District of Columbia Direct Deposit Form for Employees

Description

How to fill out Direct Deposit Form For Employees?

If you want to finish, acquire, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Employ the site’s straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the District of Columbia Direct Deposit Form for Employees in just a few clicks.

Every legal document template you acquire is yours indefinitely. You will have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Be proactive and download, and print the District of Columbia Direct Deposit Form for Employees with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal requirements.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the District of Columbia Direct Deposit Form for Employees.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

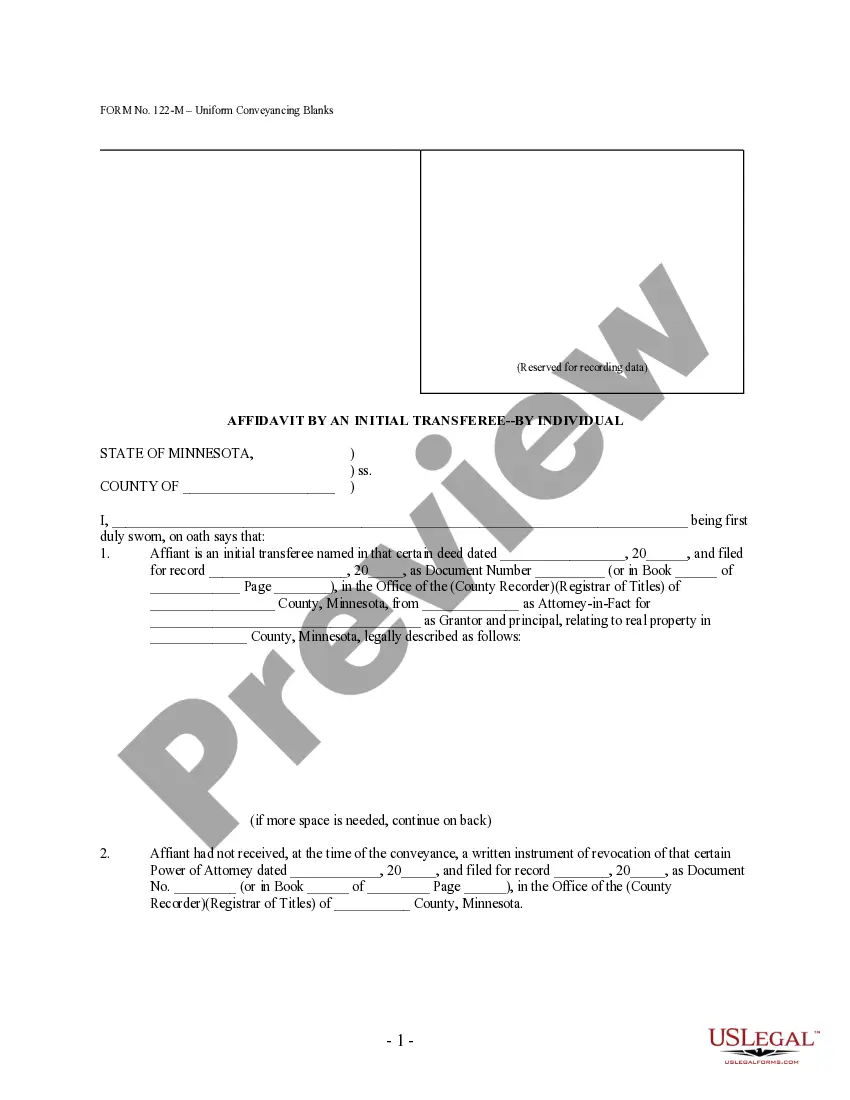

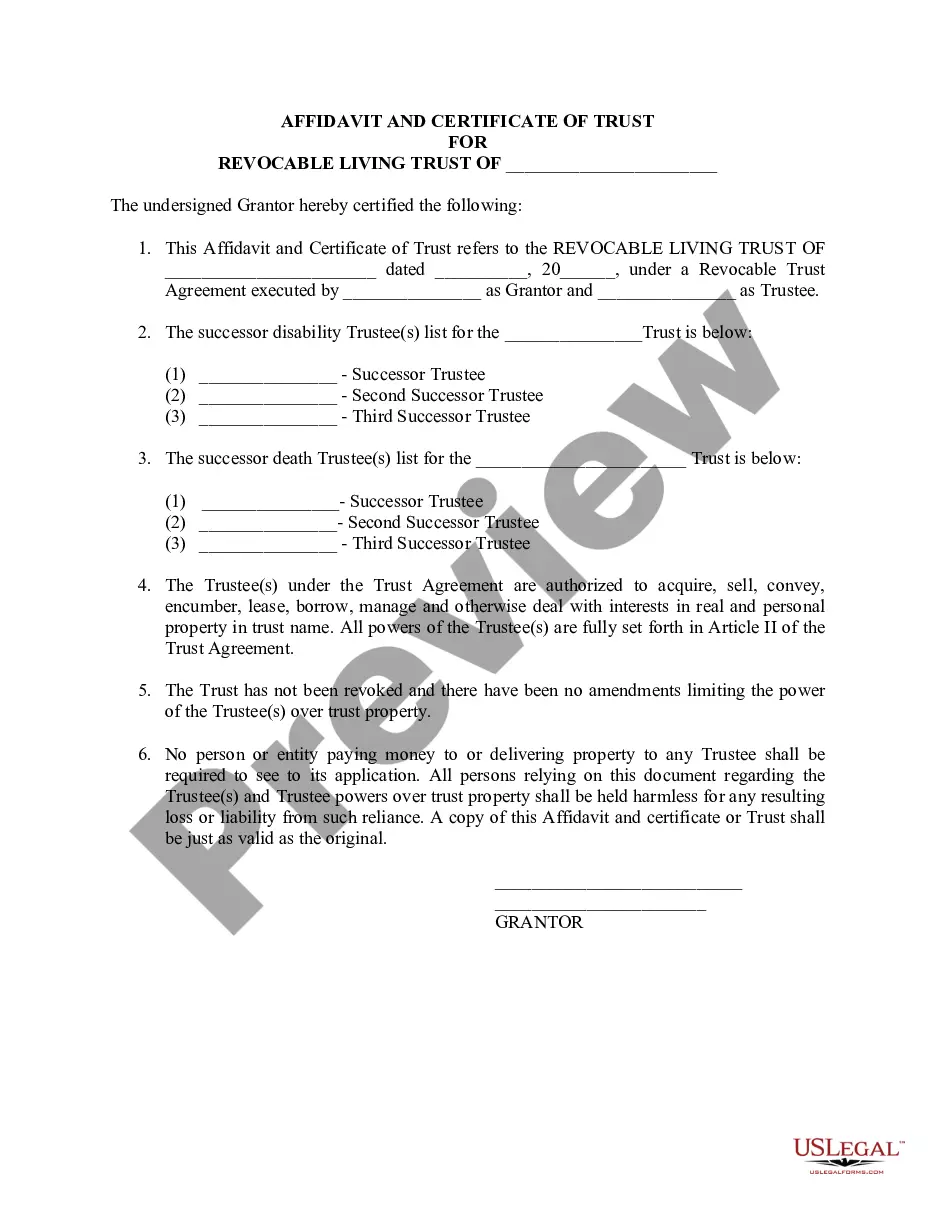

- Step 2. Use the Review option to check the form’s details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types in the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it onto your device.

- Step 7. Complete, modify, and print or sign the District of Columbia Direct Deposit Form for Employees.

Form popularity

FAQ

To fill out the District of Columbia Direct Deposit Form for Employees, start by entering your personal information, including your name, address, and Social Security number. Next, provide your bank details, such as the account type, account number, and the bank's routing number. Make sure to review your information for accuracy before submitting the form to your employer. For a seamless process, consider using the US Legal Forms platform, which offers a user-friendly solution to complete your direct deposit authorization with confidence.

Setting up direct deposit for your employees involves providing them with the District of Columbia Direct Deposit Form for Employees. Encourage your employees to fill out the form with their banking details and submit it to you. Once you have their completed forms, submit the necessary information to your payroll service or bank. This process streamlines payroll, reduces paperwork, and ensures your employees receive their wages directly in their accounts.

To fill out the District of Columbia Direct Deposit Form for Employees, start by entering your personal information, including your name, address, and Social Security number. Next, provide your bank details, such as the bank name, routing number, and account number. Finally, review the form for accuracy and submit it to your employer. By using this form, you can ensure timely and secure payments straight to your bank account.

