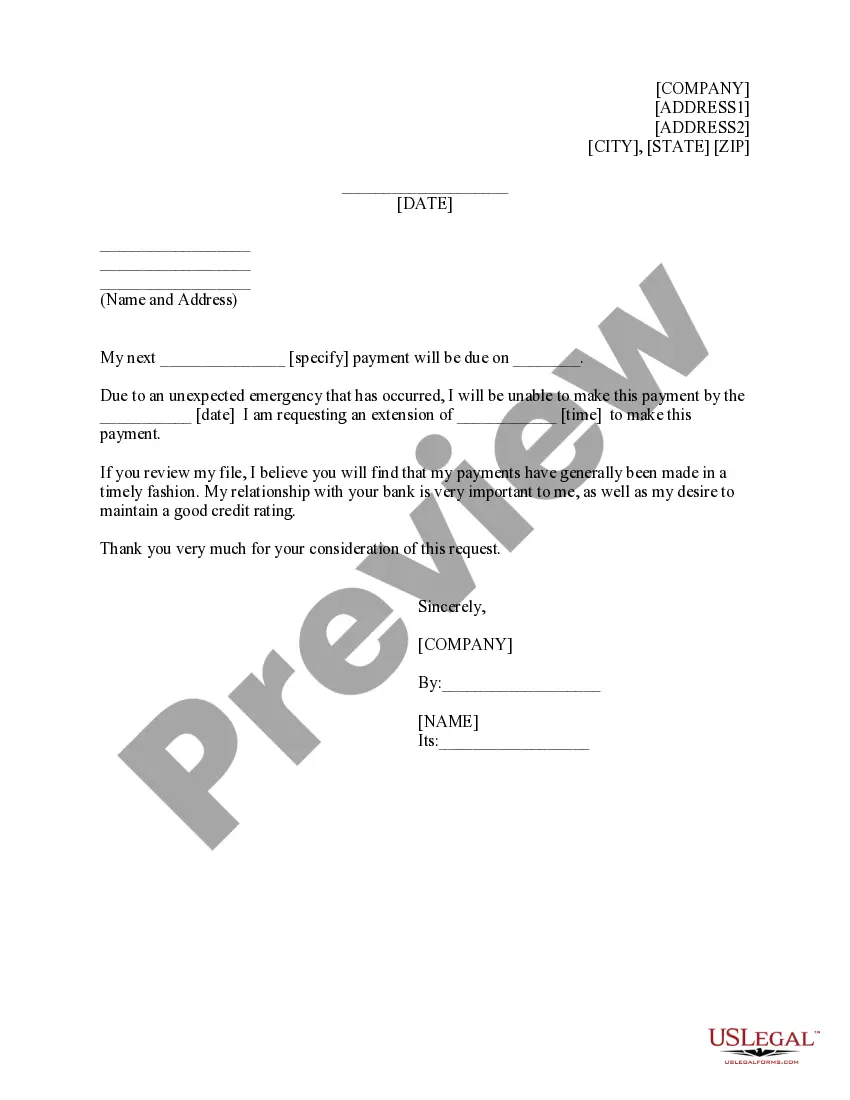

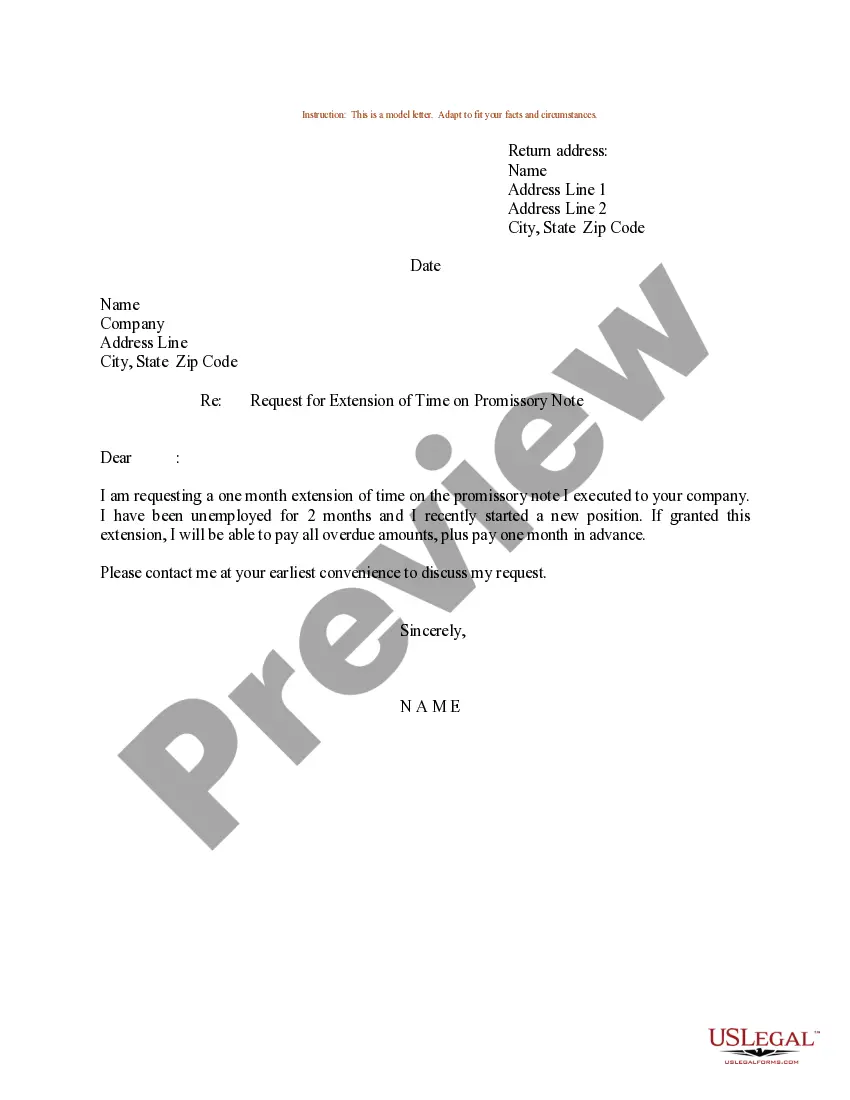

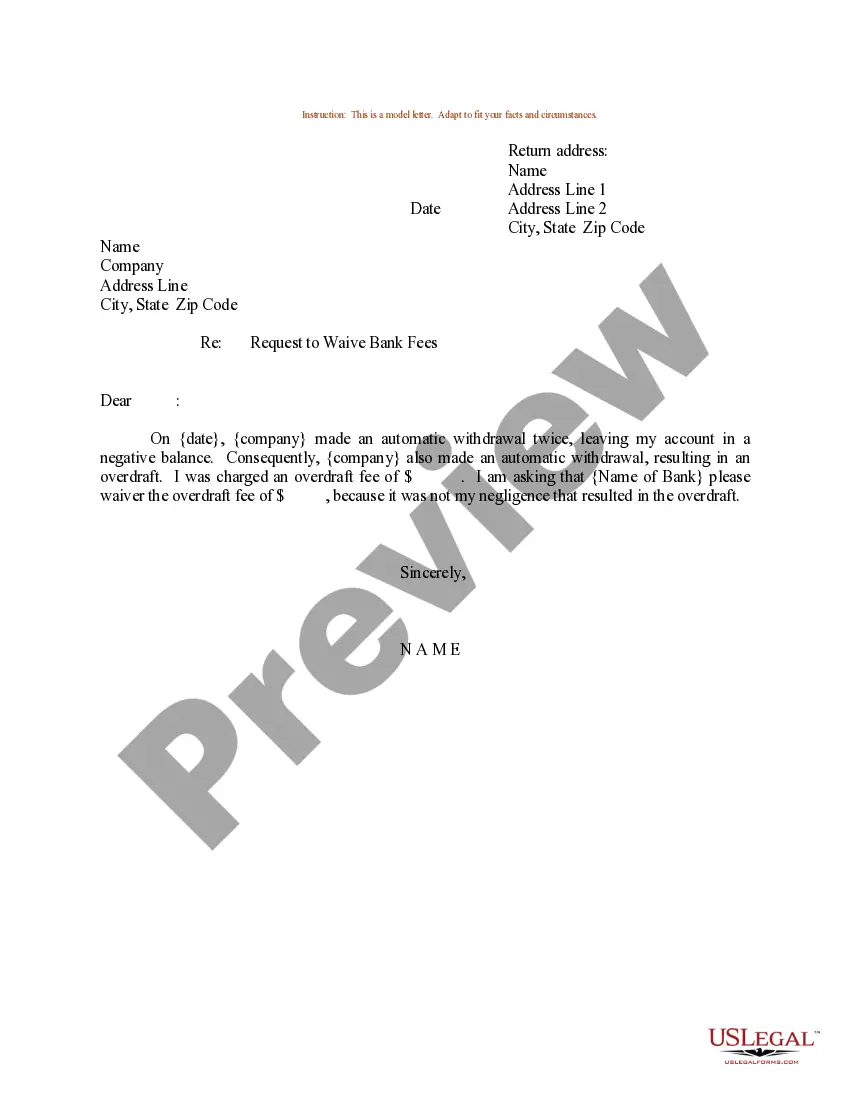

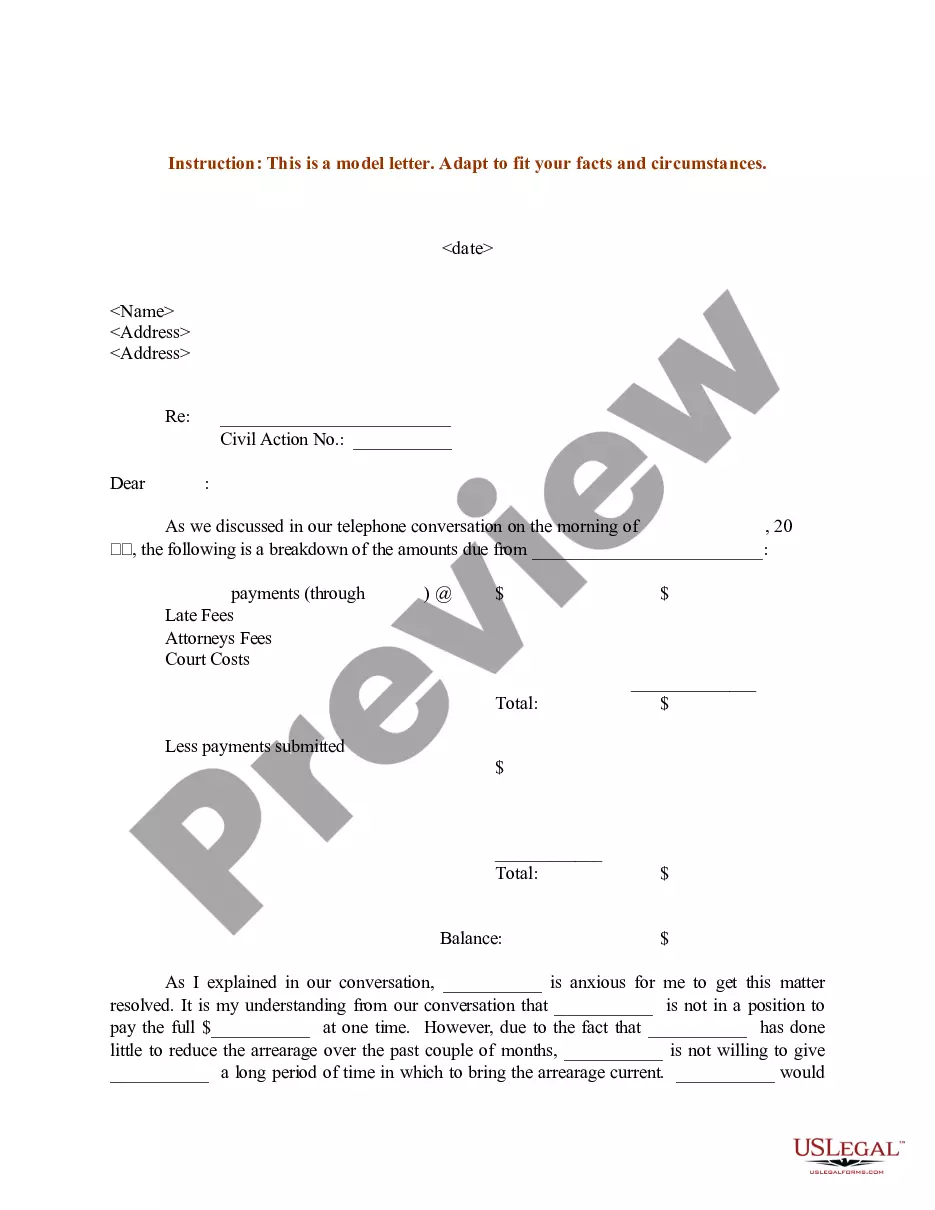

District of Columbia Sample Letter for Request to Bank for Extension of Time

Description

How to fill out Sample Letter For Request To Bank For Extension Of Time?

You might spend hours online searching for the valid document template that satisfies the state and federal requirements you need.

US Legal Forms offers a vast array of valid forms that are reviewed by professionals.

It is easy to download or print the District of Columbia Sample Letter for Request to Bank for Extension of Time from our service.

If available, use the Preview button to browse the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the District of Columbia Sample Letter for Request to Bank for Extension of Time.

- Every legal document template you buy is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town of your choice.

- Review the form details to confirm you have chosen the appropriate form.

Form popularity

FAQ

The corporate tax extension deadline for 2025 typically aligns with the standard federal tax extension dates. Corporations can usually request a six-month extension to file their taxes, but must check for any specific