District of Columbia Maximum-Minimum Compensation Rate/Supplemental Allowance

Description

How to fill out District Of Columbia Maximum-Minimum Compensation Rate/Supplemental Allowance?

How much effort and assets do you typically allocate to crafting official documentation.

There’s a better opportunity to obtain such forms than employing legal experts or spending countless hours searching the internet for a suitable template. US Legal Forms is the premier online repository that provides expertly crafted and validated state-specific legal documents for various purposes, such as the District of Columbia Maximum-Minimum Compensation Rate/Supplemental Allowance.

Another benefit of our service is that you can retrieve previously purchased documents that are securely saved in your profile under the My documents tab. Access them at any time and revise your paperwork as often as needed.

Conserve time and energy in preparing formal documents with US Legal Forms, one of the most reliable online services. Join us today!

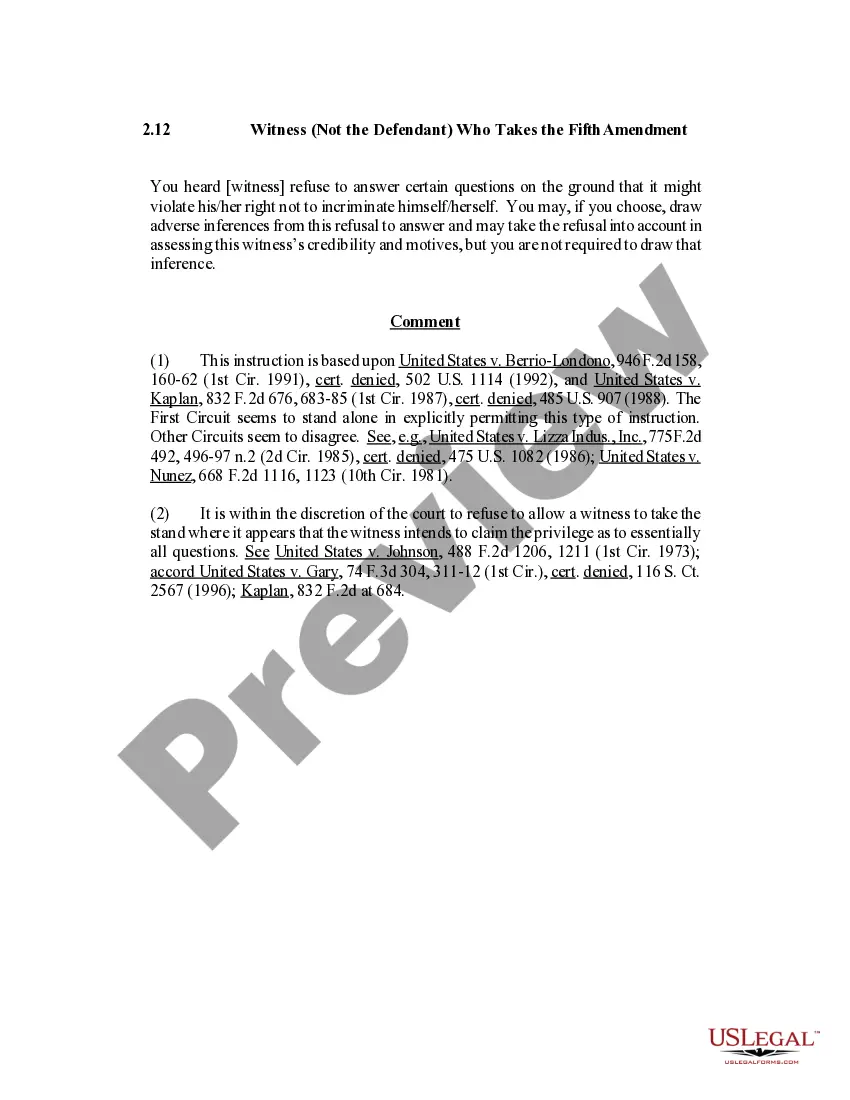

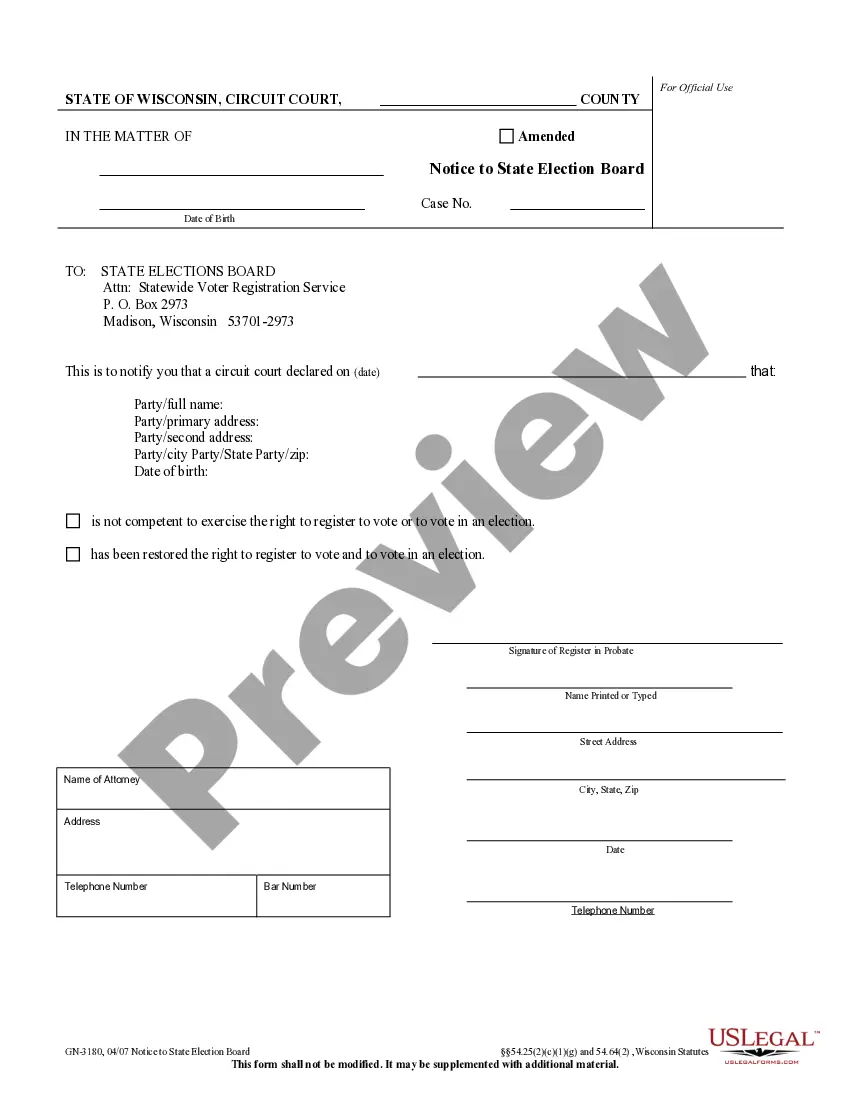

- Browse the form details to confirm it aligns with your state regulations. For this, review the form description or utilize the Preview option.

- If your legal template doesn't satisfy your needs, search for another using the search bar at the top of the page.

- If you have already registered with our service, Log In and download the District of Columbia Maximum-Minimum Compensation Rate/Supplemental Allowance. If you haven’t, continue with the next steps.

- Click Buy now when you locate the correct template. Select the subscription plan that works best for you to access our library’s complete service.

- Sign up for an account and process your subscription payment. You can pay using your credit card or through PayPal - our service is entirely secure for that.

- Download your District of Columbia Maximum-Minimum Compensation Rate/Supplemental Allowance onto your device and complete it on a printed hard copy or digitally.

Form popularity

FAQ

In the District of Columbia, the waiting period for receiving workers' compensation benefits is typically seven calendar days. If an employee's disability lasts longer than this period, benefits can be retroactively applied to the first day of inability to work. Understanding the Maximum-Minimum Compensation Rate/Supplemental Allowance is vital for employees to receive the benefits they deserve during their recovery. For seamless navigation through these processes, the uslegalforms platform offers the resources needed to ensure you are informed and compliant.

Currently, all 50 states in the U.S. require employers to carry workers' compensation insurance. This insurance provides essential financial protection to employees who suffer from work-related injuries. It's crucial for employers in the District of Columbia to understand the laws surrounding the Maximum-Minimum Compensation Rate/Supplemental Allowance, as these guidelines dictate how compensation is calculated. Ensuring compliance with these requirements not only protects employees but also safeguards employers from potential liabilities.

