The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

District of Columbia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities

Description

How to fill out Debtor's Affidavit Of Financial Status To Induce Creditor To Compromise Or Write Off The Debt Which Is Past Due - Assets And Liabilities?

Are you currently in a situation where you need documents for various business or specific purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms provides a vast array of form templates, such as the District of Columbia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write Off the Past Due Debt - Assets and Liabilities, which can be utilized to meet state and federal requirements.

Find all the document templates you have purchased in the My documents list.

You can download an additional copy of the District of Columbia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write Off the Past Due Debt - Assets and Liabilities at any time if needed. Just click the desired form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the District of Columbia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write Off the Past Due Debt - Assets and Liabilities template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/state.

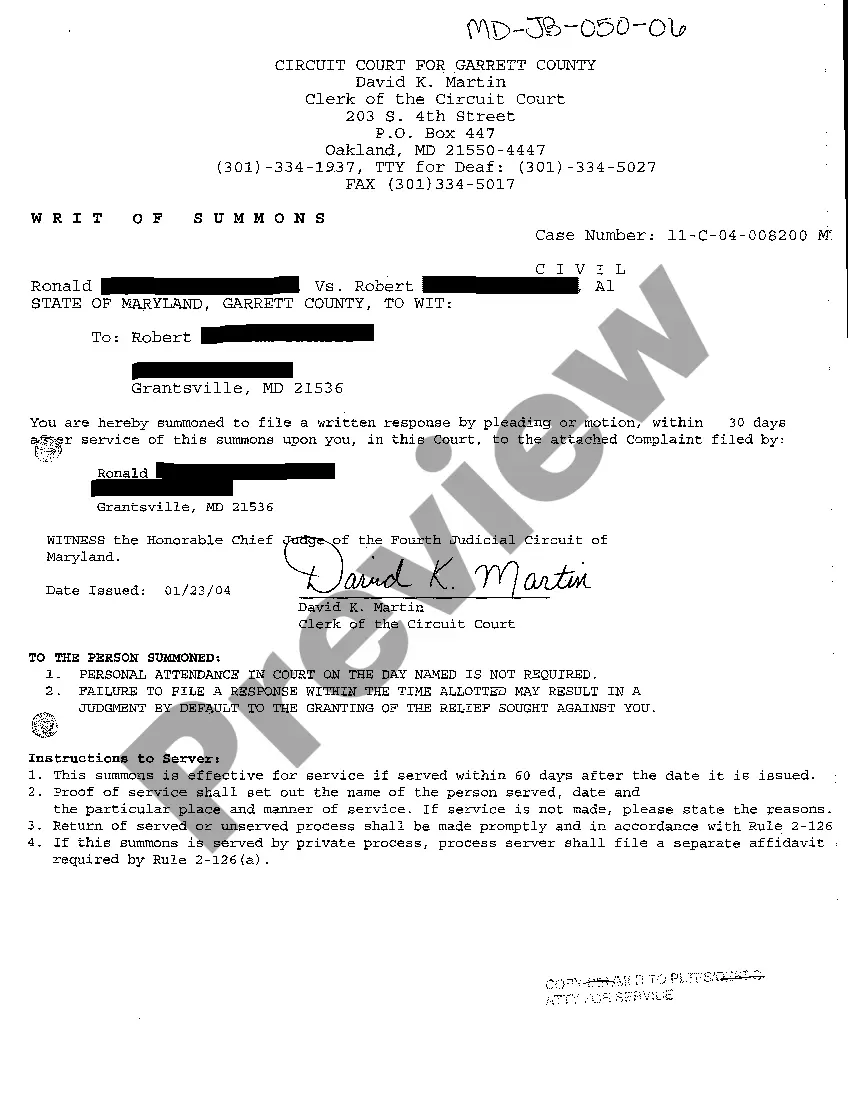

- Use the Preview button to review the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that suits you and your needs.

- Once you locate the appropriate form, click Purchase now.

- Choose the pricing plan you want, complete the necessary information to create your account, and process the payment using your PayPal, Visa, or Mastercard.

- Select a convenient file format and download your copy.

Form popularity

FAQ

It sounds like your refund was offset by the Bureau of Fiscal Services for a debt you owed--either back taxes, child support or delinquent student loans. The IRS will send you a letter of explanation in several weeks.

3 Ways To Remove Charge-Offs From Your Credit ReportNegotiate A Pay for Delete & Pay The Creditor To Delete The Charge-Off.Use The Advanced Method To Dispute The Charge-Off.Have A Professional Remove The Charge-Off.

The actions to be taken by an agency to collect the debt, such as adding interest and late charges, offset or garnishment, foreclosure of collateral property, and credit bureau reporting.

The Bureau of the Fiscal Service (BFS), which is part of the Treasury Department, initiates refund offsets to outstanding federal agency debts or child support, state income tax obligations and unemployment compensation debts.

While a charge-off means that your creditor has reported your debt as a loss, it doesn't mean you're off the hook. You should pay charged-off accounts as well as you can. "The debt is still the consumer's legal responsibility, even if the creditor has stopped trying to collect on it directly," says Tayne.

When debts are written off, they are removed as assets from the balance sheet because the company does not expect to recover payment. In contrast, when a bad debt is written down, some of the bad debt value remains as an asset because the company expects to recover it.

Charge-offs tend to be worse than collections from a credit repair standpoint for one simple reason. You generally have far less negotiating power when it comes to getting them removed. A charge-off occurs when you fail to make the payments on a debt for a prolonged amount of time and the creditor gives up.

A charged off or written off debt is a debt that has become seriously delinquent, and the lender has given up on being paid.

The Bureau of the Fiscal Service in the Department of the Treasury collects overdue (delinquent) nontax debt for other federal agencies. If you owe money to a federal agency and you did not pay it on time, you have a delinquent debt. You will receive a letter first from the agency to whom you owe the debt.

Most creditors are able to consider writing off their debt when they are convinced that your situation means that pursuing the debt is unlikely to be successful, especially if the amount is small.