An A-B trust is a revocable living trust which divides into two trusts upon the death of the first spouse. This type of trust makes use of both the estate tax exemption ($3.5 million per person in 2009) and the marital deduction to make it so that no estate taxes are due upon the death of the first spouse. The B Trust is also known as the Bypass trust and it contains the amount of that years applicable exclusion amount. The A trust is the marital deduction trust which will typically contain both the surviving spouse's separate property and one half community property interests but also the residue of the deceased spouse's estate after the estate tax exemption has been utilized by the B trust. The use of an A-B trust ensures that both spouse's applicable exclusion amounts are effectively used, thereby doubling the amount of property which can pass to heirs free of Federal Estate Taxes.

District of Columbia Marital Deduction Trust - Trust A and Bypass Trust B

Description

How to fill out Marital Deduction Trust - Trust A And Bypass Trust B?

Selecting the most suitable legitimate file template could be a challenge.

Certainly, there are numerous designs available online, but how do you find the authentic type you require.

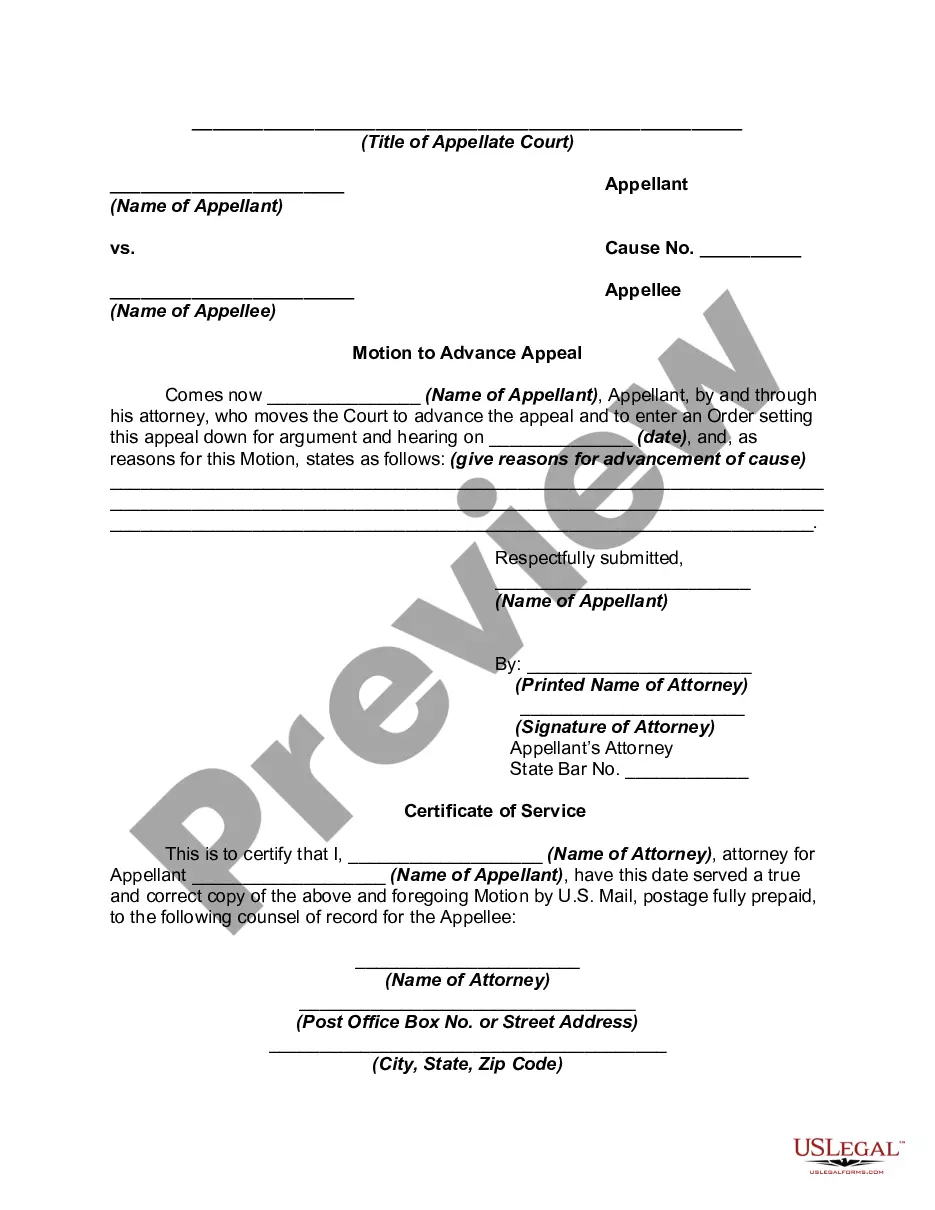

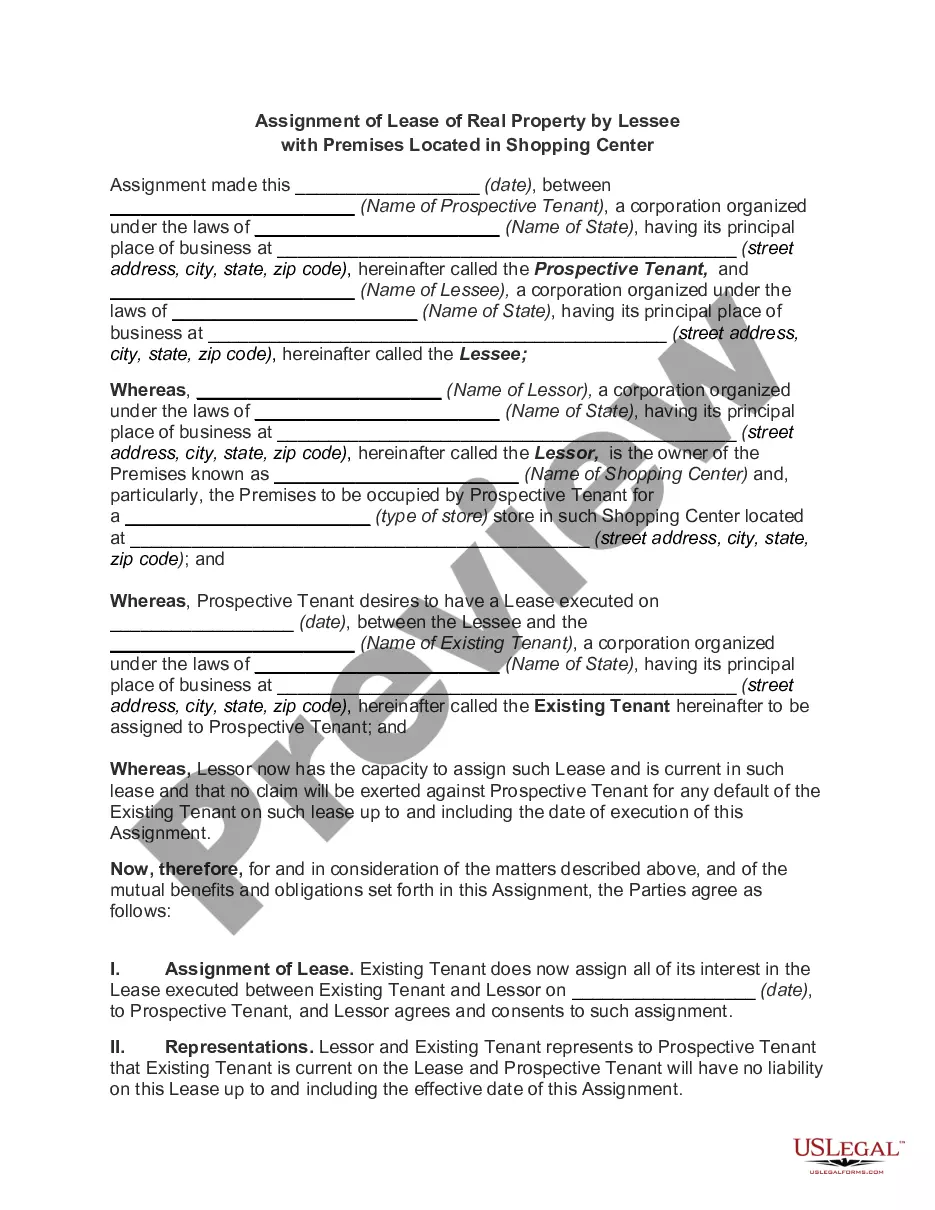

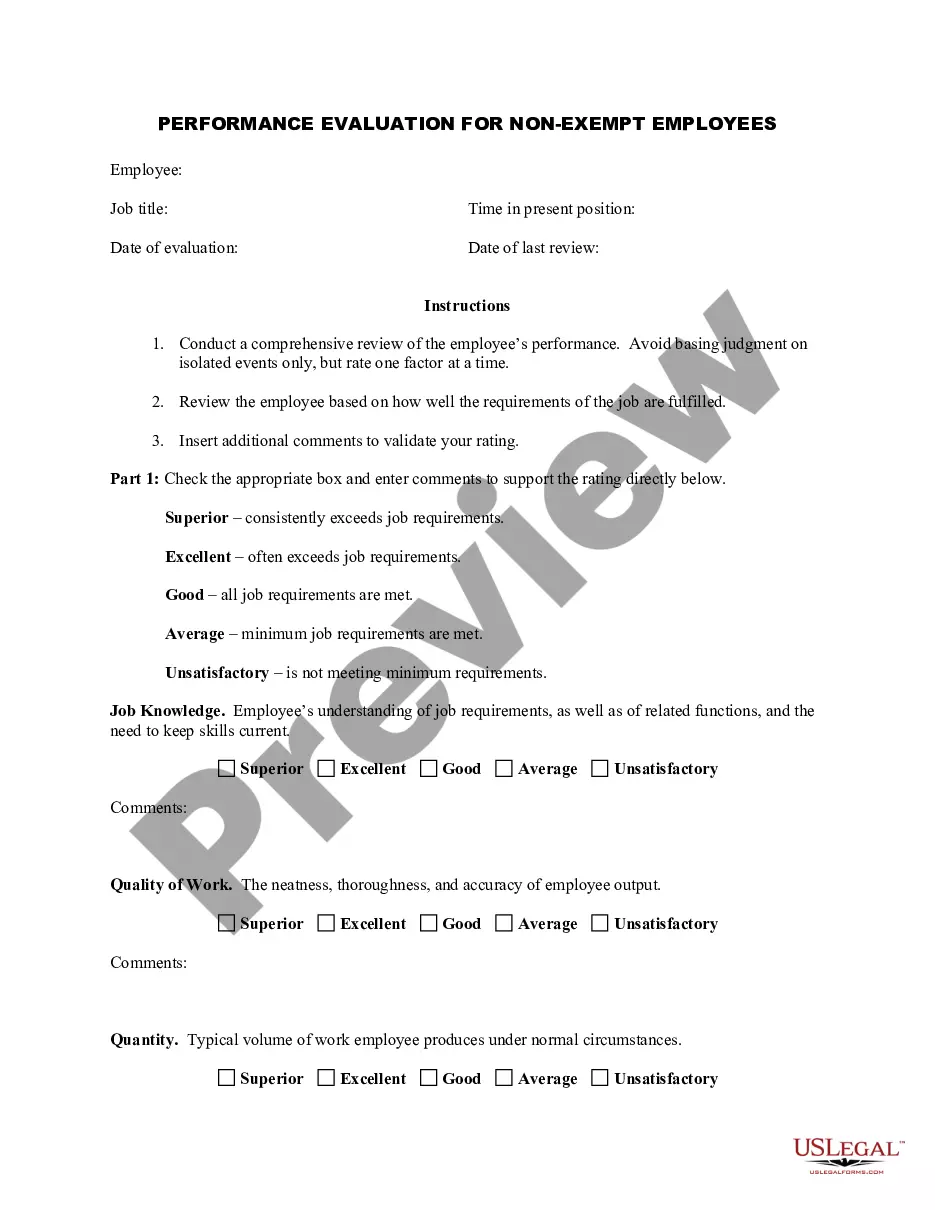

