This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

District of Columbia General Form of Agreement for Sale of Business by Sole Proprietor - Asset Purchase Agreement

Description

How to fill out General Form Of Agreement For Sale Of Business By Sole Proprietor - Asset Purchase Agreement?

Are you in a circumstance where you require documentation for both organizational or personal purposes nearly all the time.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, including the District of Columbia General Form of Agreement for Sale of Business by Sole Proprietor - Asset Purchase Agreement, designed to comply with state and federal regulations.

Choose a pricing plan, provide the required information to create your account, and complete your purchase using PayPal or a credit card.

Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can download an additional copy of the District of Columbia General Form of Agreement for Sale of Business by Sole Proprietor - Asset Purchase Agreement at any time by clicking the relevant form to download or print the template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the District of Columbia General Form of Agreement for Sale of Business by Sole Proprietor - Asset Purchase Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and verify that it is for the correct city/county.

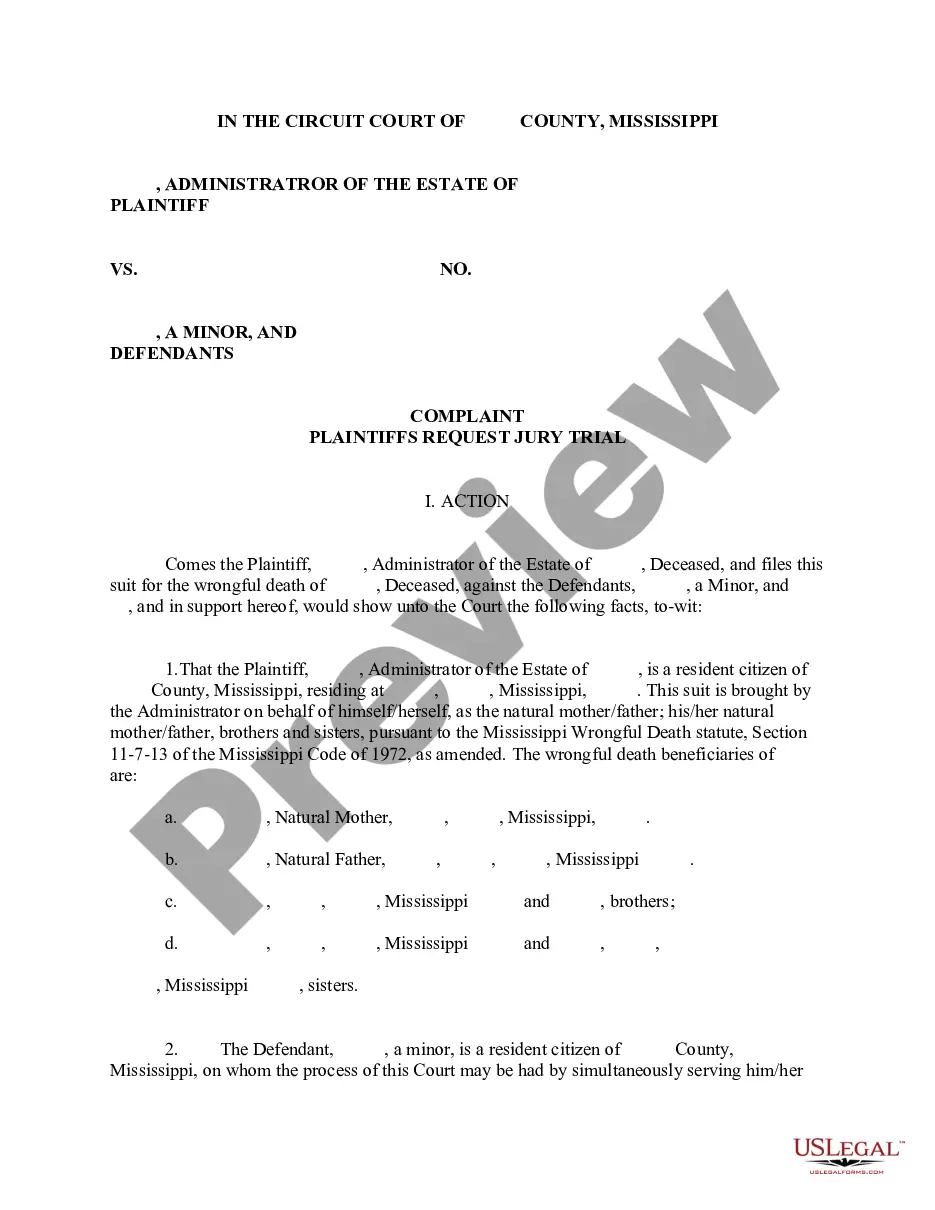

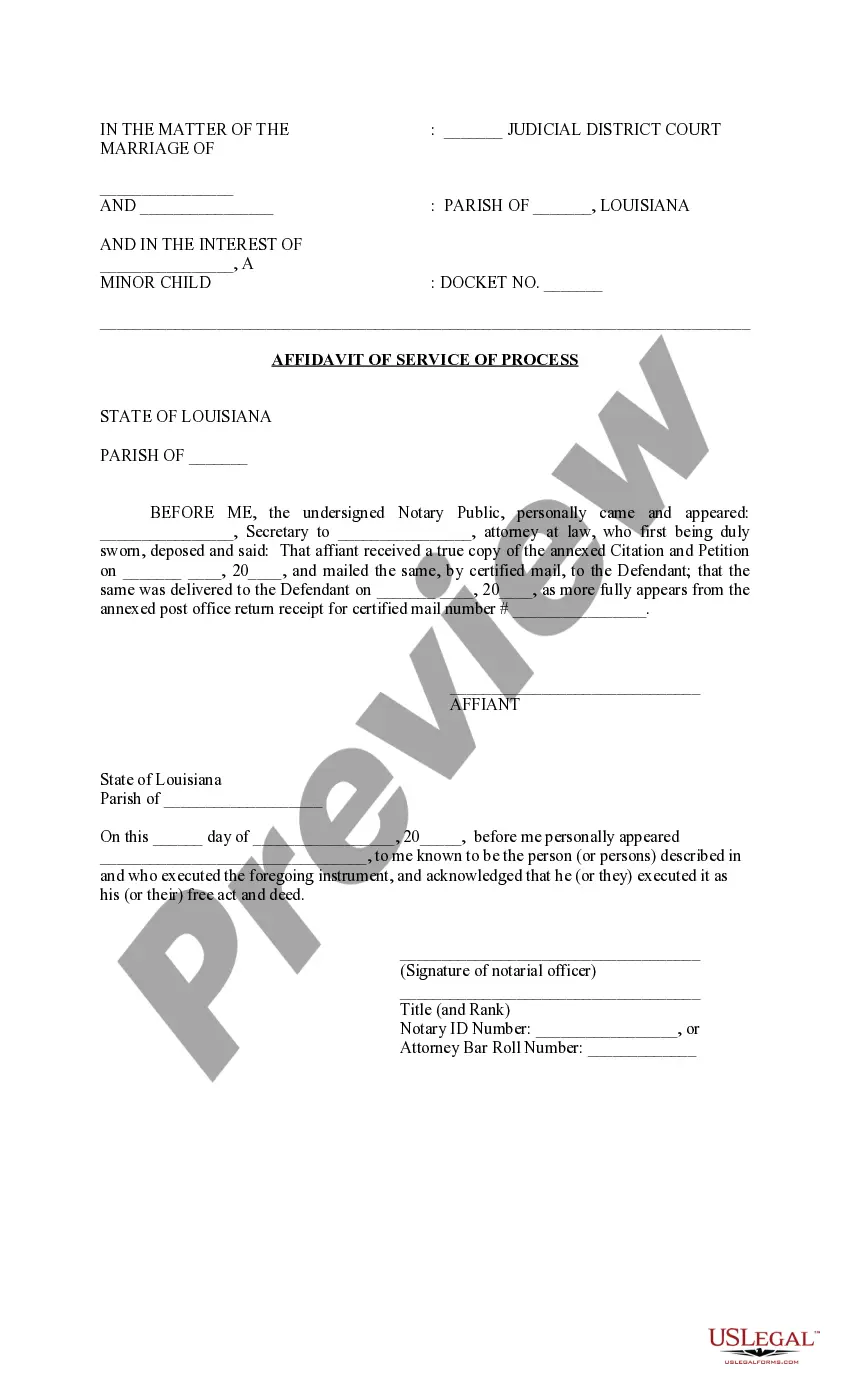

- Utilize the Preview button to view the document.

- Review the information to ensure you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that suits your needs.

- Once you find the appropriate form, click Get now.

Form popularity

FAQ

