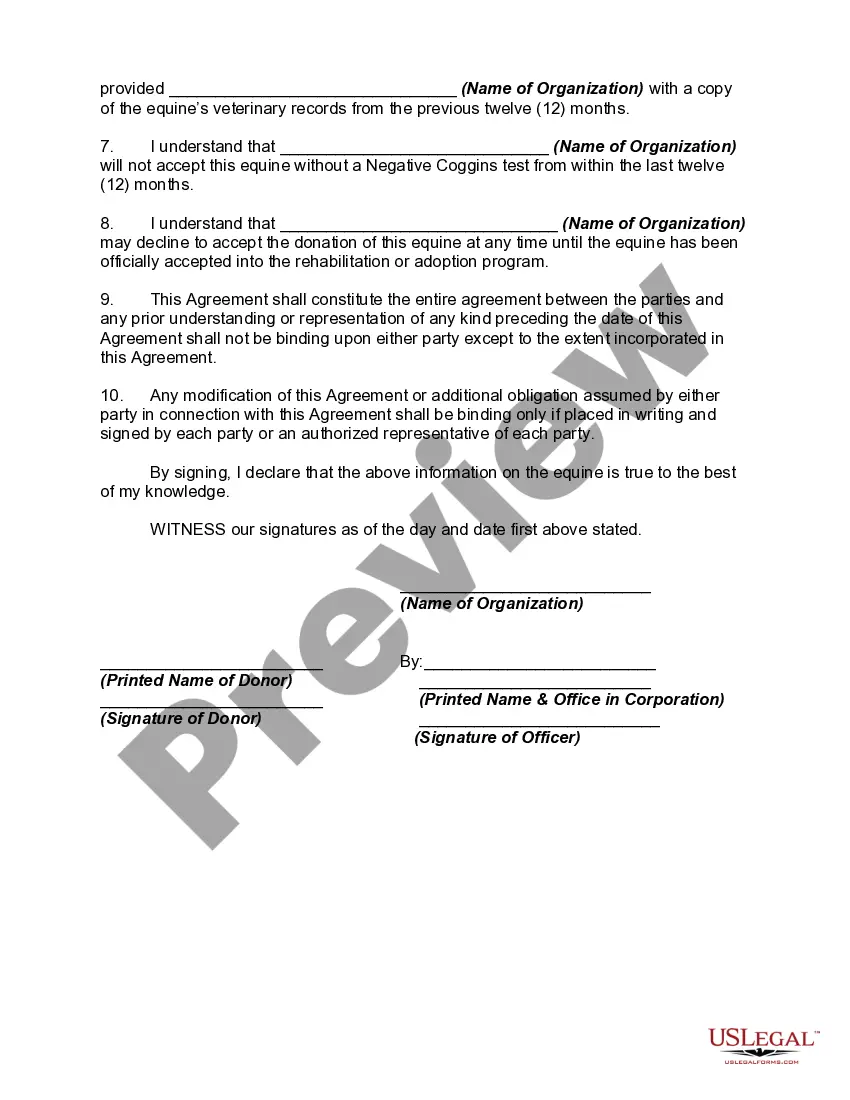

This form is an example of a contract to donate a horse to a rescue or other organization. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

District of Columbia Equine or Horse Donation Contract

Description

How to fill out Equine Or Horse Donation Contract?

Have you ever been in a situation where you require documents for both business or personal reasons virtually all the time.

There are many legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the District of Columbia Equine or Horse Donation Agreement, which are designed to comply with both federal and state regulations.

Once you find the appropriate form, click Purchase now.

Choose the pricing plan you prefer, complete the required information to create your account, and finalize the purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the District of Columbia Equine or Horse Donation Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the necessary form and ensure it is for the correct area/state.

- Use the Preview button to review the form.

- Read the details to make sure you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that fits your needs.

Form popularity

FAQ

For tax purposes, a horse is considered personal property. This classification means that the value of the horse can potentially be deducted when donated to qualified charities. Ensure you have the appropriate documentation, such as a District of Columbia Equine or Horse Donation Contract, to support your claim and help clarify any related tax implications.

Generally, there is no minimum amount needed to qualify for a tax write-off for charitable donations. However, the value of your accepted gift must meet the IRS standards for it to be deductible. Utilizing a District of Columbia Equine or Horse Donation Contract can help substantiate the value of your donation, providing you clear documentation for your tax records.

You absolutely can donate a horse to a charity, provided the charity is equipped to accept such donations. Many organizations focus on animal welfare and are delighted to receive horse donations. It’s best to draft a District of Columbia Equine or Horse Donation Contract, ensuring both you and the charity understand the terms of the donation.

Donating to a horse rescue can typically qualify as a tax write-off. These organizations often meet the criteria set by the IRS for charitable donations. To ensure that your contribution qualifies as a deduction, it's advisable to use a District of Columbia Equine or Horse Donation Contract and retain proper documentation from the rescue organization.

