amount is $1,000.

To calculate D.C. PFL, multiply your employee's weekly gross pay by 0.62%. For this employee, you must contribute $6.20 per paycheck for D.C. PFL. Your annual contribution for this employee would be $322.40 ($6.20 X 52 weeks). Remember, do not deduct D.C. PFL from the employee's gross wages.

The District of Columbia Family and Medical Leave Act (DCFMLA) requires employers with 20 or more employees to provide eligible employees with 16 weeks of unpaid family leave and 16 weeks of unpaid medical leave during a 24 month period. Employee Eligibility.

On July 1, 2020, the District of Columbia began administering paid leave benefits. DC workers can now apply for paid family leave. The Paid Leave Act provides up to: 2 weeks to care for your pregnancy.

The maximum weekly benefits for 2020 2022 are: 2022 = $1,327/week. 2021 = $1,206/week. 2020 = $1,000/week.