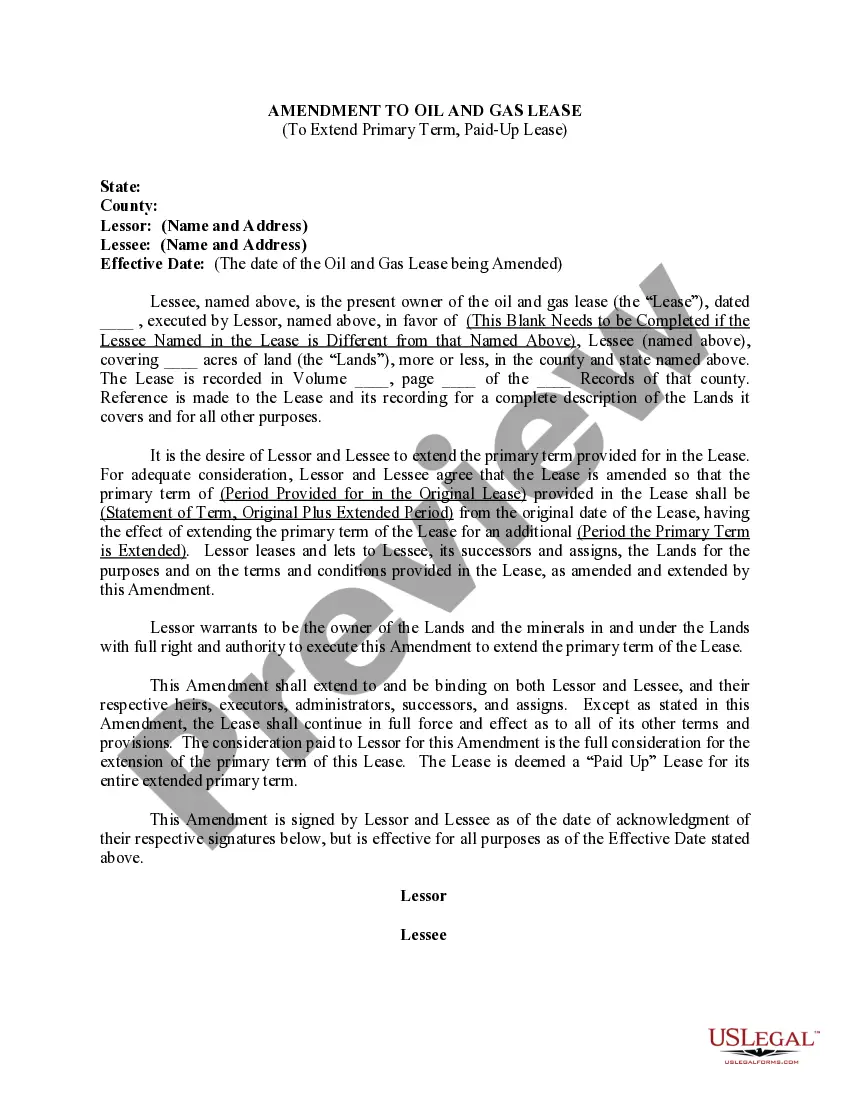

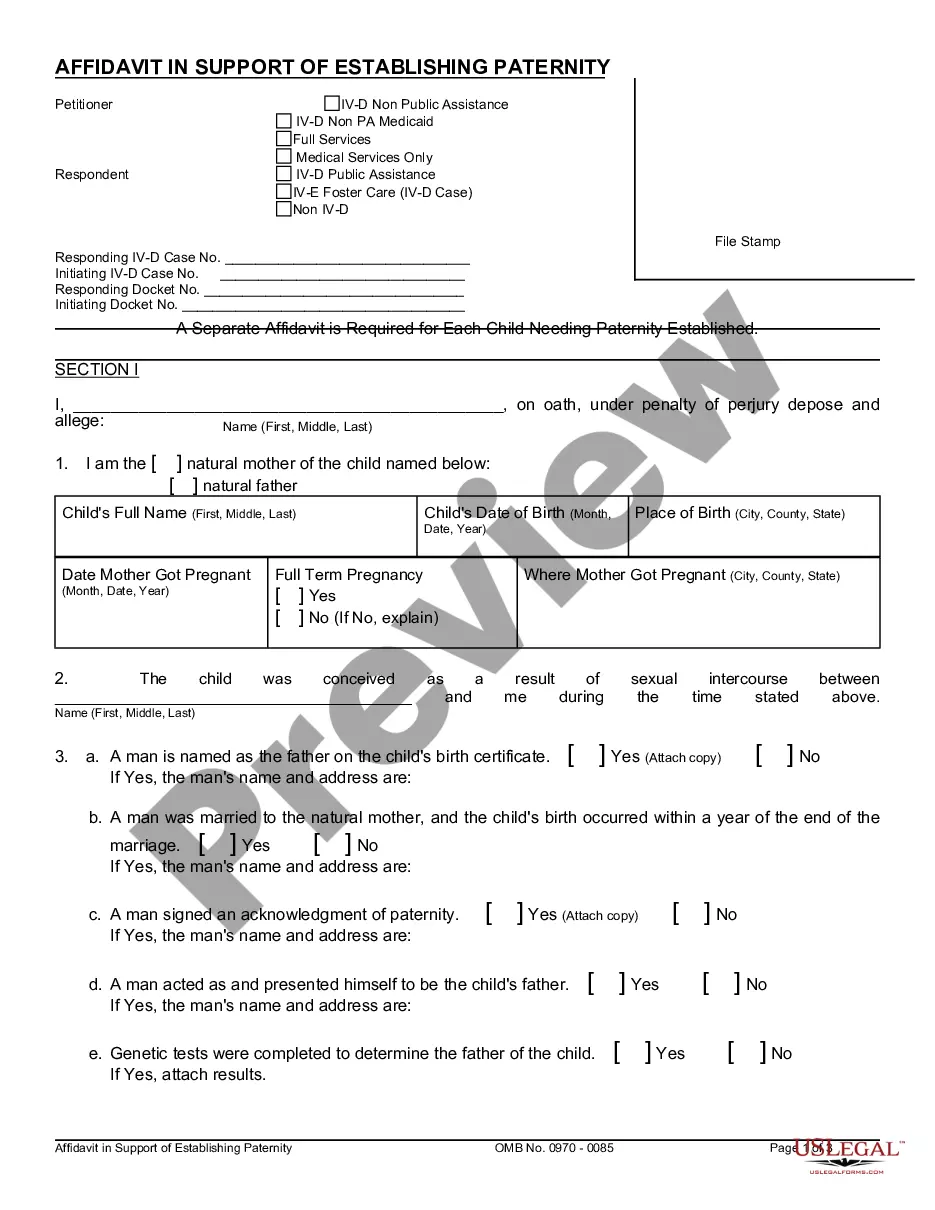

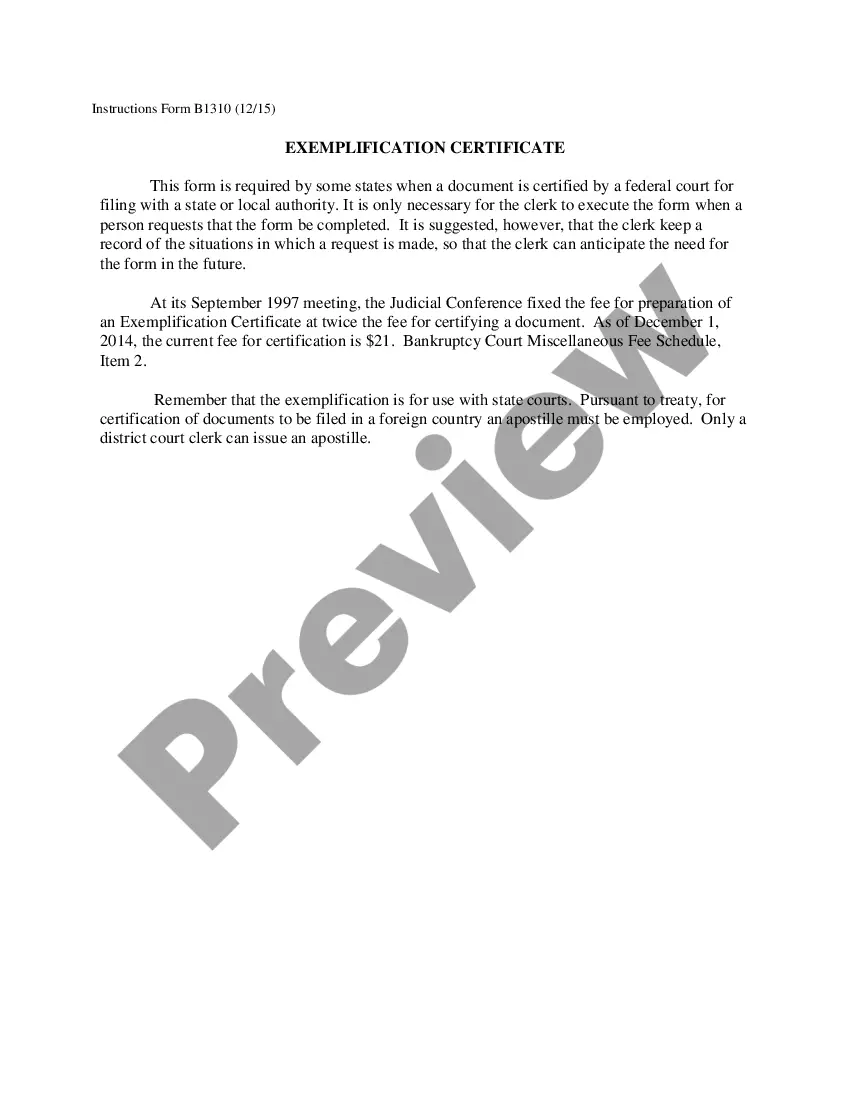