Relevant legal documents include:confidentiality agreements;heads of agreements;sale of business agreements; and.non-compete agreements.

What to include in a business sales contract.Name the parties. Clearly state the names and locations of the buyer and seller.List the assets.Define liabilities.Set sale terms.Include other agreements.Make your sales agreement digital.

Legal Documents Needed to Sell a BusinessNon-Disclosure Confidentiality Agreement.Personal Financial Statement Form for Buyer to Complete.Offer-to-Purchase Agreement.Note of Seller Financing.Financial Statements for Current and Past Two to Three Years.Statement of Seller's Discretionary Earnings and Cash Flow.More items...

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

Make selling your small business easy with these seven steps.Determine the value of your company.Clean up your small business financials.Prepare your exit strategy in advance.Boost your sales.Find a business broker.Pre-qualify your buyers.Get business contracts in order.03-Jan-2014

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

Legal documentsClient contracts and trading agreements evidence of your business agreements with clients and other parties.Employee contracts and agreements evidence of contracts between you and your staff.Franchise agreement (where applicable) evidence of your franchise agreement.More items...?20-Dec-2021

There are a number of ways to determine the market value of your business.Tally the value of assets. Add up the value of everything the business owns, including all equipment and inventory.Base it on revenue.Use earnings multiples.Do a discounted cash-flow analysis.Go beyond financial formulas.