District of Columbia Employment Application for Event Vendor

Description

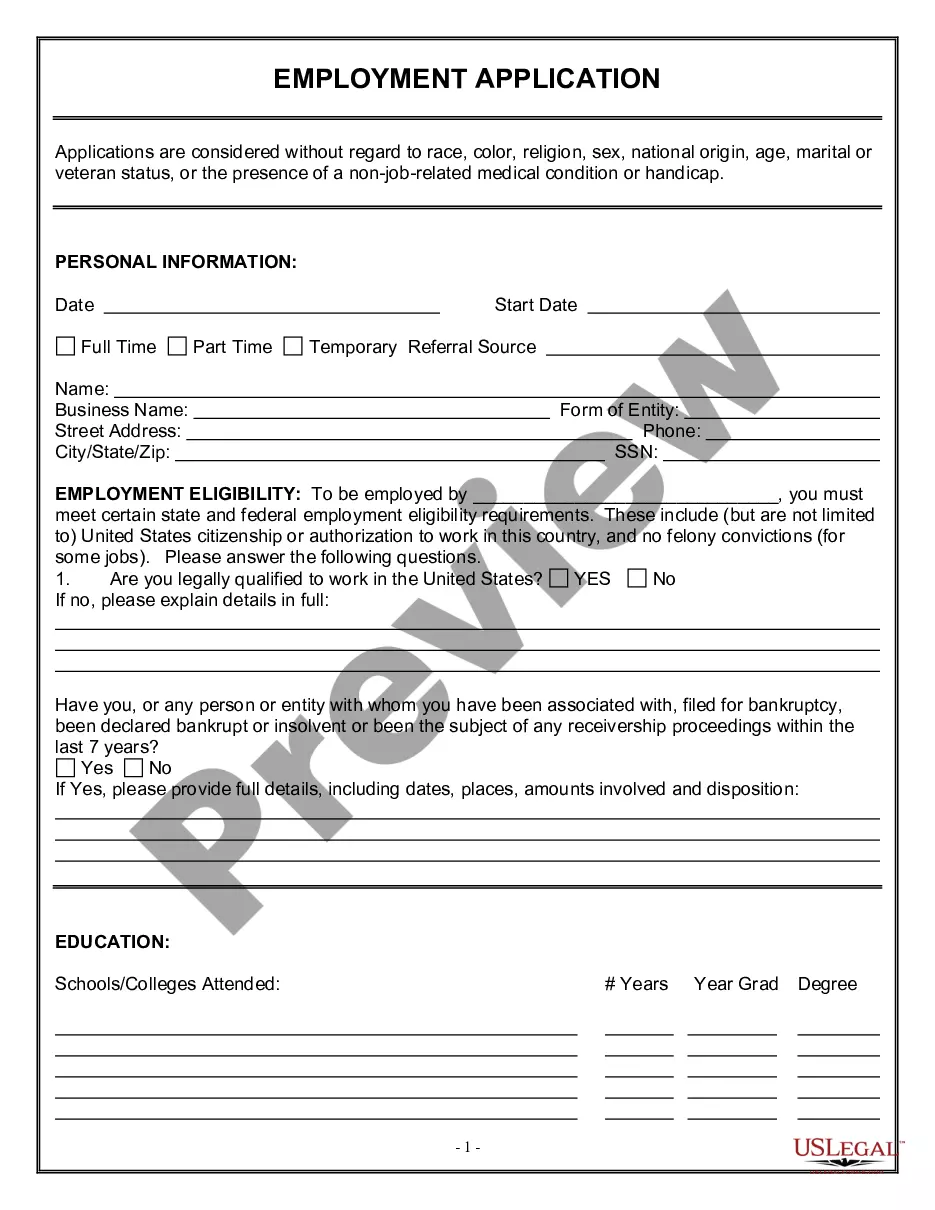

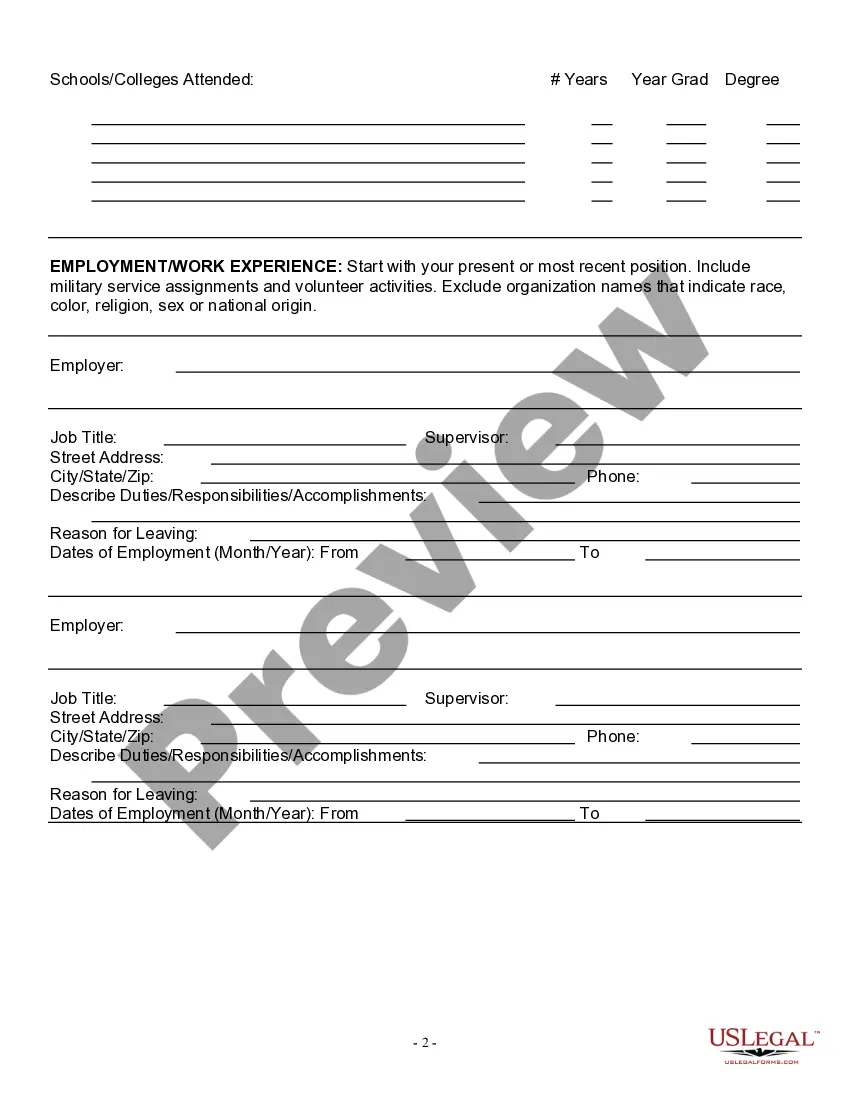

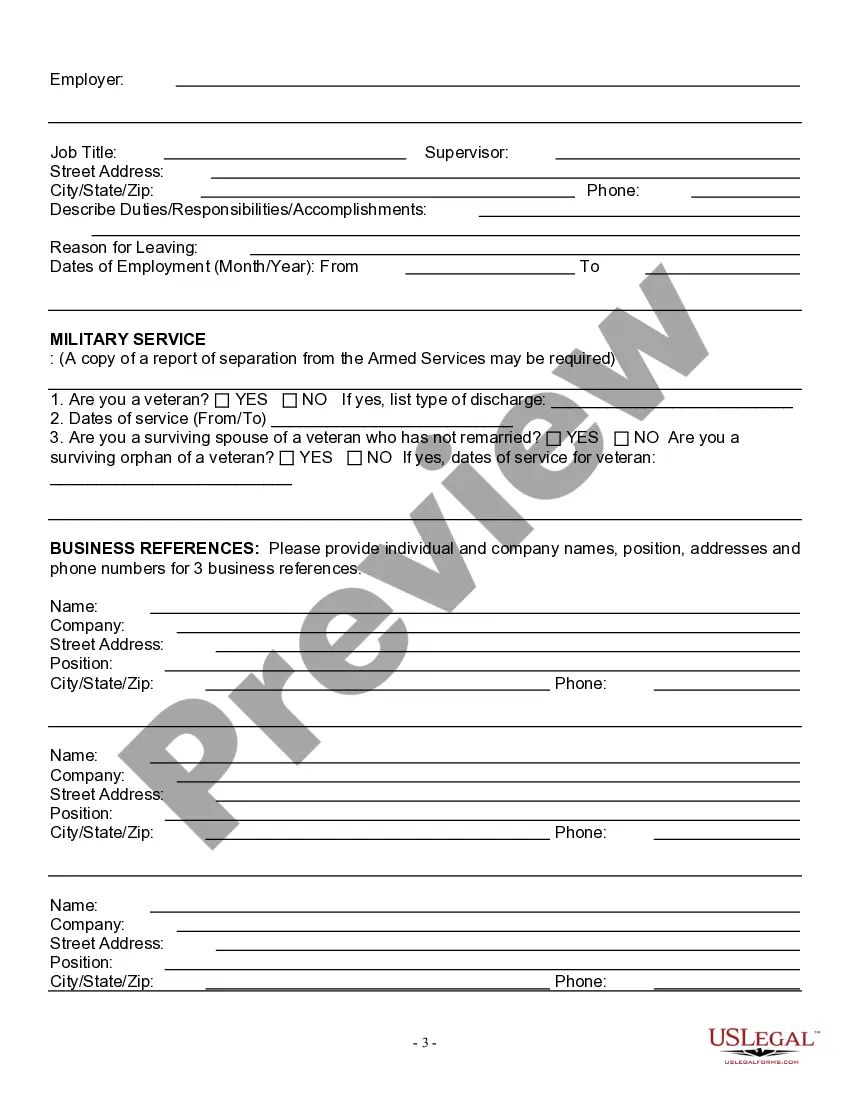

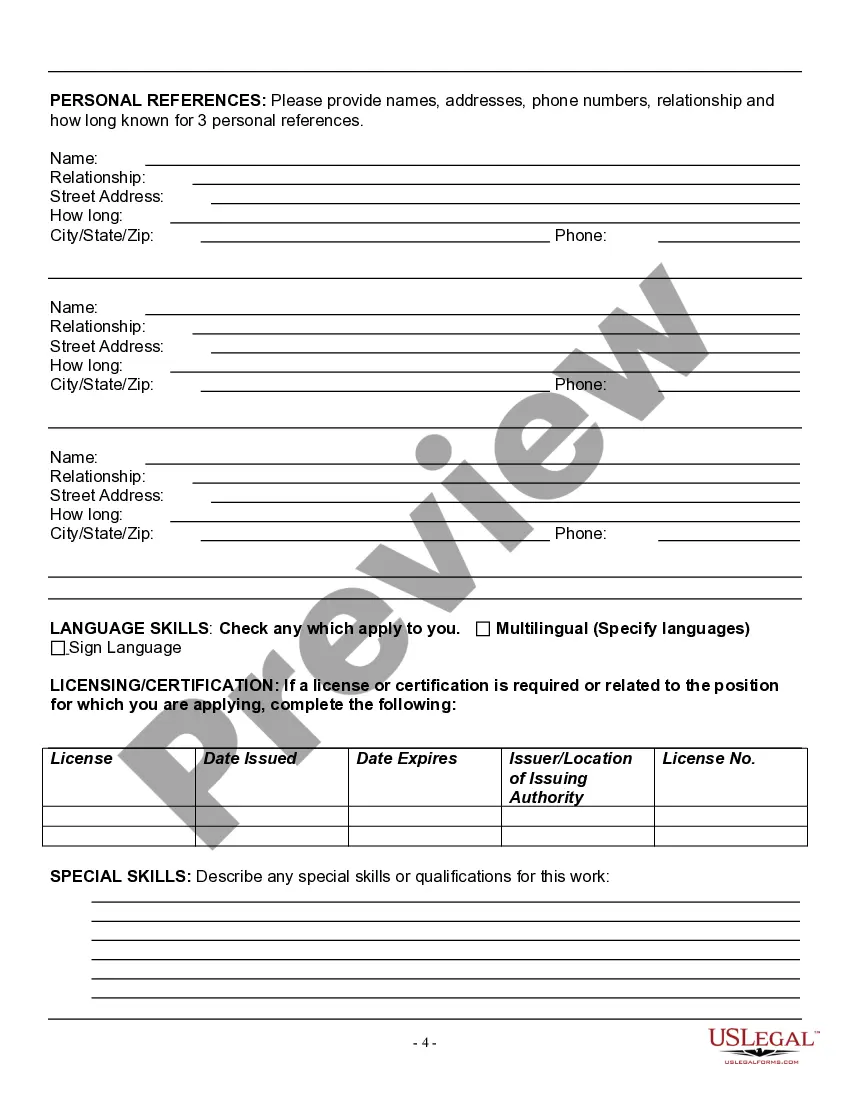