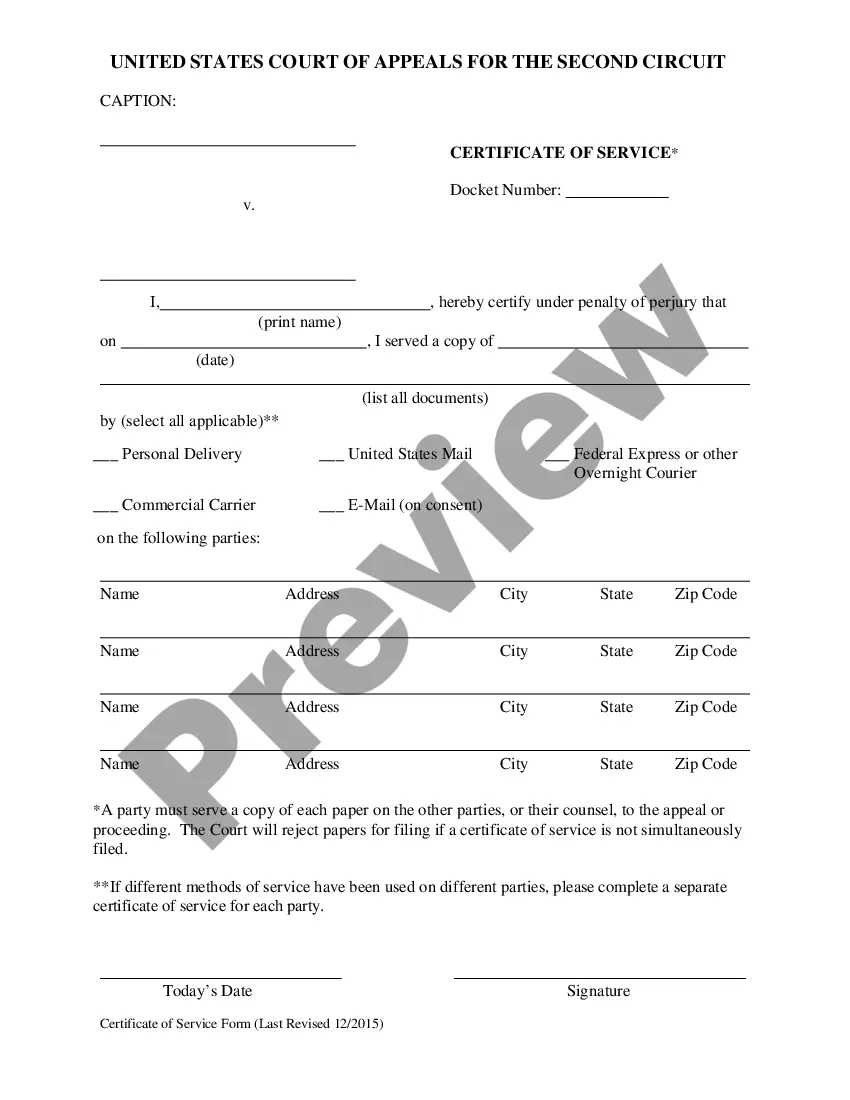

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. This form is a sample of a trustor amending the trust agreement in order to extend the term of the trust. It is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

