A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

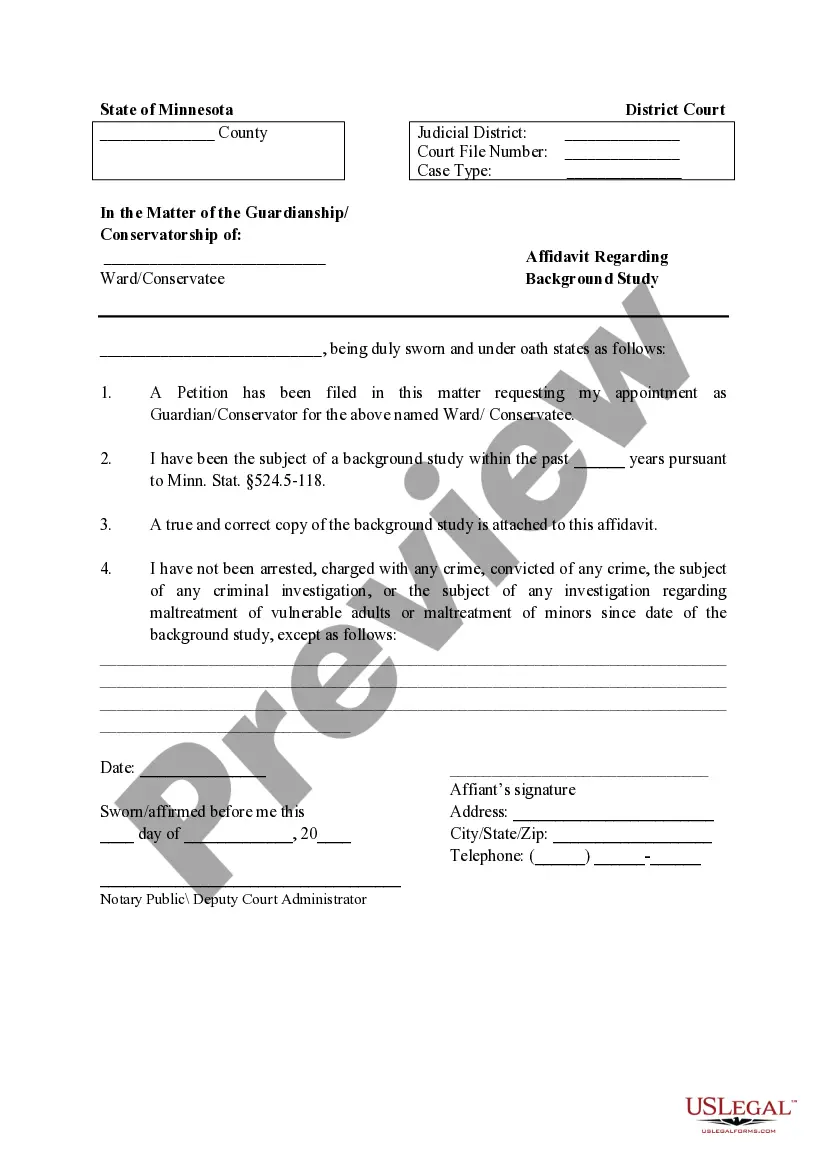

District of Columbia Notice of Default and Election to Sell - Intent To Foreclose

Description

How to fill out Notice Of Default And Election To Sell - Intent To Foreclose?

Selecting the ideal legal document format can be a challenge. Certainly, numerous online templates are accessible, but how do you locate the legal form you need.

Employ the US Legal Forms website. This service offers thousands of templates, such as the District of Columbia Notice of Default and Election to Sell - Intent To Foreclose, that you can utilize for both business and personal purposes.

All the forms are vetted by experts and meet both federal and state regulations.

If the document does not meet your needs, take advantage of the Search field to find the appropriate form. Once you are confident that the form is suitable, click on the Purchase now option to obtain the document. Choose the pricing plan you want and enter the necessary details. Create your account and complete the transaction using your PayPal account or credit card. Select the document format and download the legal file format to your device. Finally, complete, modify, print, and sign the obtained District of Columbia Notice of Default and Election to Sell - Intent To Foreclose. US Legal Forms is the premier collection of legal forms where you can discover various document templates. Use the service to download professionally crafted papers that adhere to state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the District of Columbia Notice of Default and Election to Sell - Intent To Foreclose.

- Use your account to browse the legal forms you have previously obtained.

- Go to the My documents section of your account and request another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure that you have selected the correct form for your jurisdiction/county.

- You can review the document using the Preview option and read the form description to make sure it is suitable for your needs.

Form popularity

FAQ

A letter of intent to foreclose (LIF) is a written notice listing all past due amounts owed on a mortgage and a deadline to pay those amounts. After the deadline has passed, the lender may start the foreclosure process.

Phase 1: Payment Default.Phase 2: Notice of Default.Phase 3: Notice of Trustee's Sale.Phase 4: Trustee's Sale.Phase 5: Real Estate Owned (REO)Phase 6: Eviction.Foreclosure and COVD-19 Relief.The Bottom Line.

Also, you can call the District's Foreclosure Prevention Hotline (202) 265-CALL (2255) and 1(855) 449-CALL (2255) or DISB at (202) 727-8000 for assistance on accessing any of these resources. Don't wait until it's too late make the call!

You don't automatically lose your home if you default A lender will likely not start to foreclose until after two or three months of missed mortgage payments. If you miss a mortgage payment, the lender will usually send a reminder letter.

In the District of Columbia, condominium associations are granted a super-priority lien over first mortgage lienholders, which permits an association to collect up to six months of unpaid assessments upon foreclosure on a condominium unit.

Once you default on your mortgage loan, the lender can demand that you repay the entire outstanding balance, called "accelerating the debt." If you don't repay the full loan amount or cure the default, the lender can foreclose.

Lenders can start a foreclose in one of two ways: 1) judiciallyby filing a complaint in D.C. Superior Court seeking foreclosure, or 2) outside the court systemby issuing a Notice of Default and offering mediation through the D.C. Department of Insurance, Securities, and Banking (DISB) before issuing a notice of

What Is the Foreclosure Process in the District of Columbia? Foreclosures in Washington, D.C. can be judicial (through the court) or nonjudicial (an out-of-court process). In the past, most foreclosures in the District of Columbia were nonjudicial.

While some lenders use notices of default as the final step before foreclosure, others use it as a way to work with borrowers to bring the mortgage up to date. A notice of default and subsequent foreclosure actions are documented and reported to credit bureaus.

When a borrower repays the entire outstanding loan amount in one payment rather than in EMIs, they need to write a letter for the foreclosure of the loan, which is known as the foreclosure letter.