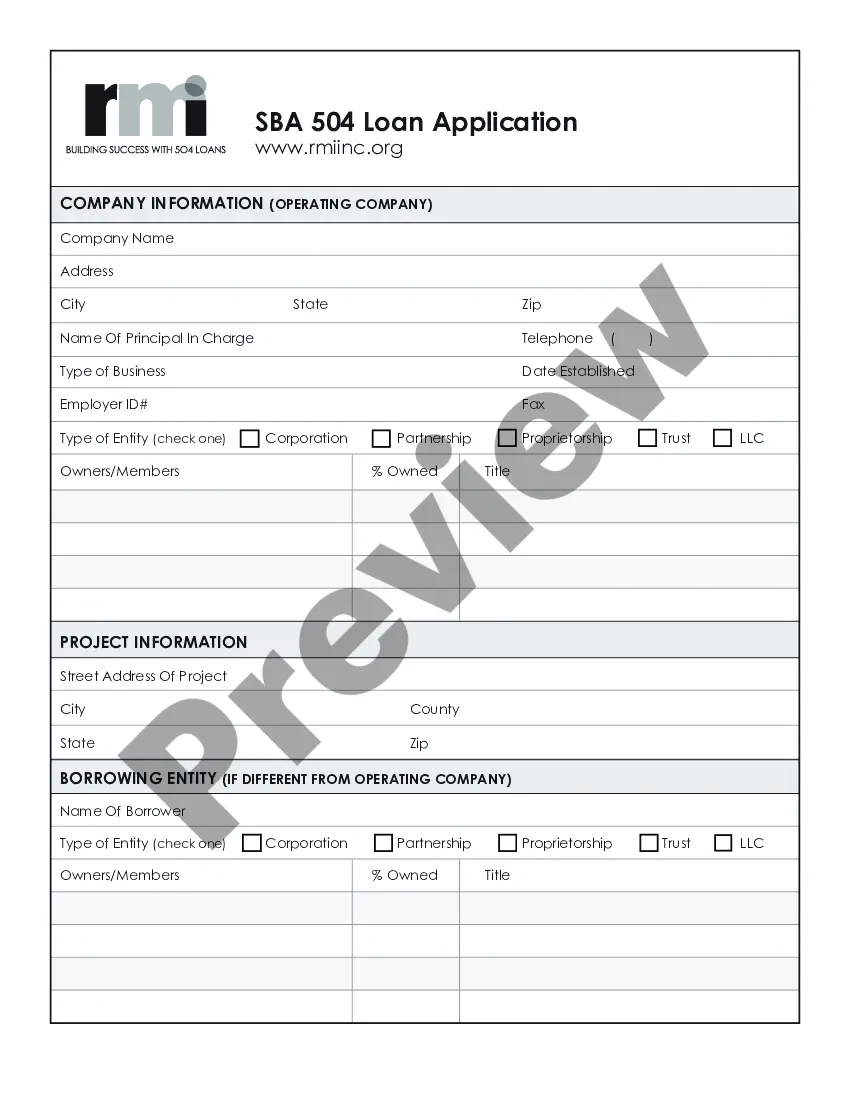

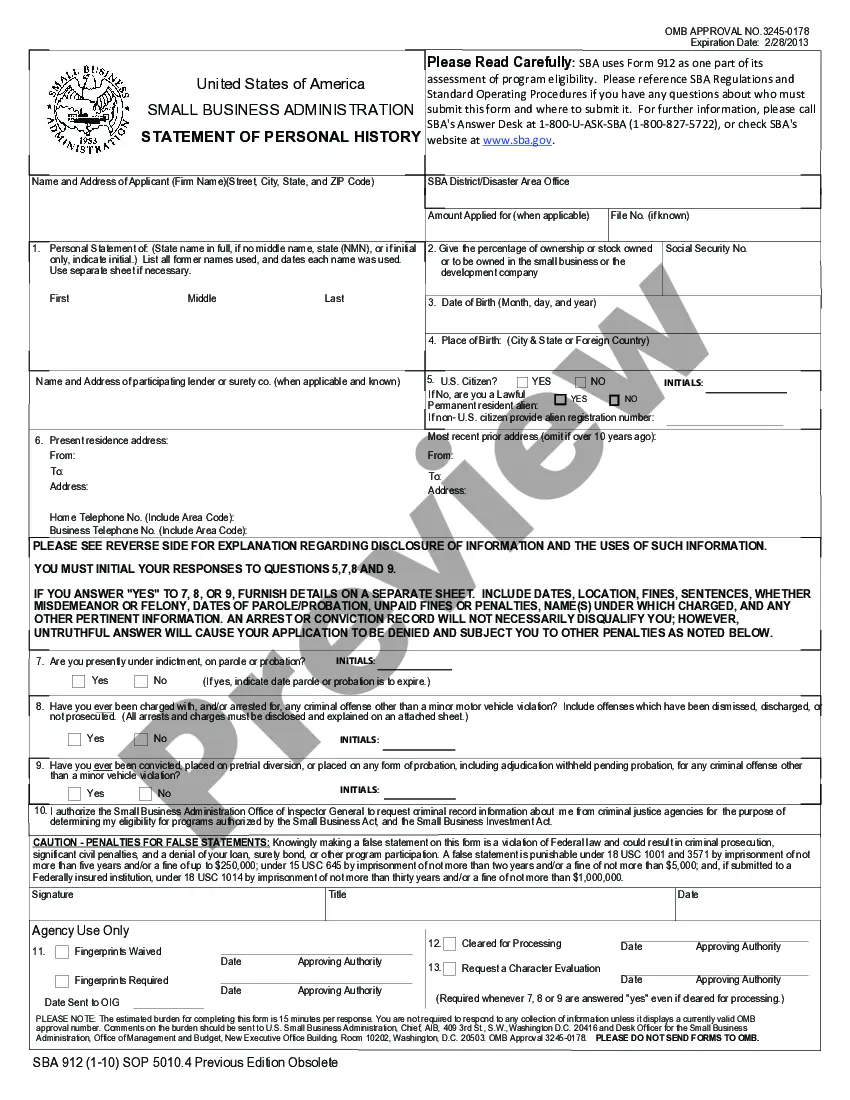

District of Columbia Small Business Administration Loan Application Form and Checklist

Description

How to fill out Small Business Administration Loan Application Form And Checklist?