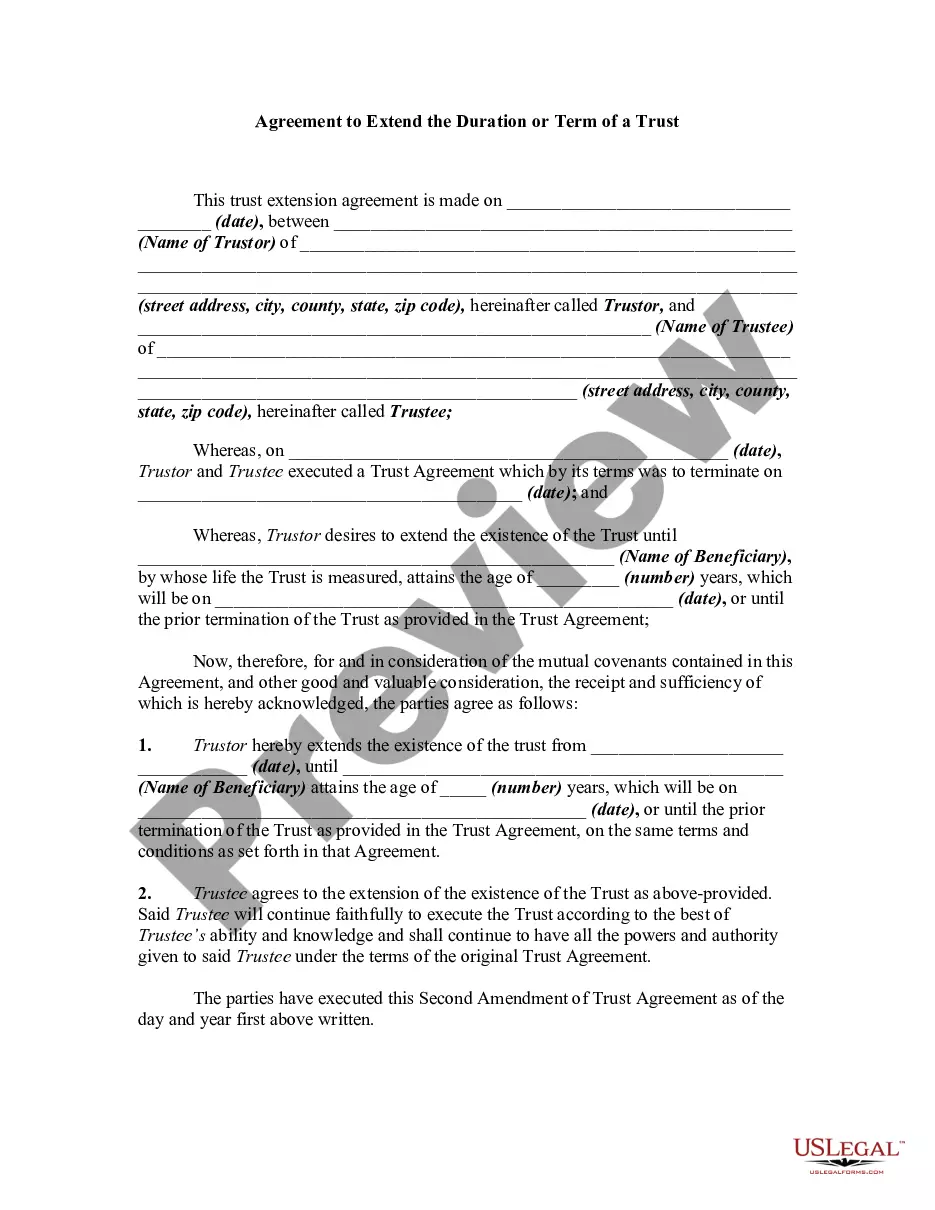

District of Columbia Agreement to Extend the Duration or Term of a Trust

Description

How to fill out Agreement To Extend The Duration Or Term Of A Trust?

Finding the appropriate legal document template can be challenging.

Clearly, there are numerous templates accessible online, but how can you locate the specific legal form you require.

Utilize the US Legal Forms platform. The service offers thousands of templates, including the District of Columbia Agreement to Extend the Duration or Term of a Trust, suitable for both business and personal needs.

