District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries

Description

How to fill out Trust Agreement - Revocable - Multiple Trustees And Beneficiaries?

If you wish to obtain, download, or print accurate document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to find the paperwork you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords. Utilize US Legal Forms to retrieve the District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries in just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to each form you saved in your account. Navigate to the My documents section and select a form to print or download again.

Compete, download, and print the District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

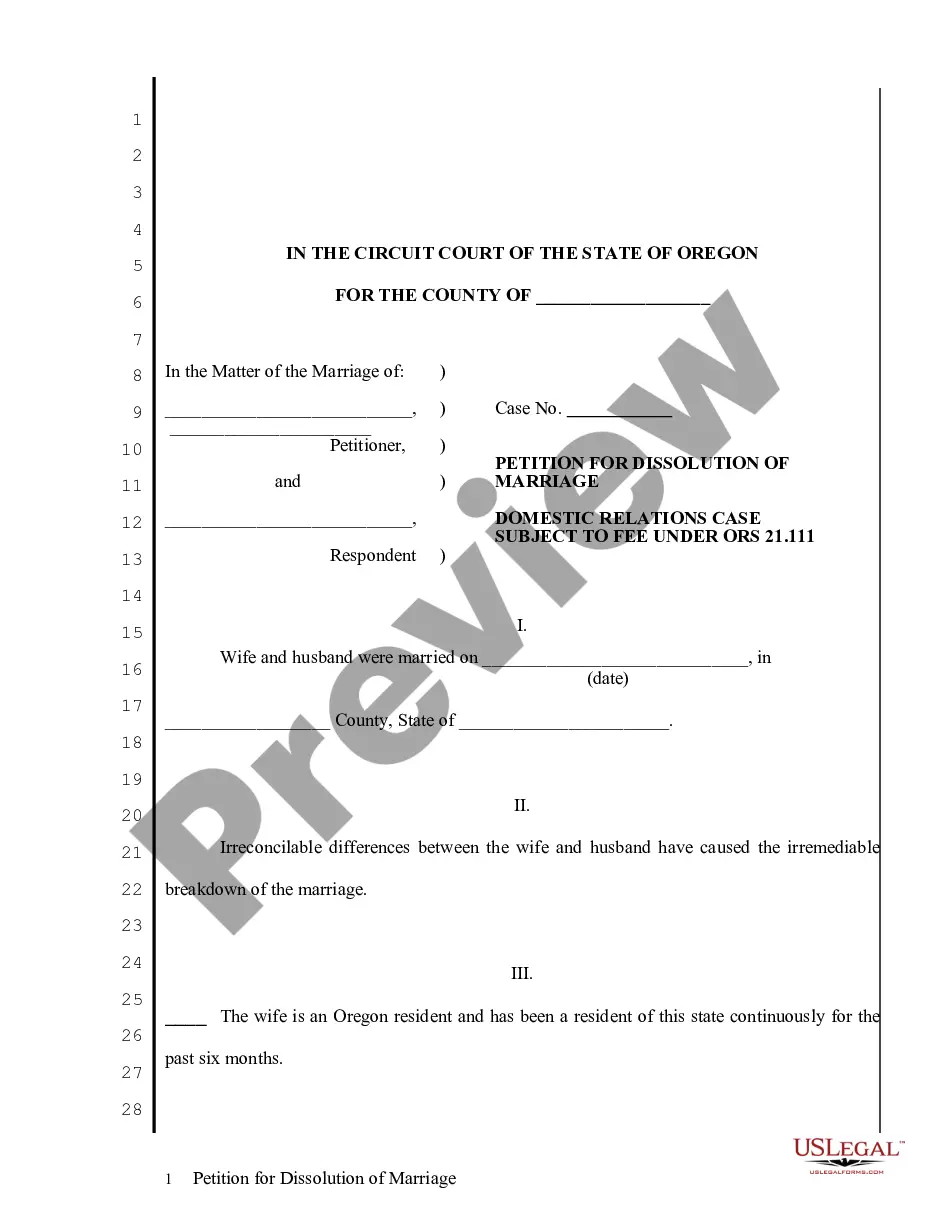

- Step 2. Use the Preview option to review the form’s content. Remember to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of your legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and provide your information to sign up for an account.

- Step 5. Complete the purchase process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, print, or sign the District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries.

Form popularity

FAQ

In a District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, there is generally no strict maximum number of trustees established by law. However, it is wise to keep the number manageable to facilitate effective communication and decision-making. Too many trustees may complicate the administration process, making coordination challenging. For best practices and detailed templates, you can rely on uslegalforms to guide you.

Yes, under a District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, a trustee can also be a beneficiary. This dual role can simplify trust management and provide personal motivation for effective administration. However, it is essential to ensure transparency and fairness in decision-making to avoid any conflicts. For clear guidelines and templates, consider using uslegalforms to navigate this complexity.

Having two trustees in a District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries enhances accountability. With more than one trustee, there is an added layer of protection against potential conflicts of interest or mismanagement. This duo can collaborate on important decisions and provide diverse insights, benefiting the trust as a whole. You can incorporate this arrangement seamlessly through uslegalforms.

Yes, a District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries can have multiple trustees. This arrangement allows for shared responsibility in managing the trust, ensuring that various perspectives contribute to decision making. Multiple trustees can provide checks and balances, which can lead to more effective and fair administration of the trust. You can easily set up such arrangements using platforms like uslegalforms.

The key difference lies in flexibility. A revocable trust allows you to modify or dissolve it anytime, while an irrevocable trust locks in your terms and relinquishes control over the assets. Understanding this distinction helps you choose the best option if you’re considering a District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries for your estate plan.

Two family members can serve as trustees under a District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. This arrangement can facilitate trust management, as family members may share a common understanding of your goals and wishes. Just ensure their roles and duties are clearly defined in the trust document to prevent misunderstandings.

Yes, you can appoint two trustees in your District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. This can promote collaboration, ensuring that decisions are made jointly, which may prevent conflicts. However, you should clearly outline their responsibilities and procedures for decision-making within the trust document to maintain efficiency.

Some assets are not suitable for a revocable trust, like retirement accounts and certain types of life insurance policies. Including these assets in a District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries may complicate distribution and taxation. It's crucial to evaluate each asset type and consult with a legal professional to determine the best approach.

Choosing between a revocable trust and an irrevocable trust depends on your specific needs. A District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries offers flexibility, allowing you to change the terms or dissolve the trust if your circumstances change. On the other hand, an irrevocable trust provides asset protection and tax advantages, as you cannot alter the trust once established.

Setting up a trust in the District of Columbia involves several steps. First, you need to decide the terms of your District of Columbia Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. Next, you should draft the trust document, outlining the roles of trustees and beneficiaries. Finally, you must fund the trust by transferring assets into it, ensuring that it meets your needs.