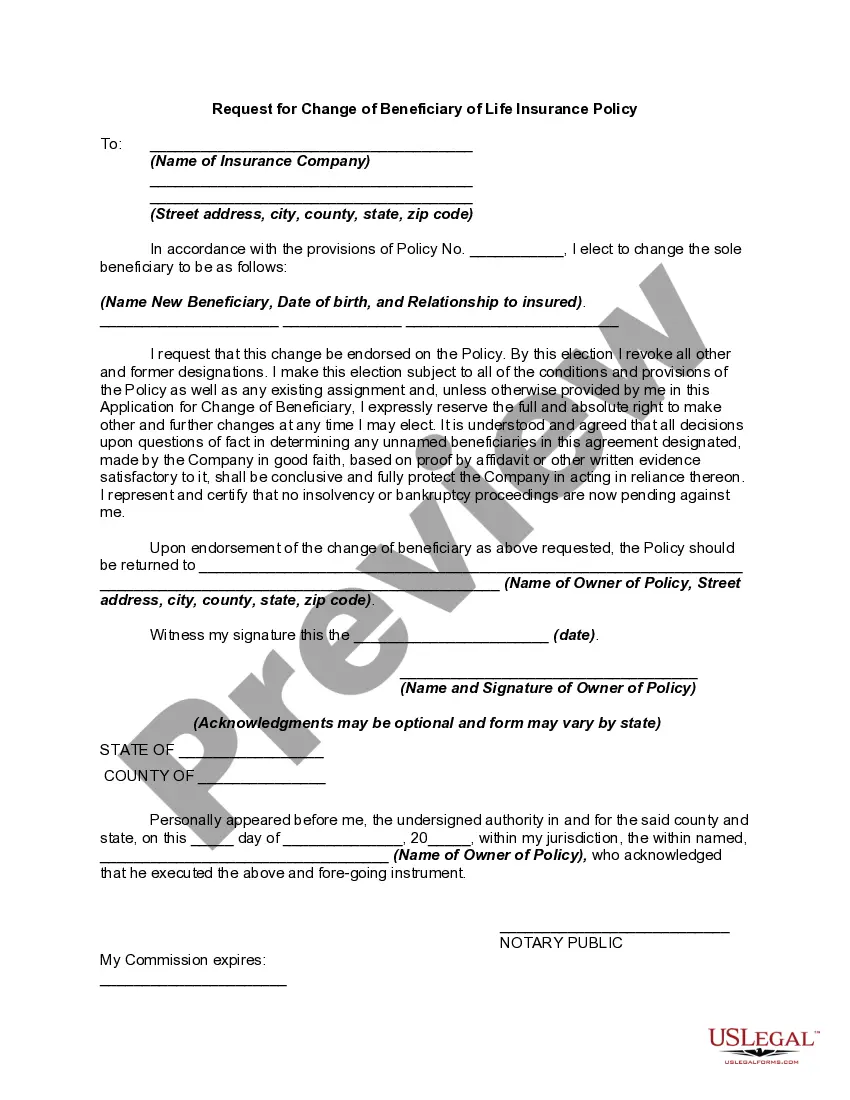

If the method of changing beneficiaries in insurance policies is prescribed by statute or by the policy itself, the required formalities must be observed. If the beneficiary has a vested right in the policy or if the policy does not reserve the right of the insured to change the beneficiary, the consent of the beneficiary must be obtained to change the beneficiary. Relevant state statutes must be consulted to determine if they require the consent of the beneficiary to effectuate a change of the beneficiary.

District of Columbia Request for Change of Beneficiary of Life Insurance Policy

Description

Form popularity

FAQ

Irrevocable beneficiaries cannot be removed once designated unless they agree to it?even if they are divorced spouses. Children are often named irrevocable beneficiaries to ensure their inheritance or secure child support payments.

Disputing who was named as the beneficiary can be a complicated, expensive ordeal. Only the court may overturn the person named as beneficiary. Insurance companies cannot change or alter the beneficiary without a court order to do so.

The policyowner can change the beneficiary. A policyowner may change a beneficiary at any time. However, consent may be needed by the current beneficiary if designated as irrevocable.

Generally, you can review and update your beneficiary designations by contacting the company or organization that provides your insurance or retirement plan. You can sometimes do this online. Otherwise, you'll have to complete, sign, and mail a paper form.

The policyholderPolicyholderThe person who owns an insurance policy is the only person allowed to make changes to your life insurance beneficiaries. The only exception is if you've granted someone power of attorney, a legal document that lets someone make financial, legal, or medical decisions on your behalf.

Most life insurance policies list one beneficiary, but some allow for more than one beneficiary. You can change the beneficiary at any time, depending on the terms of the policy, without any penalty or fee.

Your ability to change your beneficiary or have multiple beneficiaries depends on the pension option you chose when you retired. You may only change your beneficiary if: You chose a single life pension option with a guarantee period. Your spouse gave up their beneficiary rights to your pension by signing a waiver.

There are two options when it comes to transferring a life insurance policy: Transfer ownership of your policy to any other adult, including the policy beneficiary (in this case, your child or children). Create an irrevocable life insurance trust and transfer the ownership of the policy to the trust.