Yes, donating a horse can be tax-deductible if you follow the proper procedures and documentation. To qualify, you should ensure your donation aligns with IRS regulations related to charitable contributions, ideally utilizing a District of Columbia Equine or Horse Donation Contract. Consulting a tax advisor can help clarify these details and ensure you receive the maximum benefit for your generosity.

To donate a horse to UC Davis, you can start by contacting their Veterinary Teaching Hospital. They accept donations through a simple process that includes filling out a donation form and possibly setting up a District of Columbia Equine or Horse Donation Contract. It’s essential to ensure that you provide all necessary details about the horse, including its medical history and condition, to facilitate the process.

Writing a donation agreement involves several key elements to ensure clarity and legality. Begin by specifying the parties involved, describe the donation—like in a District of Columbia Equine or Horse Donation Contract—and define the purpose of the donation. For a comprehensive solution, consider using the US Legal Forms platform, which provides templates and guidance to create an effective and legally sound donation agreement.

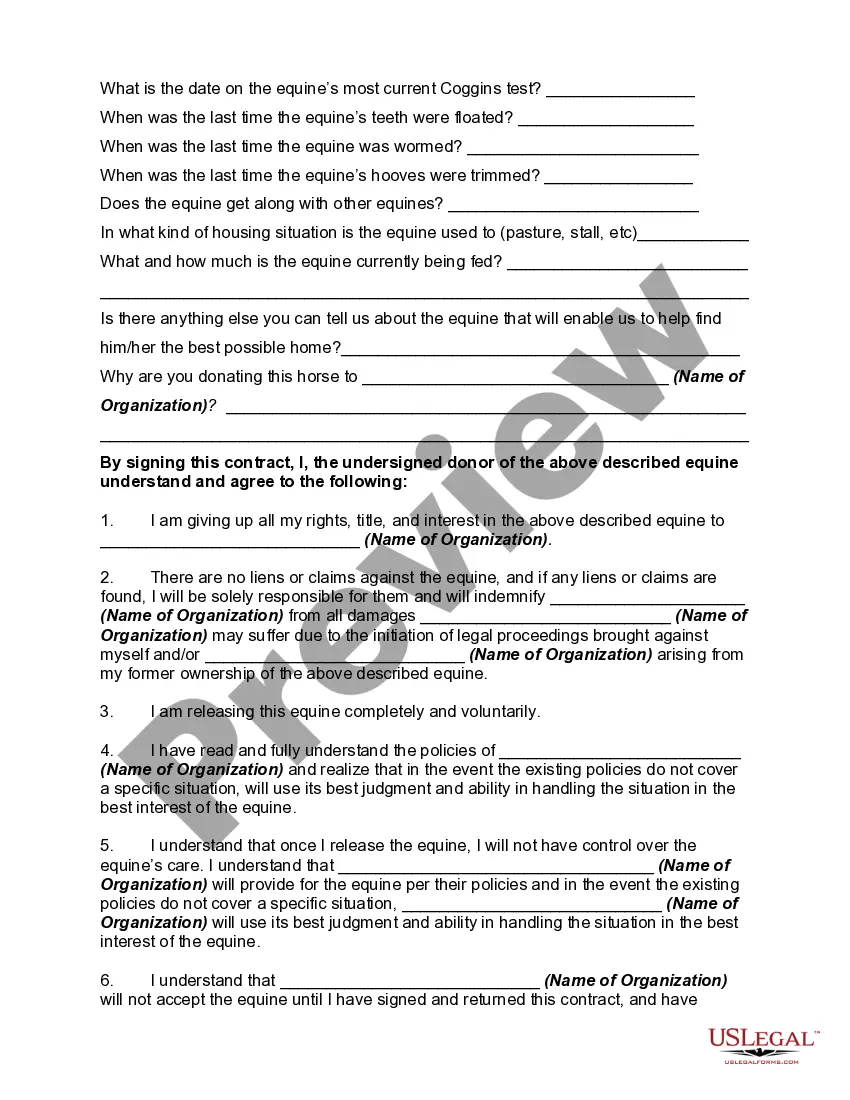

A donation contract is a legal agreement that establishes the terms under which a donation is made. In the case of a District of Columbia Equine or Horse Donation Contract, this document particularly addresses the donation process of horses, including their transfer of ownership and intended use. By clearly outlining these terms, donors and charities can avoid potential misunderstandings.

Yes, donations can be legally binding when they meet specific requirements. A properly drafted District of Columbia Equine or Horse Donation Contract solidifies the donor's intention and the recipient's acceptance, making it enforceable by law. This legal standing ensures that donors can trust their contributions will be honored as per the terms set in the contract.

A formal agreement to make donations to charity is a structured document that specifies the intentions and responsibilities of the parties involved. In a District of Columbia Equine or Horse Donation Contract, it clearly defines what is being donated and the purpose of the donation. Such agreements help safeguard both donors and charities, ensuring that contributions are used as intended.