An irrevocable trust established to qualify contributions for the annual federal gift tax exclusion for gifts of a present interest. The trust is named Crummey because of a case involving a family named Crummey. The trust contains Crummey Powers, enabling a beneficiary to withdraw assets contributed to the trust for a limited period of time.

District of Columbia Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement

Description

How to fill out Sprinkling Trust For Children During Grantor's Life, And For Surviving Spouse And Children After Grantor's Death - Crummey Trust Agreement?

You could spend hours online trying to locate the legal document template that fulfills the federal and state requirements you require.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

It is easy to download or print the District of Columbia Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement from the website.

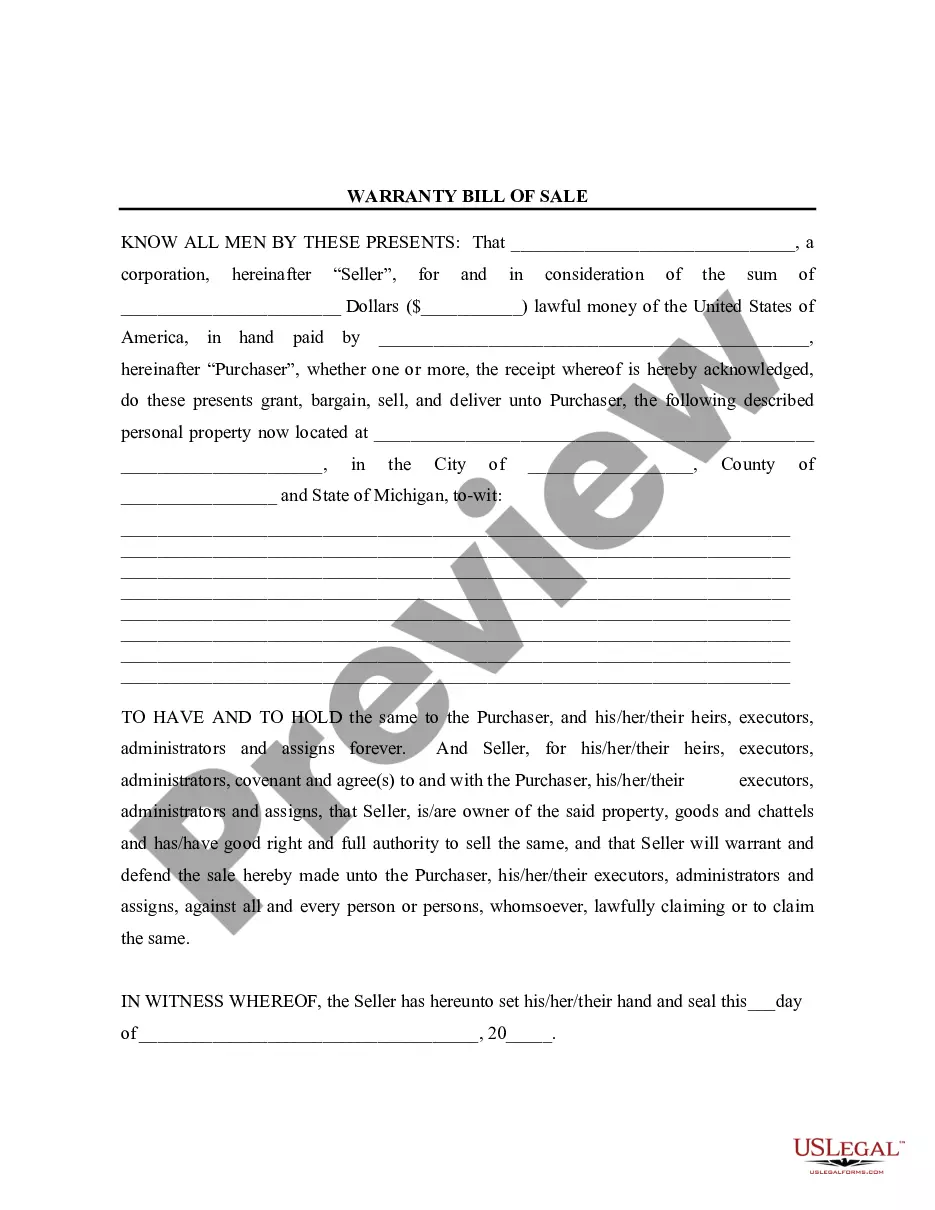

If available, use the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Obtain button.

- After that, you can complete, modify, print, or sign the District of Columbia Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement.

- Every legal document template you acquire is yours permanently.

- To get an additional copy of any purchased form, go to the My documents tab and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Check the form description to make sure you have selected the right document.

Form popularity

FAQ

The 5 by 5 rule for Crummey powers allows beneficiaries to take distributions without facing immediate taxes, up to $5,000 or 5% of the trust principal. This mechanism enables flexibility in access to funds, which can be particularly useful for the District of Columbia Sprinkling Trust for Children During Grantor's Life. Utilizing this rule correctly can significantly enhance the trust's effectiveness in asset management.

A practical example of the 5 by 5 rule might involve a trust containing $100,000. A beneficiary could withdraw up to $5,000 or 5% of the trust's value, which is $5,000 each year. This arrangement provides a balance between beneficiary access and maintaining the trust's long-term goals.

Yes, a grantor trust can include Crummey powers, allowing the grantor to make annual gifts without incurring tax liability. This can be a strategic part of establishing the District of Columbia Sprinkling Trust for Children During Grantor's Life, where the grantor retains some control. It's crucial to work with a qualified attorney to design this feature correctly.

The 5'5 lapse rule pertains to the ability of beneficiaries to allow their withdrawal powers to expire after five years or upon reaching a $5,000 limit. This rule protects against excessive withdrawals that could jeopardize the trust's overall objectives. Understanding this rule helps ensure compliance while maximizing the benefits of the District of Columbia Sprinkling Trust.

The 5 and 5 power allows beneficiaries to withdraw selected amounts from the District of Columbia Sprinkling Trust for Children During Grantor's Life up to the specified limits without immediate taxation. This ensures that beneficiaries can access funds while keeping the trust intact for future distributions. The careful application of this power can maximize the trust's benefits.

The 5 by 5 rule allows a beneficiary of the District of Columbia Sprinkling Trust for Children During Grantor's Life to withdraw up to $5,000 or 5% of the total trust assets each year, whichever is greater. This rule gives beneficiaries flexibility to access trust funds without losing the trust's beneficial tax treatment. It is essential to structure this correctly to avoid any tax issues.

If you neglect to send Crummey letters for the District of Columbia Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement, beneficiaries may lose the opportunity to withdraw contributions. This could impact the tax benefits intended for the trust. Without proper notification, the IRS may argue that the assets are not eligible for annual exclusion gifts.

Typically, Crummey letters should be sent out within a reasonable time before or after a contribution is made to the trust. For the District of Columbia Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement, aim to provide these letters to beneficiaries as soon as possible, ensuring they have a clear understanding of their withdrawal rights within the specified time frame required by IRS regulations.

While electronic communication is common, it is best to send Crummey letters via traditional mail to maintain a clear record. For the District of Columbia Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement, using postal services provides a tangible proof of delivery. However, if all parties agree, and it fits within legal guidelines, emailing these letters can serve as an alternative.

Yes, Crummey letters are essential in the context of the District of Columbia Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement. These letters notify beneficiaries of their right to withdraw contributions made to the trust, thereby ensuring the gifts qualify for the annual gift tax exclusion. Without these letters, the IRS may not recognize the contributions as present interest gifts, leading to tax complications.