A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of the transfer of ownership of stock by a separate instrument.

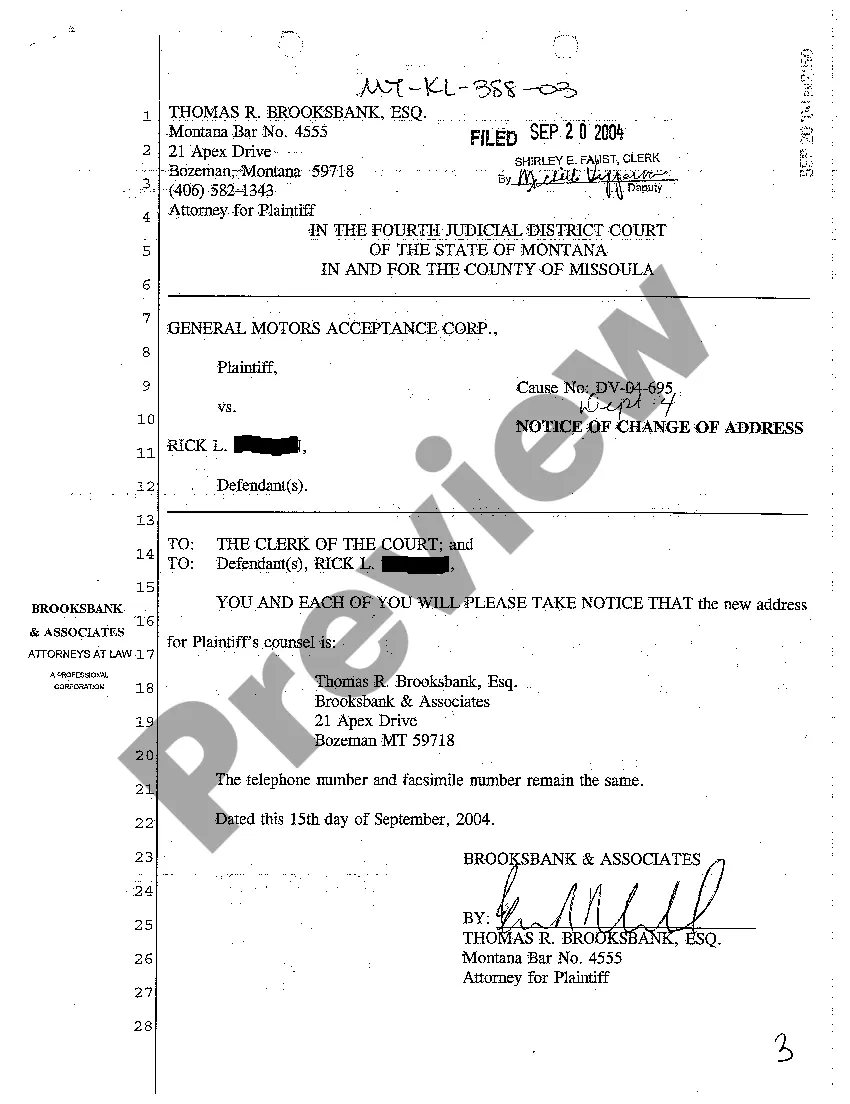

District of Columbia Bill of Sale and Assignment of Stock by Separate Instrument

Description

How to fill out Bill Of Sale And Assignment Of Stock By Separate Instrument?

You might spend time online looking for the legal document template that satisfies the state and federal regulations you need.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can obtain or print the District of Columbia Bill of Sale and Assignment of Stock by Separate Instrument from the service.

Once you have found the template you want, click Buy now to proceed. Select the payment plan you desire, input your credentials, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal form. Choose the format of the document and download it to your device. Make changes to your document if possible. You may fill out, edit, sign, and print the District of Columbia Bill of Sale and Assignment of Stock by Separate Instrument. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Next, you can fill out, edit, print, or sign the District of Columbia Bill of Sale and Assignment of Stock by Separate Instrument.

- Each legal document template you receive is yours indefinitely.

- To obtain an additional copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you’re using the US Legal Forms site for the first time, follow the basic instructions below.

- First, ensure that you have selected the appropriate document template for the county/city of your choice.

- Review the form outline to confirm you have picked the right form.

- If available, utilize the Review button to examine the document template as well.

- If you wish to find another version of the form, use the Search field to locate the template that meets your needs and requirements.

Form popularity

FAQ

To file taxes in the District of Columbia, you must typically earn a minimum amount defined by the tax regulations. For single filers, the threshold may differ based on your filing status and age. As you navigate tax obligations related to financial transactions like the District of Columbia Bill of Sale and Assignment of Stock by Separate Instrument, remember that staying informed can help ensure compliance.

To obtain a copy of a deed in the District of Columbia, you can visit the Recorder of Deeds office or access their online portal. They maintain all public real estate records, making it convenient for you to request copies. Should you need assistance with preparing documents like a District of Columbia Bill of Sale and Assignment of Stock by Separate Instrument, US Legal Forms provides templates and resources for your convenience.

In Baltimore City, the recordation tax generally applies to real estate transactions, and the rate can vary by property type. It's important to check local resources for the latest rates, as these can change. If you are looking to create a bill of sale or manage stock assignments, the District of Columbia Bill of Sale and Assignment of Stock by Separate Instrument offers a structured approach to handling these transactions.

The tax rate for the District of Columbia includes both income tax and sales tax. While income tax varies based on your earnings, the general sales tax rate is set at 6%. If you are dealing with stock transactions, the District of Columbia Bill of Sale and Assignment of Stock by Separate Instrument may also influence your tax calculations.

The buying tax in the District of Columbia can vary based on the type of transaction. When purchasing property, buyers typically encounter a sales tax and other applicable fees. Understanding the implications of the District of Columbia Bill of Sale and Assignment of Stock by Separate Instrument can help you navigate these requirements. For specific rates, consulting with a tax professional or the DC government website is advisable.

Recording a deed means submitting the document to the local government office, which officially logs it into public records. This process gives legal notice of ownership and protects the buyer's rights to the property. If you're working with a District of Columbia Bill of Sale and Assignment of Stock by Separate Instrument, understanding the recording process is essential for ensuring that ownership transfers are recognized and protected.

In the District of Columbia, a valid deed must include the names of the buyer and seller, a clear description of the property, and must be signed by the granting party. It is important to ensure that the deed is notarized and recorded with the Office of the Recorder of Deeds. Knowledge of the District of Columbia Bill of Sale and Assignment of Stock by Separate Instrument can also be beneficial, especially when dealing with stock or asset transfers.

Getting a copy of your deed in DC involves filling out a request form and providing the necessary details, such as your property's address. You can submit this request in person or online, depending on your preference. If you have a District of Columbia Bill of Sale and Assignment of Stock by Separate Instrument, it may also assist you in clarifying any relevant property transactions.

To obtain a copy of your deed in the District of Columbia, you can visit the Office of the Recorder of Deeds. Alternatively, you can also request it online through their official website. Having your District of Columbia Bill of Sale and Assignment of Stock by Separate Instrument can streamline this process if it is related to property transactions.