District of Columbia Financial Statement Form - Individual

Description

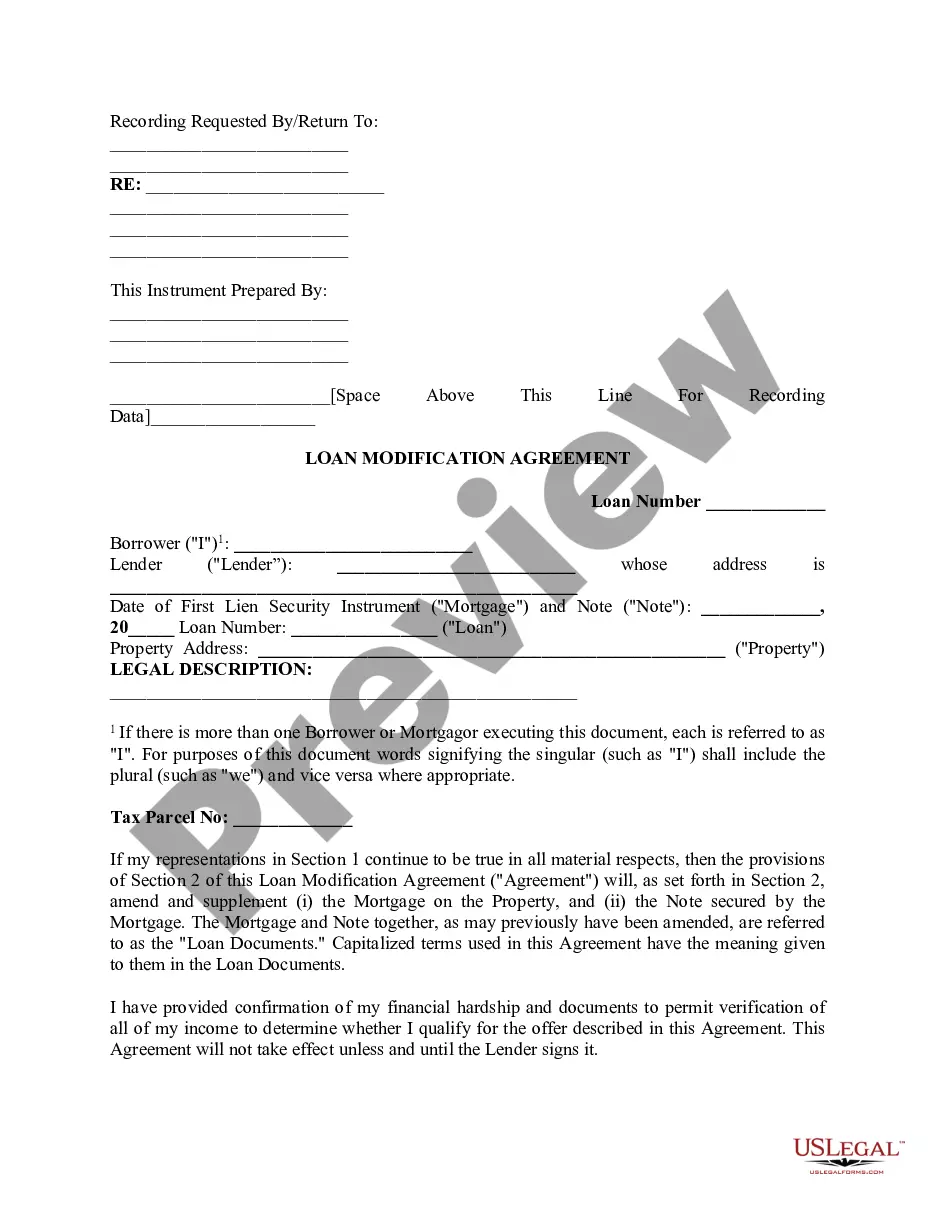

How to fill out Financial Statement Form - Individual?

You may invest hours online trying to locate the valid document template that complies with the local and federal requirements you need.

US Legal Forms offers thousands of valid templates that are reviewed by professionals.

It is easy to obtain or print the District of Columbia Financial Statement Form - Individual from your service.

If available, utilize the Review option to browse through the document template simultaneously.

- If you have a US Legal Forms account, you can Log In and then click the Download option.

- After that, you can complete, modify, print, or sign the District of Columbia Financial Statement Form - Individual.

- Every valid document template you purchase is yours for an extended period.

- To get an additional copy of a purchased form, visit the My documents section and then click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the correct document template for your chosen county/town.

- Review the form description to verify that you have selected the correct template.

Form popularity

FAQ

To complete a personal financial statement, start by gathering your essential financial documents. Use the District of Columbia Financial Statement Form - Individual to fill in your assets, liabilities, and income sources accurately. It’s important to provide precise figures and reflect your current financial situation honestly. This thorough approach will enable lenders to evaluate your financial health effectively.

An example of a financial statement is a personal balance sheet, which details what you own and what you owe. The District of Columbia Financial Statement Form - Individual serves as a structured guide to report these figures clearly. By filling out this form, you present a summarized view of your finances. This document is pivotal when seeking financial assistance or making significant investments.

A financial statement form provides a snapshot of an individual's financial condition. Specifically, the District of Columbia Financial Statement Form - Individual outlines assets, liabilities, and income. This form is essential for various financial applications, such as loans and mortgage approvals. By providing a clear view of your financial status, it helps lenders assess your creditworthiness.

Yes, if you reside or earn income in the District of Columbia, you are required to file DC taxes. This includes submitting the District of Columbia Financial Statement Form - Individual if applicable to your situation. To understand your tax obligations better, consulting with a tax professional or using online resources can help clarify any questions you may have.

You can pick up DC tax forms at places like public libraries and community centers. For the most straightforward access to the District of Columbia Financial Statement Form - Individual, visit the DC Office of Tax and Revenue's website. They provide quick downloads and instructions so you can fill out your forms easily from home.

Tax forms are generally available at public buildings, libraries, and official tax offices. To specifically find the District of Columbia Financial Statement Form - Individual, consider visiting the DC Office of Tax and Revenue online. This source is regularly updated, ensuring you have the latest forms required for your tax preparation.

To obtain DC tax forms, including the District of Columbia Financial Statement Form - Individual, you can visit the official website of the DC Office of Tax and Revenue. This website allows you to download forms directly from your computer. If you prefer a physical copy, check local libraries or tax service organizations.

You can find tax forms at various locations, such as public libraries, community centers, and tax assistance offices. For the District of Columbia Financial Statement Form - Individual, it's best to visit a local government office or the DC Office of Tax and Revenue website for access. This way, you ensure you have the correct and most updated forms.

While many post offices used to carry tax forms, availability may vary by location. To get a District of Columbia Financial Statement Form - Individual, you can check your local post office. However, it is often more reliable to access forms online through official tax websites, which provide the most current versions.

To fill out a form in Washington, D.C., first, you need to gather the necessary information and documentation required by the specific form. It's important to follow the guidelines provided for the District of Columbia Financial Statement Form - Individual. You can leverage the resources on the uslegalforms platform to ensure accurate completion and submission.