DC deadlines. To navigate this efficiently, utilizing the District of Columbia Sample Letter for Request to Bank for Extension of Time can simplify your filing process and ensure compliance with local regulations.

The 183 day rule in DC relates to tax residency and the determination of whether an individual is taxed as a resident. If you spend more than 183 days in the District during the year, you may be subject to local income taxes. This rule can affect your overall tax strategy, including filing extensions. For clarity, consider employing the District of Columbia Sample Letter for Request to Bank for Extension of Time when communicating your tax status.

Business tax extension deadlines vary, but generally fall on the same date as the original tax filing deadline. Businesses must submit their extension requests by this deadline to avoid penalties. For example, using the District of Columbia Sample Letter for Request to Bank for Extension of Time can help ensure your request is properly documented and submitted in a timely manner.

The 4868 extension allows individual taxpayers to request additional time to file their federal tax returns. This extension typically grants an extra six months to file but does not postpone tax payments. If you are also filing in DC, consider using the District of Columbia Sample Letter for Request to Bank for Extension of Time to streamline your filing process for local taxes. It’s an effective way to manage your tax deadlines.

To close a DC withholding account, you must submit a request to the Office of Tax and Revenue. Be sure to include your tax identification number and any final payments due. Using the District of Columbia Sample Letter for Request to Bank for Extension of Time can help format your request appropriately. This ensures that your account is closed without any outstanding obligations.

The FR 120 sub extension allows corporations in DC additional time to file their franchise tax return. This extension is particularly useful for businesses needing extra time to gather financial documents. To request this extension, you may use the District of Columbia Sample Letter for Request to Bank for Extension of Time. Remember, this extension does not apply to tax payments due.

Yes, the District of Columbia accepts federal extensions for corporations. When you file a federal extension, it automatically applies to your DC corporate taxes. However, you should still complete the necessary forms specific to DC to ensure proper processing. Using the District of Columbia Sample Letter for Request to Bank for Extension of Time can simplify your communication with both federal and local authorities.

Filing an extension in the District of Columbia involves submitting a request to the Office of Tax and Revenue. You can use the District of Columbia Sample Letter for Request to Bank for Extension of Time to formalize your request. Ensure you provide all necessary information, including your tax identification number and the reason for the extension. Completing this process on time helps you avoid late penalties.

You should mail your DC tax return to the Office of Tax and Revenue at their designated address, which you can find on the tax form or their website. Be sure to send it to the correct location based on the form type you are submitting. If you find yourself needing an extension or assistance, a helpful tool is the District of Columbia Sample Letter for Request to Bank for Extension of Time.

You can check if you owe DC taxes by visiting the District of Columbia's Office of Tax and Revenue website. They provide online tools that allow you to access your tax account information. Additionally, you can contact their office directly for assistance. If you need more time or clarity in your correspondence, consider using a District of Columbia Sample Letter for Request to Bank for Extension of Time.