The workers' compensation rate in Washington state for 2025 will reflect changes in state legislation and the insurance market. Rates are influenced by the nature of the business and the assigned risk classification, similar to the District of Columbia's maximum-minimum compensation rate or supplemental allowance. Employers should regularly review these rates to ensure compliance and adequate coverage. For comprehensive details on rates, US Legal Forms can provide valuable resources.

As of 2025, the minimum wage in Washington state is set to increase, aiming to provide a living wage for all workers. This adjustment will help cover basic needs and align better with the District of Columbia's maximum-minimum compensation rate or supplemental allowance. Staying updated on these wage changes is essential for employers and employees alike. You can find detailed information about wage rates on platforms like US Legal Forms.

Yes, Washington state mandates that nearly all employers carry workers' compensation insurance. This insurance protects employees who are injured on the job. If you are in the District of Columbia, don’t forget to be aware of the District of Columbia Maximum-Minimum Compensation Rate/Supplemental Allowance as this will help you assess your entitlements if you face employment-related injuries. Resources like US Legal Forms can assist in navigating these requirements.

In D.C., there is a seven-day waiting period for workers' compensation benefits to begin. If your disability extends beyond fourteen days, you will receive compensation retroactively for the initial seven days. Knowing the specifics of the District of Columbia Maximum-Minimum Compensation Rate/Supplemental Allowance can help you plan accordingly while you await your benefits. Use online resources to ensure efficient filing, like US Legal Forms.

To file for workers' compensation in D.C., you should begin by notifying your employer about your injury as soon as possible. After reporting, you can fill out a claim form, which you can obtain from the D.C. Department of Employment Services or platforms like US Legal Forms for convenience. The District of Columbia Maximum-Minimum Compensation Rate/Supplemental Allowance plays a significant role in determining your benefits, so it’s essential to understand these guidelines while filing.

The District of Columbia does not require personal injury protection (PIP) coverage for drivers. However, most auto insurance policies offer PIP as an optional coverage. Familiarizing yourself with the District of Columbia Maximum-Minimum Compensation Rate/Supplemental Allowance can also help you understand the nuances of injury benefits and how they relate to your overall compensation if you're injured in an accident.

Although most states mandate workers' compensation, Texas is an exception. In Texas, employers have the option to opt out of providing workers' comp insurance. However, knowing about the District of Columbia Maximum-Minimum Compensation Rate/Supplemental Allowance is crucial for workers in D.C., as it ensures they are covered. Understanding these differences helps you make informed decisions.