District of Columbia Receipt for Down Payment for Real Estate

Description

How to fill out Receipt For Down Payment For Real Estate?

You might invest numerous hours online searching for the valid document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of valid forms that are evaluated by specialists.

It is easy to download or print the District of Columbia Receipt for Down Payment for Real Estate from our service.

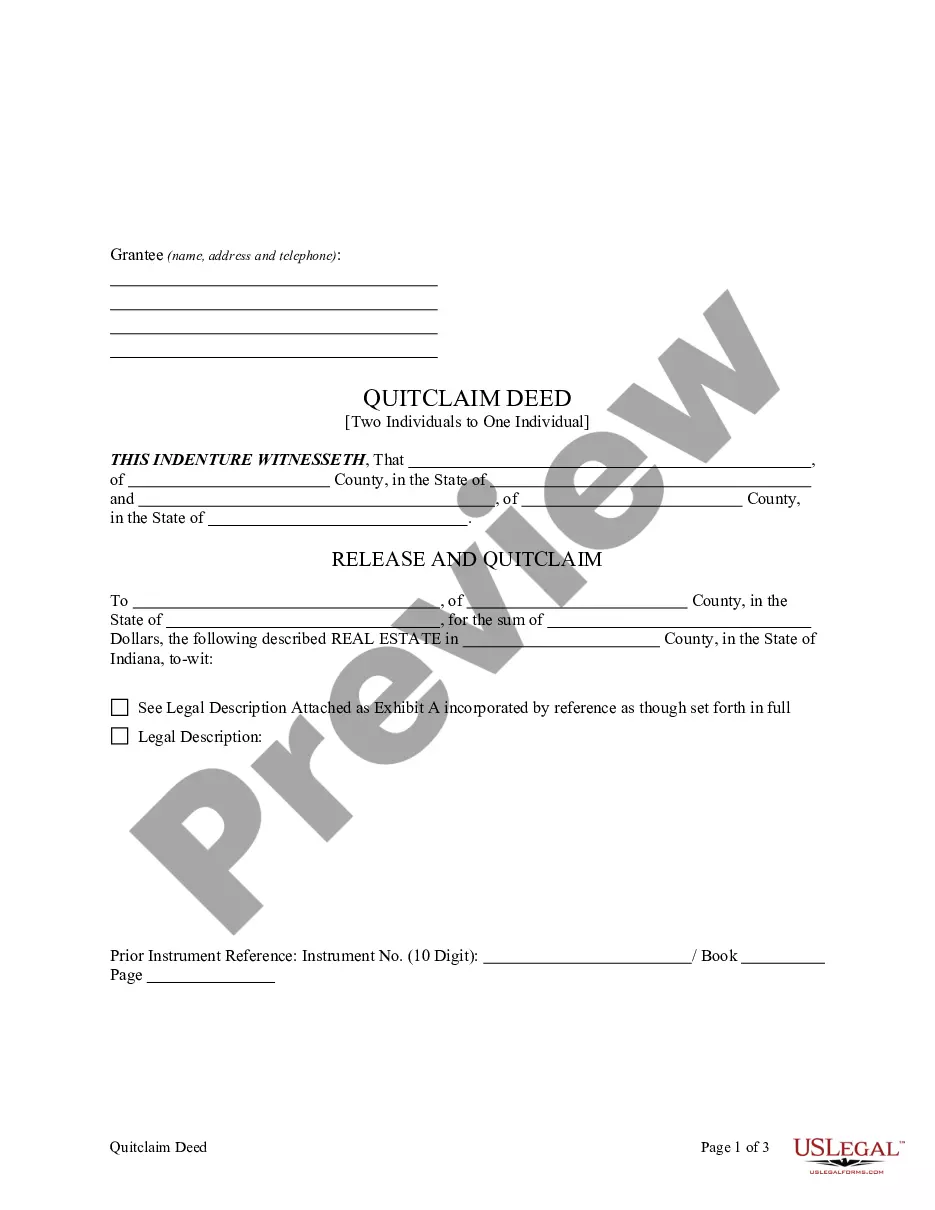

If available, use the Preview option to browse through the document template as well. If you wish to get another version of your form, utilize the Search field to find the template that fits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Obtain option.

- Then, you can complete, modify, print, or sign the District of Columbia Receipt for Down Payment for Real Estate.

- Every valid document template you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form description to ensure you have selected the right form.

Form popularity

FAQ

DC offers property tax credits to residents who meet specific eligibility criteria, such as low-income households or senior citizens. The credits aim to alleviate the financial burden of property taxes for these groups. If you're navigating the process of purchasing property, understanding these credits can be beneficial when securing the District of Columbia Receipt for Down Payment for Real Estate.

In Washington, DC, you must file a tax return if your income exceeds a certain threshold, which generally starts at around $12,200 for single filers. Your obligations depend on various factors, such as your filing status and the types of income earned. If you're engaging in real estate transactions, ensuring compliance will also involve obtaining the District of Columbia Receipt for Down Payment for Real Estate.

Washington, DC features a progressive income tax system with rates ranging from 4 percent to 10.75 percent, depending on your taxable income. Additionally, property tax rates can differ based on property classifications and assessments. For anyone purchasing real estate, understanding these rates can help in budgeting and in planning for a District of Columbia Receipt for Down Payment for Real Estate.

To determine if you owe taxes to the District of Columbia, you can visit the MyTax.DC website. By entering your information, you can easily check your tax status and outstanding balances. Staying informed about your tax obligations is essential, especially if it relates to transactions involving the District of Columbia Receipt for Down Payment for Real Estate.

Yes, MyTax.DC is the official site for local tax administration in the District of Columbia. The platform is secure and designed to provide residents with easy access to tax services, including filing and payment options. If you're looking for information related to the District of Columbia Receipt for Down Payment for Real Estate, MyTax.DC is a reliable resource for managing tax-related queries.

The 183-day rule in the District of Columbia refers to the criteria used to determine residency for tax purposes. If you spend 183 days or more in DC during the tax year, you may be considered a resident. This rule is particularly important for individuals considering real estate transactions and understanding their tax responsibilities in relation to the District of Columbia Receipt for Down Payment for Real Estate.

To obtain a copy of your deed in the District of Columbia, you can visit the DC Recorder of Deeds website. There, you can search for property records and access various forms, including the District of Columbia Receipt for Down Payment for Real Estate. Alternatively, you can visit the office in person to request copies. Remember to have your property's information ready to streamline the process.

Yes, the District of Columbia has property tax, which is levied on real estate properties located within its jurisdiction. Property tax rates can vary based on the type of property, such as residential or commercial. It is important to consider this when making real estate decisions, especially when preparing to secure a District of Columbia Receipt for Down Payment for Real Estate. Understanding the local tax implications can help you plan your budget more effectively.

In DC, property taxes are classified into various categories, including residential, commercial, and industrial properties. Each of these classifications may have different rates and assessment practices. If you're purchasing property in the District, it's crucial to understand how these taxes affect your investment. A District of Columbia Receipt for Down Payment for Real Estate can be your first step towards navigating these classifications effectively.

Several states operate under a tax deed system, including Texas, Florida, and Georgia. In these states, unpaid property taxes can lead to the sale of the property through a tax deed auction. If you're navigating real estate in the District of Columbia, understanding these differences can aid in your decision-making. Also, ensure you secure the District of Columbia Receipt for Down Payment for Real Estate to streamline your purchases.