District of Columbia Conditional Sales Contract

Description

How to fill out Conditional Sales Contract?

Are you currently in a circumstance where you need documents for either business or specific purposes almost every working day.

There are numerous legal document templates available online, but finding ones you can trust is not simple.

US Legal Forms provides a vast array of form templates, such as the District of Columbia Conditional Sales Contract, designed to fulfill state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the District of Columbia Conditional Sales Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

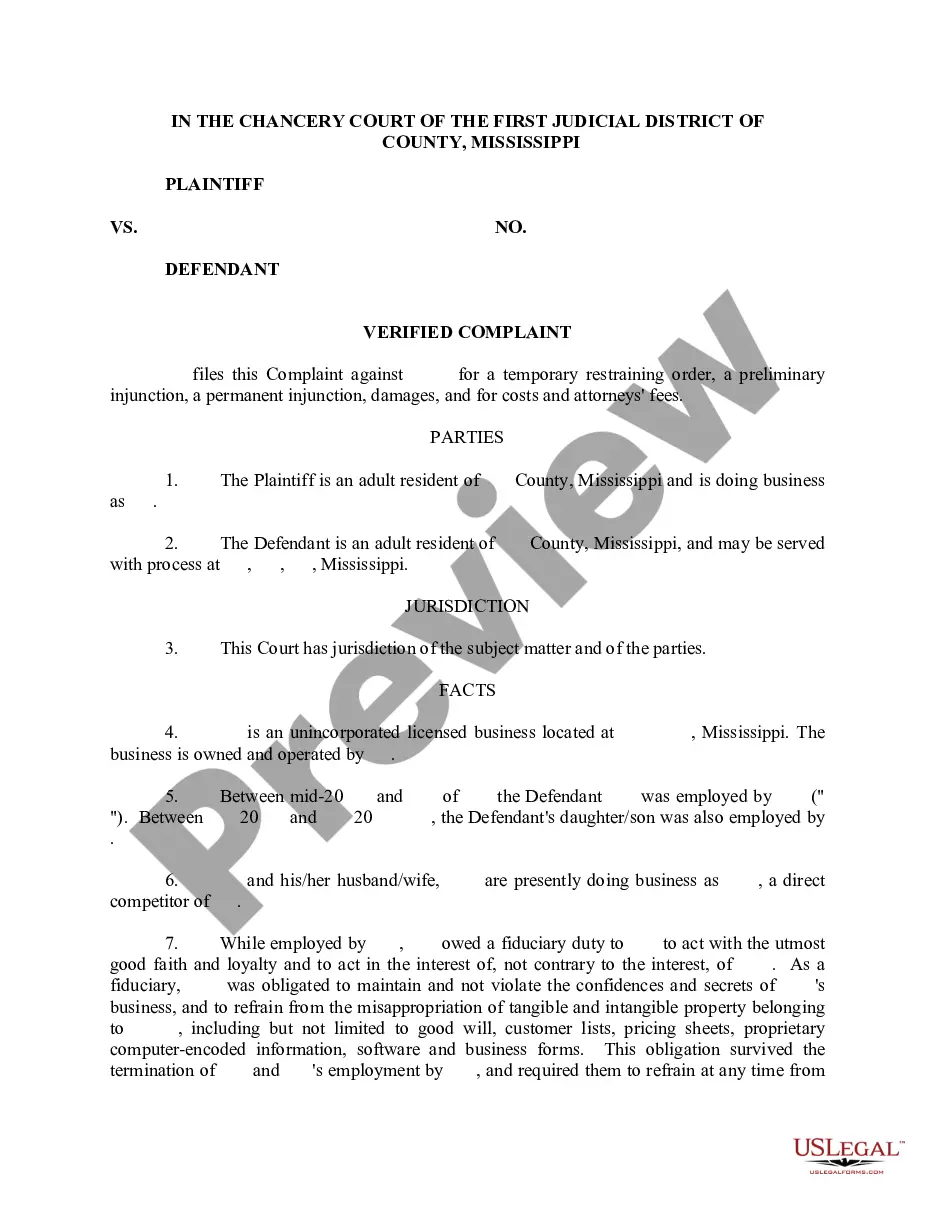

- Use the Preview button to examine the form.

- Review the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search field to locate the form that fits your needs and requirements.

- Once you find the appropriate form, click Purchase now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using your PayPal or credit card.

- Select a suitable document format and download your copy.

- Find all the document templates you have purchased in the My documents menu. You can obtain another copy of the District of Columbia Conditional Sales Contract at any time if needed. Just click on the necessary form to download or print the document template.

Form popularity

FAQ

Statute of limitations in contracts for sale. (1) An action for breach of any contract for sale must be commenced within four years after the cause of action has accrued. By the original agreement the parties may reduce the period of limitation to not less than one year but may not extend it.

Under the District of Columbia law, the statute of limitations depends on the severity of the crime you face, ranging from three years to no time limit. First or second-degree murder: No time limit. Murder of a law enforcement officer or public safety employee: No time limit.

A claim for breach of contract generally requires showing the existence of a valid contract, a duty arising out of the contract, a breach of the duty, and damages resulting from the breach.

In a conditional sales agreement, a buyer takes possession of an asset, but its title and right of repossession remain with the seller until the purchase price is fully paid. If the buyer defaults, the seller can repossess the property.

Every contract or duty within this chapter imposes an obligation of good faith in its performance or enforcement. For purposes of this chapter, the term ?good faith? means honesty in fact in the conduct or transaction concerned and the observance of reasonable commercial standards of fair dealing.

Statute of Limitations for No-Contact Orders in DC The imported statute of limitations for filing a civil protection order in DC is three years. In other words, if the respondent committed a criminal offense against you more than three years ago, then you will not be able to rely on that offense to make your case.

Washington D.C.'s standard statute of limitations period is three years. There are different exceptions for certain causes of action and where otherwise established by law, however.