District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements

Description

How to fill out Farm Lease Or Rental With Right To Make Improvements And Receive Reimbursements?

US Legal Forms - one of the most prominent collections of legal templates in the United States - provides a broad array of legal document samples that you can obtain or print.

By using the website, you can access thousands of templates for business and personal needs, organized by categories, states, or keywords. You can find the latest versions of forms such as the District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements in just moments.

If you already have a monthly membership, Log In to retrieve the District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements from the US Legal Forms database. The Download button will be available on every form you access. You can access all previously saved forms through the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

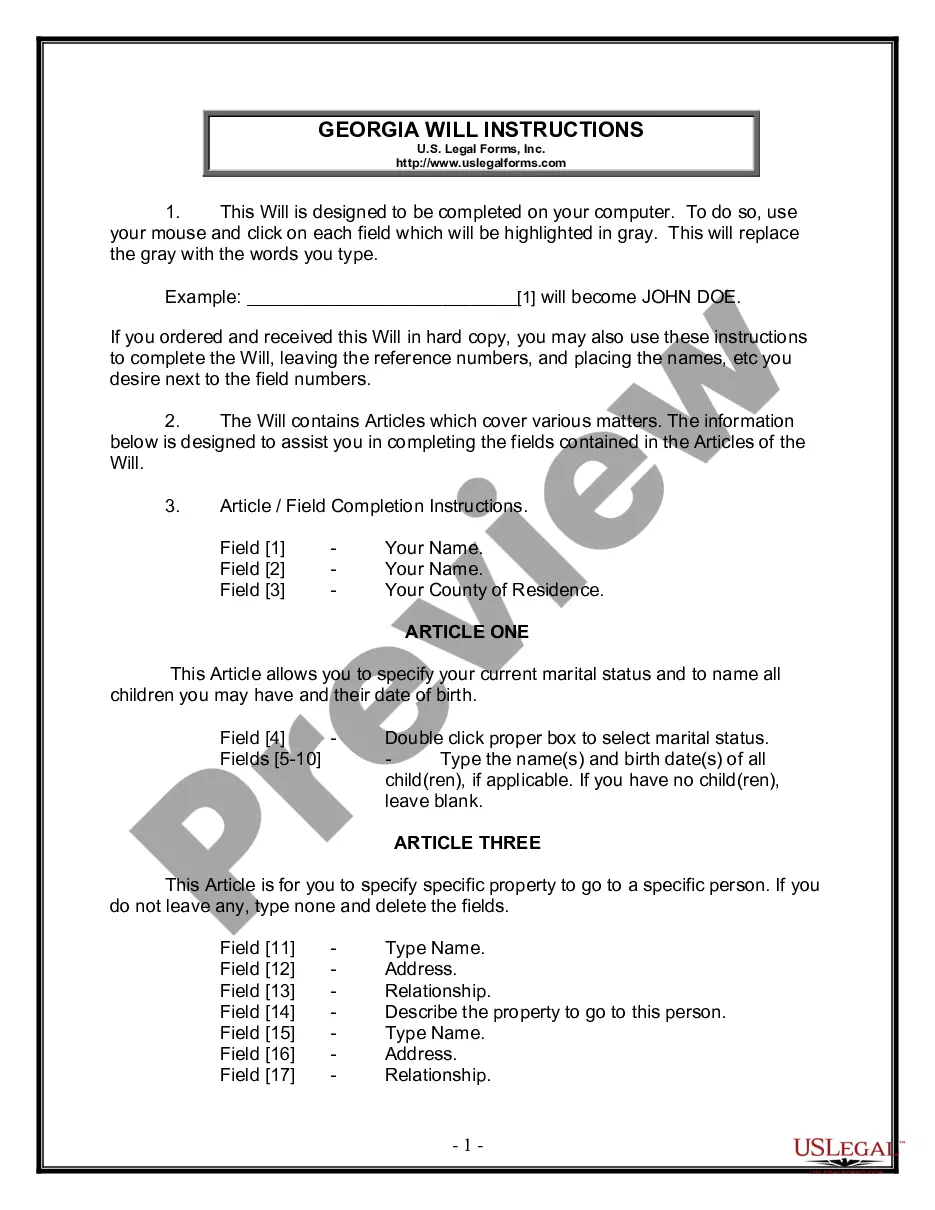

Select the format and download the form to your device. Edit. Complete, adjust, and print the saved District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements. Each template added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements with US Legal Forms, which boasts one of the largest collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- Ensure you have selected the appropriate form for your location/state.