Changing your direct deposit information with the DC government requires filling out the District of Columbia Direct Deposit Form for Employees again. Update your bank account details and submit the revised form to your payroll department. This process ensures that your payments are directed to the correct account moving forward. Regularly reviewing your information helps avoid any potential payroll delays.

To set up direct deposit for DC Public Schools (DCPS) employees, you need to complete the District of Columbia Direct Deposit Form for Employees. Make sure to provide the correct bank account information and submit it to the DCPS payroll department. They will process the forms and set up the direct deposit to ensure timely payments. This setup supports financial stability for employees.

Setting up direct deposit for your employees involves a few simple steps. First, have your employees complete the District of Columbia Direct Deposit Form for Employees. Next, submit these forms to your payroll system or provider. Ensure all banking details are accurate to avoid any payment issues. This method not only speeds up payroll but also enhances employee satisfaction.

While you can encourage employees to opt for direct deposit, you cannot mandate it without proper policies in place. To promote adoption, provide clear information about the benefits of using the District of Columbia Direct Deposit Form for Employees. Highlight how it saves time and ensures on-time payments. Creating a supportive environment for this option will help employees feel more comfortable choosing direct deposit.

Yes, you can easily print the District of Columbia Direct Deposit Form for Employees online. Visit the US Legal Forms website, where you can find this form ready for download. After filling it out, print a copy for your records and share it with your employees. This convenience helps streamline the setup process.

To get direct deposit for your employees, you should start by obtaining the District of Columbia Direct Deposit Form for Employees. This form allows you to gather the necessary banking information from your employees. Submit the completed forms to your payroll provider, and they will handle the rest. It's a straightforward process that simplifies payroll for everyone.