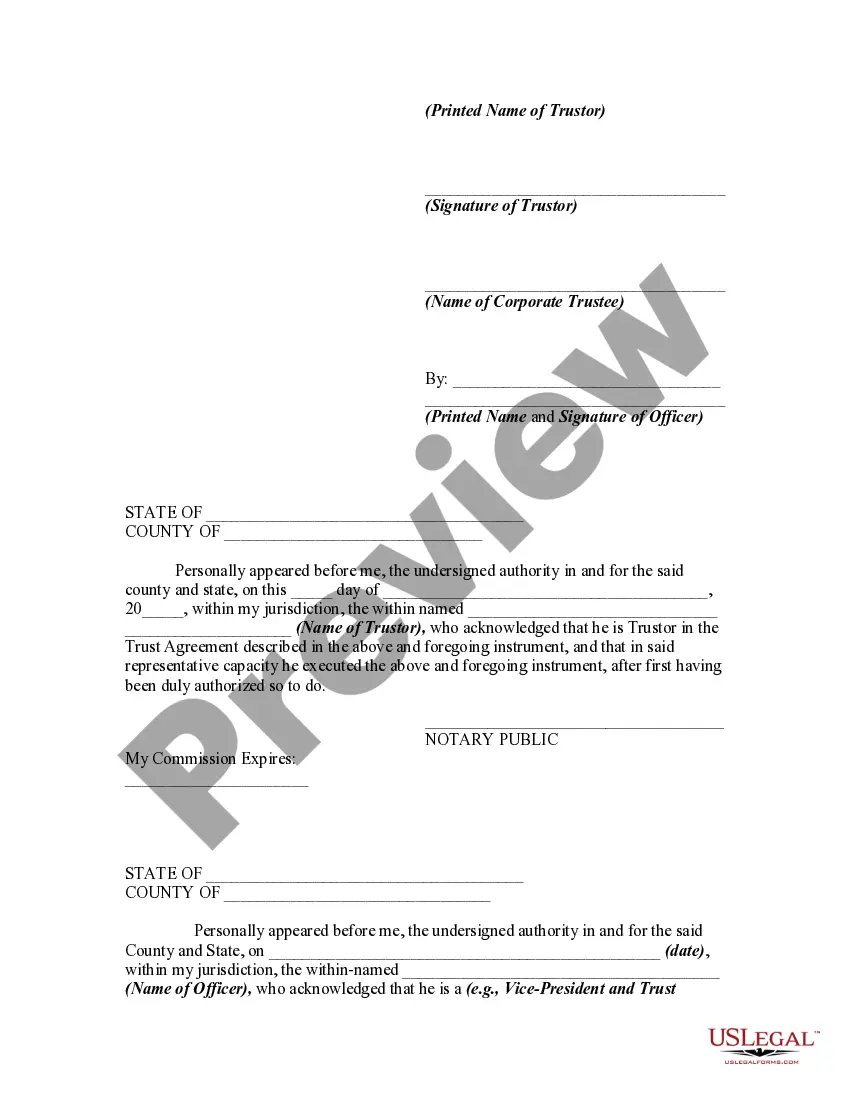

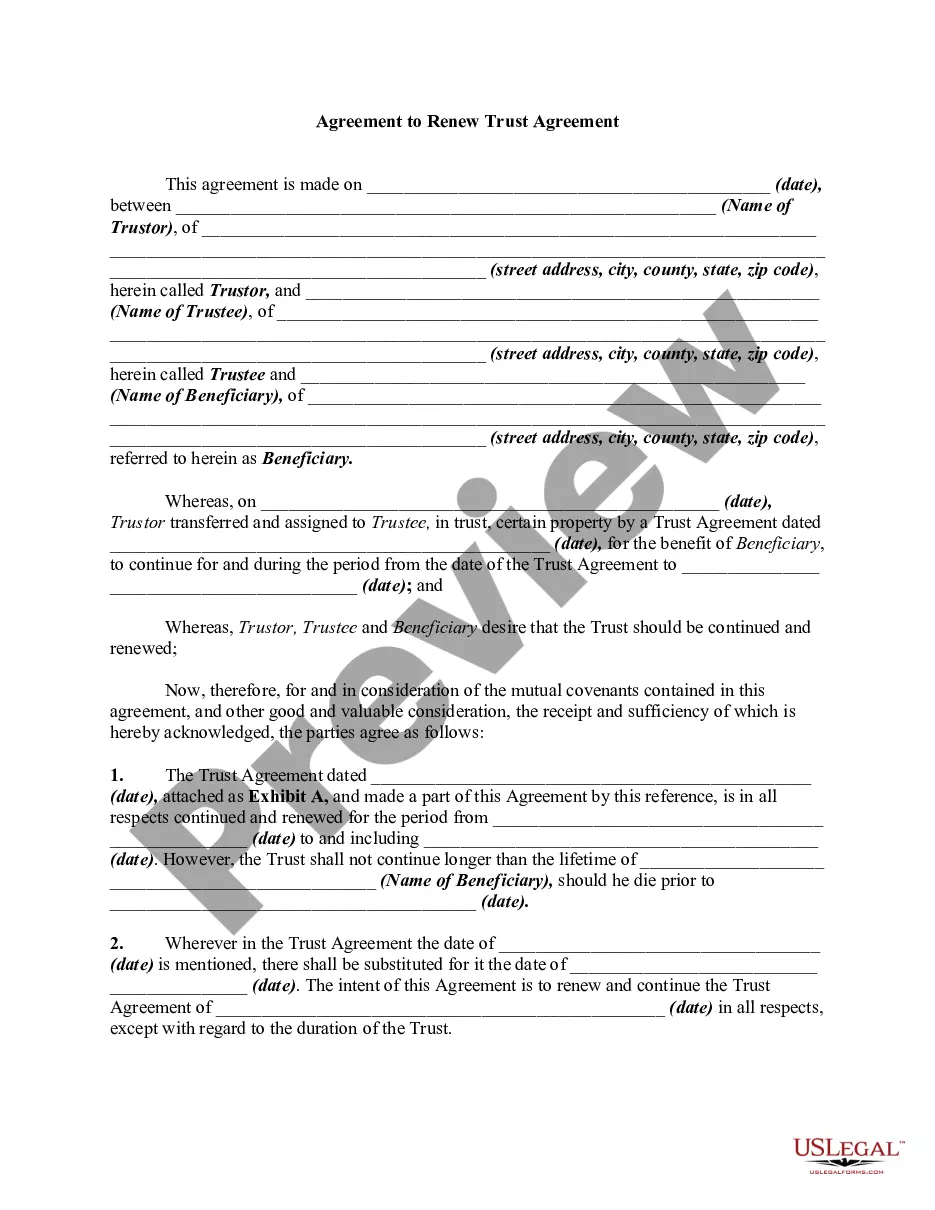

If the document does not meet your requirements, use the Search feature to find the correct form. Once you are confident that the form is appropriate, proceed to click the Buy now button to purchase the document. Choose the pricing plan you desire and provide the