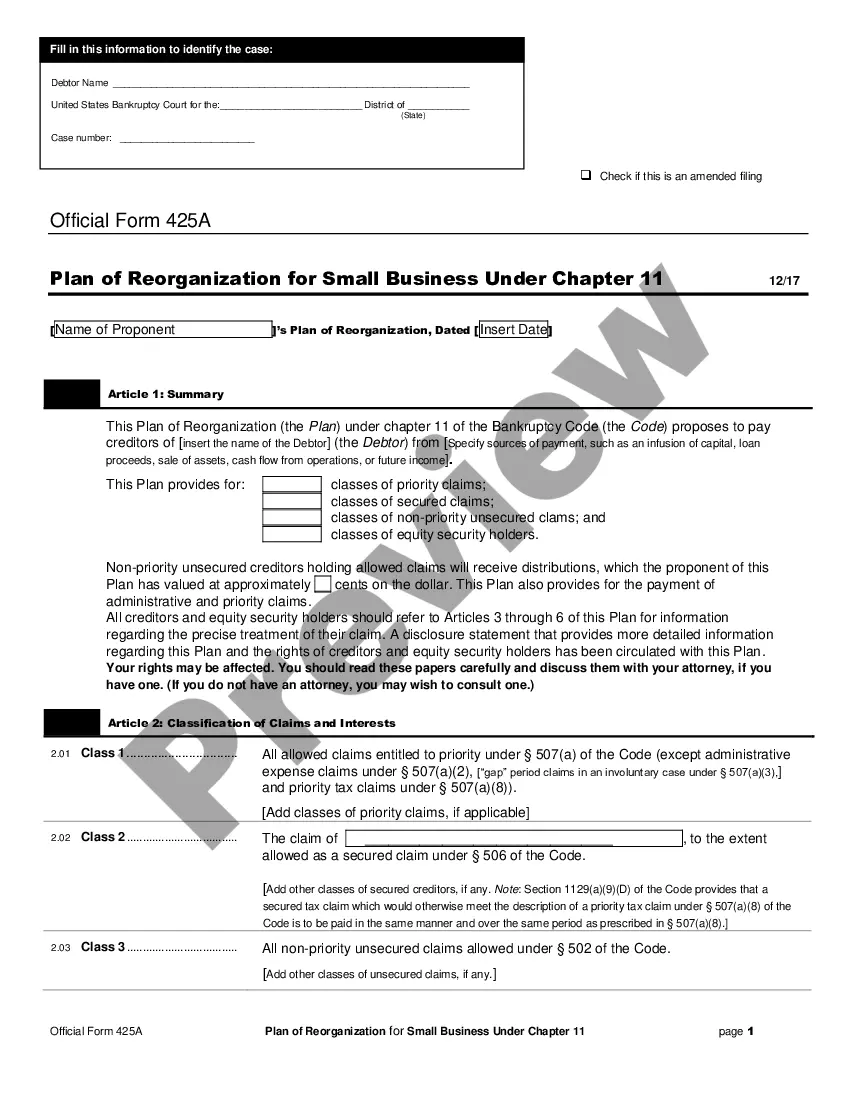

Utilize the US Legal Forms website. The service provides a vast collection of templates, such as the District of Columbia Marital Deduction Trust - Trust A and Bypass Trust B, which you can utilize for business and personal needs.

If the form does not meet your requirements, utilize the Search field to find the right form. When you are confident the form is suitable, click on the Buy now button to acquire the form. Select the pricing plan you prefer and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Choose the file format and download the legitimate document template for your system. Complete, modify, and print as well as sign the obtained District of Columbia Marital Deduction Trust - Trust A and Bypass Trust B. US Legal Forms is the premier repository of legitimate templates where you can discover various document formats. Utilize the service to acquire professionally crafted documents that adhere to state specifications.

- Every document is reviewed by professionals and complies with federal and state regulations.

- If you are already registered, sign in to your account and then click the Acquire button to obtain the District of Columbia Marital Deduction Trust - Trust A and Bypass Trust B.

- Use your account to explore the legitimate templates you have previously acquired.