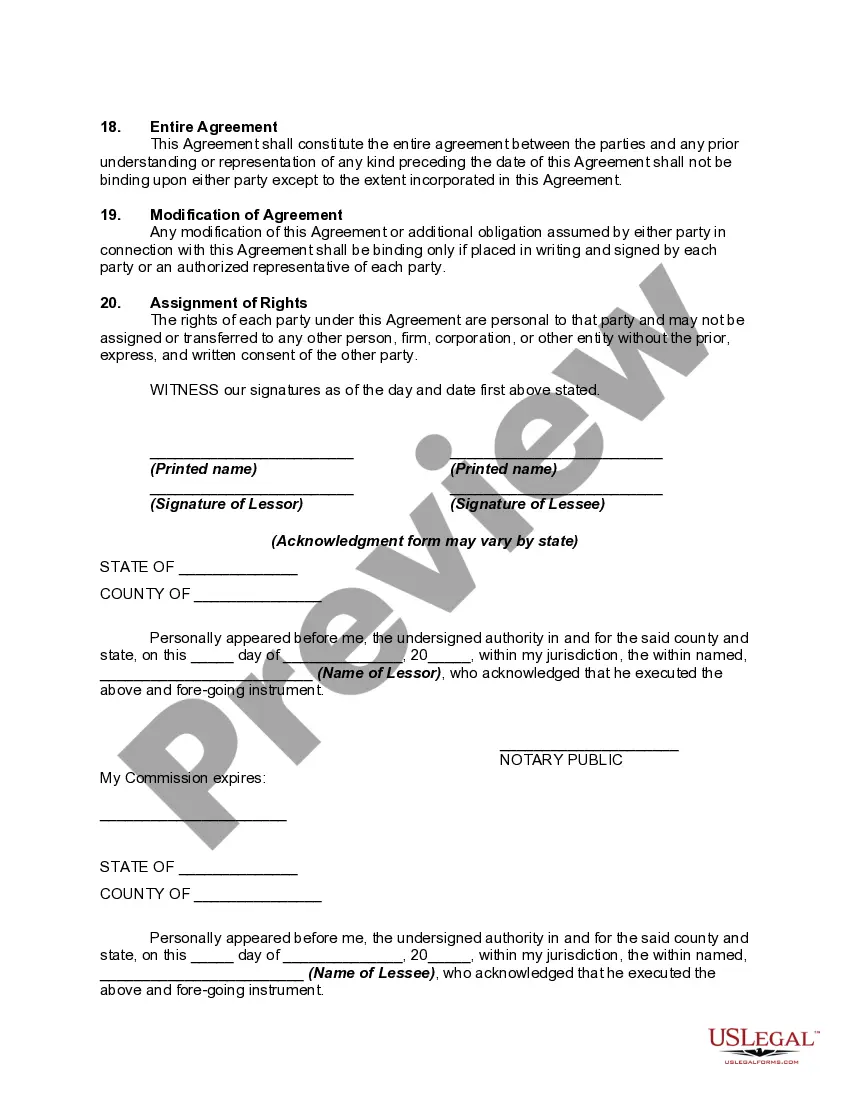

- Click the Review button to examine the contents of the form.

- Check the form details to confirm you have chosen the correct document.

- If the form does not meet your requirements, utilize the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by pressing the Download now button.

- Then, select your preferred payment plan and provide your credentials to create an account.

Form popularity

FAQ

A triple net lease assigns all costs, including property taxes, insurance, and maintenance, directly to the tenant, while an operating lease typically involves the landlord covering these expenses. This distinction is critical for anyone entering into a District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, as it affects financial responsibilities. Understanding these terms can help you choose the best lease structure for your needs. For more clarity on lease types, uslegalforms offers resources tailored to your situation.

Rent abatement in the District of Columbia allows tenants to reduce their rent if their rental unit fails to meet health and safety standards. This adjustment helps maintain quality living conditions and ensures landlords fulfill their obligations. Tenants involved in a District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements might find this provision especially relevant if their property requires maintenance or improvements. Utilizing uslegalforms can assist in understanding and applying for rent abatement.

The Rental Housing Act governs rental agreements in the District of Columbia, covering tenant rights and landlord responsibilities. Specifically, it is codified in D.C. Code § 42-3501.01 et seq. Understanding this code is essential for anyone involved in a District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements. It provides key regulations that ensure fair treatment in rental situations.

Yes, claiming land rent on your taxes is possible, provided it's part of your rental income. When managing a District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, you should include all forms of income and can deduct related expenses. This approach aids in presenting an accurate financial picture to the IRS.

The IRS utilizes various methods to detect unreported rental income, including computer algorithms and data matching technologies. They compare reported income against third-party information, such as bank deposits and property records. Maintaining accurate records for your District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements will safeguard you from potential audits.

Rental income is often considered passive income, though it may not be categorized as non-business income. If you are involved in significant management or operational activities related to your District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, the IRS might see it as business income. Understanding your specific situation is key, as it affects your tax obligations.

Yes, rental income is generally taxable for nonprofits unless specific conditions exempt it. If a nonprofit organization rents property under a District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, it should consult tax regulations to understand its liabilities. Claiming any deductions for associated expenses may help mitigate taxable income.

To claim rental income on your taxes, start by detailing your rental income and expenses on Schedule E of your Form 1040. This process allows you to deduct expenses directly related to your District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, which can lower your taxable income. Be diligent in documenting all relevant expenditures to support your claims.

To report a rental not for profit, you should accurately fill out the necessary tax forms as required by the IRS. Typically, you'll use Form 1040 and include any rental income on Schedule E. If you have a District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, it’s essential to track your expenses to illustrate your lack of profit efficiently.

Leasing farmland can be a wise investment due to the increasing demand for agricultural products and the steady income it generates. Additionally, the structure of a District of Columbia Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements can provide security and add value to your investment. Always consider researching local market trends to make informed decisions.