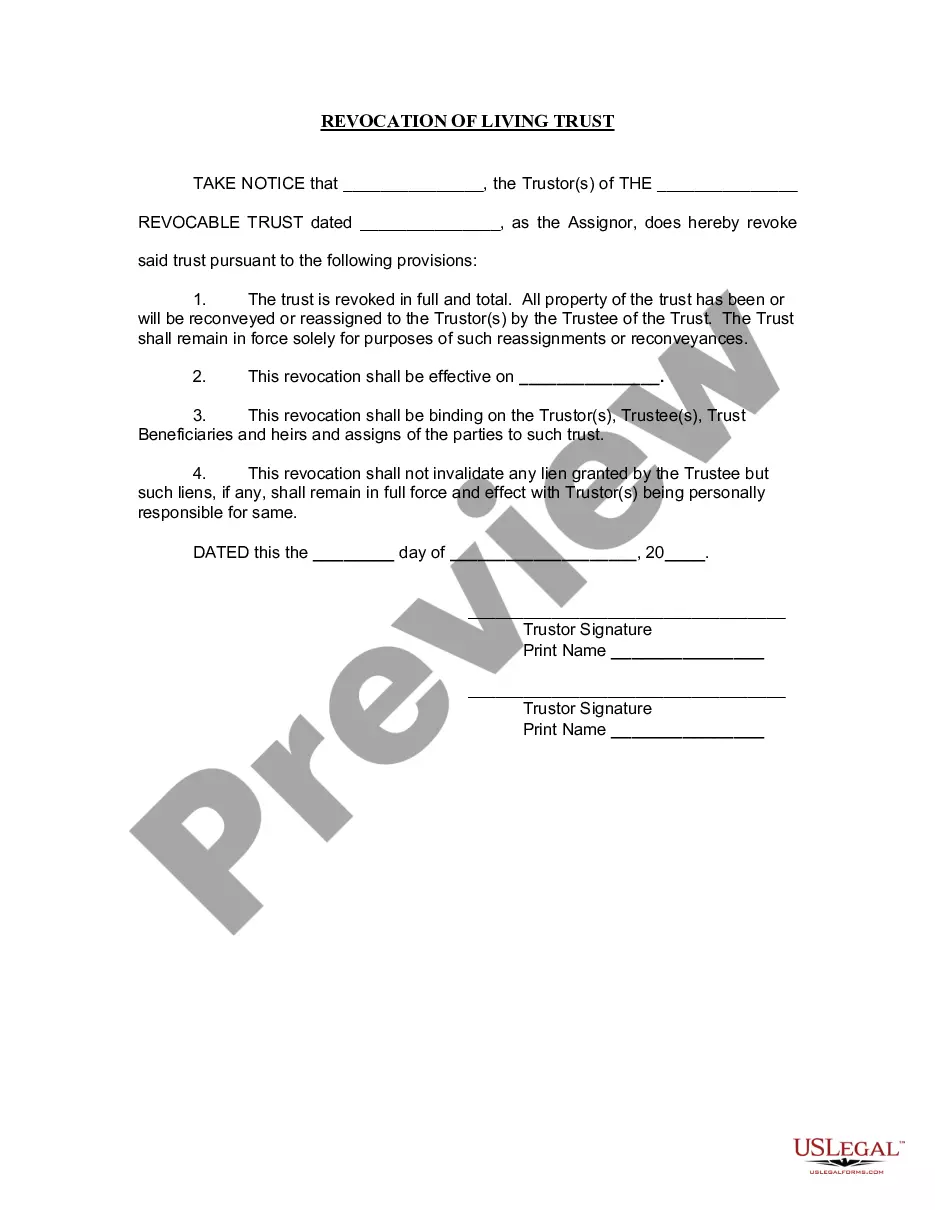

US Legal Forms - one of many largest libraries of legal varieties in the States - gives a wide range of legal file web templates you are able to obtain or print. Utilizing the website, you may get a large number of varieties for company and individual purposes, sorted by classes, suggests, or keywords.You can get the most up-to-date types of varieties much like the District of Columbia Small Business Administration Loan Application Form and Checklist within minutes.

If you already possess a registration, log in and obtain District of Columbia Small Business Administration Loan Application Form and Checklist in the US Legal Forms local library. The Down load button can look on each and every type you perspective. You get access to all in the past acquired varieties from the My Forms tab of your own accounts.

If you wish to use US Legal Forms the very first time, here are straightforward recommendations to help you get started off:

- Make sure you have picked the proper type for the town/state. Click on the Preview button to analyze the form`s articles. Look at the type explanation to actually have selected the correct type.

- If the type doesn`t suit your demands, take advantage of the Research area at the top of the display to get the one which does.

- If you are content with the form, affirm your option by clicking the Purchase now button. Then, opt for the costs prepare you prefer and offer your accreditations to sign up to have an accounts.

- Process the purchase. Make use of your Visa or Mastercard or PayPal accounts to finish the purchase.

- Choose the structure and obtain the form on your own device.

- Make adjustments. Fill up, revise and print and indicator the acquired District of Columbia Small Business Administration Loan Application Form and Checklist.