- Navigate to the My documents section of your account and acquire another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

- First, ensure you have chosen the correct form for your locale. You can review the form using the Preview button and examine the form details to confirm it is the appropriate one for you.

Form popularity

FAQ

No, a bypass trust and a marital trust serve different purposes. While a marital trust refers to the District of Columbia Marital Deduction Trust - Trust A designed to benefit the surviving spouse, a bypass trust typically aims to minimize estate taxes for the heirs. Understanding the differences between these types of trusts will help you make informed decisions regarding your estate planning.

Yes, a bypass trust, often called a credit shelter trust, is required to file its own tax return in most cases. This is important for individuals who utilize the District of Columbia Marital Deduction Trust - Trust B, as the income generated by the trust may be taxable. It's essential to maintain proper records and seek guidance from a tax professional to ensure compliance with tax regulations and avoid potential penalties.

Bypass trusts, integral to the District of Columbia Marital Deduction Trust - Trust B, may not provide necessary income for the surviving spouse, since assets are not directly available to them. This separation can sometimes lead to liquidity issues, especially if the bypass trust is not adequately funded. Furthermore, these trusts require careful administration and can incur higher fees, making it crucial to evaluate your specific circumstances before opting for this option.

A marital trust, often referred to in the context of the District of Columbia Marital Deduction Trust - Trust A, can have certain drawbacks. First, it typically does not allow for asset protection from creditors during the surviving spouse's lifetime. Additionally, if the trust is not structured properly, it may lead to unintended tax consequences or loss of flexibility in distributing assets. Understanding these drawbacks is essential for anyone considering this type of trust.

A Bypass Trust can be complex to establish and may require careful ongoing management and legal oversight. Additionally, once the trust is established, the trust assets cannot be altered easily, limiting flexibility. While the benefits of the District of Columbia Marital Deduction Trust - Trust A and Bypass Trust B are notable in minimizing estate taxes, it is important to consider whether this fixed structure aligns with your family's dynamic and long-term financial goals.

A marital deduction trust allows a surviving spouse to receive benefits during their lifetime, specifically designed to postpone estate taxes until their death. In contrast, a Bypass Trust, or Trust B, ensures assets pass directly to other beneficiaries, thereby avoiding taxes in the deceased spouse’s estate. The District of Columbia Marital Deduction Trust - Trust A and Bypass Trust B framework clearly distinguishes these approaches, offering options tailored to different estate planning needs.

One downside of an AB trust is the complexity it introduces to estate planning, which can require considerable time and resources to manage effectively. Maintaining two separate trusts can also lead to additional administrative costs and potential tax implications. While the District of Columbia Marital Deduction Trust - Trust A and Bypass Trust B offer significant advantages, weighing these factors can help you make an informed decision about your estate plan.

A trust is a general arrangement where one party holds assets for the benefit of another, whereas a B trust specifically refers to the Bypass Trust B, which is a type of irrevocable trust created to benefit other beneficiaries, such as children, while minimizing estate taxes. While the district rules allow for various trusts, the District of Columbia Marital Deduction Trust - Trust A and Bypass Trust B specifically provide strategies aimed at protecting wealth from estate taxes through careful planning.

The primary purpose of an A/B trust is to provide tax benefits to married couples while ensuring that assets are distributed according to their wishes. This type of trust separates the assets into two parts: Trust A for the surviving spouse and Trust B, or Bypass Trust B, for other beneficiaries. This structure aims to maximize the marital deduction benefits, especially under the District of Columbia Marital Deduction Trust - Trust A and Bypass Trust B framework, ensuring your estate plan serves your long-term goals.

A QTIP trust, or Qualified Terminable Interest Property trust, allows the surviving spouse to receive income from the trust during their lifetime, while ultimately directing the remaining assets to other beneficiaries after their death. In contrast, the Bypass Trust B is designed to avoid estate taxes by passing assets to beneficiaries, such as children, without being included in the surviving spouse's estate. Understanding the intricacies of the District of Columbia Marital Deduction Trust - Trust A and Bypass Trust B can help you choose the right strategy.