necessary details. Create your account and complete the purchase using your PayPal account or credit card. Select the document format and download the legal document template to your system. Complete, edit, print, and sign the acquired District of Columbia Agreement to Extend the Duration or Term of a Trust. US Legal Forms is the largest collection of legal documents where you can find numerous document templates. Utilize the service to obtain properly crafted documents that adhere to state requirements.

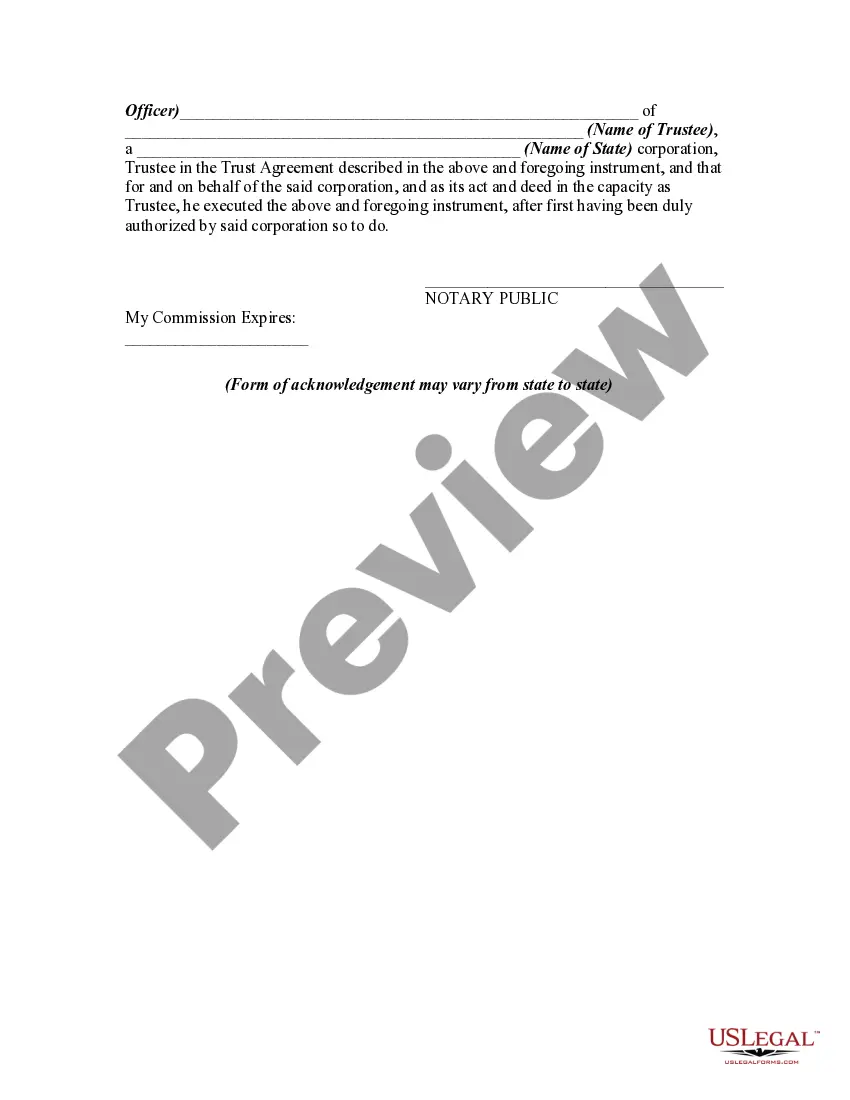

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Acquire button to get the District of Columbia Agreement to Extend the Duration or Term of a Trust.