Each web template you added to your bank account lacks an expiration date and is also your own forever. So, if you want to obtain or print one more copy, just check out the My Forms section and then click in the type you will need.

Get access to the District of Columbia Small Business Administration Loan Application Form and Checklist with US Legal Forms, by far the most substantial local library of legal file web templates. Use a large number of specialist and express-certain web templates that meet your business or individual needs and demands.

Form popularity

FAQ

A Certified Development Company (CDC) provides up to 40% of the financing through a 504 debenture (guaranteed 100% by the SBA); A third party lender provides 50% or more of the financing; The borrower contributes at least 10% of the financing.

SBA 504 loans have very long terms ? up to 25 years ? and can be used to finance real estate or equipment purchases. They are funded by Certified Development Companies, or CDCs, and financial institutions. You'll need to put at least 10% down.

SBA 504 loan requirements include: Net worth of less than $15 million. Average net income of less than $5 million for the two years prior to the application. You must be financing a major fixed asset purchase, upgrade or other eligible use case.

Understanding the SBA 504 Loan Structure The typical financing structure for a SBA 504 loan is a 50-40-10 partnership. The third-party lender (bank or credit union) will finance 50% of the project; SETEDF/SBA finances 40% and; the borrower provides at least 10% equity injection.

How are SBA 504 effective rates calculated? In a nutshell, SBA 504 interest rates are tied to the bonds that are sold to institutional investors, and the interest rates are typically reflective of 10-year U.S. Treasury bond rates, which are long-term, fixed-rate assets.