A license authorizes the holder to do something that he or she would not be entitled to do without the license. Licensing may be directed toward revenue raising purposes, or toward regulation of the licensed activity, or both. Statutes frequently require that a person obtain a license before practicing certain professions such as law or medicine, or before carrying on a particular business such as that of a real estate broker or stock broker. If the license is required to protect the public from unqualified persons, an assignment of that license to secure a loan would probably not be enforceable.

District of Columbia Assignment of Business License as Security for a Loan

Description

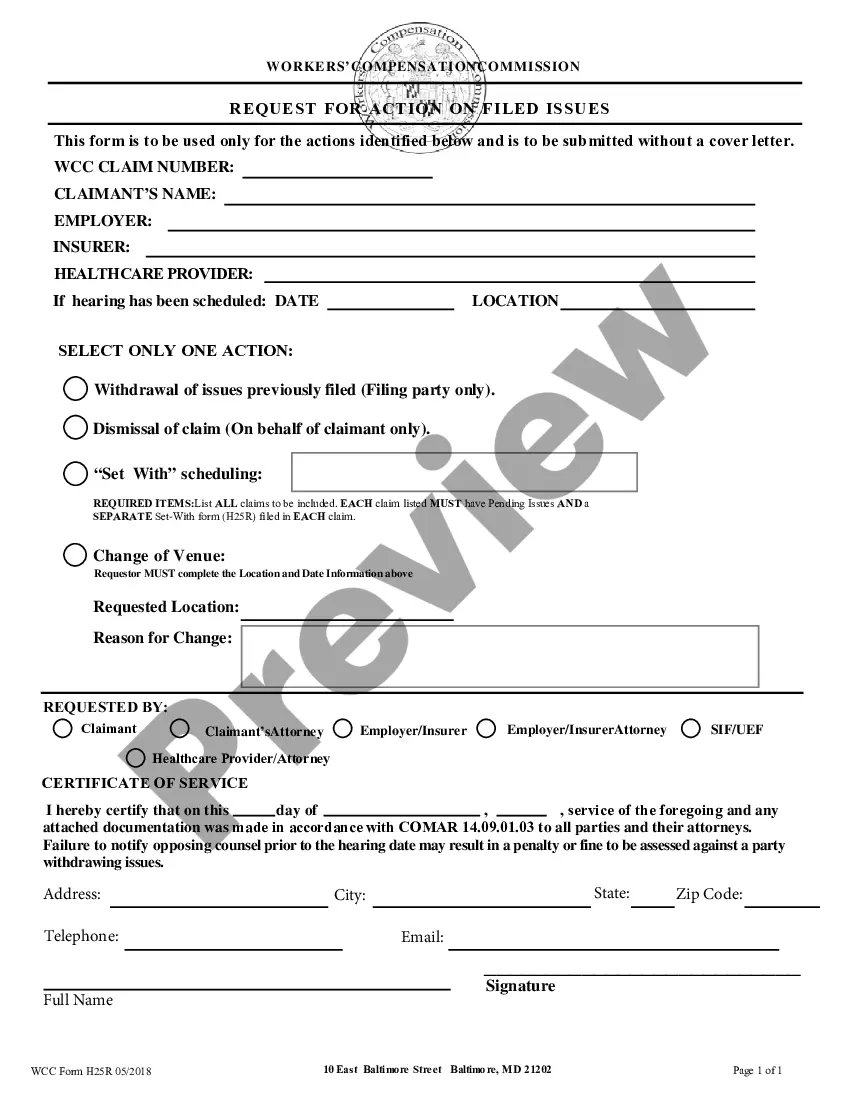

How to fill out Assignment Of Business License As Security For A Loan?

US Legal Forms - one of several most significant libraries of legal forms in the United States - delivers an array of legal papers layouts it is possible to download or print out. Making use of the website, you can find a large number of forms for enterprise and specific reasons, categorized by groups, states, or search phrases.You will find the most up-to-date versions of forms such as the District of Columbia Assignment of Business License as Security for a Loan within minutes.

If you have a membership, log in and download District of Columbia Assignment of Business License as Security for a Loan from the US Legal Forms library. The Obtain option will show up on each form you perspective. You get access to all in the past downloaded forms in the My Forms tab of your own bank account.

If you would like use US Legal Forms for the first time, allow me to share basic directions to help you get began:

- Be sure to have picked the proper form for your personal metropolis/region. Click the Preview option to check the form`s information. Browse the form description to ensure that you have chosen the correct form.

- If the form doesn`t suit your requirements, use the Lookup area on top of the display screen to get the one that does.

- If you are happy with the form, affirm your choice by visiting the Purchase now option. Then, opt for the prices program you want and offer your qualifications to register for an bank account.

- Method the purchase. Utilize your charge card or PayPal bank account to accomplish the purchase.

- Select the formatting and download the form in your device.

- Make adjustments. Fill out, revise and print out and indicator the downloaded District of Columbia Assignment of Business License as Security for a Loan.

Every format you included in your money does not have an expiration day and it is yours forever. So, if you wish to download or print out another duplicate, just proceed to the My Forms segment and click on in the form you want.

Gain access to the District of Columbia Assignment of Business License as Security for a Loan with US Legal Forms, by far the most comprehensive library of legal papers layouts. Use a large number of expert and express-certain layouts that fulfill your business or specific requires and requirements.

Form popularity

FAQ

How Much Does the Washington DC Business License Cost? There are a number of fees to be paid to obtain a Washington DC basic business license. Fees still need to be paid even without a specific endorsement of a general business license. Payments of $70 for an application and up to $25 for each endorsement are required.

The fee for a General Business License is $99. You can apply for your Basic Business License online through My DC Business Center or in person at the DLCP Business License Center. Basic Business Licenses must be renewed every two or four years, depending on license type.

You can get an LLC in DC in 5 business days if you file online (or 4-6 weeks if you file by mail). If you need your District of Columbia LLC faster, you can pay for expedited processing.

Every Washington DC LLC must get a Business License (aka Basic Business License) in order to operate in DC. This is mandatory and is required for all LLCs, regardless of income or activity. Note: A Business License and a Basic Business License mean the same thing. We may use these terms interchangeably.

Obtaining a Trade Name or DBA If you wish to establish a Washington DC DBA or trade name, you must register your trade name with the Washington DC Department of Consumer and Regulatory Affairs and pay a filing fee of $55.

If you are a corporation, partnership or limited liability company (domestic or foreign), you must be registered and in good standing with the Corporations Division. You must also have a Registered Agent.

Use this online search tool to verify a license issued by the Department of Consumer Affairs (DCA) for the professions listed under license type. Each license record will reflect if a license is current, expired, or has been subject to disciplinary action like suspension or revocation.