- Use your account to check the legal documents you have previously ordered.

- Navigate to the My documents section in your account to obtain another copy of the document you need.

- For new users of US Legal Forms, here are some easy steps to follow.

- First, ensure that you have chosen the correct document for your city/state. You can review the document using the Preview option and read the document description to ensure it is suitable.

Form popularity

FAQ

The deadline for trust extensions typically matches the original due date of the trust's tax return, allowing for an extension of up to six months. However, regularly monitoring deadlines is crucial, as failing to meet them may result in penalties. The District of Columbia Agreement to Extend the Duration or Term of a Trust provides specific regulations and deadlines that must be followed. The USLegalForms platform can help you keep track of these important dates.

The due date for filing a trust return in the District of Columbia generally aligns with the 15th day of the 4th month following the end of the trust’s tax year. For most trusts operating on a calendar year, the due date would be April 15. It is crucial to stay informed about this date to avoid penalties and ensure compliance with the District of Columbia Agreement to Extend the Duration or Term of a Trust. The USLegalForms platform provides helpful reminders and filing options.

The extended due date for a charitable remainder trust typically falls on the 15th day of the 4th month following the trust's tax year-end. If needed, you can extend this due date by filing an extension form before the original due date. This allows you to have additional time for the trust to complete its paperwork while ensuring compliance with the rules set under the District of Columbia Agreement to Extend the Duration or Term of a Trust. Check the USLegalForms platform for accurate forms and templates.

The 45-day rule for trusts refers to a specific timeline within which certain actions must be taken regarding a trust’s assets. Under this rule, a trust must notify beneficiaries within 45 days after the trust's creation or amendment, particularly if it involves a transfer of assets. This ensures that all parties are informed and can respond appropriately. Understanding this rule helps manage your trust better under the District of Columbia Agreement to Extend the Duration or Term of a Trust.

To file a trust extension in the District of Columbia, you need to complete Form 4868 for an automatic extension of time to file your trust’s return. Make sure to submit this form by the regular due date of your trust's return to qualify for the extension. It’s important to remember that this extension applies only to the time for filing and not for paying any taxes owed. For detailed guidance, consider using the USLegalForms platform to access resources tailored to the District of Columbia Agreement to Extend the Duration or Term of a Trust.

In the context of trusts, a DC port can refer to the legal allowances and options available for creating or modifying a trust under District of Columbia regulations. Understanding the purpose of a DC port helps you utilize these features effectively under the District of Columbia Agreement to Extend the Duration or Term of a Trust. If you have further questions, US Legal Forms can be a helpful resource in navigating these legal aspects.

When mailing a District of Columbia Agreement to Extend the Duration or Term of a Trust, you should send it to the Office of Tax and Revenue in the District of Columbia. Their mailing address is typically available on their official website. Properly addressing your documents helps ensure they are reviewed promptly and appropriately.

Filing a DC extension involves submitting the appropriate forms, which can often be found online or through legal service platforms like US Legal Forms. You will need to provide specific information regarding the trust and the duration you wish to extend. Ensure you've correctly completed all required paperwork to avoid delays or complications in processing your request.

Yes, if you wish to extend the duration or term of a trust in the District of Columbia, you typically need to file a District of Columbia Agreement to Extend the Duration or Term of a Trust. This legal document ensures compliance with DC laws while maximizing the benefits of your trust. If you're unsure about the process, consulting a legal professional can provide clarity and guidance.

To file an extension for a trust, you need to complete the required forms indicating your wish to extend the deadline. The District of Columbia Agreement to Extend the Duration or Term of a Trust outlines the necessary steps. It’s advisable to use resources like uslegalforms that provide templates and instructions for filing, making the process straightforward and accessible.