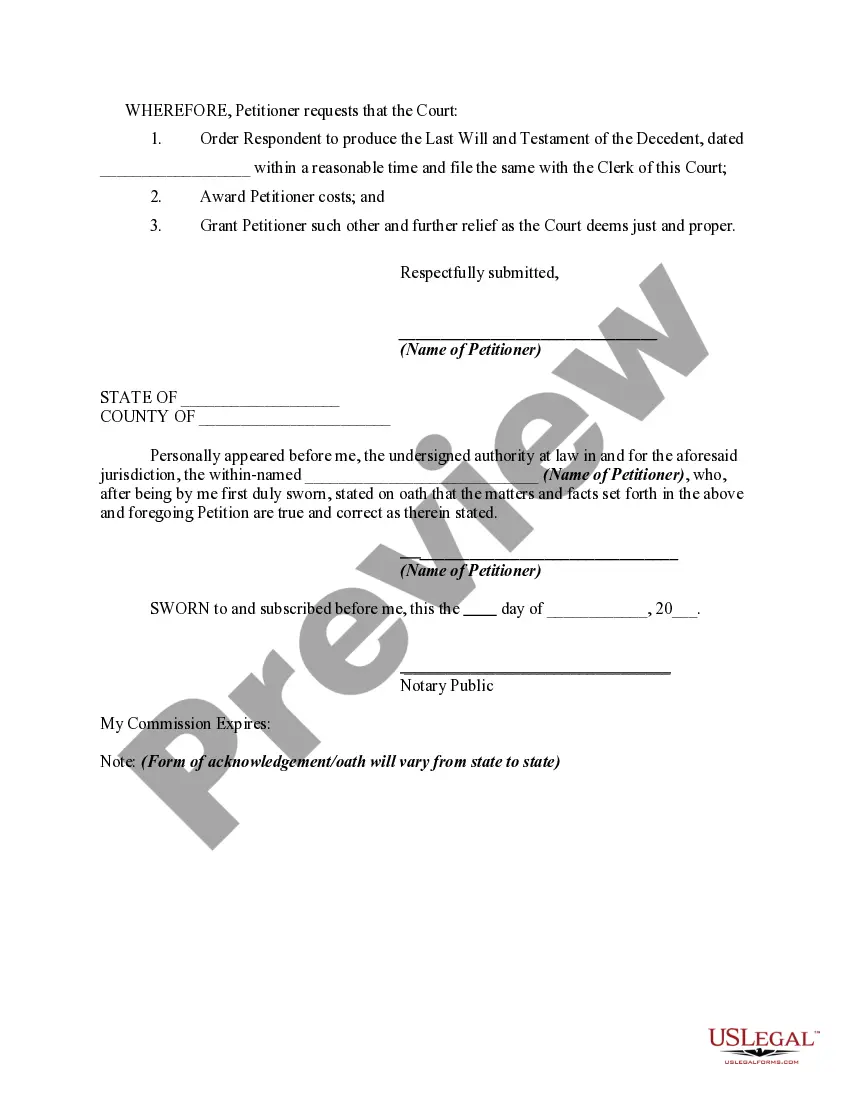

District of Columbia Petition For Order Requiring Production of Will

Description

How to fill out Petition For Order Requiring Production Of Will?

You are able to devote time on the web searching for the legitimate papers format that suits the state and federal needs you want. US Legal Forms gives thousands of legitimate varieties that happen to be evaluated by experts. It is simple to download or produce the District of Columbia Petition For Order Requiring Production of Will from your assistance.

If you already have a US Legal Forms bank account, it is possible to log in and then click the Obtain button. Next, it is possible to full, revise, produce, or sign the District of Columbia Petition For Order Requiring Production of Will. Each legitimate papers format you buy is yours forever. To have an additional version of any purchased develop, check out the My Forms tab and then click the corresponding button.

If you use the US Legal Forms site for the first time, stick to the easy directions below:

- First, make sure that you have chosen the right papers format for your area/area that you pick. See the develop description to make sure you have chosen the proper develop. If readily available, utilize the Preview button to look with the papers format too.

- If you would like discover an additional edition in the develop, utilize the Search field to obtain the format that fits your needs and needs.

- Upon having discovered the format you would like, just click Buy now to move forward.

- Select the costs program you would like, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the transaction. You may use your credit card or PayPal bank account to fund the legitimate develop.

- Select the formatting in the papers and download it to the system.

- Make alterations to the papers if possible. You are able to full, revise and sign and produce District of Columbia Petition For Order Requiring Production of Will.

Obtain and produce thousands of papers themes making use of the US Legal Forms web site, which offers the greatest variety of legitimate varieties. Use specialist and status-particular themes to tackle your organization or individual needs.

Form popularity

FAQ

Yes. The law requires that a will be filed within 90 days after the death of the testator (i.e., the person who executed or signed the will).

Is Probate Required in Washington, DC? Probate is required in many cases in the District of Columbia. If the property value is under $40,000, you can settle under small estate administration.

Under D.C. law, the Will must be filed within 90 days of the death of the decedent. To officially start the probate process, the interested person or their probate lawyer will need to file a petition for probate at the D.C. Superior Court Probate Division (515 5th Street, N.W., 3rd floor, Washington, D.C.).

DC law requires that all original wills must be filed with the Register of Wills Office. Regardless of whether there are assets that are passing through the probate administration, the law does require that original wills must be filed.

Ing to the Code of the District of Columbia § 20-351, only estates with a value of $40,000 or less will qualify for this shortened form of probate. As such, petitioners must include a list of the decedent's assets when filing their paperwork with the court.

Avoid probate with a trust With a living trust, the creator of such trust no longer ?owns? the assets in it, but a trustee does and therefore, at the moment of death this partial or full estate does not apply for probate, since ownership is no longer with the decedent.

20-906, a family allowance in a reasonable sum not to exceed $15,000 is authorized from the personal estate to____________________ as surviving spouse /domestic partner and decedent's minor child(ren) whom the decedent was obligated to support and children who were in fact being supported by the decedent, in ance ...

Probate is a legal process that takes place after someone's death. It usually involves proving that the deceased's will is valid, identifying the deceased person's property and having it appraised, paying outstanding debts and taxes, and distributing the property per the will or state law.