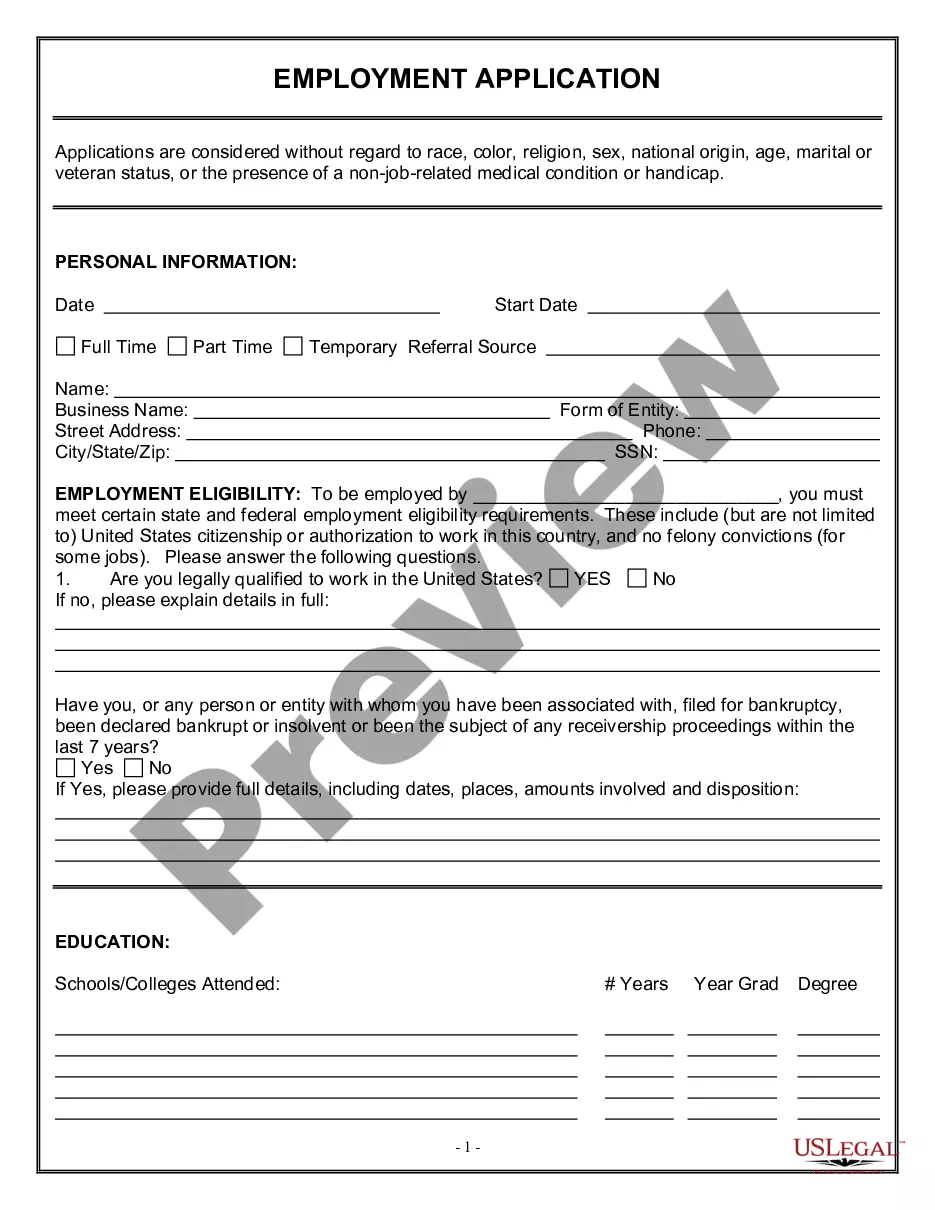

How to fill out Employment Application For Event Vendor?

It is feasible to allocate time online trying to locate the legal document format that meets the state and federal prerequisites you require.

US Legal Forms offers thousands of legal documents that can be reviewed by experts.

You can easily acquire or print the District of Columbia Employment Application for Event Vendor from the services provided.

To find another version of the form, utilize the Search field to locate the format that meets your needs and requirements.

- If you have a US Legal Forms account, you can Log In and click the Download button.

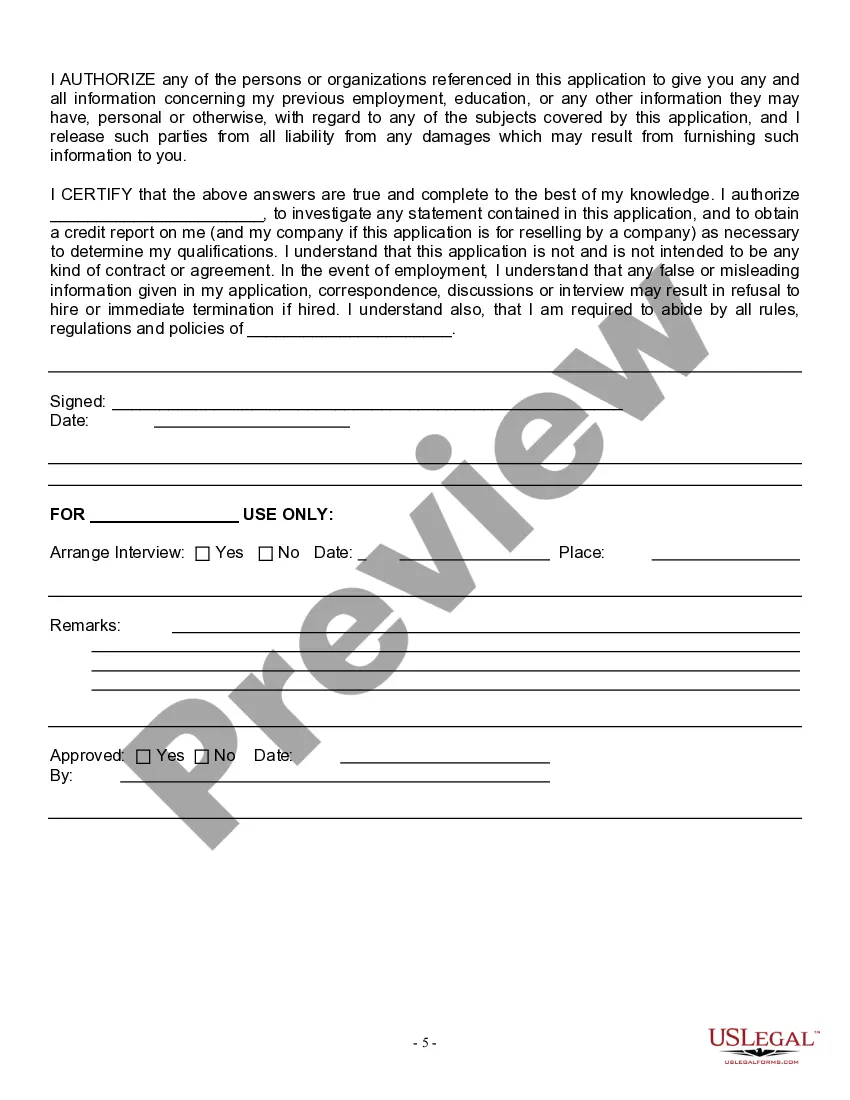

- Following that, you can complete, edit, print, or sign the District of Columbia Employment Application for Event Vendor.

- Every legal document format you obtain is yours indefinitely.

- To obtain another copy of the purchased form, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document format for your region/area of interest.

- Review the document overview to confirm you have chosen the correct form.

Form popularity

FAQ

Tax registration is required for your Basic Business License Once your LLC is registered with OTR, they will mail you a Notice of Business Tax Registration. In the upper-right hand corner of this letter will be your LLC's Notice Number. You'll need this Notice Number in order to apply for your Basic Business License.

DCCCBRC, an initiative of the DC Chamber of Commerce, supports businesses with counseling, mentoring, training, access to capital, and a computer lab. DCCCBRC operates a US Small Business Administration (SBA) Sub-Center to provide access to SBA programs for local businesses.

Taxpayers who wish to register a new business in the District of Columbia can conveniently complete the Register a New Business: Form FR-500 application online via the Office of Tax and Revenue's (OTR) tax portal, MyTax.DC.gov.

If your company is a DC corporation, DC partnership, or DC limited liability company, you need to be registered and in good standing with the DCRA Corporation Division. All business entities registered are required to have a Washington DC registered agent and office.

District of Columbia Tax Account NumbersIf you are a new business, register online with the DC Office of Tax and Revenue.If you already have a DC Withholding Account Number, you can look this up online or on on correspondence from the DC Office of Tax and Revenue. If you're unsure, contact the agency at 202-727-4829.

If your company is a DC corporation, DC partnership, or DC limited liability company, you need to be registered and in good standing with the DCRA Corporation Division. All business entities registered are required to have a Washington DC registered agent and office.

Conducting business shall be defined as any trade, profession, or activity that provides, or holds itself out to provide, goods or services to the general public or to any portion of the general public, for hire or compensation in the District of Columbia.

500, or Combined Tax Registration Form, is used by businesses to register all their tax requirements on one simple form. Whether registering for sales tax, franchise tax, unemployment tax, etc., the business person completes all areas applicable to their business activity either in hardcopy or online.

Submit a Vending Business License Application and attach the following documents:Corporate Registration and Trade Name Registration (if applicable)Notice of Business Tax Registration & Clean Hands Certificate.Certified Food Protection Manager Identification Card.DC Health Inspection Report.Propane Permit.More items...